Calculating Annuity Annual Payment 2024 is a crucial aspect of financial planning, whether you’re looking to secure a comfortable retirement or save for your children’s education. Annuities, essentially a series of payments made over a set period, can provide a steady stream of income, but understanding how these payments are calculated is essential for making informed decisions.

When you withdraw money from your annuity, you’ll need to be aware of the tax implications. An Annuity Withdrawal Tax Calculator 2024 can help you determine how much tax you’ll owe.

This guide delves into the intricacies of annuity payments, providing insights into the factors that influence them and offering practical examples to illustrate the process.

There are different types of annuities available, and you might be interested in learning more about 4 Annuity 2024. Each type has its own unique features and benefits.

Annuity payments are determined by various factors, including the initial principal amount, interest rates, and the length of the annuity period. Understanding how these variables interact is key to maximizing the benefits of an annuity. This guide explores these factors in detail, providing a comprehensive overview of the calculations involved.

An Annuity Is Payment 2024 that is made regularly over a specific period of time. This type of payment can be a great way to secure a consistent income stream for retirement.

Understanding Annuities: Calculating Annuity Annual Payment 2024

An annuity is a financial product that provides a stream of regular payments over a specified period of time. It’s like a long-term savings plan where you invest a lump sum of money, and the provider guarantees to pay you a fixed amount of income every month, year, or at any other interval you choose, for a set period of time.

If you’re looking to receive a fixed amount of money each year for a set period of time, you might be interested in learning more about an Annuity 30k 2024. These financial products can be a good option for those who want to secure their income in retirement.

Annuities are often used for retirement planning, but they can also be used for other purposes, such as saving for a child’s education or generating income during a period of disability.

If you’re looking for a way to secure your retirement income, you might consider rolling over your 401k into an Annuity 401k Rollover 2024. This can help you protect your savings and generate a steady income stream.

Types of Annuities

Annuities come in various forms, each designed to meet specific financial needs. Here are some common types:

- Fixed Annuities:These offer guaranteed payments for a fixed period, with the interest rate determined upfront. They provide stability and predictability, but may not keep pace with inflation.

- Variable Annuities:These link payments to the performance of underlying investments, such as stocks or bonds. They offer the potential for higher returns, but also carry higher risk. Payments may fluctuate depending on the market’s performance.

- Immediate Annuities:These start making payments immediately after the initial investment. They are often used for income generation in retirement.

Benefits and Risks of Annuities

Annuities offer both advantages and disadvantages, which you should carefully consider before making an investment decision.

- Benefits:

- Guaranteed income stream: Annuities provide a predictable source of income, especially important during retirement.

- Tax deferral: Earnings within an annuity grow tax-deferred, potentially leading to tax savings.

- Protection against outliving your savings: Annuities ensure you won’t outlive your savings, providing peace of mind in retirement.

- Risks:

- Limited liquidity: You may face penalties for withdrawing funds early from an annuity.

- Potential for low returns: Fixed annuities may offer lower returns compared to other investments, especially during periods of high inflation.

- Complexity: Annuities can be complex financial products, requiring careful research and understanding before investing.

Calculating Annuity Annual Payment

Calculating the annual payment of an annuity involves determining the amount of money you’ll receive each year based on your initial investment and other factors.

If you’re trying to solve a word puzzle and you come across the word “annuity”, you might need to Annuity Unscramble 2024 to figure out the letters.

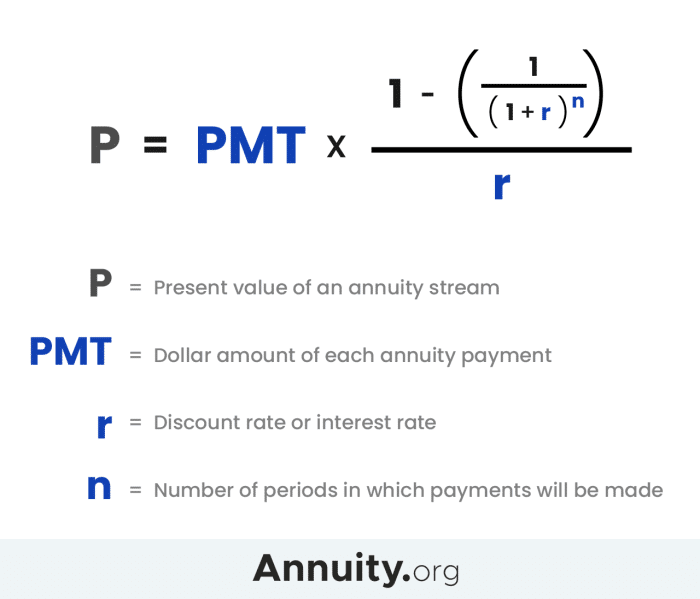

Formula for Calculating Annuity Annual Payment

Annual Payment = (Principal Amount- Interest Rate) / (1 – (1 + Interest Rate)^-Number of Years)

One of the key benefits of an annuity is that it can provide guaranteed income for life. But is this guarantee always true? You might want to ask, Is Annuity Guaranteed 2024 ?

Where:

- Principal Amount:The initial investment or lump sum you deposit into the annuity.

- Interest Rate:The annual interest rate earned on the annuity, expressed as a decimal.

- Number of Years:The duration of the annuity period, in years.

Examples of Annuity Payment Calculations

Let’s illustrate how to calculate annual payments with some scenarios:

- Scenario 1: Retirement Planning

- Principal Amount: $500,000

- Interest Rate: 4% (0.04)

- Number of Years: 20

Annual Payment = ($500,000 – 0.04) / (1 – (1 + 0.04)^-20) = $38,408.54

Annuities can be a complex financial product, and you might be wondering if they’re a good investment for you. To find out, you might ask, Is Annuity Good Investment 2024 ?

- Scenario 2: Saving for a Child’s Education

- Principal Amount: $100,000

- Interest Rate: 5% (0.05)

- Number of Years: 18

Annual Payment = ($100,000 – 0.05) / (1 – (1 + 0.05)^-18) = $9,656.36

If you’re considering purchasing an annuity, you might be wondering How Much Annuity For 40 000 2024. The amount you receive will depend on factors such as your age, gender, and the type of annuity you choose.

Factors Influencing Annuity Payments

Several factors can influence the annual payment of an annuity. Understanding these factors is crucial for making informed investment decisions.

In simple terms, an An Annuity Is Best Defined As 2024 a series of regular payments made over a specific period of time. These payments can be used for a variety of purposes, such as retirement income, savings, or debt repayment.

Interest Rates and Investment Returns

Higher interest rates generally lead to higher annuity payments. Conversely, lower interest rates result in lower payments. For variable annuities, investment returns play a significant role. Higher returns on underlying investments can lead to increased annuity payments, while poor performance can result in lower payments.

While annuities offer a certain level of security, you might wonder if they provide flexibility. To find out, you might ask, Is Annuity Flexible 2024 ?

Inflation, Calculating Annuity Annual Payment 2024

Inflation erodes the purchasing power of money over time. While fixed annuities offer guaranteed payments, these payments may not keep pace with inflation. This means the real value of your annuity payments could decrease over time.

Understanding how annuities work is crucial before making any decisions. You might want to learn how to Calculating Annuity Payments 2024 to get a better grasp of your potential income stream.

Length of the Annuity Period

The longer the annuity period, the lower the annual payment will be. This is because the annuity provider has more time to spread out the payments over a longer period.

Annuities are used for a variety of purposes, and you might be interested in learning more about Annuity Is Used In 2024. They can be a great way to supplement your retirement income, save for a specific goal, or even pay off debt.

Annuity Payment Examples

Here’s a table showcasing different annuity scenarios and their corresponding annual payments:

| Scenario | Principal Amount | Interest Rate | Annual Payment |

|---|---|---|---|

| Retirement Planning | $500,000 | 4% | $38,408.54 |

| Saving for Education | $100,000 | 5% | $9,656.36 |

| Early Retirement | $250,000 | 3% | $15,943.68 |

| Long-Term Income | $750,000 | 6% | $67,710.52 |

Annuity Payment Considerations

Beyond the calculations, several other factors are crucial to consider when evaluating annuity payments.

Tax Implications

Annuity payments are generally taxed as ordinary income. However, the tax implications can vary depending on the type of annuity and the individual’s tax situation. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.

Imagine winning a huge prize and having the option to receive it as a lump sum or as an Annuity Jackpot 2024. It’s a big decision, and you’ll need to weigh the pros and cons of each option carefully.

Fees and Expenses

Annuities often come with fees and expenses, which can impact your overall returns. These fees can include administrative fees, mortality charges, and surrender charges. Carefully review the fee structure before investing in an annuity.

To understand how much you’ll pay back on an annuity loan, you’ll need to know the Annuity Loan Formula 2024. This formula takes into account the loan amount, interest rate, and loan term to calculate the total amount you’ll owe.

Market Volatility

Market volatility can impact the value of variable annuities. During periods of market downturn, the value of your annuity may decline, potentially affecting your future payments. It’s important to understand the potential risks associated with variable annuities before investing.

Closure

Calculating annuity annual payments can seem complex, but with a clear understanding of the factors involved and the tools available, it becomes a manageable process. This guide has provided a comprehensive overview of the concepts, calculations, and considerations surrounding annuity payments.

By carefully evaluating your individual financial goals and seeking professional advice when necessary, you can harness the power of annuities to achieve your long-term financial objectives.

Query Resolution

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

How do taxes affect annuity payments?

Annuity payments are typically taxed as ordinary income. However, specific tax rules may apply depending on the type of annuity and your individual circumstances.

What are the common fees associated with annuities?

Common fees include administrative fees, mortality and expense charges, and surrender charges, which may apply if you withdraw funds before a certain period.