Calculating An Annuity Due 2024: A Guide to Understanding and Applying This Financial Tool, delves into the world of annuities, exploring the intricacies of annuities due and their practical applications in various financial scenarios. Annuities due, characterized by payments made at the beginning of each period, play a crucial role in retirement planning, loan amortization, and investment analysis.

This comprehensive guide unravels the complexities of calculating the present and future values of annuities due, providing clear explanations, step-by-step instructions, and real-world examples.

Through insightful discussions, we will examine the key features and characteristics of annuities due, highlighting the timing of payments and its impact on calculations. We will also explore the factors that influence annuity due calculations, such as interest rates, number of periods, and payment amounts.

By understanding these factors, individuals can make informed financial decisions, optimize their investment strategies, and plan for their future financial security.

Annuity products can be a bit confusing, but it’s good to know that an annuity is ordinary in the financial world. They’re a way to secure your future by receiving regular payments for a set period. If you’re looking for a way to protect your savings, you might want to learn more about why annuities are good.

Understanding Annuities Due

An annuity due is a series of equal payments made at the beginning of each period. It is a common financial instrument used in various financial scenarios, including retirement planning, loan amortization, and investment analysis. Understanding the concept of annuities due is crucial for making informed financial decisions.

Thinking about buying a home? Annuity home loans can be a good option. And if you’re a 60-year-old man looking for retirement income, an annuity can provide a steady stream of payments. Understanding the basis of an annuity is important, as it determines how much you’ll receive.

Defining Annuities Due

An annuity due is a stream of equal payments made at the beginning of each period. The key difference between an annuity due and an ordinary annuity lies in the timing of payments. In an ordinary annuity, payments are made at the end of each period, while in an annuity due, payments are made at the beginning of each period.

Many people wonder if annuities are life insurance. While they offer income protection, they are different. You might be surprised to learn that annuity funds are unrestricted funds , meaning they can be invested in various ways. The annuity contract outlines the terms of your agreement, so it’s crucial to read it carefully.

This difference in timing significantly impacts the present and future values of the annuity.

Key Features and Characteristics of Annuities Due

- Equal Payments:Annuities due involve a series of equal payments made over a specific period.

- Regular Intervals:Payments are made at regular intervals, such as monthly, quarterly, or annually.

- Beginning of Period Payments:The defining characteristic of an annuity due is that payments are made at the beginning of each period.

- Interest Accrual:Interest is accrued on the payments made at the beginning of each period, resulting in a higher future value compared to an ordinary annuity.

Real-World Examples of Annuities Due

- Rent Payments:Most rental agreements require tenants to pay rent at the beginning of each month, making it an example of an annuity due.

- Insurance Premiums:Insurance premiums are typically paid at the beginning of the policy period, making it another common example of an annuity due.

- Loan Payments:Some loans, such as mortgages, require payments to be made at the beginning of each month, making it an annuity due.

Calculating the Present Value of an Annuity Due

The present value of an annuity due is the current value of a series of future payments made at the beginning of each period. It represents the amount of money you would need to invest today to receive the same stream of future payments.

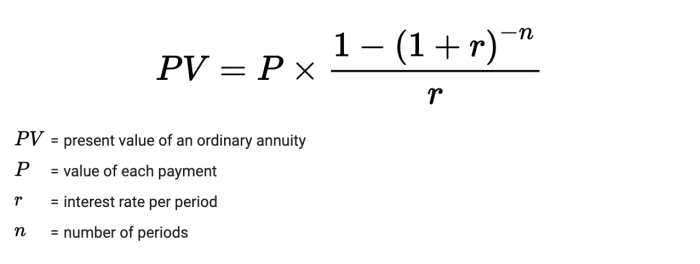

Formula for Calculating the Present Value of an Annuity Due

PV = PMT

- [(1

- (1 + r)^-n) / r]

- (1 + r)

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Step-by-Step Guide to Calculating the Present Value of an Annuity Due

- Determine the payment amount (PMT):This is the amount of each payment in the annuity.

- Determine the interest rate per period (r):This is the rate at which interest is earned or paid per period.

- Determine the number of periods (n):This is the total number of payments in the annuity.

- Plug the values into the formula:Substitute the values of PMT, r, and n into the formula for the present value of an annuity due.

- Calculate the present value (PV):Use a financial calculator or spreadsheet software to perform the calculation.

Calculating the Future Value of an Annuity Due

The future value of an annuity due is the total value of the annuity at the end of the payment period. It represents the amount of money you would have accumulated if you invested a series of equal payments at the beginning of each period.

Formula for Calculating the Future Value of an Annuity Due

FV = PMT

If you’re concerned about your annuity being out of surrender , it’s best to contact your provider for guidance. Annuity products can be complex, but understanding the basics can help you make informed decisions about your financial future.

- [((1 + r)^n

- 1) / r]

- (1 + r)

Where:

- FV = Future Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Step-by-Step Guide to Calculating the Future Value of an Annuity Due

- Determine the payment amount (PMT):This is the amount of each payment in the annuity.

- Determine the interest rate per period (r):This is the rate at which interest is earned or paid per period.

- Determine the number of periods (n):This is the total number of payments in the annuity.

- Plug the values into the formula:Substitute the values of PMT, r, and n into the formula for the future value of an annuity due.

- Calculate the future value (FV):Use a financial calculator or spreadsheet software to perform the calculation.

Applications of Annuity Due Calculations

Annuity due calculations have a wide range of applications in various financial scenarios. They are essential tools for individuals and businesses to make informed financial decisions.

Some annuities start paying out later, which is known as a deferred annuity. If you’re interested in market-linked growth, you might consider an index annuity. These annuities offer potential growth based on the performance of a specific market index.

And if you’re curious about annuity rates for a 3-year term , there are resources available to help you compare options.

Retirement Planning, Calculating An Annuity Due 2024

Annuity due calculations are crucial for retirement planning. By calculating the present value of an annuity due, individuals can determine the amount of money they need to save today to achieve their desired retirement income. Similarly, by calculating the future value of an annuity due, they can estimate the total amount of money they will have accumulated at retirement.

Loan Amortization

Annuity due calculations are used in loan amortization to determine the amount of each loan payment, including principal and interest. This information helps borrowers understand the total cost of the loan and plan their repayment schedule.

Investment Analysis

Annuity due calculations are used in investment analysis to evaluate the profitability of different investment options. By comparing the present and future values of different annuities, investors can choose the most attractive investment strategy.

Factors Affecting Annuity Due Calculations: Calculating An Annuity Due 2024

Several factors can influence the outcome of annuity due calculations, including the interest rate, the number of periods, and the payment amount.

Interest Rate

The interest rate plays a significant role in determining the present and future values of an annuity due. A higher interest rate leads to a higher future value and a lower present value. This is because the payments earn more interest over time at a higher rate.

Number of Periods

The number of periods also affects the present and future values of an annuity due. A longer period leads to a higher future value and a lower present value. This is because more payments are made over a longer period, resulting in a larger accumulation of interest.

Payment Amount

The payment amount is a direct determinant of the present and future values of an annuity due. A higher payment amount leads to a higher present and future value. This is because more money is being invested or paid over time.

Annuity Due vs. Ordinary Annuity

While both annuities due and ordinary annuities involve a series of equal payments, the timing of those payments makes a significant difference. Understanding the key differences between the two is crucial for making accurate calculations and informed financial decisions.

Key Differences in Formulas

- Present Value:The formula for the present value of an annuity due includes a multiplier of (1 + r), which accounts for the fact that payments are made at the beginning of each period.

- Future Value:The formula for the future value of an annuity due also includes a multiplier of (1 + r), which accounts for the fact that payments are made at the beginning of each period.

Impact of Differences on Results

The differences in the formulas for annuities due and ordinary annuities lead to different present and future values. Annuities due have a higher present value and a higher future value than ordinary annuities, due to the interest earned on payments made at the beginning of each period.

Appropriate Scenarios for Each Type of Annuity Calculation

- Annuity Due:Annuities due are appropriate for scenarios where payments are made at the beginning of each period, such as rent payments, insurance premiums, and some loan payments.

- Ordinary Annuity:Ordinary annuities are appropriate for scenarios where payments are made at the end of each period, such as savings accounts, investments, and some loan payments.

Real-World Examples and Case Studies

Annuity due calculations are widely used in real-world scenarios, impacting financial planning and decision-making. Here are some examples and case studies to illustrate their practical applications.

Example: Retirement Planning

A 30-year-old individual wants to retire at age 65 with an annual income of $50,000. Assuming a 5% annual interest rate, they can use an annuity due calculation to determine the amount of money they need to save each year to reach their retirement goal.

By plugging the values into the formula for the present value of an annuity due, they can calculate the annual savings required.

For those planning ahead, an annuity loan calculator can be a helpful tool. It can help you estimate monthly payments based on various interest rates and loan terms. A 6% annuity can provide a decent return, but remember that rates can fluctuate.

It’s interesting to note that an annuity is sometimes called the flip side of a loan because it involves receiving payments rather than making them.

Case Study: Loan Amortization

A homeowner takes out a $200,000 mortgage with a 30-year term and a 4% annual interest rate. The loan payments are made at the beginning of each month. Using an annuity due calculation, the homeowner can determine the monthly payment amount, which includes principal and interest.

Example: Investment Analysis

An investor is considering two investment options: a fixed deposit account with a 3% annual interest rate and a mutual fund with an expected annual return of 8%. By calculating the future value of an annuity due for each investment option, the investor can compare their potential returns and make an informed decision.

Closing Summary

Understanding the concept of annuities due and mastering the calculations associated with them empowers individuals to make informed financial decisions. By grasping the nuances of annuity due calculations, you can effectively analyze and evaluate various financial options, ensuring that you make the best choices for your specific needs and goals.

From retirement planning to loan amortization and investment strategies, annuities due provide a powerful tool for navigating the complexities of personal finance.

Helpful Answers

What are the advantages of an annuity due?

Annuities due offer the advantage of earning interest on payments made at the beginning of each period, leading to higher future values compared to ordinary annuities.

How does the interest rate affect annuity due calculations?

Higher interest rates result in larger present and future values of annuities due. This is because the payments earn more interest over time.

What are some real-world examples of annuity due calculations?

Real-world examples include retirement planning, where individuals make regular contributions to an annuity due to ensure a steady stream of income in retirement. Loan amortization is another example, where borrowers make periodic payments at the beginning of each period to gradually repay the loan.