Calculate Your Annuity 2024: A Guide to Secure Your Future delves into the world of annuities, exploring their intricacies and how they can play a crucial role in your financial planning. Annuities, often seen as a powerful tool for retirement security, offer a guaranteed stream of income for life, providing peace of mind and financial stability during your golden years.

Annuity income is generally taxable in the UK. You can learn more about the tax implications of annuities in this article, Is Annuity Income Taxable In Uk 2024 , which covers the relevant tax rules and regulations.

This comprehensive guide will navigate you through the different types of annuities available, their benefits, and potential risks, empowering you to make informed decisions about your financial future.

We will explore the factors that influence your annuity payment amount, guide you through the selection process, and highlight key features of popular annuity providers. Understanding the nuances of annuity investment strategies and their role in retirement planning will be central to this exploration, ensuring you have the knowledge to make the most of your annuity investment.

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a set period of time. They are often used for retirement planning, but they can also be used for other purposes, such as funding a college education or providing income for a loved one.

Types of Annuities

There are many different types of annuities available, each with its own features and benefits. Here are some of the most common types:

- Fixed annuities: These annuities guarantee a fixed rate of return, regardless of how the market performs. This provides a predictable stream of income, but the rate of return may be lower than what you could earn in the stock market.

Annuities can be a safe investment option, but it’s important to understand the risks involved. You can find information about the safety of annuities in this article, Is Annuity Safe 2024 , which covers the factors to consider when evaluating the safety of an annuity.

- Variable annuities: These annuities allow you to invest your money in a variety of sub-accounts, such as stocks, bonds, or mutual funds. The value of your annuity will fluctuate based on the performance of your investments. This type of annuity offers the potential for higher returns, but it also carries more risk.

The taxability of annuity income in India can vary depending on the type of annuity and other factors. You can find detailed information about the tax implications of annuities in India in this article, Is Annuity Income Taxable In India 2024.

- Indexed annuities: These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth, but they also have limits on how much your annuity can grow.

- Immediate annuities: These annuities begin making payments immediately after you purchase them. They are often used to provide a guaranteed stream of income for life.

- Deferred annuities: These annuities do not begin making payments until a later date, such as retirement. They are often used to save for retirement or to supplement other retirement income sources.

Key Features and Benefits

Annuities offer a number of key features and benefits, including:

- Guaranteed income: Some annuities, such as fixed annuities, provide a guaranteed stream of income for life.

- Tax deferral: The earnings on your annuity grow tax-deferred, meaning you won’t have to pay taxes on them until you start receiving payments.

- Protection from market volatility: Annuities can help protect your savings from market downturns.

- Longevity protection: Annuities can help ensure that you have enough income to live on throughout your retirement years, even if you live longer than expected.

Tax Implications

The tax implications of annuities can be complex, and they vary depending on the type of annuity you purchase and how you use it. Generally, the earnings on your annuity are taxed as ordinary income when you start receiving payments.

However, there are some exceptions to this rule. For example, if you purchase an annuity with after-tax dollars, the payments you receive may be tax-free.

Understanding the present value of an annuity is crucial for making informed financial decisions. This article, Calculate Annuity Of Present Value 2024 , will help you understand the concept and how to calculate it.

Potential Risks

Annuities also carry some potential risks, including:

- Lower returns: Fixed annuities typically offer lower returns than other investment options, such as stocks or bonds.

- Market risk: Variable annuities are subject to market risk, meaning that the value of your annuity can fluctuate based on the performance of your investments.

- Surrender charges: Some annuities charge surrender charges if you withdraw your money before a certain period of time.

- Complexity: Annuities can be complex financial products, and it’s important to understand the terms and conditions before you purchase one.

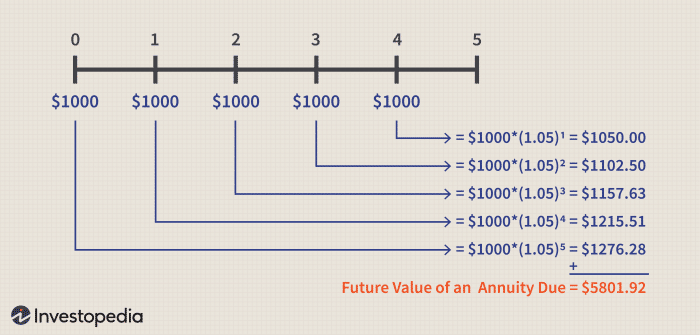

Calculating Your Annuity Payment

The amount of your annuity payment will depend on a number of factors, including the amount of money you invest, the type of annuity you purchase, and the interest rate or rate of return. You can use an annuity calculator to estimate your annuity payment.

Calculating the annuity from your pension pot is an important step in planning for retirement. This article, Calculate Annuity From Pension Pot 2024 , can help you understand the process and the factors that affect your annuity payments.

Step-by-Step Guide, Calculate Your Annuity 2024

Here is a step-by-step guide on how to calculate your annuity payment:

- Determine your investment amount: This is the amount of money you will be investing in the annuity.

- Choose an annuity type: The type of annuity you choose will affect the interest rate or rate of return you receive.

- Determine the payment period: This is the length of time you will receive payments from the annuity.

- Use an annuity calculator: There are many online annuity calculators available that can help you estimate your annuity payment.

Factors that Influence Annuity Payments

The following factors can influence the amount of your annuity payment:

- Interest rate or rate of return: The higher the interest rate or rate of return, the higher your annuity payment will be.

- Investment amount: The more money you invest, the higher your annuity payment will be.

- Payment period: The longer the payment period, the lower your annuity payment will be.

- Annuity type: The type of annuity you choose will affect the interest rate or rate of return you receive.

- Your age and health: Some annuities offer higher payments to people who are older or have a shorter life expectancy.

Annuity Payment Options

There are a number of different annuity payment options available, including:

- Fixed payments: You receive the same amount of money each month.

- Variable payments: Your payments fluctuate based on the performance of your investments.

- Life annuity: You receive payments for the rest of your life.

- Period certain annuity: You receive payments for a set period of time, such as 10 or 20 years.

- Joint life annuity: You and your spouse receive payments for as long as either of you is alive.

Pros and Cons of Payment Options

| Payment Option | Pros | Cons |

|---|---|---|

| Fixed payments | Predictable income stream | May not keep up with inflation |

| Variable payments | Potential for higher returns | More risk |

| Life annuity | Guaranteed income for life | Payments may stop if you die early |

| Period certain annuity | Guaranteed income for a set period | Payments may stop after the period ends |

| Joint life annuity | Guaranteed income for both spouses | Payments may stop if both spouses die early |

Choosing the Right Annuity for You: Calculate Your Annuity 2024

Choosing the right annuity for you can be a complex decision. There are many factors to consider, including your financial goals, risk tolerance, and time horizon.

While annuities are often associated with life insurance, they are not technically life insurance policies. This article, Is Annuity A Life Insurance Policy 2024 , will clarify the differences between annuities and life insurance.

Factors to Consider

Here are some factors to consider when choosing an annuity:

- Your financial goals: What are you trying to achieve with the annuity? Are you saving for retirement, funding a college education, or providing income for a loved one?

- Your risk tolerance: How much risk are you willing to take with your investments? Fixed annuities offer lower risk, while variable annuities offer higher risk.

- Your time horizon: How long do you plan to invest in the annuity? The longer your time horizon, the more time you have for your investments to grow.

- Your age and health: Your age and health can affect the type of annuity you choose. For example, if you are older or have a shorter life expectancy, you may want to consider a life annuity.

- The fees and charges: Be sure to compare the fees and charges associated with different annuities. Some annuities charge higher fees than others.

Annuity Selection Process

Here is a flowchart to guide you through the annuity selection process:

[Flowchart illustrating the annuity selection process. This flowchart should be comprehensive and easy to follow. It should include steps such as defining financial goals, assessing risk tolerance, comparing annuity types, considering fees and charges, and making an informed decision.]

The annuity exclusion ratio is a key factor in determining the taxable portion of your annuity payments. You can learn how to calculate this ratio in this article, Calculate Annuity Exclusion Ratio 2024 , which also provides examples to help you understand the process.

Annuity Scenarios

Here are some examples of different annuity scenarios and their potential outcomes:

- Scenario 1: A 65-year-old retiree purchases a fixed annuity with $100,000. The annuity guarantees a 3% annual return. The retiree will receive a monthly payment of $400 for life.

- Scenario 2: A 45-year-old investor purchases a variable annuity with $50,000. The investor chooses to invest in a stock mutual fund. The value of the annuity will fluctuate based on the performance of the mutual fund. If the mutual fund earns an average annual return of 8%, the investor could receive a monthly payment of $800 in retirement.

If your annuity is out of surrender, it means that you can no longer withdraw the full value of your investment. This article, My Annuity Is Out Of Surrender 2024 , explains the implications of this situation and your options.

- Scenario 3: A 55-year-old individual purchases an indexed annuity with $75,000. The annuity is linked to the performance of the S&P 500. If the S&P 500 earns a 5% annual return, the individual could receive a monthly payment of $500 in retirement.

If you have questions about annuities, this article, Annuity Questions And Answers 2024 , provides answers to some of the most common questions about annuities.

Popular Annuity Providers

| Provider | Key Features |

|---|---|

| [Provider 1] | [Key features of Provider 1] |

| [Provider 2] | [Key features of Provider 2] |

| [Provider 3] | [Key features of Provider 3] |

Annuity Investment Strategies

Once you’ve purchased an annuity, you’ll need to decide how to invest the funds. There are a number of different investment strategies available, each with its own risks and rewards.

Annuities are considered fixed income because they provide a guaranteed stream of payments. This article, Is Annuity Fixed Income 2024 , explains the reasons why annuities are classified as fixed income.

Investment Strategies

Here are some common annuity investment strategies:

- Conservative strategy: This strategy involves investing in low-risk investments, such as bonds or money market accounts. It’s a good option for people who are risk-averse and want to preserve their capital.

- Moderate strategy: This strategy involves investing in a mix of stocks, bonds, and other investments. It’s a good option for people who are willing to take on some risk but still want to protect their capital.

- Aggressive strategy: This strategy involves investing in high-risk investments, such as stocks or growth-oriented mutual funds. It’s a good option for people who are willing to take on a lot of risk in hopes of earning higher returns.

Investment Option Performance

The performance of various annuity investment options can vary widely. It’s important to consider the historical performance of different investments and the potential risks and rewards associated with each.

The monthly payments from an $80,000 annuity can vary depending on several factors. You can find an estimate of the monthly payments for an $80,000 annuity in this article, How Much Does A 80 000 Annuity Pay Per Month 2024 , which also explains how to calculate your own payments.

[Table comparing the historical performance of different annuity investment options. This table should include data on the average annual return, standard deviation, and risk level for each investment option.]

Annuity quotes can vary significantly, so it’s important to compare different options before you make a decision. You can find a comprehensive guide to annuity quotes in the UK in this article, Annuity Quotes Uk 2024 , which includes tips on how to get the best deal.

Managing Annuity Investments

Here are some tips for managing annuity investments over time:

- Monitor your investments regularly: Keep track of the performance of your investments and make adjustments as needed.

- Rebalance your portfolio: As your investments grow, you may need to rebalance your portfolio to maintain your desired asset allocation.

- Consider withdrawing funds strategically: If you need to withdraw funds from your annuity, consider doing so strategically to minimize taxes and penalties.

Annuity Investment Growth

Here are some illustrative examples of the potential growth of annuity investments:

- Example 1: A 50-year-old investor invests $100,000 in a variable annuity. The investor chooses to invest in a stock mutual fund that earns an average annual return of 8%. If the investor continues to invest $5,000 per year, the annuity could grow to $500,000 by the time the investor reaches retirement at age 65.

Calculating your annuity online can be a quick and easy way to get an estimate of your potential payments. You can find a helpful online calculator in this article, Calculate Annuity Online 2024 , which will guide you through the process.

- Example 2: A 60-year-old retiree invests $200,000 in a fixed annuity that guarantees a 3% annual return. The retiree will receive a monthly payment of $1,000 for life. If the retiree lives for 20 years after retirement, the annuity will have paid out $240,000 in total.

Annuity is a financial product that provides a stream of payments for a specific period of time. You can learn more about the definition of an annuity in this article, Annuity Is Defined As Mcq 2024. This article covers the basics of annuities and provides some examples to help you understand how they work.

Annuities and Retirement Planning

Annuities can play an important role in retirement planning. They can provide a guaranteed stream of income for life, helping you to meet your financial needs in retirement.

A PV annuity of 1 table is a useful tool for calculating the present value of an annuity. You can find a detailed explanation of this table and its applications in this article, Pv Annuity Of 1 Table 2024.

Benefits of Annuities

Here are some benefits of using annuities as a retirement income source:

- Guaranteed income: Some annuities, such as fixed annuities, provide a guaranteed stream of income for life. This can help you to avoid running out of money in retirement.

- Tax deferral: The earnings on your annuity grow tax-deferred, meaning you won’t have to pay taxes on them until you start receiving payments. This can help you to save on taxes in retirement.

- Longevity protection: Annuities can help ensure that you have enough income to live on throughout your retirement years, even if you live longer than expected.

Incorporating Annuities into Retirement Plans

Here are some examples of how annuities can be incorporated into retirement plans:

- Use an annuity to supplement your Social Security benefits: If your Social Security benefits are not enough to cover your living expenses, you can use an annuity to provide additional income.

- Use an annuity to create a guaranteed stream of income: If you are concerned about running out of money in retirement, you can use an annuity to create a guaranteed stream of income for life.

- Use an annuity to protect your assets from market volatility: If you are concerned about market downturns, you can use a fixed annuity to protect your assets from risk.

Challenges and Limitations

While annuities can be a valuable tool for retirement planning, they also have some potential challenges and limitations:

- Lower returns: Fixed annuities typically offer lower returns than other investment options, such as stocks or bonds.

- Complexity: Annuities can be complex financial products, and it’s important to understand the terms and conditions before you purchase one.

- Fees and charges: Some annuities charge high fees and charges, which can eat into your returns.

- Limited access to funds: You may not be able to access your annuity funds before a certain age or without incurring penalties.

Final Conclusion

As you embark on your journey to secure a comfortable retirement, understanding annuities and their potential benefits is crucial. By carefully considering your individual needs and financial goals, you can determine if an annuity is the right investment for you.

This guide has provided you with a foundation of knowledge to navigate the world of annuities, empowering you to make informed decisions that align with your financial aspirations. Remember, seeking advice from a qualified financial advisor can help you personalize your annuity strategy and achieve your long-term financial objectives.

FAQ Summary

What is the difference between a fixed and variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of underlying investments.

How do I choose the right annuity provider?

Consider factors such as financial strength, investment options, fees, and customer service.

Can I withdraw money from my annuity before retirement?

Some annuities allow withdrawals, but there may be penalties or restrictions depending on the type of annuity and the terms of your contract.

Are annuities subject to taxes?

Yes, annuity payments are generally taxable as ordinary income. However, there may be tax advantages depending on the specific type of annuity and your individual tax situation.