Calculate Annuity On Hp10bii 2024 – Calculate Annuity On HP 10bii 2024: A Guide is your comprehensive guide to understanding and calculating annuities using the powerful HP 10bii financial calculator. This guide will take you through the basics of annuities, explore the features of the HP 10bii, and equip you with the skills to confidently calculate present and future values of annuities.

Annuity options for a lump sum of $400,000 can offer a significant source of income during retirement. To explore annuity options for $400,000 in 2024, check out Annuity $400 000 2024. This resource can help you understand how annuities can be used to generate income from a large sum of money.

From defining annuities and their types to navigating the HP 10bii’s functionalities, this guide will provide step-by-step instructions, practical examples, and real-world applications. Whether you’re planning for retirement, managing loans, or simply want to understand the concept of annuities, this guide will serve as your trusted resource.

Calculating annuity cash flows in Excel can be helpful for financial planning and analysis. To learn how to calculate annuity cash flows using Excel in 2024, check out Calculating Annuity Cash Flows Excel 2024. This article provides step-by-step instructions and practical examples.

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. Annuities are commonly used for retirement planning, but they can also be used for other financial goals, such as saving for a child’s education or paying off a mortgage.

Calculating an annuity involves determining the present value or future value of a series of payments. If you need help calculating annuities in 2024, visit Calculating A Annuity 2024. This resource provides formulas and examples to guide you through the process.

Annuities can be a powerful tool for financial planning, but it’s important to understand the different types of annuities and how they work before making a decision.

Calculating annuity payments can be done using a financial calculator, which is a handy tool for financial planning. If you’re looking for guidance on how to calculate annuities on a financial calculator in 2024, check out Calculating Annuity On Financial Calculator 2024.

This article provides step-by-step instructions and helpful tips.

Types of Annuities

Annuities can be classified based on when payments begin and how the payments are structured. Here are some common types of annuities:

- Immediate Annuities:Payments begin immediately after the purchase of the annuity.

- Deferred Annuities:Payments begin at a later date, often after a certain period of time has passed.

- Fixed Annuities:Payments are guaranteed to remain the same throughout the term of the annuity.

- Variable Annuities:Payments fluctuate based on the performance of the underlying investments.

Factors Influencing Annuity Payments

Several factors influence the amount of annuity payments, including:

- Interest Rates:Higher interest rates generally result in larger annuity payments.

- Time Period:The longer the term of the annuity, the larger the payments will be.

- Payment Frequency:More frequent payments, such as monthly payments, will result in smaller individual payments compared to less frequent payments, such as annual payments.

HP 10bii Financial Calculator Overview

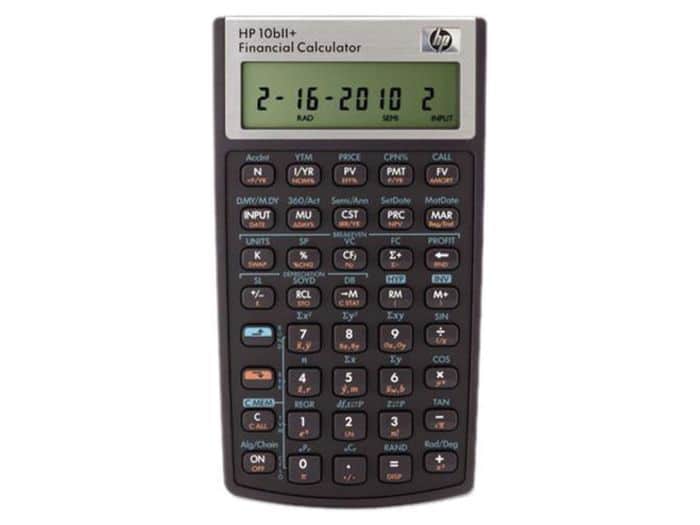

The HP 10bii is a powerful financial calculator that can be used to perform a wide range of calculations, including annuity calculations. The calculator has a user-friendly interface and is relatively easy to use, making it a popular choice for students, professionals, and individuals who need to perform financial calculations.

The value of an annuity depends on various factors, including interest rates, investment performance, and the age of the annuitant. To understand how the value of an annuity is determined in 2024, visit Annuity Is The Value Of 2024.

This article provides insights into the factors that influence annuity value.

Key Features for Annuity Calculations

The HP 10bii calculator includes several keys and functions specifically designed for annuity calculations. These include:

- PV (Present Value):This key is used to calculate the present value of an annuity.

- FV (Future Value):This key is used to calculate the future value of an annuity.

- PMT (Payment):This key is used to calculate the payment amount for an annuity.

- N (Number of Periods):This key is used to input the number of periods for an annuity.

- I/YR (Interest Rate per Year):This key is used to input the interest rate per year.

Inputting Financial Data

To calculate annuity payments using the HP 10bii, you need to input the following financial data:

- Present Value (PV):The initial amount invested or borrowed.

- Future Value (FV):The desired amount at the end of the annuity period. This can be zero if you are calculating the payment amount for a loan.

- Payment (PMT):The amount of each periodic payment. This can be zero if you are calculating the present or future value of an annuity.

- Number of Periods (N):The total number of payments in the annuity.

- Interest Rate per Year (I/YR):The annual interest rate.

Calculating Annuity Payments

The HP 10bii calculator can be used to calculate the present value of an annuity, which represents the current value of a series of future payments. This calculation is useful for determining how much money you need to invest today to receive a certain amount of income in the future.

Formula for Present Value

PV = PMT- [1 – (1 + i)^-n] / i

Annuity is a financial concept that is widely understood in many languages. To learn about the meaning of “annuity” in Tamil in 2024, visit Annuity Meaning In Tamil 2024. This resource provides a translation and explanation of the term in Tamil.

Where:

- PV is the present value of the annuity

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

Examples

Here are some examples of how to calculate the present value of an annuity using the HP 10bii:

- Example 1:You want to receive $1,000 per month for 10 years. The interest rate is 5% per year. What is the present value of this annuity?

Annuities are also known as “guaranteed income streams” or “retirement income plans.” To learn more about the different terms used to describe annuities in 2024, visit Annuity Is Also Known As 2024. This resource clarifies the terminology surrounding annuities.

To calculate the present value, input the following data into the HP 10bii:

- PMT = $1,000

- N = 120 (10 years – 12 months/year)

- I/YR = 5%

- FV = 0

Press the PV key to calculate the present value, which will be approximately $95,142.37.

- Example 2:You are considering buying an annuity that pays $5,000 per year for 20 years. The interest rate is 4% per year. What is the present value of this annuity?

Choosing between an annuity and drawdown can be a tough decision. If you’re weighing the pros and cons of each option in 2024, consider visiting Is Annuity Better Than Drawdown 2024. This article compares the two options, highlighting key factors to consider when making your choice.

To calculate the present value, input the following data into the HP 10bii:

- PMT = $5,000

- N = 20

- I/YR = 4%

- FV = 0

Press the PV key to calculate the present value, which will be approximately $67,100.82.

Annuity examples can help you understand how these financial products work in real-world scenarios. For example, if you’re looking for examples of annuities in 2024, check out Annuity Examples 2024. This resource can provide you with insights into different types of annuities and their potential benefits.

Calculating Annuity Future Value

The HP 10bii calculator can also be used to calculate the future value of an annuity, which represents the total amount of money you will have at the end of the annuity period, including all accumulated interest. This calculation is useful for determining how much money you will have saved or earned after a certain period of time.

An annuity is a type of payment that provides a regular income stream over a set period. To learn more about annuities and their payment structures in 2024, check out Annuity Is Payment 2024. This resource provides information on how annuities work and how payments are structured.

Formula for Future Value

FV = PMT- [(1 + i)^n – 1] / i

If you’re looking for a career in the annuity industry, there are various job opportunities available. To explore annuity-related job opportunities in 2024, visit Annuity Jobs 2024. This resource provides insights into the industry and available positions.

Where:

- FV is the future value of the annuity

- PMT is the payment amount

- i is the interest rate per period

- n is the number of periods

Examples

Here are some examples of how to calculate the future value of an annuity using the HP 10bii:

- Example 1:You deposit $500 per month into a savings account for 5 years. The interest rate is 3% per year. What is the future value of this annuity?

Three-year annuity rates can offer a fixed income stream for a specific period. To explore 3-year annuity rates in 2024, visit Annuity 3 Year Rates 2024. This resource provides information on current rates and factors influencing them.

To calculate the future value, input the following data into the HP 10bii:

- PMT = $500

- N = 60 (5 years – 12 months/year)

- I/YR = 3%

- PV = 0

Press the FV key to calculate the future value, which will be approximately $34,283.94.

New Zealand residents have various annuity options available to them. To explore annuity options in New Zealand in 2024, visit Annuity Nz 2024. This resource provides information on annuity providers, types of annuities, and relevant regulations in New Zealand.

- Example 2:You are saving for retirement and plan to contribute $2,000 per year for 30 years. The interest rate is 6% per year. What is the future value of this annuity?

To calculate the future value, input the following data into the HP 10bii:

- PMT = $2,000

- N = 30

- I/YR = 6%

- PV = 0

Press the FV key to calculate the future value, which will be approximately $163,879.58.

A 5-year annuity payout can provide a predictable income stream for a specific period. To learn more about 5-year annuity payouts in 2024, explore Annuity 5 Year Payout 2024. This resource explains the mechanics of such annuities and their potential benefits.

Advanced Annuity Calculations

The HP 10bii calculator can also be used to perform more advanced annuity calculations, such as calculating the payment amount for an annuity or the number of periods for an annuity.

Annuities are becoming increasingly popular in 2024, offering individuals a way to secure a steady stream of income during retirement. To learn more about the benefits of annuities in 2024, explore Annuity Is 2024. This article discusses the advantages and disadvantages of annuities in today’s market.

Calculating Payment Amount

To calculate the payment amount for an annuity, you need to know the present value, future value, number of periods, and interest rate. Input these values into the HP 10bii and press the PMT key to calculate the payment amount.

Calculating Number of Periods, Calculate Annuity On Hp10bii 2024

To calculate the number of periods for an annuity, you need to know the present value, future value, payment amount, and interest rate. Input these values into the HP 10bii and press the N key to calculate the number of periods.

Real-World Applications

Annuity calculations have a wide range of real-world applications, including:

- Retirement Planning:Annuities can be used to calculate the amount of income you will receive in retirement, or to determine how much you need to save to reach your retirement goals.

- Loan Amortization:Annuities can be used to calculate the monthly payments for a loan, as well as the total interest paid over the life of the loan.

- Investment Analysis:Annuities can be used to compare the returns of different investment options, such as stocks, bonds, and mutual funds.

Last Recap: Calculate Annuity On Hp10bii 2024

By mastering the techniques Artikeld in this guide, you’ll gain a deeper understanding of annuities and unlock the potential of the HP 10bii calculator. Whether you’re a financial professional, a student, or simply an individual seeking to make informed financial decisions, this guide will empower you to confidently calculate and analyze annuity scenarios.

Questions and Answers

What are the different payment frequencies for annuities?

Annuities can have various payment frequencies, including monthly, quarterly, semi-annually, and annually. The payment frequency impacts the total amount of interest earned or paid over the life of the annuity.

What are some real-world examples of annuities?

Annuities are commonly used in retirement planning, loan amortization, and insurance products. For example, a retirement annuity provides a stream of regular income after retirement, while a loan amortization schedule uses annuity calculations to determine monthly payments.