Calculating Annuity Future Value Compounded Monthly 2024 delves into the world of financial planning, exploring the powerful concept of annuities and their potential to grow your wealth over time. Annuities, a series of regular payments, offer a structured approach to saving and investing, allowing individuals to accumulate substantial funds for future goals, such as retirement or a down payment on a home.

Planning to use HDFC’s annuity calculator? This article provides details on the HDFC annuity calculator in 2024: Annuity Calculator Hdfc 2024. It guides you through its features and functionalities.

This guide provides a comprehensive understanding of how annuities work, how to calculate their future value, and the factors that influence their growth.

Inheriting an annuity can be a great asset. This article helps you understand what happens when you inherit an annuity in 2024: What Happens When I Inherit An Annuity 2024. It covers important aspects like claiming and managing the inherited annuity.

We will delve into the intricacies of annuity calculations, focusing on the formula used to determine the future value of an annuity compounded monthly. Understanding the role of key variables like present value, interest rate, and the number of periods is crucial for making informed financial decisions.

For those studying for the Jaiib exam, understanding annuity formulas is crucial. Discover the specific formulas you need to know in 2024 with this guide: Annuity Formula Jaiib 2024. It provides a clear explanation of the formulas and their applications.

We will explore how different interest rates and time periods impact the future value of an annuity, providing insights into the power of compounding and the importance of long-term financial planning.

Understanding future values is crucial when it comes to annuities. Learn how to calculate annuity future values in 2024 with this article: Calculating Annuity Future Values 2024. It explains the process and its significance.

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. It’s a financial instrument that provides a steady stream of income, making it popular for retirement planning, loan repayment, and other financial goals. Annuities are characterized by regular payments, a fixed interest rate, and a defined duration.

Types of Annuities, Calculating Annuity Future Value Compounded Monthly 2024

- Ordinary Annuities:Payments are made at the end of each period, making them the most common type of annuity. For instance, a monthly mortgage payment is an example of an ordinary annuity.

- Annuities Due:Payments are made at the beginning of each period. Rent payments, where the tenant pays at the start of each month, are an example of an annuity due.

Real-World Applications of Annuities

- Retirement Planning:Annuities can provide a steady stream of income during retirement, ensuring financial security.

- Loan Repayments:Mortgage payments, car loans, and student loans often involve regular payments, which are essentially annuities.

- Insurance Policies:Some insurance policies offer annuity options, providing regular payments to beneficiaries.

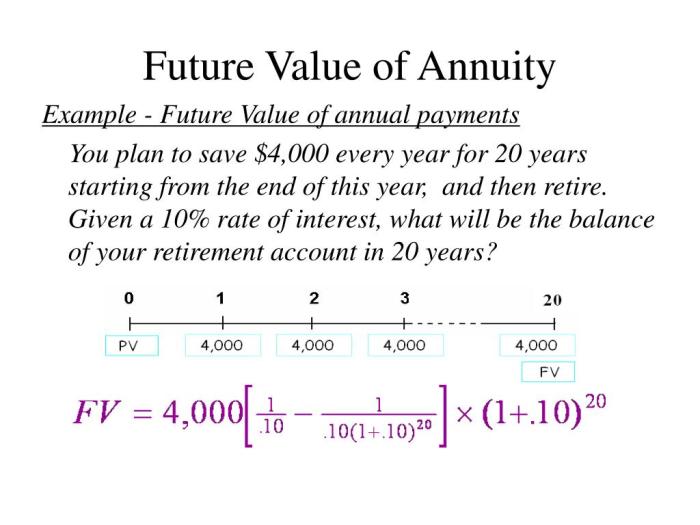

Future Value Calculation

The future value (FV) of an annuity is the total amount of money that will be accumulated at the end of the annuity period. This calculation takes into account the regular payments, the interest rate, and the number of periods.

Need a detailed guide on calculating annuities? This article provides comprehensive information on calculating annuities in 2024: Calculating An Annuity 2024. It covers various methods and formulas for accurate calculations.

Formula for Future Value of an Annuity

FV = P

Want to delve deeper into the world of annuities? This article explores nine important aspects of annuities in 2024: 9 Annuity 2024. It covers topics like types, benefits, and risks associated with annuities.

- (((1 + r)^n

- 1) / r)

Where:

- FVis the future value of the annuity.

- Pis the payment amount.

- ris the interest rate per period.

- nis the number of periods.

Step-by-Step Guide to Calculate Future Value

- Determine the payment amount (P):This is the fixed amount paid each period.

- Identify the interest rate (r):This is the rate at which the annuity earns interest, expressed as a decimal.

- Calculate the number of periods (n):This is the total number of payments made over the annuity’s duration.

- Plug the values into the formula:Substitute the values of P, r, and n into the formula provided above.

- Calculate the future value (FV):Solve the equation to determine the total amount accumulated at the end of the annuity period.

Impact of Interest Rates and Time

The future value of an annuity is significantly influenced by both the interest rate and the time period. A higher interest rate will result in a larger future value, while a longer time period will also lead to greater accumulation.

Want to understand how annuities work? Learn how to calculate them on your calculator in 2024 with this helpful guide: How To Calculate Annuity On Calculator 2024. This guide breaks down the process step-by-step, making it easy to understand.

Effect of Interest Rates

As the interest rate increases, the future value of the annuity grows exponentially. This is because the interest earned on the principal amount is compounded over time, leading to significant growth.

Thinking about a $400,000 annuity? Explore the details of a $400,000 annuity in 2024 with this guide: Annuity $400 000 2024. It provides insights into potential returns and other relevant information.

Impact of Time Period

The longer the annuity period, the greater the future value. This is due to the power of compounding, where interest is earned not only on the principal but also on the accumulated interest. The longer the investment horizon, the more time interest has to compound, resulting in substantial growth.

Annuity joint ownership is a popular option. Learn about the implications of joint ownership in 2024 with this guide: Annuity Joint Ownership 2024. It covers benefits, drawbacks, and important considerations.

Comparison of Future Values

| Interest Rate | Time Period (Years) | Future Value |

|---|---|---|

| 5% | 10 | $125,778 |

| 5% | 20 | $265,330 |

| 7% | 10 | $140,255 |

| 7% | 20 | $386,968 |

The table above illustrates the impact of interest rates and time on the future value of an annuity. A higher interest rate (7%) and a longer time period (20 years) result in a significantly larger future value compared to a lower interest rate (5%) and a shorter time period (10 years).

Looking for a specific annuity calculator? This article focuses on the HL annuity calculator in 2024: Annuity Calculator Hl 2024. It explains how to use this calculator and its features.

Practical Applications: Calculating Annuity Future Value Compounded Monthly 2024

Annuity future value calculations are widely used in personal finance, helping individuals plan for various financial goals.

Planning to invest in an annuity? This article helps you understand how much a $80,000 annuity might pay per month in 2024: How Much Does A 80 000 Annuity Pay Per Month 2024. It provides insights into potential monthly payments based on current market conditions.

Retirement Savings

Imagine John, a 30-year-old professional, aiming to retire at 65. He wants to save $1 million for retirement. By using an annuity calculator, he can determine the monthly contribution required to reach his goal, assuming a specific interest rate and time period.

Understanding how to calculate annuities can be tricky. This article provides a clear example of calculating an annuity in 2024: Calculate Annuity Example 2024. It walks you through the steps with a real-life scenario.

Benefits and Drawbacks of Annuities

Benefits

- Guaranteed Income Stream:Annuities provide a predictable stream of income, reducing financial uncertainty.

- Tax Advantages:Some annuities offer tax-deferred growth, allowing investments to accumulate tax-free until withdrawal.

- Protection Against Market Volatility:Annuities can offer protection against market fluctuations, providing a stable income source.

Drawbacks

- Limited Growth Potential:Annuities typically offer lower returns compared to other investment options.

- Fees and Charges:Annuities often involve fees, which can impact returns.

- Lack of Flexibility:Once an annuity is purchased, it can be difficult to access funds before the designated payout period.

Tools and Resources

Numerous online calculators and software tools are available to assist in calculating annuity future values.

Annuity is a financial tool with various applications. This article explores the fundamentals of what an annuity is in 2024: 1 An Annuity Is 2024. It provides a clear definition and its key characteristics.

Online Calculators

- Bankrate:Provides a comprehensive annuity calculator with various features, including variable interest rates and different payment frequencies.

- Investopedia:Offers a simple annuity calculator that allows users to input key parameters and calculate future value.

- Calculator.net:Provides a versatile calculator that can handle both ordinary annuities and annuities due.

Software Tools

- Microsoft Excel:Includes built-in financial functions, such as FV, which can be used to calculate annuity future values.

- Quicken:A popular personal finance software that offers robust annuity calculations and analysis.

- Mint:A free financial management tool that provides basic annuity calculations.

Comparison of Features

| Tool | Features | Advantages | Disadvantages |

|---|---|---|---|

| Bankrate | Variable interest rates, payment frequencies, and annuity types | Comprehensive functionality, user-friendly interface | May require registration |

| Investopedia | Simple calculation, easy to use | Free and accessible, straightforward | Limited features compared to other tools |

| Calculator.net | Handles both ordinary and annuities due | Versatile, supports various annuity types | May require some technical knowledge |

| Microsoft Excel | Built-in FV function, customizable calculations | Powerful and flexible, widely available | Requires basic spreadsheet knowledge |

| Quicken | Comprehensive financial management, advanced annuity calculations | Robust features, detailed analysis | Paid software, may require subscription |

| Mint | Basic annuity calculations, free to use | Accessible, easy to use, free | Limited features, may not be suitable for complex calculations |

Conclusive Thoughts

By understanding the principles of annuity calculations, you can harness the potential of these financial instruments to achieve your financial goals. Whether you’re planning for retirement, saving for a major purchase, or simply seeking a reliable way to grow your wealth, annuities can be a valuable tool in your financial arsenal.

As you embark on your financial journey, remember that careful planning, informed decision-making, and a long-term perspective are key to maximizing your financial well-being.

FAQs

What is the difference between an ordinary annuity and an annuity due?

When considering annuities, knowing the issuer is essential. This article explores the key aspects of annuity issuers in 2024: Annuity Issuer 2024. It covers factors to consider when choosing an annuity provider.

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference affects the future value calculation.

How does inflation affect annuity calculations?

Inflation can erode the purchasing power of future annuity payments. It’s important to consider inflation when making annuity calculations to ensure that the future value is sufficient to meet your financial needs.

Are there any tax implications associated with annuities?

Yes, annuity payments are generally taxable as ordinary income. However, there may be tax-advantaged annuity options available depending on your specific circumstances.

Curious about the meaning of “annuity” in Tamil? This article provides a detailed explanation in 2024: Annuity Meaning In Tamil 2024. It covers the concept and its relevance in the Tamil language.

What are some common mistakes people make when using annuities?

Some common mistakes include choosing an annuity with high fees, failing to understand the terms and conditions of the annuity, and not considering the impact of inflation.