Calculate Annuity Years 2024 sets the stage for understanding how annuities can play a vital role in retirement planning. Annuities, essentially financial contracts, provide a stream of regular payments, offering a potential source of income during retirement. This guide delves into the intricacies of annuities, exploring their components, calculations, and implications for retirement planning in the current economic landscape.

The rate of return on an annuity can significantly impact your overall retirement income. It’s essential to understand the factors that influence annuity rates and how they might change over time. For insights into annuity rates, visit Annuity Rate Is 2024.

We’ll analyze how interest rates and inflation influence annuity calculations, discuss factors affecting annuity payouts, and explore different methods for determining their present and future values. This guide will equip you with the knowledge to understand the various types of annuities, their tax implications, and the risks involved, ultimately helping you make informed decisions about incorporating annuities into your retirement plan.

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s a popular choice for retirement planning, as it can provide a steady income stream during your golden years. Annuities are based on three key components: principal, interest rate, and payment period.

Annuity drawdown allows you to withdraw funds from your annuity as needed, providing flexibility for your retirement income. However, it’s crucial to understand the potential risks and implications before opting for this approach. To learn more about annuity drawdown, check out Is Annuity Drawdown 2024.

Annuity Components, Calculate Annuity Years 2024

- Principal:The initial amount of money invested in the annuity.

- Interest Rate:The rate of return on the investment, which determines the growth of the annuity over time.

- Payment Period:The frequency and duration of the payments received from the annuity. This could be monthly, quarterly, annually, or over a specific number of years.

Ordinary Annuities vs. Annuities Due

There are two main types of annuities: ordinary annuities and annuities due. The key difference lies in the timing of payments.

Annuity options and regulations can vary depending on your location. If you’re in the UK, it’s important to understand the specific rules and considerations surrounding annuities. You can find information about annuities in the UK in Annuity Uk 2024.

- Ordinary Annuities:Payments are made at the end of each period (e.g., at the end of each month).

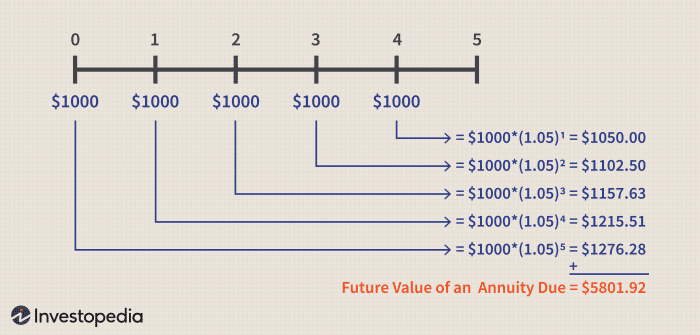

- Annuities Due:Payments are made at the beginning of each period (e.g., at the beginning of each month).

Types of Annuities

Annuities come in various forms, each with its own characteristics and benefits. Some common types include:

- Fixed Annuities:These offer a guaranteed interest rate and fixed payment amounts, providing predictable income.

- Variable Annuities:The interest rate and payment amounts fluctuate based on the performance of underlying investments, potentially offering higher returns but also higher risk.

- Immediate Annuities:Payments begin immediately after the initial investment is made.

- Deferred Annuities:Payments are delayed until a future date, allowing the investment to grow for a longer period.

Annuity Calculations in 2024: Calculate Annuity Years 2024

Calculating annuity payouts involves considering various factors, including current interest rates, inflation, and investment performance. Understanding these factors is crucial for making informed decisions about annuity investments.

Impact of Interest Rates and Inflation

Interest rates and inflation significantly influence annuity calculations. In a high-interest rate environment, annuities can generate higher returns, leading to larger payouts. However, inflation can erode the purchasing power of those payments over time. In 2024, interest rates are expected to remain relatively low, which could impact annuity payouts.

Calculating an annuity can seem daunting, but it doesn’t have to be. There are various resources available to guide you through the process. For a comprehensive guide on how to calculate an annuity, check out How Calculate Annuity 2024.

It’s essential to consider the potential impact of inflation when planning for retirement using annuities.

Annuity bonds are a type of investment that can provide a steady stream of income throughout retirement. Understanding how to calculate the value of an annuity bond is essential for making informed investment decisions. For a guide on calculating annuity bond values, visit Calculate Annuity Bond 2024.

Factors Influencing Annuity Payouts

Apart from interest rates and inflation, several other factors influence annuity payouts:

- Investment Performance:For variable annuities, the performance of underlying investments directly impacts the payouts.

- Longevity:The longer you live, the more payments you receive from an annuity. However, this also increases the risk of outliving your savings.

- Annuity Type:Different annuity types have varying payout structures, so it’s crucial to understand the terms of your specific annuity contract.

Annuity Calculation Methods

There are two primary methods for calculating annuity payouts:

- Present Value (PV):This method determines the current value of a future stream of payments, considering the time value of money and interest rates.

- Future Value (FV):This method calculates the future value of an investment, considering the growth of the principal over time due to interest accumulation.

Annuity Planning for Retirement

Annuities can be a valuable tool for retirement planning, providing a steady income stream during your golden years. To effectively plan for retirement using annuities, you need to set clear goals, calculate your required income, and choose the right annuity type.

Understanding how annuities have evolved over time can provide valuable insights into their current state and future potential. For a historical perspective on annuities, check out Annuity 2021 2024.

Projected Annuity Growth

| Year | Initial Investment | Interest Rate 5% | Interest Rate 7% | Interest Rate 9% |

|---|---|---|---|---|

| 1 | $100,000 | $105,000 | $107,000 | $109,000 |

| 2 | $100,000 | $110,250 | $114,490 | $118,810 |

| 3 | $100,000 | $115,763 | $122,504 | $129,503 |

| 4 | $100,000 | $121,551 | $131,080 | $140,710 |

| 5 | $100,000 | $127,628 | $140,255 | $152,666 |

| 10 | $100,000 | $162,889 | $196,715 | $236,736 |

| 15 | $100,000 | $207,893 | $295,216 | $404,556 |

| 20 | $100,000 | $265,330 | $405,784 | $672,750 |

Steps for Retirement Planning with Annuities

- Determine Your Retirement Goals:Define your desired lifestyle, living expenses, and financial objectives during retirement.

- Calculate Required Income:Estimate your monthly or annual income needs based on your goals and expenses.

- Choose an Annuity Type:Select an annuity that aligns with your risk tolerance, investment objectives, and income needs.

- Consider Tax Implications:Understand the tax implications of receiving annuity payments and choose an annuity type that minimizes your tax burden.

- Review and Adjust Your Plan:Periodically review your retirement plan and make adjustments as needed to ensure it remains on track.

Choosing an Annuity

Choosing the right annuity is crucial for achieving your retirement goals. Here’s a flowchart to guide your decision-making process:

Flowchart:

The term “annuity jackpot” might sound enticing, but it’s essential to approach it with caution. It’s crucial to understand the potential risks and rewards associated with this type of investment. To learn more about annuity jackpots, visit Annuity Jackpot 2024.

- Start:What are your retirement income needs?

- Branch 1:Do you prefer guaranteed income or potential for higher returns?

- Branch 2:If guaranteed income, consider a fixed annuity. If potential for higher returns, consider a variable annuity.

- Branch 3:Do you need income immediately or in the future?

- Branch 4:If immediate income, consider an immediate annuity. If future income, consider a deferred annuity.

- End:Choose the annuity that best meets your needs and risk tolerance.

Annuity Tax Implications

Annuities have tax implications that need careful consideration. Understanding these implications can help you maximize the benefits of your annuity investment and minimize your tax burden.

Tax Implications of Annuity Payments

When you receive annuity payments, they are generally taxed as ordinary income. This means that the portion of each payment that represents a return on your principal investment is taxed at your marginal income tax rate. Additionally, any capital gains realized from the investment may be subject to capital gains tax.

One of the key benefits of an annuity is its potential to provide guaranteed income throughout retirement. This can offer peace of mind knowing that you’ll have a reliable stream of income, regardless of market fluctuations. To learn more about guaranteed income from annuities, read Is Annuity Income Guaranteed 2024.

Tax Advantages and Disadvantages

Different annuity types have varying tax implications. Some annuities may offer tax advantages, while others may have drawbacks. For example, some annuities allow for tax-deferred growth, meaning that you don’t pay taxes on the earnings until you start receiving payments.

Your age plays a significant role in determining the value of an annuity. An annuity calculator that considers age can provide personalized estimates based on your specific circumstances. Explore Annuity Calculator By Age 2024 to see how your age might affect your annuity.

However, it’s important to note that these tax advantages may come with certain restrictions or limitations.

An annuity of £2,000 per month can provide a substantial stream of income throughout retirement. If you’re considering an annuity that pays out this amount, it’s essential to understand the factors that influence its value and how it might affect your overall financial planning.

For more information on annuities that pay £2,000 per month, visit Annuity 2000 Per Month 2024.

Tax Strategies for Maximizing Benefits

By carefully planning your annuity investment, you can minimize your tax liability and maximize the benefits. Some strategies include:

- Choose an Annuity with Tax-Deferred Growth:This can help you defer taxes on your earnings for a longer period.

- Consider Roth Annuities:Roth annuities allow for tax-free withdrawals in retirement, but contributions are made with after-tax dollars.

- Consult a Tax Professional:Seek advice from a qualified tax professional to develop a tax strategy that aligns with your individual circumstances.

Annuity Risks and Considerations

While annuities can be a valuable part of your retirement plan, it’s essential to understand the potential risks associated with them. By carefully considering these risks, you can make informed decisions and mitigate potential downsides.

HMRC, the UK’s tax authority, provides valuable resources for understanding annuity-related tax implications. You can find an annuity calculator specifically designed for HMRC guidelines on Annuity Calculator Hmrc 2024.

Potential Risks of Annuities

- Interest Rate Risk:Fixed annuities may lose value if interest rates rise after you’ve purchased them.

- Inflation Risk:The purchasing power of your annuity payments may be eroded by inflation over time.

- Longevity Risk:You may outlive your annuity payments, leaving you with insufficient income in your later years.

- Investment Risk:Variable annuities carry investment risk, meaning that the value of your investment can fluctuate based on the performance of underlying investments.

Understanding Annuity Contracts

It’s crucial to carefully review the terms and conditions of your annuity contract before making a purchase. Pay attention to the following:

- Interest Rate Guarantees:Understand the interest rate guarantees and how they might affect your returns.

- Fees and Expenses:Be aware of any fees associated with the annuity, including administrative fees, surrender charges, and mortality charges.

- Withdrawal Penalties:Understand the penalties for withdrawing funds early from the annuity.

- Death Benefit Provisions:Understand the provisions for death benefits and how they might impact your beneficiaries.

Comparing Annuity Providers

| Annuity Provider | Annuity Type | Interest Rate | Fees and Expenses | Withdrawal Penalties | Death Benefit Provisions |

|---|---|---|---|---|---|

| Provider A | Fixed Annuity | 3.5% | $100 per year | 10% for withdrawals within 5 years | 100% of principal to beneficiary |

| Provider B | Variable Annuity | 5% (based on investment performance) | $150 per year | 5% for withdrawals within 3 years | 100% of principal to beneficiary |

| Provider C | Immediate Annuity | 4% | $50 per year | No withdrawal penalties | No death benefit |

Final Summary

Understanding annuities is crucial for anyone seeking a secure financial future. By carefully considering your individual needs and risk tolerance, you can leverage the benefits of annuities to create a comprehensive retirement plan. This guide has provided a comprehensive overview of annuities, empowering you to make informed decisions about incorporating them into your financial strategy.

As you navigate the world of annuities, remember to seek professional financial advice tailored to your unique circumstances.

FAQ Guide

What are the benefits of annuities?

If you’re looking for a straightforward way to calculate an annuity, using a financial calculator can be a great option. These calculators can simplify the process and provide accurate results. Learn how to utilize a financial calculator for annuity calculations in How To Calculate Annuity Using Financial Calculator 2024.

Annuities offer guaranteed income streams, tax-deferred growth, and potential for longevity protection. They can provide a steady source of income during retirement, ensuring financial security.

Are annuities right for everyone?

Calculating an annuity can be a bit tricky, especially if you’re new to financial planning. Luckily, there are resources available to help you understand the basics. You can find a comprehensive guide on Calculating Simple Annuity 2024 that covers everything from defining an annuity to calculating its value.

Annuities are not a one-size-fits-all solution. It’s crucial to evaluate your individual needs, risk tolerance, and financial goals before deciding if an annuity is appropriate for you.

What are the risks associated with annuities?

Annuity payments are typically deposited into a specific account. It’s important to know what type of account this is, as it might impact your tax liability or other financial implications. You can find information about the account type associated with annuities in Annuity Is Which Account 2024.

Annuities carry risks such as interest rate risk, inflation risk, and longevity risk. It’s essential to understand these risks and consider them carefully before investing.

When it comes to retirement planning, you might be wondering whether an annuity or drawdown is the right choice for you. Both have their own pros and cons, so it’s essential to weigh your options carefully. You can learn more about the differences and which option might suit you better by reading Annuity Or Drawdown 2024.