Calculating Annuity Due In Excel 2024 empowers you to navigate the complexities of financial planning with ease. Whether you’re managing loan repayments, crafting investment strategies, or planning for retirement, understanding the nuances of annuity due calculations is crucial. Excel provides a powerful platform for these calculations, offering a user-friendly interface and robust functions that streamline the process.

If you’re in the UK, understanding annuity rates is crucial. Explore Annuity Rates Uk 2024 to get insights into current rates and how they affect your retirement income.

This guide delves into the fundamentals of annuity due, exploring its key characteristics and differentiating it from ordinary annuities. We’ll uncover the secrets behind compounding in annuity due and explore how Excel functions like PV, FV, and PMT can be harnessed to calculate present value, future value, and periodic payments.

Understanding the unit of measurement for annuities is essential. Visit Annuity Unit Is 2024 to learn how annuity payments are typically expressed and how to interpret them.

Calculating Annuity Due in Excel 2024

Annuity due is a financial concept that involves a series of equal payments made at the beginning of each period. It’s commonly used in various financial scenarios, including loan repayments, investment planning, and retirement savings. Understanding annuity due calculations is crucial for making informed financial decisions.

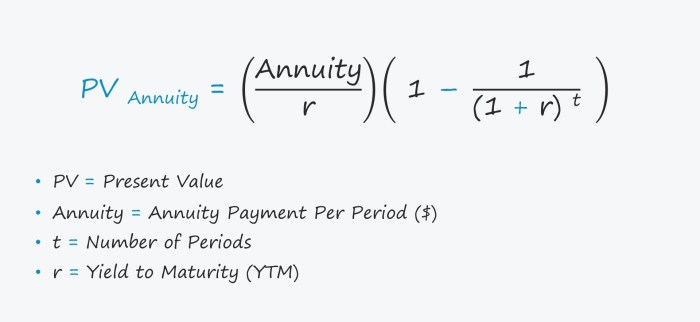

Curious about the formula used to calculate annuities? Explore Annuity Formula Is 2024 to learn the fundamental formula and its variations for different annuity types.

Understanding Annuity Due, Calculating Annuity Due In Excel 2024

An annuity due is a stream of equal payments made at the beginning of each period. It’s characterized by its regular payment schedule, fixed interest rate, and a defined period of time.

Understanding how to calculate annuity payments is essential for planning your retirement. Visit Calculating Annuity Payments 2024 to learn the steps and factors involved in determining your payments.

The key difference between an annuity due and an ordinary annuity lies in the timing of payments. In an ordinary annuity, payments are made at the end of each period, while in an annuity due, payments are made at the beginning.

This seemingly small difference can have a significant impact on the overall value of the annuity.

Planning for retirement at 65? Understanding annuities can be crucial. Learn about Annuity 65 2024 and explore how annuities can provide a steady stream of income during your golden years.

Compounding plays a vital role in annuity due calculations. It refers to the process of earning interest on both the principal amount and accumulated interest. In an annuity due, interest is compounded on the initial principal amount and each subsequent payment, as payments are made at the beginning of each period.

Want to know how much your £80,000 annuity might pay out each month? Find out with How Much Does A 80 000 Annuity Pay Per Month 2024 and gain valuable insights into your potential monthly income.

This leads to a higher overall return compared to an ordinary annuity.

Excel can be your best friend when it comes to annuity calculations. Learn how to use Excel’s functions to calculate your annuity payments by visiting Calculating An Annuity In Excel 2024.

Excel Functions for Annuity Due Calculation

Excel provides several built-in functions that simplify annuity due calculations. These functions are designed to handle the complexities of compounding and payment timing, making it easier to determine the present value, future value, and periodic payment amount of an annuity due.

Need a quick and easy way to estimate your annuity payments? Check out Annuity Estimator 2024 for a simple tool that helps you visualize your potential income.

- PV (Present Value) function: This function calculates the present value of an annuity due, which represents the current worth of a series of future payments. It takes into account the interest rate, number of periods, and payment amount.

- FV (Future Value) function: This function calculates the future value of an annuity due, which represents the total amount accumulated at the end of the specified period. It considers the interest rate, number of periods, and payment amount.

- PMT (Payment) function: This function calculates the periodic payment amount required to achieve a specific present value or future value of an annuity due. It takes into account the interest rate, number of periods, and the desired present or future value.

Steps to Calculate Annuity Due in Excel

Calculating annuity due in Excel involves using the appropriate functions and inputting the relevant parameters. The steps are as follows:

- Identify the parameters: Determine the payment amount, interest rate, and number of periods for the annuity due.

- Select the appropriate function: Use the PV function for calculating the present value, the FV function for calculating the future value, and the PMT function for calculating the periodic payment amount.

- Input the parameters into the function: Enter the payment amount, interest rate, and number of periods into the selected function. Remember to adjust the “TYPE” argument to 1 for annuity due calculations. The “TYPE” argument specifies whether the payments are made at the beginning (1) or end (0) of each period.

- Execute the function: Press Enter to calculate the desired value.

Examples of Annuity Due Calculations

Let’s consider a few examples to illustrate the application of Excel functions for annuity due calculations.

Curious about how a £300,000 annuity might pay out? Learn about Annuity 300k 2024 to understand the potential income stream and factors that influence it.

| Scenario | Payment | Interest Rate | Number of Periods |

|---|---|---|---|

| Scenario 1 | $1,000 | 5% | 10 |

| Scenario 2 | $500 | 3% | 20 |

| Scenario 3 | $2,000 | 6% | 15 |

To calculate the present value for Scenario 1, we can use the PV function in Excel: =PV(5%, 10, 1000, 0, 1). This formula returns a present value of $7,721.73. Similarly, we can use the FV, and PMT functions to calculate the future value and payment amount for each scenario.

An annuity is a series of regular payments, but what makes them unique? Dive deeper into An Annuity Is A Series Of Equal Periodic Payments 2024 to understand the core principles of annuity payments.

Applications of Annuity Due Calculations

Annuity due calculations have various real-world applications, including:

- Loan repayments: Many loan agreements, such as mortgages and car loans, involve annuity due payments, where the borrower makes regular payments at the beginning of each period. Annuity due calculations can be used to determine the total amount of interest paid over the loan term and the remaining balance after each payment.

Want to figure out how much your annuity will pay out this year? Check out this guide on Calculating An Annuity Payout 2024 to understand the factors that influence your payout and learn how to estimate your income.

- Investment planning: Annuity due calculations can be used to plan for future financial goals, such as retirement or a down payment on a house. By making regular contributions at the beginning of each period, investors can benefit from compounding and achieve their financial objectives sooner.

Wondering if your annuity payments are guaranteed? Discover the answer to this question by reading about Is Annuity Certain 2024. You’ll gain insights into the different types of annuities and their associated guarantees.

- Retirement savings: Retirement savings plans often involve annuity due payments, where individuals contribute a fixed amount at the beginning of each month. Annuity due calculations can be used to estimate the future value of retirement savings and determine the required monthly contributions to reach a desired retirement income.

- Insurance premiums: Many insurance policies, such as life insurance and health insurance, require regular premium payments at the beginning of each period. Annuity due calculations can be used to determine the total cost of insurance premiums over the policy term and the present value of future premium payments.

Annuity payments are a known quantity, but it’s important to understand the specifics. Explore An Annuity Is Known 2024 to learn about the factors that determine the amount and frequency of your payments.

Outcome Summary

Mastering annuity due calculations in Excel 2024 equips you with a valuable skillset for managing your financial future. From analyzing loan scenarios to crafting investment strategies, the knowledge gained from this guide can empower you to make informed decisions and achieve your financial goals.

Remember, understanding the intricacies of annuity due calculations is not just about formulas and functions; it’s about gaining control over your financial well-being.

Query Resolution: Calculating Annuity Due In Excel 2024

What is the difference between annuity due and ordinary annuity?

Calculating annuities can be easier than you think, especially with Excel. Learn how to use Excel’s powerful tools to calculate your annuity payouts by visiting Calculating Annuity In Excel 2024.

An annuity due has payments made at the beginning of each period, while an ordinary annuity has payments made at the end of each period.

Looking for a solid return on your annuity investment? Discover the possibilities with 7 Annuity Return 2024 , where you’ll find information on potential returns and strategies for maximizing your gains.

How does the “TYPE” argument in Excel functions affect annuity due calculations?

The “TYPE” argument in PV and FV functions specifies the timing of payments. Setting it to 0 indicates an ordinary annuity, while setting it to 1 indicates an annuity due.

Can I use Excel to calculate annuity due for irregular payment periods?

While Excel is primarily designed for regular payment periods, you can adapt the formulas to handle irregular periods by adjusting the number of periods and interest rate calculations accordingly.

Are there any limitations to using Excel for annuity due calculations?

Excel can handle a wide range of scenarios, but it’s important to note that complex financial calculations may require specialized software or financial modeling tools.