Calculate Annuity From Pension 2024: Navigating the complexities of retirement planning can feel overwhelming, but understanding how to calculate your annuity from your pension in 2024 is a crucial step towards a secure financial future. This guide will demystify the process, providing you with the knowledge and tools to make informed decisions about your retirement income.

Curious about the different ways annuities are provided? Annuity Is Given By 2024 delves into the various providers and options available for annuities. This knowledge can help you explore the different avenues for securing your financial future.

From understanding the fundamentals of annuities and pensions to exploring various payment options and tax implications, we’ll cover everything you need to know. We’ll also delve into the factors that influence annuity calculations, including age, life expectancy, interest rates, and contribution amounts.

Annuity payments can provide a sense of financial security in retirement. Is Annuity Income Guaranteed 2024 explores the concept of guaranteed income and its implications for annuities. This article can help you understand the level of risk and security associated with different annuity options.

Understanding Annuities and Pensions

Annuities and pensions are both financial instruments designed to provide income during retirement, but they differ in their structure, funding mechanisms, and how benefits are received. Understanding the key distinctions between these two financial tools is crucial for making informed decisions about your retirement planning.

Canadian residents seeking to explore annuity options have access to helpful tools. Annuity Calculator Canada 2024 provides a guide to annuity calculators available in Canada. This resource can help you estimate potential annuity payments and make informed financial decisions.

Annuities

An annuity is a financial product that provides a stream of regular payments, either for a fixed period or for the lifetime of the annuitant. It’s typically purchased with a lump sum of money, which is then invested by the annuity provider.

Choosing the right annuity for your retirement is a big decision. What Annuity Is The Best For Retirement 2024 offers a comprehensive guide to help you find the best annuity for your individual circumstances and retirement goals.

In return, the annuitant receives periodic payments, starting either immediately or at a later date, depending on the type of annuity chosen.

It’s important to understand the tax implications of annuities. Annuity Is Taxable 2024 explains the taxability of annuity payments and how it can impact your overall financial strategy. This knowledge can help you make informed decisions about your retirement income.

Types of Annuities

- Fixed Annuities:These annuities offer guaranteed payments for a set period or for life. The payment amount is fixed and doesn’t fluctuate with market performance.

- Variable Annuities:These annuities invest in a portfolio of assets, such as stocks or bonds. The payment amount fluctuates based on the performance of the underlying investments, making them riskier than fixed annuities but potentially offering higher returns.

- Indexed Annuities:These annuities tie their returns to the performance of a specific index, such as the S&P 500. They offer a combination of growth potential and some protection against market losses.

Pensions

A pension is a retirement plan that provides a regular income stream to employees after they retire. Pensions are typically funded by contributions from both the employer and the employee, and the benefits are often based on the employee’s salary and years of service.

Unlike annuities, pensions are typically funded by employers, and benefits are usually guaranteed for life.

Pension System in 2024

The pension system in 2024 is characterized by a mix of traditional defined benefit plans and defined contribution plans. Defined benefit plans offer a guaranteed income stream in retirement, based on factors like years of service and salary. Defined contribution plans, like 401(k)s, allow employees to contribute a portion of their earnings, which are then invested and grow tax-deferred.

The amount of income generated from a defined contribution plan depends on the investment performance.

Considering an annuity at age 65? Annuity 65 Male 2024 delves into the specific considerations for men entering retirement at this age. This article can help you make informed decisions about your retirement income strategy.

Factors Influencing Annuity Calculation

Several factors influence the value of an annuity, impacting the amount of income you receive. These factors play a critical role in determining the annuity payout, making it essential to understand their impact.

The terms “annuity” and “IRA” are often used interchangeably, but they have distinct differences. Is Annuity Same As Ira 2024 clarifies the key distinctions between these retirement savings options. This understanding can help you choose the best strategy for your retirement planning.

Key Factors

- Age:The younger you are when you purchase an annuity, the longer you’ll receive payments, resulting in a smaller monthly payment. Conversely, older individuals receive larger monthly payments due to their shorter expected lifespan.

- Life Expectancy:The average life expectancy for individuals at the time of annuity purchase is a crucial factor. Longer life expectancies lead to smaller monthly payments to ensure the annuity funds last throughout the recipient’s lifetime.

- Interest Rates:Interest rates directly affect the growth of the annuity’s investment portfolio. Higher interest rates generally result in larger annuity payments.

- Contribution Amounts:The initial lump sum used to purchase the annuity, or the amount of contributions made to a pension plan, directly determines the size of the annuity payments.

Inflation’s Impact

Inflation erodes the purchasing power of money over time. Annuity payments, particularly those with fixed payments, can be affected by inflation, meaning the purchasing power of future payments may be lower than today’s value. To mitigate inflation’s impact, consider annuities that offer some protection against inflation, such as indexed annuities.

Want to learn how to calculate annuity payments? Annuity Calculation Formula 2024 provides a comprehensive explanation of the formulas used for annuity calculations. This knowledge can help you better understand the mechanics of annuity payments and their impact on your finances.

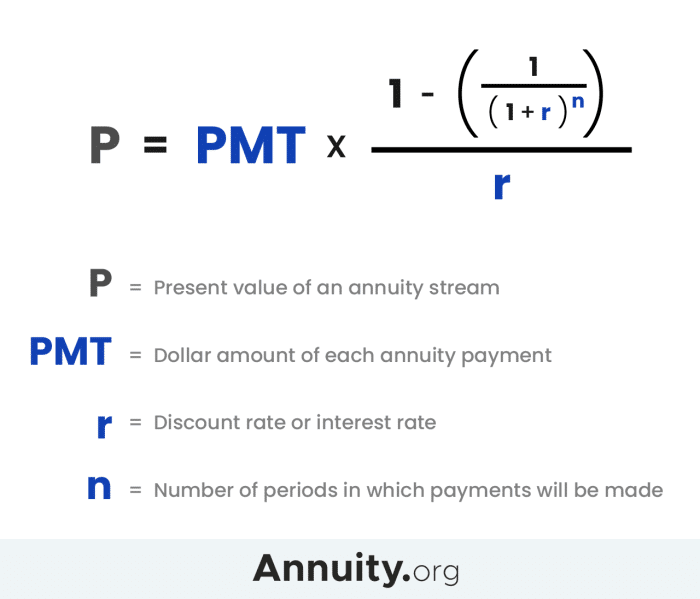

Annuity Calculation Methods

- Present Value Approach:This method calculates the current value of a stream of future payments, discounting future payments to reflect the time value of money.

- Future Value Approach:This method calculates the future value of a lump sum investment, growing at a specific interest rate, to determine the future value of the annuity payments.

Calculating Annuity from Pension in 2024

Calculating the annuity amount from a pension in 2024 requires understanding the specific terms of the pension plan, including contribution rates, vesting periods, and payout options. The calculation involves several steps, using specific formulas to determine the final annuity amount.

Looking to understand the different types of annuities available in 2024? 5 Annuity 2024 provides a comprehensive overview of the most popular options. This can help you make an informed decision based on your specific needs and financial goals.

Step-by-Step Guide

- Determine the Pension Plan’s Contribution Rate:This is the percentage of your salary that is contributed to the pension plan each year. The contribution rate can vary depending on the pension plan and your employer.

- Calculate Total Contributions:Multiply the annual contribution rate by your annual salary and then multiply that amount by the number of years you’ve been employed. This will give you the total amount of money contributed to your pension plan.

- Factor in Investment Growth:The total contributions will grow over time, earning interest or investment returns. The growth rate depends on the investment strategy of the pension plan. To calculate the future value of your contributions, you can use a compound interest formula.

- Determine the Annuity Payout Option:Pension plans offer various payout options, such as a lump sum, a fixed monthly payment, or a variable monthly payment. Choose the option that best suits your financial needs and risk tolerance.

- Calculate the Annuity Payment:The annuity payment is calculated based on the future value of your contributions, the chosen payout option, and your life expectancy. You can use a specialized annuity calculator or consult with a financial advisor to determine the exact payment amount.

Planning for the future involves calculating the potential growth of your investments. Calculate Annuity Due Future Value 2024 provides a helpful guide to understand how to calculate the future value of an annuity due. This information can be valuable for making sound financial projections.

Pension Plan Options

| Pension Plan Option | Contribution Rate | Vesting Period | Potential Annuity Payout |

|---|---|---|---|

| Traditional Defined Benefit Plan | 5% of salary | 5 years | $2,000 per month |

| Defined Contribution Plan (401(k)) | 6% of salary (with employer match) | Immediately vested | Variable, based on investment performance |

| Hybrid Pension Plan | 4% of salary (fixed contribution) | 3 years | $1,500 per month (guaranteed) + potential additional payments based on investment performance |

Real-World Examples, Calculate Annuity From Pension 2024

Let’s consider a hypothetical scenario: John has been working for a company for 20 years and has contributed 5% of his salary to a defined benefit pension plan. His average salary over the past 20 years was $60,000. The pension plan has a guaranteed payout of 2% of the average salary per year of service.

Planning for your legacy can be complex. Annuity Beneficiary Is A Trust 2024 explores the benefits of designating a trust as the beneficiary of your annuity. This article helps you understand the potential tax implications and other considerations.

John’s total contribution to the plan would be $60,000 x 0.05 x 20 = $60,000. His annual pension payout would be $60,000 x 0.02 x 20 = $24,000, or $2,000 per month.

If you have questions about annuities, you’re not alone. Annuity Questions 2024 addresses common inquiries about annuities, providing helpful insights and explanations. This can help you gain a better understanding of these financial instruments and their potential benefits.

Annuity Payment Options and Considerations

Once you’ve determined the annuity amount, you need to decide on the payment option that best suits your needs and risk tolerance. Different payment options offer varying levels of risk, income stability, and flexibility.

Exploring the different types of annuities can be complex. Annuity Contingent Is 2024 explains the concept of contingent annuities and their potential benefits. This article can help you understand the various options available and choose the one that best suits your needs.

Payment Options

- Fixed Annuities:These provide a guaranteed monthly payment for life, offering predictable income but limited growth potential. They are suitable for individuals seeking guaranteed income and low risk.

- Variable Annuities:These offer the potential for higher returns but also carry higher risk, as payments fluctuate based on investment performance. They are suitable for individuals with a higher risk tolerance and a longer time horizon.

- Indexed Annuities:These offer some protection against inflation by tying their returns to a specific index. They provide a balance between growth potential and some level of downside protection.

Pros and Cons

Choosing the right payment option depends on several factors, including:

- Risk Tolerance:Individuals with a low risk tolerance may prefer fixed annuities, while those comfortable with more volatility may opt for variable annuities.

- Longevity:If you expect to live a long life, a fixed annuity may provide more predictable income, while a variable annuity may offer the potential for higher returns over time.

- Financial Goals:Your financial goals will also influence your choice. If you need a guaranteed income stream, a fixed annuity may be appropriate. If you are looking for potential growth, a variable annuity may be a better choice.

Tax Implications

Annuity payments are generally taxed as ordinary income. However, the specific tax treatment may vary depending on the type of annuity and the circumstances of the recipient. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.

Understanding your retirement benefits is crucial. Calculating A Federal Annuity – Fers 2024 provides a detailed guide on how to calculate your federal annuity under the Federal Employees Retirement System (FERS). This information can help you plan for a comfortable retirement.

Planning for Retirement with Annuities

Annuities can be a valuable component of a comprehensive retirement income strategy. However, it’s important to consider their role within a diversified portfolio and to plan for their effective management.

Retirement Planning Checklist

- Assess your retirement income needs:Determine how much income you’ll need to maintain your desired lifestyle in retirement.

- Evaluate your existing savings and investments:Determine how much you’ve saved and how those assets are performing.

- Consider the role of annuities in your retirement income plan:Determine how annuities can supplement your existing retirement income sources.

- Choose the right type of annuity:Select an annuity that aligns with your risk tolerance, financial goals, and time horizon.

- Diversify your retirement income sources:Don’t rely solely on annuities for retirement income. Consider other sources, such as Social Security, pensions, and investment accounts.

- Develop a plan for managing your annuity payments:Determine how you will use your annuity payments to cover your expenses and achieve your financial goals.

Diversifying Retirement Income

Diversifying your retirement income sources is crucial for reducing risk and ensuring financial stability. Annuities can be a valuable part of a diversified portfolio, but they shouldn’t be the only source of retirement income. Consider other sources, such as Social Security, pensions, and investment accounts, to create a more resilient income stream.

Managing Annuity Payments

Managing annuity payments effectively is essential for maximizing their value over time. Consider:

- Creating a budget:Track your expenses and ensure you have a plan for using your annuity payments to cover your needs.

- Investing excess funds:If you receive more annuity payments than you need for expenses, consider investing those funds to grow your wealth.

- Reviewing your annuity periodically:As your circumstances change, you may need to adjust your annuity plan. Consult with a financial advisor to review your annuity strategy and ensure it aligns with your current needs.

Last Recap: Calculate Annuity From Pension 2024

As you embark on your retirement journey, having a clear understanding of your annuity options and how they fit into your overall financial strategy is paramount. By carefully considering your needs, goals, and risk tolerance, you can make informed choices that ensure a comfortable and secure retirement.

Understanding how annuities are reported for tax purposes is crucial. Annuity 1099 2024 provides valuable information on Form 1099-R and how it relates to annuity payments. It can help you navigate the complexities of tax reporting related to annuities.

FAQ Section

How do I know if I’m eligible for a pension?

Eligibility for a pension depends on your employment history and the specific pension plan you are enrolled in. You should contact your employer or the pension plan administrator to determine your eligibility.

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is linked to the performance of underlying investments. Fixed annuities offer more stability, while variable annuities have the potential for higher returns but also carry more risk.

What are the tax implications of receiving annuity payments?

Annuity payments are typically taxed as ordinary income. However, the specific tax treatment can vary depending on the type of annuity and your individual circumstances. It’s essential to consult with a tax professional for personalized advice.