Calculate Annuity Online 2024: Planning for your future can seem daunting, but understanding annuities can make it easier. Annuities are financial products that provide a stream of income, often used for retirement planning. They can be tailored to your specific needs and risk tolerance, offering a sense of security for the years ahead.

Online annuity calculators have become increasingly popular, providing a convenient and accessible way to estimate potential payouts and explore different annuity options. These tools empower individuals to take control of their financial future and make informed decisions about their retirement savings.

The suitability of annuities can be debated. Annuity Is Bad 2024 explores the potential drawbacks of annuities, highlighting the risks and downsides to consider before investing.

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract between you and an insurance company, where you make a lump sum payment or series of payments in exchange for guaranteed income in the future.

Canadians seeking to explore annuity options have a range of resources available. Annuity Calculator Canada 2024 provides a convenient tool for Canadians to calculate annuity payments and make informed financial decisions.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Some common types include:

- Fixed Annuities:These offer a guaranteed interest rate and fixed payment amount. They provide predictable income, making them suitable for those seeking stability.

- Variable Annuities:These tie the payment amount to the performance of underlying investments. While they offer potential for higher returns, they also carry investment risk.

- Immediate Annuities:Payments begin immediately after the initial investment is made. They’re ideal for individuals seeking immediate income, such as retirees.

- Deferred Annuities:Payments start at a later date, typically after a specific period. They allow you to accumulate wealth and defer income until a desired time.

Examples of Annuity Use Cases

Annuities can serve diverse financial goals, including:

- Retirement Planning:Annuities provide a reliable income stream during retirement, helping to supplement other retirement savings.

- Income Generation:They can be used to create a steady income stream for individuals who are no longer working or have limited income sources.

- Legacy Planning:Annuities can be structured to provide income to beneficiaries after the policyholder’s death, ensuring a financial legacy for loved ones.

Benefits of Calculating an Annuity Online: Calculate Annuity Online 2024

Calculating an annuity online offers numerous advantages, making it a convenient and accessible tool for financial planning.

Convenience and Accessibility

Online annuity calculators are readily available, allowing you to explore various annuity options and estimate potential payouts from the comfort of your home. These calculators are often free to use, eliminating any upfront costs.

The tax implications of annuities vary across the globe. Is Annuity Income Taxable In India 2024 delves into the specific tax regulations for annuities in India, helping you understand your tax obligations.

Benefits of Online Calculators vs. Financial Advisors

While consulting with a financial advisor offers personalized advice, online calculators provide a quick and easy way to get a general idea of annuity payouts based on your specific circumstances. They can be particularly helpful for initial research and exploration before engaging with an advisor.

Personalization and Customization, Calculate Annuity Online 2024

Online annuity calculators allow you to input various parameters, such as age, investment amount, interest rate, and payment frequency. This customization enables you to personalize your annuity plan based on your individual financial goals and risk tolerance.

Factors to Consider When Calculating an Annuity

Several factors influence annuity calculations, ultimately impacting the final payout amount. Understanding these factors is crucial for making informed decisions about annuity investments.

Annuities are often considered a key component of retirement planning. Annuity Is A Voluntary Retirement Vehicle 2024 delves into the role of annuities as a voluntary retirement vehicle, exploring their benefits and limitations.

Key Factors Influencing Annuity Calculations

Here’s a comprehensive list of factors that play a significant role in annuity calculations:

- Age:Older individuals typically receive higher annuity payouts due to a shorter life expectancy.

- Investment Amount:The initial investment amount directly impacts the potential payout, with larger investments generally leading to higher payouts.

- Interest Rate:Higher interest rates generally result in larger annuity payments, as the investment earns more over time.

- Payment Frequency:The frequency of payments (e.g., monthly, quarterly, annually) affects the total amount received over the annuity term.

- Annuity Type:The type of annuity chosen (fixed, variable, immediate, deferred) influences the payout structure and potential returns.

- Gender:Women generally have longer life expectancies than men, which may result in slightly lower annuity payouts.

- Health Status:Individuals with good health may receive higher annuity payouts, as they are expected to live longer.

Impact of Factors on Annuity Payout

The table below illustrates the relationship between key factors and their corresponding annuity values:

| Factor | Impact on Annuity Payout |

|---|---|

| Higher Age | Higher Payout |

| Larger Investment Amount | Higher Payout |

| Higher Interest Rate | Higher Payout |

| More Frequent Payments | Higher Payout (over the same period) |

How to Calculate an Annuity Online

Calculating an annuity online is a straightforward process, typically involving a few simple steps.

Step-by-Step Guide

Here’s a step-by-step guide on using an online annuity calculator:

- Find a Reputable Calculator:Search for “annuity calculator” online and choose a reputable website or financial institution offering this tool.

- Input Your Information:Enter your personal details, including age, gender, and desired payout frequency.

- Specify Investment Amount:Indicate the amount you plan to invest in the annuity.

- Select Annuity Type:Choose the type of annuity you’re interested in (fixed, variable, immediate, deferred).

- Adjust Other Parameters:If applicable, modify other parameters, such as interest rate or payment period.

- Calculate Your Annuity:Click on the “Calculate” button to generate your estimated annuity payout.

- Review the Results:Analyze the calculator’s output, which typically displays the estimated monthly or annual payments you can expect to receive.

Interpreting the Results

The results of an online annuity calculator provide valuable insights into your potential annuity payouts. They can help you compare different annuity options, assess the impact of various factors, and make informed decisions about your financial future.

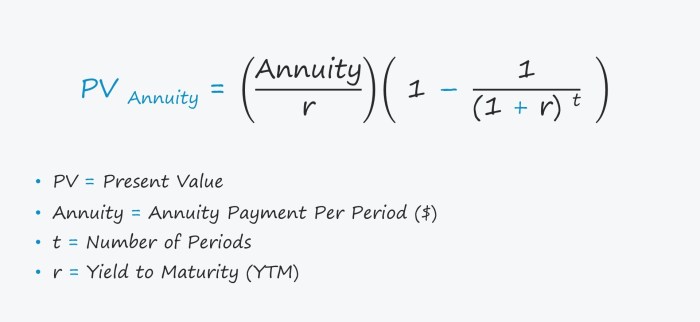

Understanding the intricacies of annuities can be daunting. Calculating A Annuity 2024 provides a step-by-step guide to help you calculate the value of an annuity, making the process easier and more accessible.

Key Considerations for Choosing an Annuity Provider

Selecting the right annuity provider is crucial, as it directly impacts your financial security and the overall success of your annuity investment.

Annuity can be a complex financial product. Annuity Meaning With Example 2024 provides a clear and concise explanation of what annuities are and how they function, using practical examples for better understanding.

Importance of Research and Comparison

Before choosing an annuity provider, it’s essential to thoroughly research and compare different options. This involves evaluating their financial stability, fees, customer service, and overall reputation.

Factors to Consider When Choosing an Annuity Provider

Here are some key factors to consider when selecting an annuity provider:

- Financial Stability:Choose a provider with a strong financial track record and a solid reputation for reliability. Look for companies with high ratings from independent agencies.

- Fees:Carefully examine the fees associated with the annuity, including administrative fees, surrender charges, and mortality and expense charges. Compare fees across different providers to find the most competitive options.

- Customer Service:Assess the provider’s customer service quality, responsiveness, and accessibility. Consider reading customer reviews and testimonials to gain insights into their overall customer experience.

- Product Features:Compare the features and benefits of different annuity products offered by various providers. Look for features that align with your specific financial goals and risk tolerance.

Comparing Annuity Providers

The table below compares the pros and cons of different annuity providers based on relevant criteria:

| Provider | Pros | Cons |

|---|---|---|

| Provider A | – Strong financial stability

|

– Limited product offerings |

| Provider B | – Wide range of annuity products

For those looking for a short-term income stream, a five-year annuity payout might be a good option. Annuity 5 Year Payout 2024 provides insights into how such annuities work and the factors to consider.

|

– Higher fees than some competitors

Planning for a substantial retirement income often involves substantial savings. Annuity 300 000 2024 explores the potential of annuities for those with a $300,000 savings goal, providing valuable insights into how annuities can work for you.

|

| Provider C | – Low fees

For those who prefer a hands-on approach to financial planning, understanding how to calculate annuities is essential. How To Calculate Annuities On Ti 84 2024 provides a step-by-step guide using a TI-84 calculator.

|

– Smaller company with less financial stability |

Annuity Calculations in 2024

The current market conditions play a significant role in annuity calculations, influencing the potential payouts and overall attractiveness of these investments.

Planning for retirement often involves significant savings. Annuity 75000 2024 explores the potential of annuities for those with a $75,000 savings goal, offering valuable insights into how annuities can work for you.

Impact of Market Conditions on Annuity Calculations

Factors such as interest rates, inflation, and investment returns can have a direct impact on annuity payouts in 2024.

Calculating the right annuity for your needs can be complex, especially when considering joint life scenarios. Annuity Calculator Joint Life 2024 provides valuable insights into how to calculate annuities for multiple individuals.

- Interest Rates:Rising interest rates can potentially lead to higher annuity payouts, as insurance companies can invest the premiums at a higher rate of return. However, higher interest rates can also make it more expensive to purchase an annuity.

- Inflation:High inflation erodes the purchasing power of annuity payments. To offset inflation, insurance companies may offer higher payouts, but the real value of those payments could still be lower than anticipated.

- Investment Returns:The performance of underlying investments can impact the payouts of variable annuities. Strong investment returns can lead to higher payouts, while poor returns can result in lower payments.

Potential Changes in Annuity Regulations and Tax Laws

Changes in annuity regulations or tax laws can also influence annuity calculations. It’s crucial to stay informed about any potential changes that may affect your annuity investment.

Investing in an annuity is a significant decision. Annuity Is It A Good Investment 2024 offers a comprehensive analysis of whether annuities are a good investment option for your specific financial situation.

Closure

By understanding the basics of annuities and utilizing online calculators, you can make informed decisions about your retirement planning. Remember, it’s crucial to consider your individual financial goals, risk tolerance, and the current market conditions when choosing an annuity provider.

Annuity options are numerous, and understanding the different types can be confusing. 3 Annuity 2024 offers a comprehensive guide to three popular annuity types, helping you choose the right one for your financial goals.

With careful planning and the right tools, you can create a secure and fulfilling retirement.

Choosing between an annuity and an IRA in 2024 can be a tough decision, especially considering the different features and benefits each offers. Annuity Or Ira 2024 provides insights to help you weigh the pros and cons of each option.

FAQ Insights

What is the difference between a fixed and variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

Dreaming of a comfortable retirement with a monthly income of $10,000? Annuity 10000 Per Month 2024 explores the feasibility of such an income stream through annuities and provides practical advice.

How do interest rates affect annuity payouts?

Higher interest rates generally result in larger annuity payouts, while lower interest rates lead to smaller payouts.

Are there any tax implications associated with annuities?

Yes, annuity payouts are typically taxed as ordinary income. However, there may be specific tax advantages depending on the type of annuity and your individual circumstances.

Is it necessary to consult a financial advisor when considering an annuity?

While online calculators can be helpful, it’s recommended to consult a financial advisor for personalized advice and guidance.