Calculate Annuity Of Present Value 2024 is a fundamental concept in finance that helps us understand the true value of future payments. It allows us to determine the current worth of a series of equal payments received or paid over a specific period, taking into account the time value of money.

It’s important to understand that annuities are considered a life insurance product. To learn more about this, you can visit An Annuity Is A Life Insurance Product That 2024 and get a better understanding of how they work within the context of life insurance.

This calculation is crucial for making informed financial decisions in various situations, from personal savings and investments to business loans and mortgages.

Understanding the relationship between annuity and present value involves considering the impact of factors such as interest rates, the number of periods, and the payment amount. By analyzing these factors, we can gain insights into the present value of future cash flows, enabling us to make sound financial choices.

To help you calculate annuity payments, you can use an Excel template. You can find a helpful template at Annuity Calculator Excel Template 2024.

Understanding Annuity and Present Value

In the realm of finance, understanding concepts like annuity and present value is crucial for making sound financial decisions. An annuity refers to a series of equal payments made over a specific period, while present value represents the current worth of a future sum of money.

In simple terms, an annuity is a series of payments made over a set period of time. You can learn more about the definition of an annuity at Annuity Is A Series Of 2024.

These concepts are closely intertwined, and comprehending their relationship is essential for various financial calculations.

Defining Annuity and Its Types

An annuity is a sequence of equal payments made at regular intervals. It can be categorized into two main types:

- Ordinary Annuity:Payments are made at the end of each period. For example, monthly mortgage payments made at the end of each month.

- Annuity Due:Payments are made at the beginning of each period. An example would be rent payments made at the beginning of each month.

Understanding Present Value

Present value (PV) is the current worth of a future sum of money, considering the time value of money. This means that money received today is worth more than the same amount received in the future due to the potential for earning interest or returns over time.

The concept of present value is fundamental in financial calculations, as it allows for comparing and evaluating investments and financial obligations.

The Relationship Between Annuity and Present Value

The present value of an annuity is the current worth of a series of future payments. In essence, it calculates the lump sum amount that, if invested today at a specific interest rate, would generate the same stream of payments as the annuity over the given period.

To get a clearer picture of how annuities work, it’s helpful to explore the basics. You can learn more about the fundamentals of annuities at Annuity Explained 2024.

This relationship is crucial for determining the fair value of financial instruments like loans, mortgages, and retirement plans.

An annuity certain is a type of annuity that guarantees payments for a specific period of time. You can learn more about this type of annuity at Annuity Certain Is An Example Of 2024.

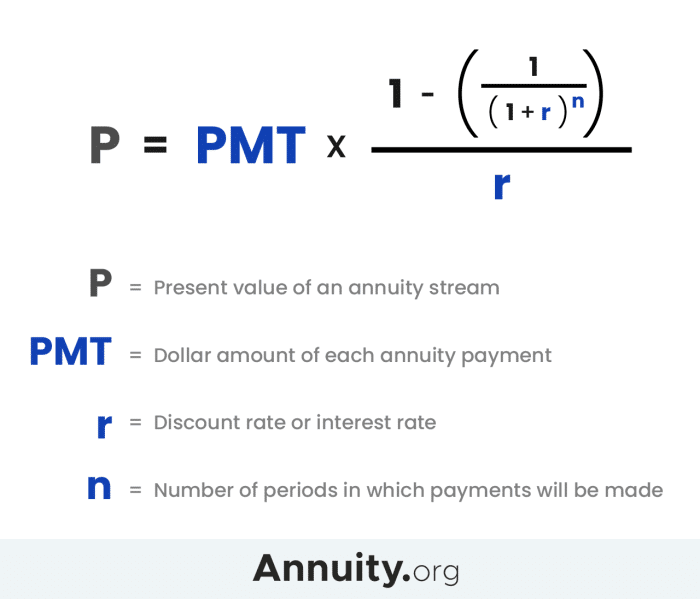

Formula for Calculating Annuity of Present Value

The present value of an annuity can be calculated using a specific formula that takes into account the payment amount, interest rate, and number of periods. This formula is essential for determining the current worth of a series of future payments.

Formula Breakdown

PV = PMT- [1 – (1 + r)^-n] / r

If you’re considering an annuity with a principal of $80,000, you might be curious about the monthly payout. To get an idea of the potential monthly income, you can visit How Much Does A 80 000 Annuity Pay Per Month 2024.

Where:

- PV: Present Value

- PMT: Payment Amount

- r: Interest Rate per Period

- n: Number of Periods

Table Illustrating Formula Application

| Payment Amount (PMT) | Interest Rate (r) | Number of Periods (n) | Present Value (PV) |

|---|---|---|---|

| $1,000 | 5% | 10 | $7,721.73 |

| $2,000 | 8% | 15 | $18,992.52 |

| $500 | 3% | 20 | $8,530.20 |

This table demonstrates how the present value of an annuity changes based on variations in the payment amount, interest rate, and number of periods. It highlights the importance of considering these factors when evaluating financial instruments.

Annuity rates can fluctuate over time. To see how rates have changed from 2021 to 2024, you can check out Annuity Rates 2021 2024.

Factors Influencing Annuity of Present Value

Several factors can significantly influence the present value of an annuity. Understanding these factors is crucial for making informed financial decisions and evaluating investment opportunities.

A common question about annuities is whether the death benefit is taxable. To get a clear answer to this question, you can check out Is Annuity Death Benefit Taxable 2024.

Impact of Interest Rates

Interest rates play a crucial role in determining the present value of an annuity. As interest rates rise, the present value of an annuity decreases. This is because a higher interest rate implies that a lump sum invested today can generate more returns over time, making future payments less valuable in present terms.

Conversely, a lower interest rate results in a higher present value.

If you’re looking for an annuity that provides a monthly payment of $10,000, you can learn more about this type of annuity at Annuity 10000 Per Month 2024.

Number of Periods and Present Value

The number of periods over which payments are made also influences the present value of an annuity. As the number of periods increases, the present value of the annuity generally increases. This is because a longer payment stream provides more opportunities for earning interest or returns, making the future payments more valuable in present terms.

Payment Amount and Present Value

The payment amount is directly proportional to the present value of an annuity. A higher payment amount leads to a higher present value, while a lower payment amount results in a lower present value. This relationship is intuitive, as a larger stream of payments is naturally worth more than a smaller stream.

Applications of Annuity of Present Value Calculation: Calculate Annuity Of Present Value 2024

The calculation of annuity of present value has numerous applications in financial planning and decision-making. This calculation is used to evaluate various financial instruments and make informed choices about investments, loans, and savings.

Annuity 30k in 2024 could be a good option for those looking to secure a consistent income stream. You can find more information about this type of annuity at Annuity 30k 2024 and get a better understanding of how it works.

Financial Planning Applications

Present value calculations are widely used in financial planning to evaluate the feasibility of various financial goals. For example, individuals can use present value calculations to determine the amount they need to save each month to reach a specific retirement savings target.

Similarly, businesses can use present value calculations to evaluate the profitability of potential investments.

The concept of an “annuity unit” can be a bit confusing. To understand what it means, you can find more information at Annuity Unit Is 2024.

Real-World Scenarios

- Mortgages:When taking out a mortgage, the present value calculation helps determine the total cost of the loan, including interest payments, over the entire loan term. This calculation allows borrowers to compare different mortgage options and choose the most financially advantageous one.

If you’re concerned about the religious implications of annuities, you can learn more about whether annuities are considered halal at Is Annuity Halal 2024.

- Retirement Planning:Present value calculations are crucial for retirement planning, as they help individuals estimate the amount of money they need to save to maintain their desired lifestyle after retirement. By calculating the present value of future retirement income needs, individuals can develop a comprehensive retirement savings plan.

- Loans:Present value calculations are also used in loan analysis. Lenders use these calculations to determine the present value of future loan payments, helping them assess the risk and profitability of extending loans.

Informed Financial Decisions, Calculate Annuity Of Present Value 2024

Present value calculations provide a powerful tool for making informed financial decisions. By considering the time value of money, present value analysis allows individuals and businesses to compare different financial options, evaluate investments, and make sound choices that align with their financial goals.

When considering an annuity, the licensing number of the insurer is an important factor. You can find information about the LIC annuity number for 2024 at Annuity Number Lic 2024.

Tools and Resources for Calculating Annuity of Present Value

Various tools and resources are available to assist in calculating the present value of an annuity. These tools simplify the process and ensure accuracy in the calculations.

If you’re lucky enough to win the lottery, you might need to figure out how annuity payments work. To learn more about calculating lottery annuity payments, you can visit Calculating Lottery Annuity Payments 2024.

Financial Calculators

Financial calculators are widely used for calculating present value and other financial metrics. These calculators are specifically designed to handle complex financial calculations and provide accurate results. Many financial calculators have built-in functions for calculating the present value of an annuity, making the process straightforward.

Online Tools and Software

Numerous online tools and software applications are available for calculating present value. These tools are often user-friendly and provide a convenient way to perform present value calculations without the need for specialized financial calculators. Many online calculators allow for customization of variables like interest rates and payment periods, providing flexibility in the analysis.

When it comes to lottery winnings, you have the option of taking a lump sum or an annuity. To help you decide which option is best for you, you can find information about the pros and cons of each choice at Annuity Or Lump Sum 2024.

Resources and Guides

Numerous resources and guides are available online and in print to help individuals learn more about present value calculations. These resources often provide detailed explanations of the concepts, formulas, and applications of present value analysis. Additionally, financial textbooks and online courses can provide comprehensive coverage of present value calculations and their importance in financial decision-making.

Summary

Calculating the annuity of present value empowers individuals and businesses to make informed financial decisions. By understanding the true worth of future payments, we can make informed choices about investments, loans, and retirement planning. Whether you are a seasoned investor or just starting to explore the world of finance, mastering the concept of present value is essential for achieving your financial goals.

General Inquiries

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity involves payments made at the end of each period, while an annuity due involves payments made at the beginning of each period.

How does inflation affect present value calculations?

Inflation erodes the purchasing power of money over time. Higher inflation rates generally result in lower present values, as future payments are worth less in today’s dollars.

What are some common online tools for calculating present value?

Popular online tools include calculators from websites like Investopedia, Bankrate, and Moneychimp.