Calculating Annuity Interest 2024: A Guide explores the complexities of annuity interest, providing a comprehensive understanding of how it works and what factors influence its rate. This guide will delve into the intricacies of calculating annuity interest, examining current trends and projections for 2024.

We’ll also discuss the impact of interest rates on annuity payments, explore strategies for maximizing returns, and address the tax implications of annuity interest. By shedding light on these crucial aspects, this guide aims to empower readers with the knowledge necessary to make informed decisions regarding their annuity investments.

Annuity interest is a critical component of retirement planning, as it directly impacts the amount of income you receive during your retirement years. Understanding how annuity interest is calculated, the factors that influence it, and the strategies for maximizing returns can help you make the most of your annuity investments.

For those seeking stability and guaranteed income, annuities with a 5-year guarantee can be attractive. You can find information on Annuity 5 Year Guarantee 2024 to learn more about this type of annuity.

This guide will equip you with the knowledge and tools necessary to navigate the complexities of annuity interest and make informed decisions for a secure financial future.

Annuity plans can be a valuable component of retirement planning. But are they considered qualified retirement plans? You can explore this topic further on Is An Annuity A Qualified Retirement Plan 2024.

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period of time. It is often used for retirement planning, income generation, and wealth preservation. Annuities are characterized by their predictable cash flows, which can provide financial security and peace of mind.

Annuity options can be diverse, and sometimes it’s helpful to compare a few. You might be interested in the specifics of three different types of annuities. Head over to 3 Annuity 2024 to learn more.

Types of Annuities

Annuities can be categorized into different types based on their payment structure, investment options, and other characteristics. Some common types include:

- Fixed Annuities:These annuities offer guaranteed payments at a fixed interest rate. They provide stability and predictability, but their returns may not keep pace with inflation.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of underlying investments. They have the potential for higher returns but also carry greater risk.

- Immediate Annuities:Payments begin immediately after the annuity is purchased. They are suitable for individuals who need income right away.

- Deferred Annuities:Payments are delayed until a future date, allowing time for the annuity to grow. They are often used for retirement planning.

- Indexed Annuities:These annuities offer returns linked to a specific market index, such as the S&P 500. They provide some protection against inflation while offering potential for growth.

Real-World Scenarios

Annuities are used in various real-world scenarios, including:

- Retirement Income:Annuities provide a steady stream of income during retirement, supplementing other sources of income.

- Income Generation:Individuals can use annuities to generate income from their savings, particularly in retirement.

- Wealth Preservation:Annuities can help preserve wealth by providing guaranteed payments and protecting against market fluctuations.

- Long-Term Care:Annuities can be used to cover the costs of long-term care, providing financial security in case of unexpected health issues.

Calculating Annuity Interest: Calculating Annuity Interest 2024

Annuity interest is the rate of return earned on an annuity contract. It is calculated based on the annuity’s principal amount, the interest rate, and the payment period. The interest earned is typically credited to the annuity account, increasing its value over time.

Annuity rates can vary, and understanding the impact of different interest rates is important. If you’re looking for information on annuities with an 8% return, you can find helpful insights on Annuity 8 Percent 2024.

Factors Influencing Annuity Interest Rates

Several factors influence annuity interest rates, including:

- Market Conditions:Interest rates are generally influenced by economic conditions, inflation, and Federal Reserve policies. When interest rates are high, annuity interest rates tend to be higher as well.

- Creditworthiness:Annuity providers assess the creditworthiness of their customers, offering higher interest rates to those with strong credit histories.

- Type of Annuity:Different types of annuities offer different interest rates. For example, fixed annuities typically have lower interest rates than variable annuities.

Calculating Annuity Interest

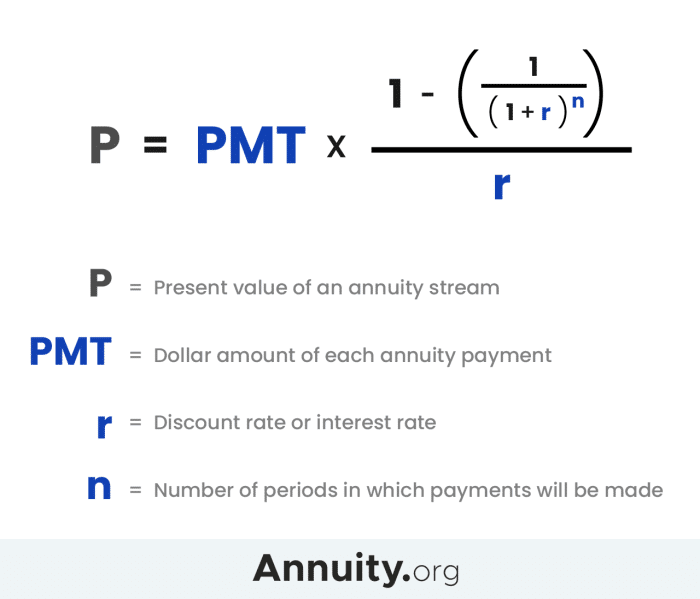

Annuity interest can be calculated using formulas or online calculators. Here is a step-by-step guide on how to calculate annuity interest:

- Determine the principal amount:This is the initial investment in the annuity.

- Identify the interest rate:This is the annual rate of return on the annuity.

- Calculate the interest earned:Multiply the principal amount by the interest rate. For example, if the principal amount is $100,000 and the interest rate is 3%, the interest earned would be $3,000.

- Adjust for the payment period:If payments are made more frequently than annually, the interest earned needs to be adjusted accordingly. For example, if payments are made monthly, the interest rate would be divided by 12.

Online calculators can simplify the process of calculating annuity interest. These calculators typically require users to input the principal amount, interest rate, payment period, and other relevant information. The calculator will then provide the interest earned and other details about the annuity.

When analyzing annuities, the discount factor plays a vital role. Understanding how to calculate it is essential. You can find resources and examples on Calculate Annuity Discount Factor 2024 to help you with this calculation.

Annuity Interest Rates in 2024

Annuity interest rates in 2024 are expected to be influenced by a number of factors, including economic growth, inflation, and monetary policy. While interest rates are generally expected to remain at historically low levels, there are some indications that they may rise slightly throughout the year.

The process of purchasing an annuity involves various considerations. You can find information on Annuity Is Purchased 2024 to better understand this process.

Factors Impacting Interest Rates

- Inflation:As inflation rises, the Federal Reserve may raise interest rates to control price increases. This could lead to higher annuity interest rates.

- Economic Growth:Strong economic growth can also lead to higher interest rates, as investors demand higher returns for their investments.

- Monetary Policy:The Federal Reserve’s monetary policy decisions play a significant role in determining interest rates. The Fed may raise or lower interest rates to manage inflation and economic growth.

Comparing Interest Rates

It is important to compare interest rates offered by different annuity providers to find the best deal. Factors to consider include:

- Interest Rate:Look for providers offering competitive interest rates on the type of annuity you are considering.

- Fees:Be aware of any fees associated with the annuity, as these can impact your overall returns.

- Guarantees:Some annuities offer guarantees, such as a minimum interest rate or protection against market losses.

- Customer Service:Choose a provider with a strong reputation for customer service and financial stability.

Impact of Interest Rates on Annuity Payments

Annuity interest rates have a direct impact on annuity payments. Higher interest rates generally result in larger payments, while lower interest rates lead to smaller payments.

To grasp the essence of an annuity, it’s helpful to understand its core definition. You can find a clear explanation on An Annuity Is Best Defined As 2024.

Fixed vs. Variable Interest Rates

The impact of interest rates on annuity payments depends on whether the annuity has a fixed or variable interest rate.

It’s a common question: is an annuity a life insurance policy? While they share some similarities, they are distinct financial products. You can explore the differences and similarities in detail on Is Annuity A Life Insurance Policy 2024.

- Fixed Interest Rates:With a fixed interest rate, the payment amount remains the same throughout the annuity’s term, regardless of changes in market interest rates. This provides stability and predictability but may not keep pace with inflation.

- Variable Interest Rates:With a variable interest rate, the payment amount fluctuates based on changes in market interest rates. This can provide potential for higher returns but also carries greater risk.

Impact on Annuity Payments Over Time, Calculating Annuity Interest 2024

| Interest Rate | Annuity Payment (Year 1) | Annuity Payment (Year 5) | Annuity Payment (Year 10) |

|---|---|---|---|

| 2% | $1,000 | $1,104 | $1,219 |

| 3% | $1,000 | $1,159 | $1,344 |

| 4% | $1,000 | $1,217 | $1,480 |

The table above illustrates the impact of different interest rates on annuity payments over time. As you can see, higher interest rates lead to significantly larger payments over the long term.

Some annuities offer a feature known as “X share.” You can explore the details of this type of annuity on X Share Annuity 2024 to learn more about its advantages and disadvantages.

Strategies for Maximizing Annuity Interest

Several strategies can help maximize annuity interest, including:

Choosing the Right Type of Annuity

- Fixed vs. Variable:Consider your risk tolerance and investment goals when deciding between fixed and variable annuities. Fixed annuities provide stability, while variable annuities offer potential for higher returns.

- Indexed Annuities:Indexed annuities offer returns linked to a market index, providing some protection against inflation while offering potential for growth.

Negotiating with Providers

Annuity providers may be willing to negotiate interest rates, particularly for larger investments. Be prepared to compare offers from multiple providers and highlight your financial strengths.

Understanding how to calculate annuity due is crucial for making informed financial decisions. Check out Calculating Annuity Due 2024 for a detailed explanation and examples.

Comparing Interest Rates

Regularly compare interest rates offered by different annuity providers to ensure you are getting the best deal. Use online comparison tools or consult with a financial advisor.

The annuity factor is a crucial element in calculating the present value of future payments. You can find resources on Calculating Annuity Factor 2024 to understand how this factor works.

Successful Annuity Investment Strategies

- Long-Term Perspective:Annuities are typically designed for long-term investments. Avoid withdrawing funds prematurely to maximize interest earnings.

- Diversification:Consider diversifying your investments by allocating a portion of your portfolio to annuities, alongside other asset classes.

- Professional Advice:Consult with a financial advisor to develop a personalized annuity investment strategy that aligns with your financial goals and risk tolerance.

Tax Implications of Annuity Interest

Annuity interest is typically taxed as ordinary income. The tax treatment of annuity interest can vary depending on the type of annuity and other factors.

If you’re interested in learning more about annuities, Khan Academy offers a great resource for understanding the basics. You can find their latest content on Annuity Khan Academy 2024 to get started.

Tax Treatment of Annuities

- Traditional Annuities:Interest earned on traditional annuities is taxed as ordinary income when withdrawn. However, contributions may be tax-deductible.

- Roth Annuities:Interest earned on Roth annuities is tax-free when withdrawn, as long as certain conditions are met. Contributions are not tax-deductible.

- Variable Annuities:Interest earned on variable annuities is taxed as ordinary income, and capital gains or losses are taxed separately.

Tax Deductions and Credits

Annuity holders may be eligible for certain tax deductions and credits, such as:

- Deduction for Medical Expenses:If you use an annuity to pay for medical expenses, you may be able to deduct these expenses on your taxes.

- Credit for Qualified Retirement Savings Contributions:You may be eligible for a tax credit for contributions to a qualified retirement savings plan, including annuities.

It is important to consult with a tax professional to understand the tax implications of your specific annuity.

The Jaiib (Junior Associate of the Indian Institute of Bankers) exam often includes questions about annuities. You can find information on Annuity Jaiib 2024 to prepare for this important exam.

Risks and Considerations for Annuity Investments

Annuity investments, like any other financial product, carry certain risks. It is important to carefully consider these risks before investing in an annuity.

Risks Associated with Annuities

- Market Volatility:Variable annuities are subject to market volatility, which can impact the value of your investment and the amount of your annuity payments.

- Inflation:Fixed annuities may not keep pace with inflation, which can erode the purchasing power of your payments over time.

- Interest Rate Risk:Interest rates can fluctuate, potentially impacting the returns on your annuity.

Factors to Consider

Before investing in an annuity, consider the following factors:

- Investment Goals:Determine your financial goals and whether an annuity is an appropriate investment vehicle to achieve them.

- Risk Tolerance:Assess your risk tolerance and choose an annuity that aligns with your comfort level.

- Time Horizon:Consider your time horizon for the investment and choose an annuity with a term that matches your needs.

Managing Risks

To manage the risks associated with annuity investments, consider the following strategies:

- Diversification:Diversify your investments by allocating a portion of your portfolio to annuities, alongside other asset classes.

- Professional Advice:Consult with a financial advisor to develop a personalized investment strategy that addresses your specific circumstances and risk tolerance.

- Regular Monitoring:Regularly monitor your annuity investments and adjust your strategy as needed to mitigate risks and maximize returns.

End of Discussion

In conclusion, understanding annuity interest is crucial for anyone considering this investment option. By understanding the factors that influence interest rates, the impact of interest rates on annuity payments, and strategies for maximizing returns, you can make informed decisions that align with your financial goals.

While annuities offer potential benefits, it’s important to be aware of the associated risks and consider your individual circumstances before making an investment. Remember to consult with a financial advisor to receive personalized guidance and tailor your annuity investment strategy to your specific needs and objectives.

When considering an annuity for retirement, it’s essential to understand the exclusion ratio. This ratio helps determine how much of your annuity payments are taxable. You can learn more about this calculation on Calculate Annuity Exclusion Ratio 2024.

Popular Questions

What are the different types of annuities?

Annuities can be categorized based on their payout structure, such as fixed, variable, immediate, deferred, and indexed. Fixed annuities provide a guaranteed rate of return, while variable annuities offer potential for higher returns but also carry more risk. Immediate annuities begin payouts immediately, while deferred annuities have a delayed payout period.

Indexed annuities offer returns tied to a specific market index, such as the S&P 500.

How do I choose the right type of annuity?

Seeking guaranteed income for a specific period? You might be interested in an annuity with a guaranteed return. Find out more about Annuity 6 Guaranteed 2024 to see if it aligns with your financial goals.

The best type of annuity for you depends on your individual circumstances, risk tolerance, and financial goals. Consider factors such as your age, investment horizon, and desired level of income security when making your decision. It’s recommended to consult with a financial advisor to determine the most suitable type of annuity for your needs.

Are there any tax advantages to annuities?

Yes, annuities offer certain tax advantages. The growth of annuity funds is typically tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them. However, withdrawals from annuities are generally taxed as ordinary income.