Calculate Annuity Hp10bii 2024 – Calculate Annuity with the HP-10bii in 2024 is your guide to understanding and calculating annuities using the powerful HP-10bii financial calculator. This guide explores the fundamentals of annuities, their various types, and their significance in financial planning. We’ll delve into the features of the HP-10bii, demonstrating how to effectively use it to calculate present values of annuities and explore their applications in real-world scenarios.

Wondering if an annuity counts as income? It’s a common question, especially when you’re planning your finances. Check out this article on Is Annuity Income 2024 to understand the tax implications and how it can impact your overall financial picture.

Annuities are a crucial financial tool, offering a steady stream of income during retirement or for other financial goals. The HP-10bii is a user-friendly calculator that simplifies the process of calculating annuity values. This guide will equip you with the knowledge and skills to confidently navigate the world of annuities, making informed decisions for your financial future.

If you’re looking for the Bengali meaning of “annuity,” you can find a translation on Annuity Is Bengali Meaning 2024.

Introduction to Annuities

Annuities are financial instruments that provide a series of regular payments over a specific period of time. They are often used in retirement planning, but they can also be helpful for other financial goals, such as saving for a down payment on a house or funding a child’s education.

Wondering about the specifics of a 2 million annuity in 2024? You can find information on this type of annuity on Annuity 2 Million 2024.

Annuities can be a valuable tool for individuals who want to ensure a steady stream of income during their retirement years or for other long-term financial goals.

Need real-world examples to better understand how annuities work? You can find various annuity examples and scenarios on Annuity Examples 2024.

Key Characteristics of Annuities, Calculate Annuity Hp10bii 2024

- Regular Payments:Annuities provide a series of consistent payments, either for a fixed period or for the lifetime of the annuitant.

- Guaranteed Income:In some cases, annuities offer guaranteed income streams, providing financial security and predictability.

- Investment Growth Potential:Some annuities allow for investment growth potential, with the potential to earn higher returns than traditional savings accounts.

- Tax Advantages:Annuities can offer tax benefits, depending on the type of annuity and the tax laws in your jurisdiction.

Types of Annuities

Annuities come in various forms, each with its own characteristics and benefits. Here are some common types:

- Fixed Annuities:These annuities provide a guaranteed rate of return, offering predictable income streams. However, they may not keep up with inflation.

- Variable Annuities:These annuities allow for investment growth potential, but the income payments are not guaranteed and can fluctuate based on market performance.

- Immediate Annuities:These annuities start making payments immediately after the purchase. They are often used for retirement income or other immediate financial needs.

- Deferred Annuities:These annuities start making payments at a future date, allowing for tax-deferred growth over time. They are commonly used for long-term savings goals.

Purpose of Annuities in Financial Planning

Annuities can play a significant role in various aspects of financial planning, including:

- Retirement Income:Annuities can provide a steady stream of income during retirement, ensuring financial security and peace of mind.

- Long-Term Savings:Deferred annuities can be used to save for long-term financial goals, such as a down payment on a house or college tuition.

- Income Protection:Annuities can help protect against outliving your savings, providing a guaranteed income stream for the rest of your life.

- Estate Planning:Annuities can be used to create a legacy for loved ones, providing a source of income for beneficiaries after your passing.

The HP-10bii Financial Calculator

The HP-10bii is a popular financial calculator widely used by individuals and professionals for various financial calculations, including annuity calculations. It is a compact and user-friendly calculator that offers a range of features to simplify complex financial calculations.

Looking to understand the details of a 300,000 annuity in 2024? You can find information on the specifics of this type of annuity on Annuity 300 000 2024.

Key Features and Functionalities

- Time Value of Money Functions:The HP-10bii calculator provides dedicated functions for calculating present value (PV), future value (FV), payment (PMT), interest rate (I/Y), and number of periods (N).

- Annuity Functions:It includes specific functions for calculating annuity values, such as present value of an annuity (PV of an annuity) and future value of an annuity (FV of an annuity).

- Amortization Functions:The calculator can also perform amortization calculations, allowing you to see how much of each payment goes towards principal and interest.

- Other Financial Functions:The HP-10bii offers additional functions for calculating depreciation, bond yields, and other financial metrics.

Accessing Annuity Functions

The HP-10bii calculator provides dedicated keys for accessing annuity functions. The “PV” key is used to calculate the present value of an annuity, while the “FV” key is used to calculate the future value of an annuity. To access these functions, you need to input the relevant values for payment (PMT), interest rate (I/Y), and number of periods (N), depending on the specific annuity calculation you are performing.

Annuity bonds can be a complex investment, but understanding how to calculate their value is essential. For a detailed guide on calculating annuity bond values in 2024, visit Calculate Annuity Bond 2024.

Calculating Annuity Values

The HP-10bii calculator simplifies the calculation of annuity values, making it easy to determine the present value or future value of an annuity stream.

Annuity payments can be a valuable source of income, especially during retirement. If you’re interested in learning more about how to calculate the value of an annuity in 2024, you can find helpful information on Annuity Is The Value Of 2024.

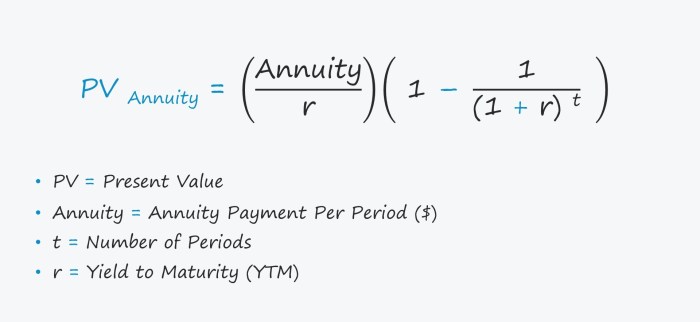

Calculating the Present Value of an Annuity

The present value of an annuity represents the current value of a series of future payments. To calculate the present value of an annuity using the HP-10bii calculator, you need to input the following values:

- Payment Amount (PMT):The amount of each payment in the annuity stream.

- Interest Rate (I/Y):The annual interest rate, expressed as a percentage.

- Time Period (N):The number of periods (years, months, etc.) over which the payments are made.

Step-by-Step Guide

- Clear the Calculator:Press the “CLR” key to clear any previous calculations.

- Input Payment Amount (PMT):Enter the payment amount and press the “PMT” key.

- Input Interest Rate (I/Y):Enter the annual interest rate and press the “I/Y” key.

- Input Time Period (N):Enter the number of periods and press the “N” key.

- Calculate Present Value (PV):Press the “PV” key to calculate the present value of the annuity.

The calculator will display the present value of the annuity, representing the current value of the future payments. This value can be used to compare different annuity options or to determine the amount you need to invest today to receive a specific future income stream.

If you’re in the UK and looking for information on annuities, you can find resources on Annuity Uk 2024.

Annuity Applications

Annuities have various real-world applications in financial planning, helping individuals achieve their financial goals and manage their finances effectively.

For information on a specific type of annuity, like a 712 annuity in 2024, you can find details on Annuity 712 2024.

Retirement Planning

Annuities are commonly used in retirement planning to provide a steady stream of income during retirement. They can help individuals ensure they have sufficient funds to cover their living expenses, healthcare costs, and other retirement needs. Annuities can also provide peace of mind by guaranteeing a certain level of income, regardless of market fluctuations.

A $400,000 annuity can be a significant financial asset. You can find information on this type of annuity on Annuity $400 000 2024.

Investment Analysis

Annuity calculations can be used in investment analysis to evaluate the profitability of different investment options. By comparing the present value of different investment streams, investors can make informed decisions about where to allocate their funds. Annuities can be particularly useful for comparing investments with different payment structures, such as bonds and stocks.

The UK government provides helpful resources for understanding annuities. You can find an annuity calculator and other useful tools on Annuity Calculator Gov Uk 2024.

Benefits and Drawbacks of Annuities

Annuities offer several potential benefits, such as guaranteed income, tax advantages, and investment growth potential. However, it’s important to consider their drawbacks as well. Some potential drawbacks include:

- High Fees:Annuities can have high fees, which can reduce your overall returns.

- Limited Flexibility:Once you purchase an annuity, you may have limited flexibility to access your funds or change your investment strategy.

- Potential for Loss:Variable annuities can lose value if the underlying investments perform poorly.

Advanced Annuity Concepts: Calculate Annuity Hp10bii 2024

Beyond basic annuity calculations, there are several advanced concepts that can enhance your understanding of annuities and their applications.

Need to calculate annuity cash flows in Excel? This can be a handy tool for financial planning. You can find a step-by-step guide on Calculating Annuity Cash Flows Excel 2024 to help you with your calculations.

Annuity Due

An annuity due is an annuity where payments are made at the beginning of each period, rather than at the end. This means that the first payment is made immediately upon purchase, and subsequent payments are made at the beginning of each subsequent period.

The 72t rule can be a helpful tool for understanding annuities. For more information on this rule, visit Annuity 72t 2024.

To calculate the present value of an annuity due, you can use the same formula as for a regular annuity, but you need to adjust the time period by one period.

Bankrate offers a user-friendly annuity calculator to help you estimate your potential annuity payments. Check out Annuity Calculator Bankrate 2024 to get started.

Inflation

Inflation can significantly impact the value of annuities over time. As prices rise, the purchasing power of your annuity payments decreases. To account for inflation, you can use an inflation-adjusted interest rate in your annuity calculations. This will help you estimate the real value of your annuity payments over time, considering the impact of inflation.

Relationship to Other Financial Instruments

Annuities are related to other financial instruments, such as bonds and stocks. Bonds typically offer a fixed stream of income, similar to fixed annuities. However, bonds have a maturity date, while annuities can provide income for life. Stocks offer the potential for higher returns than annuities, but they also carry higher risk.

When choosing between annuities and other financial instruments, it’s essential to consider your risk tolerance, time horizon, and financial goals.

Excel can be a powerful tool for managing annuities. Learn how to use Excel to calculate and analyze annuity payments by checking out Annuity Is Excel 2024.

Summary

By mastering the HP-10bii and understanding the intricacies of annuities, you gain a powerful tool for financial planning. Whether you’re planning for retirement, seeking a steady income stream, or simply exploring investment options, the knowledge gained from this guide will empower you to make informed decisions.

Remember, annuities are versatile financial instruments, and the HP-10bii can be your trusted companion in navigating their complexities.

Frequently Asked Questions

What is the difference between a fixed and variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return fluctuates based on the performance of underlying investments.

How does inflation affect annuity values?

Inflation erodes the purchasing power of future payments, so it’s important to consider inflation when calculating annuity values.

What are the benefits of using an annuity in retirement planning?

Annuities provide a steady stream of income, help manage longevity risk, and can offer tax advantages.