Calculating A Federal Annuity – FERS 2024 is a crucial step in planning your retirement as a federal employee. Understanding how your annuity is calculated, considering factors like your years of service, average salary, and retirement age, can significantly impact your financial security in the years ahead.

Reversionary annuities offer unique characteristics. If you’re curious about Annuity Is Reversionary 2024 , this link provides details on this specific type of annuity.

This guide will delve into the complexities of FERS annuities, providing insights into the different types, calculation methods, and key changes expected in 2024.

Life expectancy is a key factor in annuity planning. If you’re looking for information on When Annuity Is Written Whose Life Expectancy 2024 , this link can provide you with insights and guidance.

The Federal Employees Retirement System (FERS) offers a comprehensive retirement plan designed specifically for federal employees. This system provides a combination of benefits including a basic annuity, which is a regular payment you receive after retirement, a special annuity for certain situations like early retirement or disability, and a survivor annuity for your beneficiaries.

If you’re planning to work while receiving an annuity, it’s essential to understand the rules. This link can provide you with information on Can You Receive Annuity And Still Work 2024 , helping you make informed decisions about your financial future.

Understanding how these components work together is essential to making informed decisions about your retirement.

Annuity terms can impact your financial planning. If you’re looking for information about Annuity 20 Year Certain 2024 , this link provides details on this specific type of annuity.

Understanding FERS Annuity

The Federal Employees Retirement System (FERS) provides a retirement annuity to eligible federal employees. Understanding the structure and components of this annuity is crucial for planning your retirement. This article will guide you through the different types of FERS annuities, the factors influencing their calculation, and the key aspects of the 2024 FERS annuity system.

The 59.5 rule plays a significant role in annuity planning. For a comprehensive understanding of the Annuity 59.5 Rule 2024 , follow this link. It’s a key factor to consider when making financial decisions.

FERS Annuity Components

The FERS annuity is comprised of three primary components:

- Basic Annuity:This is the primary component of your FERS annuity, calculated based on your years of service and high-3 average salary.

- Special Annuity:This component applies to specific situations like disability retirement or early retirement under certain conditions.

- Survivor Annuity:This provides benefits to your eligible survivors upon your death, offering financial protection for your family.

Types of FERS Annuities

FERS offers various annuity options based on your retirement circumstances:

- Regular Retirement:This is the standard retirement option available to eligible employees who meet the age and service requirements.

- Disability Retirement:This option is available to employees who are unable to perform their duties due to a disability.

- Survivor Annuity:This provides a monthly benefit to your surviving spouse or other eligible dependents.

Factors Influencing FERS Annuity Calculation

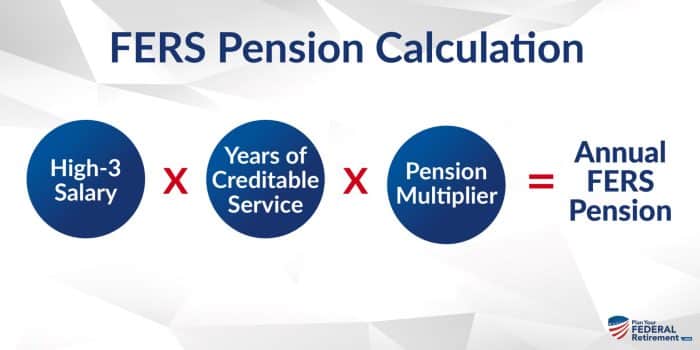

The calculation of your FERS annuity depends on several factors, including:

- Years of Service:The longer you serve, the higher your annuity will be.

- High-3 Average Salary:This is the average of your highest three consecutive years of salary, which plays a significant role in determining your annuity amount.

- Age at Retirement:Your retirement age influences the amount of your annuity. Retiring earlier typically results in a lower annuity, while retiring later often leads to a higher annuity.

Calculating Your Basic Annuity

The basic annuity is the core component of your FERS retirement benefit. It’s calculated using a formula that considers your years of service and high-3 average salary. The formula for calculating the basic annuity is:

Basic Annuity = (Years of Service x High-3 Average Salary) x Annuity Factor

Annuity investments require careful consideration. If you’re wondering if Annuity Is It A Good Investment 2024 , this link provides valuable information to help you make an informed decision.

The annuity factor is a percentage determined by your age at retirement. For example, if you retire at age 62, the annuity factor might be 1.5%. This means that for every $100 of your high-3 average salary, you would receive $1.50 in basic annuity each month.

Example Calculations

Let’s consider a few examples to illustrate the basic annuity calculation:

- Scenario 1:Employee A has 20 years of service and a high-3 average salary of $80, 000. If the annuity factor for their age at retirement is 1.7%, their basic annuity would be: (20 x $80,000) x 0.017 = $27,200 per year.

- Scenario 2:Employee B has 30 years of service and a high-3 average salary of $100, 000. If the annuity factor is 1.9%, their basic annuity would be: (30 x $100,000) x 0.019 = $57,000 per year.

Impact of Retirement Age

The age at which you retire significantly affects your basic annuity amount. Here’s a table illustrating the impact of different retirement ages, assuming the same years of service (25) and high-3 average salary ($75,000):

| Retirement Age | Annuity Factor | Basic Annuity (per year) |

|---|---|---|

| 55 | 1.3% | $24,375 |

| 60 | 1.5% | $28,125 |

| 65 | 1.7% | $31,875 |

| 70 | 1.9% | $35,625 |

As you can see, retiring later results in a higher basic annuity due to the increased annuity factor.

Special Annuity and Survivor Annuity

Special Annuity

A special annuity is a supplemental benefit that may be available under certain circumstances. These annuities are typically provided for disability retirement or early retirement under specific conditions.

To be eligible for a special annuity, you must meet specific requirements. The eligibility criteria and calculation methods for different types of special annuities vary, so it’s essential to consult the FERS regulations for detailed information.

Understanding the tax implications of annuities is crucial. For details on whether Is A Living Annuity Taxable 2024 , this link provides you with relevant information to help you make informed financial decisions.

The special annuity is calculated differently from the basic annuity, often based on the specific circumstances of your situation. It’s important to note that the special annuity is not a guaranteed benefit and is subject to eligibility requirements and specific calculation methods.

Understanding the different types of annuities is essential. If you’re interested in learning about Annuity Is Term 2024 , this link provides valuable information about this type of annuity.

Survivor Annuity

A survivor annuity provides financial protection for your eligible survivors upon your death. Under FERS, there are different survivor annuity options available, each with its own calculation method and benefits:

- Spouse Annuity:This option provides a monthly benefit to your surviving spouse. The amount of the annuity is calculated based on your years of service and high-3 average salary, and the specific formula may vary depending on the age of your spouse at the time of your death.

For a comprehensive overview of annuities, you can find valuable information on Annuity General 2024. This resource covers various aspects of annuities, helping you gain a better understanding of this financial tool.

- Child Annuity:This option provides a monthly benefit to your surviving children. The amount of the annuity is calculated based on the number of children and their age, and the specific formula may vary depending on the age of your children at the time of your death.

Annuity rates can fluctuate over time. For up-to-date information on Annuity Rate Is 2024 , this link can provide you with current data and analysis.

- Combined Spouse and Child Annuity:This option provides a monthly benefit to both your surviving spouse and children. The amount of the annuity is calculated based on the combined benefits of the spouse and child annuities.

The survivor annuity options available to you and the specific calculation methods depend on your circumstances and the choices you make during your employment. It’s essential to understand these options and make informed decisions to ensure your family’s financial security after your death.

FERS Annuity in 2024

While the core principles of FERS annuity calculation remain consistent, there may be changes to specific aspects in 2024. These changes could include updates to the high-3 average salary calculation or adjustments to the retirement age. It’s crucial to stay informed about any potential changes to the FERS annuity system in 2024 to ensure accurate planning for your retirement.

For example, there might be adjustments to the method used to calculate the high-3 average salary, which could impact the final annuity amount. Similarly, changes to the retirement age could affect the annuity factor and ultimately influence the amount of your annuity.

Understanding the implications of these changes is essential for individuals planning their retirement under FERS. By staying updated on any adjustments to the FERS annuity system, you can make informed decisions about your retirement plans and ensure you receive the maximum benefits available to you.

Resources and Tools

Several resources and tools are available to help you calculate your FERS annuity and understand your retirement benefits. These resources can provide valuable insights into your potential annuity amount and assist you in making informed retirement planning decisions.

Online Calculators

Online calculators offer a convenient way to estimate your FERS annuity. These calculators typically require you to input your years of service, high-3 average salary, and retirement age to provide an approximate annuity amount. While online calculators can provide a general idea of your potential annuity, it’s essential to remember that they are estimates and may not reflect all the specific factors that influence your actual annuity.

Annuity options can vary widely. If you’re interested in learning more about Annuity 300 000 2024 , this link can provide you with insights into this specific type of annuity.

Government Websites, Calculating A Federal Annuity – Fers 2024

The official government websites for the Office of Personnel Management (OPM) and the Federal Retirement Thrift Investment Board (Thrift Savings Plan) provide comprehensive information about FERS annuities. These websites offer detailed explanations of the annuity calculation process, eligibility requirements, and other relevant information.

Navigating the tax implications of annuities can be complex. If you’re looking for information on whether Annuity Is Taxable 2024 , this link can provide you with insights and guidance.

Tips for Using Resources

Here are some tips for effectively using FERS annuity resources:

- Use multiple resources:Compare the results from different online calculators and government websites to get a more comprehensive understanding of your potential annuity.

- Consult with a financial advisor:A financial advisor can provide personalized guidance and help you understand the complexities of FERS annuities and their impact on your retirement planning.

- Stay updated:Regularly check for updates to FERS regulations and any changes to the annuity calculation methods.

FERS Annuity Calculators

Here’s a table summarizing some key features and functionalities of different FERS annuity calculators:

| Calculator Name | Features | Functionalities |

|---|---|---|

| [Calculator Name 1] | [Features 1] | [Functionalities 1] |

| [Calculator Name 2] | [Features 2] | [Functionalities 2] |

| [Calculator Name 3] | [Features 3] | [Functionalities 3] |

Remember to carefully review the assumptions and limitations of each calculator before using it to estimate your FERS annuity.

Before diving into an annuity, it’s wise to consider all angles. If you’re looking for information on Why An Annuity Is Bad 2024 , this link can offer you a balanced perspective on potential drawbacks.

Last Recap: Calculating A Federal Annuity – Fers 2024

As you approach retirement, taking the time to understand the intricacies of calculating your FERS annuity is a wise investment in your future. By understanding the factors that influence your annuity amount, you can make informed decisions about your retirement planning, ensuring a comfortable and secure transition into your next chapter.

Remember to utilize the available resources and tools to calculate your potential annuity and seek professional guidance if needed. With careful planning and a clear understanding of your options, you can confidently navigate the path to a fulfilling retirement.

Looking for information on annuity health services in Westmont, Illinois? You can find details about Annuity Health Westmont Il 2024 by following this link. This resource can provide you with valuable insights into local options and providers.

Essential FAQs

What is the difference between a basic annuity and a special annuity?

A basic annuity is the regular payment you receive after retirement based on your years of service and average salary. A special annuity is an additional payment for certain situations like early retirement or disability, with specific eligibility requirements and calculation methods.

How does the high-3 average salary affect my annuity?

Annuity lotteries can be a fascinating topic. If you’re curious about Annuity Lottery 2024 , this link will provide you with information about the latest developments and potential opportunities.

The high-3 average salary is the average of your highest three consecutive years of salary before retirement. This average is used in the calculation of your basic annuity, so a higher high-3 average salary generally results in a larger annuity payment.

Are there any changes to FERS in 2024 that I should be aware of?

It’s important to stay informed about any potential changes to FERS, as these could impact your annuity calculation. Consult official government resources for the latest updates and information regarding FERS changes in 2024.