Calculating Annuity Excel 2024 empowers you to navigate the complexities of financial planning with ease. Whether you’re aiming for a comfortable retirement, managing mortgage payments, or achieving other financial goals, understanding annuities is essential. This comprehensive guide will equip you with the knowledge and tools to effectively utilize Excel for calculating annuities.

Looking for an annuity with a guaranteed payout for 20 years? Annuity 20 Year Certain 2024 explains the concept of a 20-year certain annuity, providing insights into its features and potential advantages.

Annuities are a powerful financial tool that allows you to make regular payments over a set period, either for a lump sum or a series of future payments. By leveraging Excel’s built-in functions, you can effortlessly calculate present values, future values, and periodic payments for various annuity scenarios.

Understanding Annuities

An annuity is a series of equal payments made over a specific period of time. They are commonly used in financial planning for retirement, mortgage payments, and other financial goals. Annuities can be categorized into different types based on the timing of payments and other factors.

Curious about how annuities work and want a straightforward explanation? Annuity Khan Academy 2024 offers a clear and concise explanation of annuities, covering essential concepts and providing valuable insights into this retirement planning tool.

Let’s explore the different types of annuities and the key components involved in their calculations.

Types of Annuities

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period. This type of annuity often results in a higher future value compared to an ordinary annuity.

- Perpetuity:Payments continue indefinitely. This type of annuity is typically used for investments that generate a steady stream of income for an extended period.

Key Components of Annuity Calculations

- Principal:The initial amount of money invested or borrowed.

- Interest Rate:The rate at which the principal grows over time.

- Payment Period:The frequency of payments, such as monthly, quarterly, or annually.

- Time Period:The total duration of the annuity, expressed in years or periods.

Annuity Formulas

Annuity calculations involve determining either the present value or the future value of a stream of payments. These calculations rely on specific formulas that consider the key components mentioned earlier.

Present Value of an Annuity

The present value (PV) of an annuity is the current value of a series of future payments, discounted back to the present using the interest rate.

The formula for calculating the present value of an ordinary annuity is:

PV = PMT

Choosing between an annuity and an IRA can be a tough decision. Annuity V Ira 2024 compares the pros and cons of each investment option, helping you determine which one best aligns with your retirement goals and financial situation.

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Future Value of an Annuity

The future value (FV) of an annuity is the value of a series of payments at a future point in time, compounded forward using the interest rate.

Want to understand the meaning of “annuity” in plain English? Annuity Meaning In English 2024 offers a simple and straightforward explanation of annuities, making it easier to grasp this important retirement planning tool.

The formula for calculating the future value of an ordinary annuity is:

FV = PMT

Want to streamline your annuity calculations? Calculating Annuity Payments In Excel 2024 guides you through the process of using Excel to calculate annuity payments, providing a convenient and efficient way to manage your retirement planning.

- [(1 + r)^n

- 1] / r

Where:

- FV = Future Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Present Value vs. Future Value

The key difference between present value and future value calculations is the perspective on time. Present value discounts future payments to their current worth, while future value compounds current payments forward to their future value. The choice between these calculations depends on the specific financial situation and the desired outcome.

Understanding the formula behind annuity bonds is essential for making informed investment decisions. Formula Annuity Bond 2024 breaks down the key components of the formula, providing insights into how these bonds function and their potential returns.

Excel Functions for Annuity Calculations: Calculating Annuity Excel 2024

Microsoft Excel provides a range of built-in functions that simplify annuity calculations. These functions streamline the process, eliminating the need for manual calculations and reducing the risk of errors. Let’s explore some of the most commonly used Excel functions for annuities.

Deciding between an annuity and a drawdown strategy for your retirement funds? Annuity Or Drawdown 2024 compares the pros and cons of each approach, helping you make an informed decision based on your individual circumstances and risk tolerance.

Excel Functions for Annuity Calculations

| Function | Description | Syntax | Example |

|---|---|---|---|

| PV | Calculates the present value of an annuity | PV(rate, nper, pmt, [fv], [type]) | =PV(0.05, 10, 1000, 0, 0) |

| FV | Calculates the future value of an annuity | FV(rate, nper, pmt, [pv], [type]) | =FV(0.05, 10, 1000, 0, 0) |

| PMT | Calculates the periodic payment amount for an annuity | PMT(rate, nper, pv, [fv], [type]) | =PMT(0.05, 10,

|

| NPER | Calculates the number of periods for an annuity | NPER(rate, pmt, pv, [fv], [type]) | =NPER(0.05,

|

| RATE | Calculates the interest rate for an annuity | RATE(nper, pmt, pv, [fv], [type], [guess]) | =RATE(10,

Want to understand the true value of an annuity? Annuity Is The Value Of 2024 explains how to determine the present value of an annuity, considering factors like interest rates and payment periods.

|

Using the PV Function

To calculate the present value of an annuity using the PV function in Excel, follow these steps:

- Enter the interest rate per period in the “rate” argument. For example, if the annual interest rate is 5% and payments are made monthly, the interest rate per period would be 0.05/12.

- Enter the total number of periods in the “nper” argument. For example, if the annuity lasts for 10 years and payments are made monthly, the total number of periods would be 10*12.

- Enter the payment amount in the “pmt” argument. Note that payments are considered negative if they are outflows (e.g., mortgage payments) and positive if they are inflows (e.g., retirement income).

- Enter any future value in the “fv” argument. If there is no future value, leave this argument blank or enter 0.

- Enter 0 in the “type” argument for an ordinary annuity (payments at the end of each period) or 1 for an annuity due (payments at the beginning of each period).

Using the FV Function

To calculate the future value of an annuity using the FV function in Excel, follow these steps:

- Enter the interest rate per period in the “rate” argument.

- Enter the total number of periods in the “nper” argument.

- Enter the payment amount in the “pmt” argument.

- Enter any present value in the “pv” argument. If there is no present value, leave this argument blank or enter 0.

- Enter 0 in the “type” argument for an ordinary annuity or 1 for an annuity due.

Using the PMT Function

To calculate the periodic payment amount for an annuity using the PMT function in Excel, follow these steps:

- Enter the interest rate per period in the “rate” argument.

- Enter the total number of periods in the “nper” argument.

- Enter the present value of the annuity in the “pv” argument.

- Enter any future value in the “fv” argument. If there is no future value, leave this argument blank or enter 0.

- Enter 0 in the “type” argument for an ordinary annuity or 1 for an annuity due.

Annuity Calculation Examples

Let’s illustrate how to calculate the present value, future value, and periodic payment amount for an annuity using Excel. We’ll use a hypothetical scenario to demonstrate the steps involved.

Thinking about annuities for retirement? 5 Annuity 2024 highlights five key types of annuities that might be a good fit for your financial goals. From immediate annuities to deferred annuities, explore the different options and find the one that aligns with your needs.

Example 1: Calculating the Present Value of an Annuity

Suppose you want to receive $10,000 per year for 10 years, starting at the end of the first year. The annual interest rate is 5%. To calculate the present value of this annuity, you would use the PV function in Excel as follows:

- Enter the interest rate per period in cell A1: =0.05

- Enter the total number of periods in cell A2: =10

- Enter the payment amount in cell A3: =-10000

- Enter the future value in cell A4: =0

- Enter the type of annuity in cell A5: =0

- In cell A6, enter the formula: =PV(A1, A2, A3, A4, A5)

The result in cell A6 will be the present value of the annuity, which is approximately $77,217.35.

Looking to understand the different types of annuities available in 2024? You’ve come to the right place! Annuity Kinds 2024 provides a comprehensive overview of the various options, from fixed annuities to variable annuities, helping you navigate the world of retirement planning.

Example 2: Calculating the Future Value of an Annuity

Suppose you want to save $1,000 per month for 5 years, starting at the end of the first month. The annual interest rate is 6%. To calculate the future value of this annuity, you would use the FV function in Excel as follows:

- Enter the interest rate per period in cell B1: =0.06/12

- Enter the total number of periods in cell B2: =5*12

- Enter the payment amount in cell B3: =-1000

- Enter the present value in cell B4: =0

- Enter the type of annuity in cell B5: =0

- In cell B6, enter the formula: =FV(B1, B2, B3, B4, B5)

The result in cell B6 will be the future value of the annuity, which is approximately $71,689.82.

Are you curious about the tax implications of annuities? Annuity Is Taxable 2024 provides a clear explanation of how annuity income is taxed, covering different types of annuities and the potential tax benefits they offer.

Example 3: Calculating the Periodic Payment Amount for an Annuity

Suppose you want to borrow $100,000 for a 30-year mortgage at an annual interest rate of 4%. To calculate the monthly payment amount, you would use the PMT function in Excel as follows:

- Enter the interest rate per period in cell C1: =0.04/12

- Enter the total number of periods in cell C2: =30*12

- Enter the present value of the loan in cell C3: =100000

- Enter the future value in cell C4: =0

- Enter the type of annuity in cell C5: =0

- In cell C6, enter the formula: =PMT(C1, C2, C3, C4, C5)

The result in cell C6 will be the monthly payment amount, which is approximately $477.42.

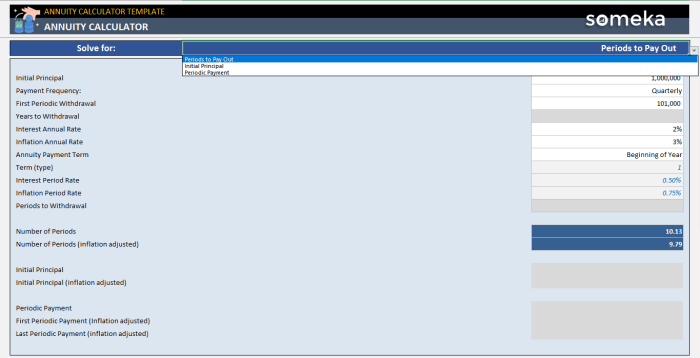

Excel Spreadsheet Template for Annuity Calculations

You can create an Excel spreadsheet template to streamline annuity calculations. The template should include input fields for the key components (principal, interest rate, payment period, and time period) and formulas to calculate the present value, future value, and periodic payment amount.

The template can be customized based on the specific needs of the user.

Thinking about an annuity at age 65? Annuity 65 2024 discusses the benefits and considerations of purchasing an annuity at this age, helping you make an informed decision about your retirement income.

Practical Applications of Annuities

Annuities play a significant role in various aspects of personal finance, business, and investment planning. They provide a structured framework for managing financial obligations and achieving financial goals. Let’s explore some real-world examples of how annuities are used.

Encountering a situation where your annuity is out of surrender? My Annuity Is Out Of Surrender 2024 explains the concept of surrender charges and provides insights into potential solutions for dealing with this situation.

Retirement Planning

Annuities are often used in retirement planning to provide a steady stream of income during retirement. Individuals can purchase an annuity with a lump sum of money, and the insurance company will make regular payments to them for a predetermined period.

Calculating the necessary deposit for your desired annuity payments can be a crucial step in retirement planning. Calculate Annuity Deposit 2024 provides guidance on how to estimate the deposit amount based on your income goals and the chosen annuity type.

Mortgage Payments

Mortgage payments are a classic example of an annuity. Homeowners make regular payments to their lender over a set period of time, paying off both the principal and interest on the loan. The monthly mortgage payment is calculated as an annuity.

Investment Planning, Calculating Annuity Excel 2024

Annuities can be used in investment planning to generate a predictable income stream. Investors can purchase an annuity with their savings, and the insurance company will make regular payments to them for a specific period. This can provide a stable source of income for retirement or other financial goals.

Other Financial Goals

Annuities can be used for a variety of other financial goals, such as funding education expenses, paying off debt, or creating a legacy for future generations. The flexibility of annuities makes them a valuable tool for managing financial obligations and achieving financial objectives.

Are you wondering if an annuity can provide income for your entire lifetime? Is Annuity For Life 2024 explores the concept of lifetime income annuities and discusses the factors that influence their duration and potential benefits.

Concluding Remarks

Mastering annuity calculations in Excel opens doors to a world of financial possibilities. By understanding the concepts and applying the right functions, you can make informed decisions about your investments, retirement planning, and overall financial well-being. This guide has provided you with the foundation to confidently navigate the world of annuities, ensuring your financial future is secure and prosperous.

Commonly Asked Questions

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How do I calculate the present value of an annuity in Excel?

Use the PV function in Excel, which requires inputs for the interest rate, the number of periods, the payment amount, and the future value.

Can I use Excel to calculate the payment amount for a loan?

Yes, the PMT function in Excel allows you to calculate the periodic payment amount for a loan based on the interest rate, loan term, and principal amount.