Calculate Annuity On Ti 84 2024 – Calculate Annuity On Ti 84: A Step-by-Step Guide, this guide will walk you through the process of calculating annuities using the TI-84 calculator, a powerful tool for financial planning and analysis. Annuities are a series of equal payments made over a set period of time, often used for retirement planning, loan repayment, or investment strategies.

Need to calculate your potential annuity payments? This guide on annuity calculators from Groww in 2024 can help you estimate your future income.

This guide will delve into the fundamentals of annuities, explore different types, and demonstrate how to utilize the TI-84 calculator for efficient and accurate calculations.

Are you approaching retirement at age 65? Learn more about annuities and their potential role in your retirement planning in our article on annuities at age 65 in 2024.

Understanding annuities is crucial for making informed financial decisions. By mastering the use of the TI-84 calculator for annuity calculations, you can gain valuable insights into the long-term financial implications of various annuity scenarios. Whether you’re planning for retirement, managing debt, or investing, this guide provides the necessary knowledge and tools to navigate the complexities of annuity calculations.

While annuities provide income, they are not life insurance policies. Learn more about the differences between these financial products in our article on annuities and life insurance in 2024.

Understanding Annuities: Calculate Annuity On Ti 84 2024

An annuity is a series of equal payments made over a specified period of time. It’s a financial product that provides a steady stream of income, often used for retirement planning, saving for a specific goal, or managing debt. Imagine you’re making regular contributions to a retirement fund, and in return, you receive a set amount of money each month after retirement.

If you’re looking for information about annuities, you might be interested in our article on annuity unscramble in 2024. It provides a comprehensive overview of this financial product.

That’s an example of an annuity.

Looking for a tool to help you calculate annuity payments? Check out this guide on annuity calculators in the UK in 2024. It can provide valuable insights into your potential annuity income.

Types of Annuities

There are different types of annuities, each with unique characteristics:

- Ordinary Annuity:Payments are made at the end of each period (e.g., monthly payments at the end of each month).

- Annuity Due:Payments are made at the beginning of each period (e.g., monthly payments at the beginning of each month).

Key Features of an Annuity

Here are the essential elements that define an annuity:

- Payment Amount:The fixed amount paid out in each period.

- Interest Rate:The rate at which the annuity grows over time. This is crucial for calculating the future value of the annuity.

- Time Period:The duration of the annuity, typically expressed in years or months.

Annuity Formulas

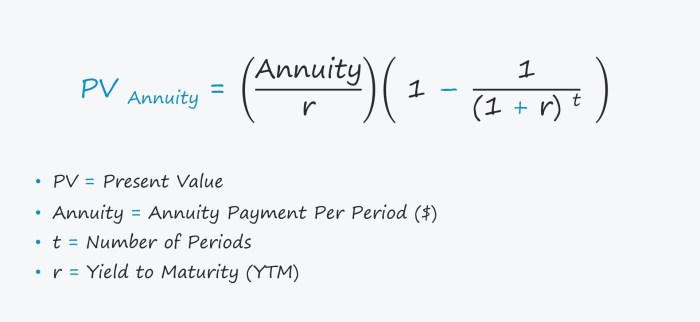

Annuity calculations involve determining the present value (PV) or future value (FV) of the annuity, based on the payment amount, interest rate, and time period.

Are you looking for guaranteed income in retirement? Learn about the certainty of annuity payments in our article on annuity certainty in 2024.

Present Value of an Annuity

PV = PMT

Annuity can be a valuable tool for retirement planning, providing a guaranteed income stream. Learn more about how annuities can play a role in your retirement strategy in our article on annuities and retirement in 2024.

- [1

- (1 + i)^-n] / i

Where:

- PV = Present Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Future Value of an Annuity

FV = PMT

Understanding the present value of your annuity can help you make informed financial decisions. Learn more about calculating present value in our article on calculating annuity present value in 2024.

- [(1 + i)^n

- 1] / i

Where:

- FV = Future Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Relationship between PV, FV, i, and n

The present value, future value, interest rate, and time period are interconnected. A higher interest rate generally leads to a higher future value and a lower present value. Increasing the time period also tends to increase the future value and decrease the present value.

Figuring out how much your annuity will pay out? Check out this guide on calculating annuity amount in 2024. It can help you understand the potential income stream you could receive.

Using the TI-84 Calculator for Annuity Calculations

The TI-84 calculator is a handy tool for performing annuity calculations. Here’s how to use it for present value and future value calculations:

Calculating the Present Value of an Annuity

- Press the “APPS” button and select “Finance” (usually option 1).

- Choose option “TVM Solver” (usually option 1).

- Enter the following values:

- N = Number of Periods

- I% = Interest Rate per Period (as a percentage)

- PMT = Payment Amount

- FV = Future Value (set to 0 if calculating present value)

- P/Y = Payments per Year (usually 1 for annual payments, 12 for monthly payments)

- C/Y = Compounding Periods per Year (usually the same as P/Y)

- Move the cursor to “PV” and press “ALPHA” then “SOLVE” to calculate the present value.

Calculating the Future Value of an Annuity

- Follow the same steps as above for calculating the present value.

- Enter the future value (FV) as a non-zero value instead of 0.

- Move the cursor to “FV” and press “ALPHA” then “SOLVE” to calculate the future value.

Practical Examples of Annuity Calculations

Retirement Planning

Let’s say you want to save for retirement and plan to contribute $5,000 annually for 25 years. You expect an average annual return of 7%. To calculate the future value of your retirement savings, you would use the future value of an annuity formula.

Trying to decide between an annuity and a 401k? We explore the key differences between these retirement savings options in our article on annuities vs. 401ks in 2024.

Using the TI-84 calculator, you would input the following values:

- N = 25 (years)

- I% = 7

- PMT = $5,000

- FV = ?

- P/Y = 1 (annual payments)

- C/Y = 1 (annual compounding)

Solving for FV, you would find that your retirement savings would be approximately $308,000 after 25 years.

Fixed annuities can provide a guaranteed income stream in retirement. Learn more about this type of annuity in our article on fixed annuities in 2024.

Loan Repayment

Consider a scenario where you take out a loan of $20,000 with an interest rate of 5% per year, payable over 5 years. To determine the monthly payment amount, you would use the present value of an annuity formula. In the TI-84 calculator, you would input:

- N = 60 (months)

- I% = 5 (annual interest rate)

- PMT = ?

- FV = 0

- P/Y = 12 (monthly payments)

- C/Y = 12 (monthly compounding)

Solving for PMT, you would find that your monthly payment would be approximately $377.42.

Want to know if annuities qualify as a retirement plan? We delve into the details of annuities and their tax implications in our article on annuities and qualified retirement plans in 2024.

Additional Considerations

Compounding Frequency

The frequency of compounding significantly impacts annuity calculations. The more frequently interest is compounded (e.g., monthly instead of annually), the higher the future value will be. This is because interest earned on the principal is added back to the principal more frequently, leading to greater growth over time.

Inflation

Inflation erodes the purchasing power of money over time. When calculating annuities, it’s important to consider the impact of inflation. To adjust for inflation, you can use a real interest rate, which is the nominal interest rate adjusted for inflation.

For example, if the nominal interest rate is 5% and inflation is 2%, the real interest rate is 3%.

Resources for Further Exploration, Calculate Annuity On Ti 84 2024

For deeper dives into annuity concepts and calculations, you can explore resources like:

- Financial textbooks and online courses

- Websites of financial institutions and investment firms

- The website of the Society of Actuaries

Last Recap

Mastering the art of annuity calculations on the TI-84 calculator empowers you to confidently analyze and plan for your financial future. From retirement planning to loan management, understanding the principles of annuities and leveraging the calculator’s capabilities will equip you with the tools to make sound financial decisions.

Whether you’re a seasoned investor or a novice seeking to grasp the fundamentals, this guide provides a clear and concise path to unlocking the power of annuity calculations.

Common Queries

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How do I adjust annuity calculations for inflation?

You can adjust annuity calculations for inflation by using a discounted interest rate that accounts for the anticipated rate of inflation.

Are there any online resources for further exploration of annuity concepts?

If you’re planning for your retirement with your spouse, you might want to consider a joint and survivor annuity. Discover how this type of annuity works and its potential benefits in our article on annuity joint and survivor in 2024.

Yes, numerous websites and financial institutions offer resources on annuities, including calculators, articles, and tutorials.

When it comes to your retirement savings, deciding between an annuity and a lump sum can be tough. Explore the pros and cons of each option in our article on annuity or lump sum in 2024.

Your 401k plan may offer annuity options. Explore the potential benefits and drawbacks of this approach in our article on annuities in 401k plans in 2024.