Calculating Annuities On Ba Ii Plus 2024 is a guide that empowers you to master the intricacies of annuity calculations using the powerful BA II Plus calculator. Whether you’re a finance professional, a student, or simply someone seeking to understand the fundamentals of annuities, this resource will equip you with the knowledge and tools necessary to navigate complex financial scenarios.

An annuity with a value of $400,000 can provide a significant amount of income in retirement. The amount of income you receive will depend on a number of factors, including the interest rate and your age. To learn more about the potential income from a $400,000 annuity, you can visit Annuity 400k 2024.

Annuities, essentially a series of equal payments made over a specified period, are ubiquitous in finance. From retirement planning and loan payments to investment strategies and insurance premiums, annuities play a pivotal role in shaping our financial futures. The BA II Plus calculator, with its dedicated functions and user-friendly interface, becomes an invaluable tool for tackling these calculations with ease and accuracy.

An annuity is a financial product that provides a stream of regular payments over a set period of time. These payments can be used for a variety of purposes, such as retirement income, income for life, or a lump sum payment.

To learn more about the different types of annuities and how they work, you can visit An Annuity Is A Stream Of 2024.

Understanding Annuities

Annuities are financial instruments that provide a stream of regular payments over a specified period. They are commonly used for retirement planning, income generation, and managing long-term financial goals. Annuities can be categorized into various types based on their payment structure, duration, and other characteristics.

Types of Annuities

- Ordinary Annuities:Payments are made at the end of each period. This is the most common type of annuity.

- Annuities Due:Payments are made at the beginning of each period.

- Perpetuities:Payments continue indefinitely.

- Fixed Annuities:Payments remain constant throughout the annuity period.

- Variable Annuities:Payments fluctuate based on the performance of underlying investments.

Key Features of Annuities

Annuities are characterized by several key features that influence their value and performance.

The National Pension System (NPS) is a government-sponsored retirement savings scheme in India. The NPS offers annuity options, which can provide you with a regular income after retirement. To learn more about the annuity options available under the NPS, you can visit Annuity Nps 2024.

- Payment Amount:The amount of each regular payment.

- Interest Rate:The rate of return earned on the annuity’s principal.

- Number of Periods:The total number of payments in the annuity.

- Present Value:The current worth of all future payments, discounted back to the present.

- Future Value:The total value of all payments accumulated at the end of the annuity period.

Annuity Scenarios

Here are some examples of different annuity scenarios:

- Ordinary Annuity:A retiree receives a monthly payment of $1,000 for 20 years from an annuity contract.

- Annuity Due:A student makes monthly payments of $500 at the beginning of each month for a 5-year loan.

- Perpetuity:A foundation establishes a perpetual endowment that provides annual scholarships of $10,000 forever.

The BA II Plus Calculator

The BA II Plus calculator is a powerful tool for financial professionals and students alike. It offers a wide range of functions, including those specifically designed for annuity calculations. The calculator’s intuitive interface and dedicated keys make it easy to perform complex calculations with accuracy and speed.

An annuity is a financial product that provides a series of equal periodic payments. There are different types of annuities available, each with its own unique features and benefits. To learn more about the different types of annuities and how they work, you can visit 4 Annuity 2024.

Annuity Functions on the BA II Plus

- PV (Present Value):Calculates the present value of an annuity.

- FV (Future Value):Calculates the future value of an annuity.

- PMT (Payment):Calculates the payment amount for an annuity.

- I/Y (Interest Rate):Calculates the interest rate for an annuity.

- N (Number of Periods):Calculates the number of periods for an annuity.

Navigating the BA II Plus for Annuity Calculations

Here’s a step-by-step guide to navigating the BA II Plus for annuity calculations:

- Clear the Calculator:Press the “2nd” key followed by the “CLR WORK” key to clear any previous calculations.

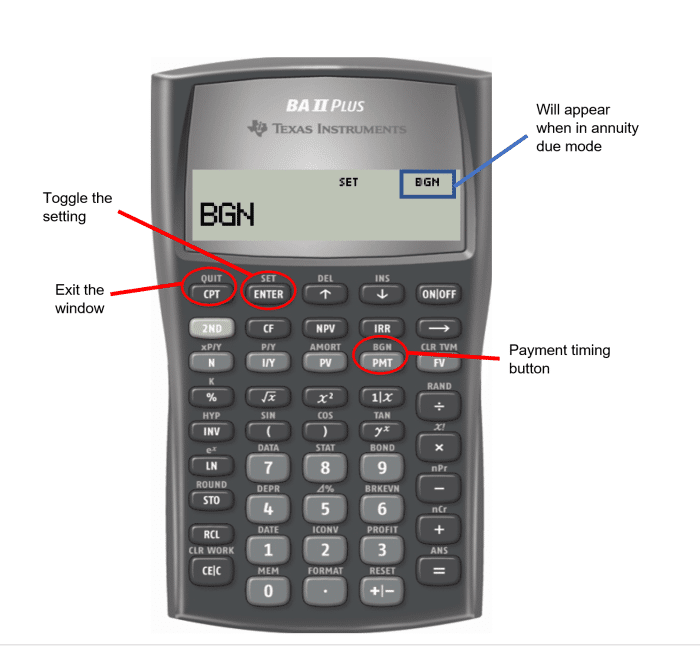

- Set the Payment Mode:Press the “2nd” key followed by the “BGN” key to set the payment mode to “BEGIN” for annuities due or “END” for ordinary annuities.

- Input the Annuity Variables:Enter the values for PV, FV, PMT, I/Y, and N, depending on the type of calculation you need to perform.

- Calculate the Desired Variable:Press the corresponding key (PV, FV, PMT, I/Y, or N) to calculate the desired variable.

Calculating Present Value of an Annuity

The present value (PV) of an annuity represents the current worth of all future payments, discounted back to the present using a specific interest rate. This calculation is crucial for evaluating investments, determining loan amounts, and making informed financial decisions.

The Annuity 2000 Basic Mortality Table is a standard table used by insurance companies to calculate life expectancies. This table is used to determine the amount of income that will be paid out to annuitants. To learn more about the Annuity 2000 Basic Mortality Table, you can visit Annuity 2000 Basic Mortality Table 2024.

Formula for Present Value of an Annuity

PV = PMT

- [1

- (1 + i)^-n] / i

Where:

- PV = Present Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Calculating PV on the BA II Plus

To calculate the present value of an annuity on the BA II Plus, follow these steps:

- Set the Payment Mode:Ensure the payment mode is set to “END” or “BEGIN” as required.

- Input the Variables:Enter the values for PMT, I/Y, and N.

- Calculate PV:Press the “PV” key to calculate the present value of the annuity.

Examples of PV Calculations

- Investment Evaluation:A company is considering investing in a project that generates annual cash flows of $100,000 for 5 years. The required rate of return is 10%. The present value of these cash flows can be calculated to determine the project’s profitability.

- Loan Amount:A borrower wants to take out a loan with monthly payments of $500 for 10 years at an interest rate of 6%. The present value of these payments represents the loan amount the borrower can receive.

Calculating Future Value of an Annuity

The future value (FV) of an annuity represents the total value of all payments accumulated at the end of the annuity period, compounded at a specific interest rate. This calculation is useful for forecasting investment growth, planning for retirement, and assessing the future value of savings plans.

Formula for Future Value of an Annuity, Calculating Annuities On Ba Ii Plus 2024

FV = PMT

- [(1 + i)^n

- 1] / i

Where:

- FV = Future Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Calculating FV on the BA II Plus

To calculate the future value of an annuity on the BA II Plus, follow these steps:

- Set the Payment Mode:Ensure the payment mode is set to “END” or “BEGIN” as required.

- Input the Variables:Enter the values for PMT, I/Y, and N.

- Calculate FV:Press the “FV” key to calculate the future value of the annuity.

Examples of FV Calculations

- Retirement Planning:An individual plans to save $5,000 per year for 30 years at an average annual return of 8%. The future value of these savings can be calculated to estimate their retirement nest egg.

- Investment Growth:An investor makes monthly contributions of $100 to a mutual fund that has an average annual return of 12%. The future value of these contributions can be calculated to project the investment’s growth over time.

Solving for Payment, Interest Rate, or Number of Periods

In some scenarios, you may need to solve for the payment amount (PMT), interest rate (I/Y), or number of periods (N) in an annuity calculation. The BA II Plus calculator allows you to solve for any of these variables using the same basic principles and formulas.

An annuity 401k plan can be a great way to save for retirement, but it’s important to understand how they work. If you’re considering an annuity 401k plan, you should learn more about it by reading Annuity 401k Plan 2024.

This will help you make an informed decision about whether or not this type of plan is right for you.

Techniques for Solving for Variables

The BA II Plus calculator uses the same formulas for present value and future value calculations, but instead of solving for PV or FV, you can solve for the unknown variable by entering the known values and pressing the corresponding key.

Examples of Solving for Variables

- Solving for Payment (PMT):A borrower wants to take out a $100,000 loan at an interest rate of 5% for 15 years. The monthly payment amount can be calculated using the PV function and entering the known values for PV, I/Y, and N.

Annuities are a popular financial product in Hong Kong, offering a guaranteed stream of income for life. If you’re interested in learning more about annuities in Hong Kong, you can check out Annuity Hk 2024.

- Solving for Interest Rate (I/Y):An investor wants to earn a return of $100,000 on a $50,000 investment over 10 years. The required annual interest rate can be calculated using the FV function and entering the known values for FV, PV, and N.

- Solving for Number of Periods (N):A retiree wants to withdraw $2,000 per month from an annuity that has a present value of $200,000 at an interest rate of 4%. The number of months the annuity will last can be calculated using the PV function and entering the known values for PV, PMT, and I/Y.

If you’re considering purchasing an annuity, you’ll likely want to know how much income it will generate. The amount of income you receive will depend on a number of factors, including the size of your annuity, the interest rate, and your age.

To get an estimate of how much a $80,000 annuity might pay per month, you can check out How Much Does A 80 000 Annuity Pay Per Month 2024.

Advanced Annuity Calculations

Advanced annuity calculations involve scenarios with varying payment amounts, interest rates, or other complexities. The BA II Plus calculator can handle these situations with its versatile functions and advanced capabilities.

An annuity with a value of $300,000 can provide a significant amount of income in retirement. The amount of income you receive will depend on a number of factors, including the interest rate and your age. To learn more about the potential income from a $300,000 annuity, you can visit Annuity 300 000 2024.

Annuities with Varying Payments or Interest Rates

In some cases, annuity payments or interest rates may change over time. For example, a retirement annuity might have increasing payments to account for inflation, or a loan might have a variable interest rate that fluctuates with market conditions.

The “59 1/2 Rule” refers to the age at which you can withdraw money from a traditional IRA or 401(k) without penalty. However, this rule doesn’t apply to annuities. For more information about the rules and regulations surrounding annuities, you can visit Annuity 59 1/2 Rule 2024.

Handling Complex Scenarios

To handle these complex scenarios, you can use the BA II Plus calculator’s advanced features, such as the “CF” (Cash Flow) register and the “IRR” (Internal Rate of Return) function. The CF register allows you to input a series of cash flows with varying amounts and timings, while the IRR function calculates the rate of return that equates the present value of all cash flows to zero.

An annuity that pays $10,000 per month can provide a comfortable level of income in retirement. The amount of income you receive will depend on the size of your annuity, the interest rate, and your age. To learn more about annuities that pay $10,000 per month, you can visit Annuity 10000 Per Month 2024.

Examples of Advanced Annuity Calculations

- Retirement Annuity with Inflation:A retiree receives a monthly payment of $1,000 from an annuity, but the payments increase by 3% each year to account for inflation. The BA II Plus can be used to calculate the present value of this annuity, taking into account the increasing payments.

When you purchase an annuity, you’re essentially buying a guaranteed stream of income for the rest of your life. However, the amount of income you receive will depend on your life expectancy. For more information about how life expectancy is factored into annuity payments, you can check out When Annuity Is Written Whose Life Expectancy 2024.

- Loan with Variable Interest Rate:A borrower takes out a loan with an initial interest rate of 5%, but the rate adjusts annually based on market conditions. The BA II Plus can be used to calculate the monthly payments and the total interest paid over the loan’s term, taking into account the changing interest rate.

Tips and Tricks for Using the BA II Plus

Here are some tips and tricks to make using the BA II Plus calculator more efficient for annuity calculations:

Tips for Efficient Use

- Clear the Calculator:Always clear the calculator before starting a new calculation to avoid errors.

- Check the Payment Mode:Ensure the payment mode is set to “END” or “BEGIN” as required for the specific annuity type.

- Use the “2nd” Key:The “2nd” key is used to access secondary functions for many keys on the calculator.

- Utilize the Memory Functions:The memory functions (STO, RCL) can be used to store and recall values for later use.

Common Mistakes to Avoid

- Incorrect Payment Mode:Using the wrong payment mode can lead to inaccurate results.

- Inputting Values in the Wrong Order:Ensure that you input the values for PV, FV, PMT, I/Y, and N in the correct order.

- Forgetting to Clear Previous Calculations:Failure to clear previous calculations can result in incorrect results.

Useful Features and Shortcuts

- “2nd” + “CLR WORK”:Clears all previous calculations.

- “2nd” + “BGN”:Sets the payment mode to “BEGIN” for annuities due.

- “2nd” + “END”:Sets the payment mode to “END” for ordinary annuities.

- “STO” + Number:Stores a value in memory.

- “RCL” + Number:Recalls a value from memory.

Practical Applications of Annuity Calculations

Annuity calculations have widespread applications in various fields, including finance, insurance, and retirement planning. Understanding how to perform these calculations can provide valuable insights for making informed financial decisions.

Applications in Finance

- Loan Payments:Annuities are used to calculate the regular payments for loans, such as mortgages, car loans, and student loans.

- Investment Analysis:Annuity calculations help evaluate the present value and future value of investments, including stocks, bonds, and mutual funds.

- Financial Planning:Annuities are essential for financial planning, such as retirement planning, college savings, and estate planning.

Applications in Insurance

- Life Insurance Premiums:Annuities are used to calculate the premiums for life insurance policies.

- Annuities as Insurance Products:Annuities themselves can be used as insurance products to provide a guaranteed stream of income during retirement.

Real-World Examples

- Retirement Planning:A 40-year-old individual plans to retire at age 65 and wants to receive a monthly income of $5,000 for 20 years. Using annuity calculations, they can determine how much they need to save each year to achieve their retirement goal.

The interest rate is a key factor in determining the amount of income you receive from an annuity. Understanding how interest rates work and how they impact your annuity payments is essential for making informed financial decisions. For more information about calculating annuity interest rates, you can visit Calculating Annuity Interest Rate 2024.

- Loan Repayment:A borrower takes out a $200,000 mortgage at an interest rate of 4% for 30 years. Annuity calculations can be used to calculate the monthly mortgage payments and the total interest paid over the loan’s term.

Final Review: Calculating Annuities On Ba Ii Plus 2024

Understanding annuities and mastering the art of calculating them on the BA II Plus calculator unlocks a world of financial possibilities. From determining the present value of a stream of future payments to calculating the future value of a series of investments, the skills you gain through this guide empower you to make informed financial decisions.

Whether you’re planning for your retirement, evaluating investment options, or simply seeking a deeper understanding of the financial world, the knowledge you acquire here will serve you well.

Common Queries

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity’s payments occur at the end of each period, while an annuity due’s payments occur at the beginning of each period. This difference in timing affects the present and future value calculations.

How do I clear the memory of the BA II Plus calculator before starting a new calculation?

Press the [2nd] key followed by the [CLR WORK] key to clear the calculator’s memory and reset the settings.

Can I use the BA II Plus calculator for other financial calculations besides annuities?

Calculating annuity cash flows can be a bit tricky, but it’s essential for understanding the potential returns on your investment. Fortunately, you can use Excel to help you with these calculations. For step-by-step instructions on how to use Excel to calculate annuity cash flows, you can visit Calculating Annuity Cash Flows Excel 2024.

Yes, the BA II Plus calculator is a versatile tool used for a wide range of financial calculations, including bond pricing, loan amortization, and cash flow analysis.

An annuity is a financial product that provides a series of equal periodic payments. An annuity can be used for a variety of purposes, such as retirement income, income for life, or a lump sum payment. To learn more about how annuities work, you can visit An Annuity Is A Series Of Equal Periodic Payments 2024.