Calculating Annuity Factor 2024 is essential for understanding how interest rates and time periods affect future financial planning. This guide explores the concept of annuity factors, their calculation, and their implications for individuals and businesses alike.

An annuity factor is a mathematical tool used to determine the present value of a stream of future payments. It considers factors such as interest rates, the number of payments, and the timing of payments. Understanding how these variables influence the annuity factor can help you make informed financial decisions, whether you are saving for retirement, planning for a mortgage, or investing in a business.

Annuity Factor: Definition and Purpose

An annuity factor is a crucial tool in financial calculations, particularly when dealing with annuities. An annuity is a series of equal payments made over a specific period, often used for retirement planning, loan repayments, or investments. The annuity factor helps determine the present value or future value of these streams of payments.

Understanding the Annuity Factor

In simple terms, the annuity factor represents the present value of a stream of $1 payments made over a certain period. It is a multiplier used to convert a series of future payments into a single lump sum value today.

The factor is determined by the interest rate and the number of periods involved.

Annuity and pension are often compared, and the article Is Annuity Same As Pension 2024 can help you understand the differences. Calculating the value of an annuity can be done using a calculator that considers monthly compounding. You can find information on Annuity Calculator Compounded Monthly 2024.

Understanding the ownership of an annuity is important, and you can find more information on Annuity Owner Is 2024.

The Importance of the Annuity Factor

The annuity factor plays a pivotal role in various financial calculations, including:

- Present Value of an Annuity:Determining the current worth of future payments, essential for evaluating investments or loans.

- Future Value of an Annuity:Calculating the accumulated value of regular payments over time, useful for retirement planning or savings goals.

- Loan Repayments:Calculating the monthly payment amount for a loan based on the principal, interest rate, and loan term.

- Investment Analysis:Comparing different investment options by considering the present value of their future cash flows.

Examples of Annuity Factor Applications

Here are some real-world examples of how the annuity factor is used:

- Retirement Planning:Calculating the present value of a stream of retirement income payments to determine how much you need to save.

- Mortgage Payments:Calculating the monthly mortgage payment based on the loan amount, interest rate, and loan term.

- Loan Amortization:Creating an amortization schedule that shows the breakdown of principal and interest payments over the life of a loan.

- Investment Valuation:Evaluating the worth of an investment that generates regular cash flows, such as a rental property.

Calculating the Annuity Factor

The annuity factor is calculated using a specific formula that takes into account the interest rate and the number of periods. The formula varies depending on whether you are calculating the present value or future value of the annuity.

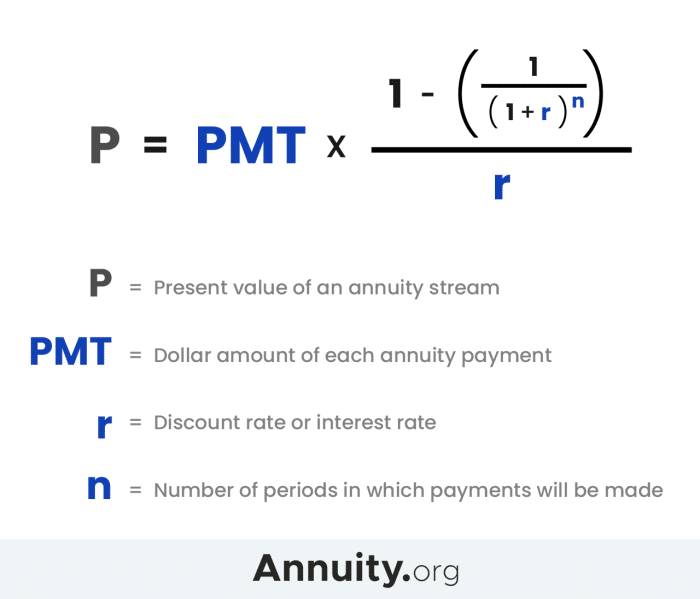

Formula for Present Value Annuity Factor

Present Value Annuity Factor = (1- (1 + r)^-n) / r

Where:

- rrepresents the interest rate per period.

- nrepresents the number of periods.

Formula for Future Value Annuity Factor

Future Value Annuity Factor = ((1 + r)^n- 1) / r

Where:

- rrepresents the interest rate per period.

- nrepresents the number of periods.

Step-by-Step Calculation of the Annuity Factor

To calculate the annuity factor, follow these steps:

- Identify the interest rate (r) and the number of periods (n).

- Plug the values into the appropriate formula (present value or future value).

- Calculate the result using a calculator or spreadsheet software.

Factors Affecting the Annuity Factor

The value of the annuity factor is influenced by several factors, primarily the interest rate and the number of periods. Understanding these factors helps interpret the impact on the present or future value of an annuity.

Impact of Interest Rates

The annuity factor is directly proportional to the interest rate. A higher interest rate leads to a higher annuity factor, indicating a higher present value or future value of the annuity. This is because higher interest rates mean the money invested or borrowed grows faster over time.

Relationship Between Time Period and Annuity Factor

The annuity factor also increases with the number of periods. As the time period for the annuity extends, the present value or future value increases due to the compounding effect of interest. The longer the time period, the more time the money has to grow at the given interest rate.

Applications of the Annuity Factor: Calculating Annuity Factor 2024

The annuity factor finds applications in various financial contexts. Here’s a table summarizing some key applications, formulas, variables, and examples:

| Application | Formula | Variables | Example |

|---|---|---|---|

| Present Value of an Annuity | PV = PMT

|

PV = Present Value, PMT = Payment Amount, r = Interest Rate, n = Number of Periods | Calculating the present value of a $1,000 annual retirement income stream for 20 years at a 5% interest rate. |

| Future Value of an Annuity | FV = PMT

Many people consider rolling over their 401k into an annuity. The article Annuity 401k Rollover 2024 provides information on this. There are times when an annuity might be out of its surrender period. You can find information on this in the article My Annuity Is Out Of Surrender 2024. Annuity is often described as a present value, which you can read more about in the article Annuity Is Present Value 2024.

|

FV = Future Value, PMT = Payment Amount, r = Interest Rate, n = Number of Periods | Calculating the future value of a $50 monthly savings plan for 10 years at a 3% interest rate. |

| Loan Repayments | PMT = (PV

Annuity rules can be complex, including those related to rollovers. The article Annuity 60 Day Rollover 2024 provides details on a 60-day rollover option. There are different types of annuities, and some are classified as “9” annuities. The article 9 Annuity 2024 explains more about these. If you’re interested in annuities in New Zealand, the article Annuity Nz 2024 can be a good resource.

|

PMT = Monthly Payment, PV = Loan Amount, r = Interest Rate, n = Loan Term | Calculating the monthly payment for a $200,000 mortgage at a 4% interest rate over 30 years. |

| Investment Valuation | PV = CF1 / (1 + r) + CF2 / (1 + r)^2 + … + CFn / (1 + r)^n | PV = Present Value, CF = Cash Flow, r = Discount Rate, n = Number of Periods | Evaluating the present value of a rental property that generates $12,000 annual cash flow for 10 years at a 6% discount rate. |

Annuity Factor in 2024

The annuity factor in 2024 will be influenced by the prevailing economic conditions, particularly interest rate trends. While predicting the future is challenging, analyzing current trends can provide insights into potential impacts.

Annuity is a financial product that provides regular payments, either for a fixed period or for life. To understand the basics of annuity, you can check out this article on Annuity What Is The Meaning 2024. When receiving annuity payments, you might be curious about how it’s reported on your taxes.

The article Annuity 1099 2024 can provide insight on that. There are different types of annuities, and one type, an immediate annuity, starts paying out right away. You can learn more about that in the article Annuity Is Immediate 2024.

Economic Conditions and Interest Rates

The current economic landscape is characterized by rising inflation and central banks raising interest rates to combat it. This trend is likely to continue in 2024, potentially leading to higher interest rates across various financial products.

Impact on Annuity Factor

Higher interest rates generally result in a higher annuity factor, implying a higher present value or future value of an annuity. This is because the compounding effect of interest becomes more pronounced at higher rates.

Financial Planning in 2024, Calculating Annuity Factor 2024

In 2024, individuals and businesses should be mindful of the potential impact of interest rate changes on annuity-related financial planning. For example, investors may want to consider the higher potential returns offered by investments with longer time horizons, while borrowers might need to factor in higher interest costs when taking out loans.

Final Conclusion

As we enter 2024, understanding the annuity factor is more crucial than ever. By considering the impact of economic conditions, interest rate trends, and the time value of money, individuals and businesses can make sound financial decisions. This guide has provided a framework for calculating the annuity factor and applying it to various financial scenarios, equipping you with the knowledge to navigate the complexities of financial planning in the year ahead.

Q&A

What is the difference between an annuity factor and a discount factor?

An annuity factor is used to calculate the present value of a stream of future payments, while a discount factor is used to calculate the present value of a single future payment. The annuity factor considers multiple payments, while the discount factor considers only one.

How does the annuity factor change with increasing interest rates?

There are various annuity providers, and one of them is Annuity King, based in Sarasota. You can find more information on Annuity King Sarasota 2024. If you’re interested in annuities in Hong Kong, the article Annuity Hk 2024 might be helpful.

For those looking to learn about the age requirement for accessing retirement funds through an annuity, the article Annuity 59 1/2 Rule 2024 is a good starting point.

As interest rates increase, the annuity factor decreases. This is because higher interest rates make future payments less valuable in today’s dollars.

How does the annuity factor change with increasing time periods?

As the time period increases, the annuity factor also increases. This is because the longer the time period, the more payments are included in the calculation, resulting in a higher present value.