Budgeting in an Inflationary Environment: Using the November 2024 CPI, navigating the current economic landscape requires strategic planning and adaptability. With rising prices impacting purchasing power, understanding the Consumer Price Index (CPI) becomes crucial for making informed financial decisions.

This guide explores the challenges and opportunities presented by an inflationary environment, providing practical strategies to manage your budget effectively. We’ll analyze the November 2024 CPI data, highlighting key trends and their impact on household expenses. By understanding the forces driving inflation, you can implement proactive measures to protect your financial well-being.

Remember to click The Role of Monetary Policy in Controlling Inflation in November 2024 to understand more comprehensive aspects of the The Role of Monetary Policy in Controlling Inflation in November 2024 topic.

Understanding Inflation and the Consumer Price Index (CPI)

Inflation is a persistent increase in the general price level of goods and services in an economy over a period of time. It erodes the purchasing power of money, meaning that a dollar today buys less than it did in the past.

Do not overlook the opportunity to discover more about the subject of CPI and Savings Account Interest Rates in November 2024.

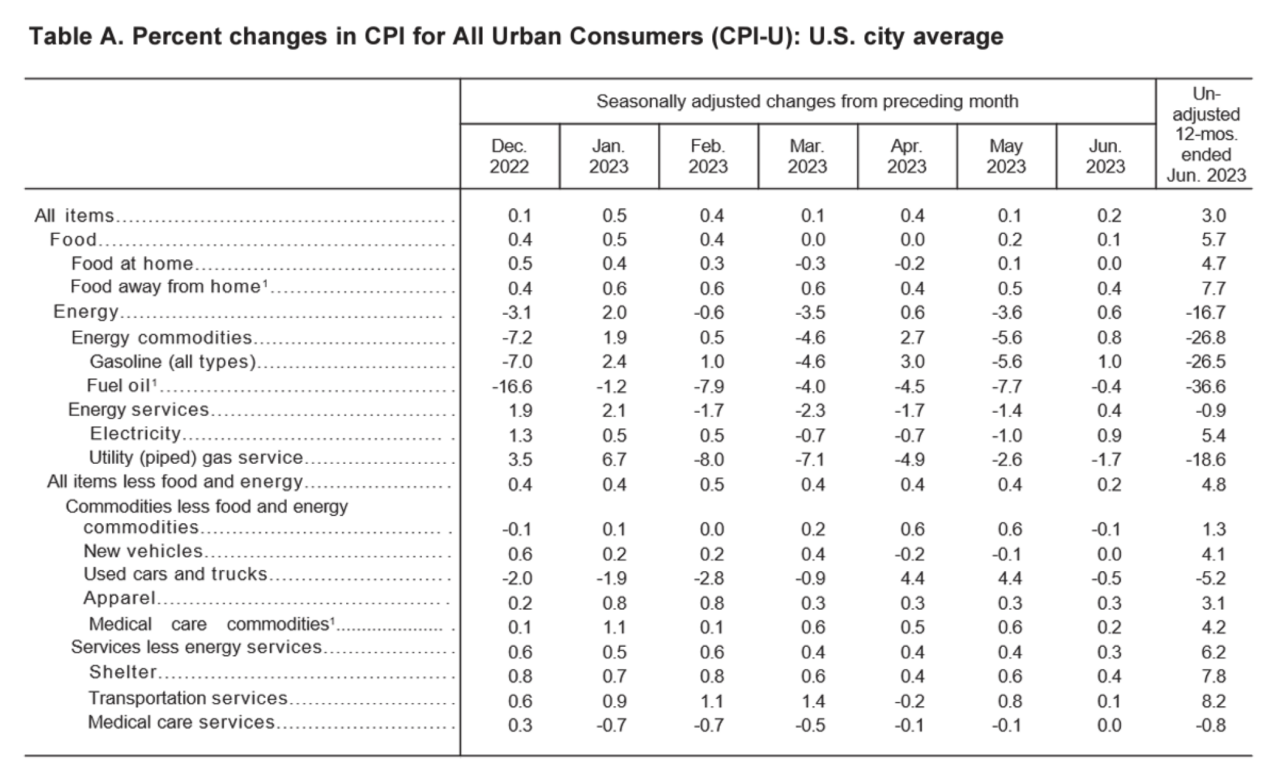

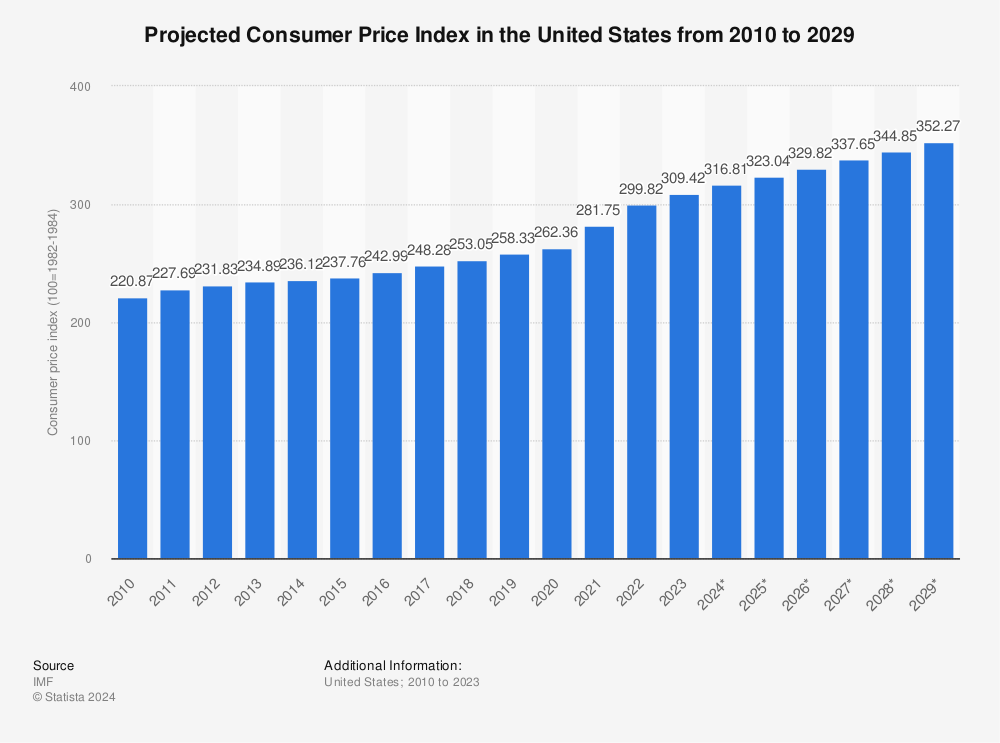

The Consumer Price Index (CPI) is a key measure of inflation, providing a snapshot of changes in the prices of a basket of consumer goods and services commonly purchased by households.

Defining Inflation and Its Impact on Purchasing Power

Inflation occurs when the supply of money in an economy grows faster than the production of goods and services. This leads to a decrease in the value of money, as more money chases the same amount of goods. As prices rise, consumers need to spend more to buy the same amount of goods, reducing their purchasing power.

For example, if the price of a gallon of milk increases from $3 to $4, consumers can buy fewer gallons of milk with the same amount of money.

Find out further about the benefits of The Future of the CPI: What to Expect After November 2024 that can provide significant benefits.

The Consumer Price Index (CPI) and Its Role in Measuring Inflation

The CPI is a weighted average of prices of a basket of consumer goods and services, such as food, housing, transportation, healthcare, and education. It is calculated by comparing the cost of this basket in a given period to its cost in a base period.

In this topic, you find that Accuracy and Reliability of the November 2024 CPI Data is very useful.

The CPI is used to measure the rate of inflation, which is the percentage change in the CPI over a specific period.

Analyzing the November 2024 CPI Data

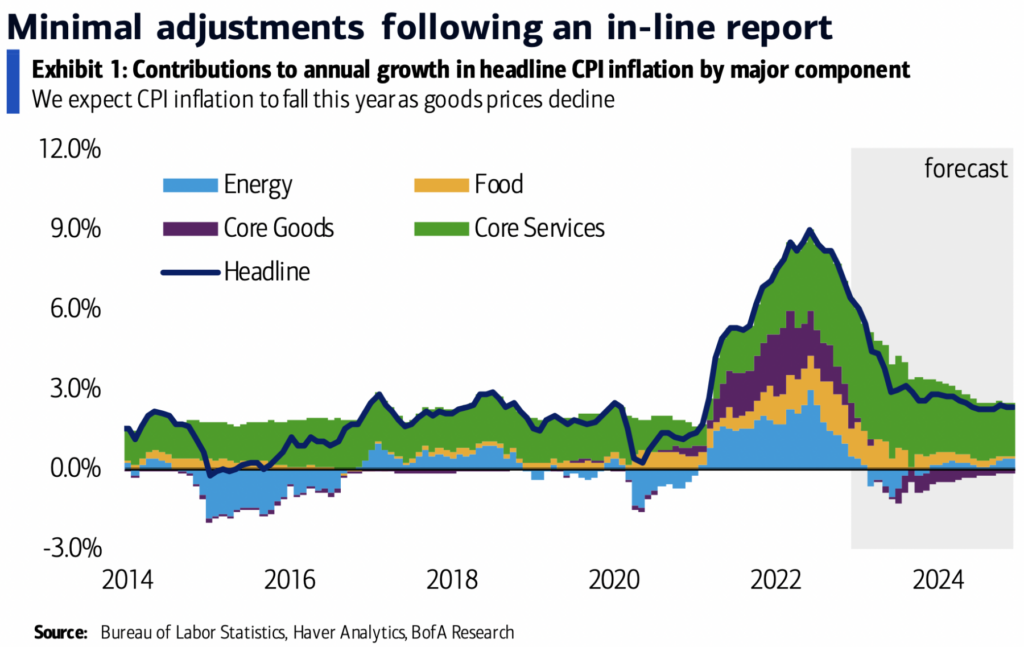

The November 2024 CPI data will provide insights into the current inflation trends in the economy. Analyzing this data will help identify key trends and changes in the price of goods and services. For example, if the CPI shows a significant increase in the price of energy, it could indicate rising gasoline prices, which would impact transportation costs for consumers.

You also can investigate more thoroughly about Measuring the Cost of Living in November 2024: The Role of the CPI to enhance your awareness in the field of Measuring the Cost of Living in November 2024: The Role of the CPI.

Understanding these trends is crucial for making informed financial decisions.

Budgeting Strategies in an Inflationary Environment

Budgeting during periods of high inflation can be challenging, as rising prices can quickly erode the purchasing power of income. However, by implementing effective strategies, individuals can mitigate the impact of inflation and maintain their financial stability.

Remember to click CPI and the November 2024 Election to understand more comprehensive aspects of the CPI and the November 2024 Election topic.

Challenges of Budgeting During High Inflation

- Increased Expenses:Rising prices for essential goods and services, such as food, housing, and transportation, can significantly increase household expenses.

- Reduced Purchasing Power:Inflation erodes the purchasing power of income, meaning that consumers can buy less with the same amount of money.

- Uncertainty:The unpredictable nature of inflation can make it difficult to plan for future expenses.

Effective Budgeting Strategies to Mitigate Inflation

To combat the challenges of inflation, individuals can adopt various budgeting strategies, including:

- Track Expenses:Carefully monitor all spending to identify areas where costs can be reduced.

- Create a Budget:Develop a realistic budget that allocates income to essential expenses and leaves room for savings.

- Prioritize Needs over Wants:Differentiate between essential needs and non-essential wants and cut back on discretionary spending.

- Shop Around for Deals:Compare prices at different stores and take advantage of discounts, coupons, and sales.

- Consider Alternatives:Explore cheaper alternatives for goods and services, such as generic brands or public transportation.

- Negotiate Prices:Negotiate prices with service providers and retailers, especially for larger purchases.

- Increase Income:Explore ways to increase income, such as taking on a side hustle or asking for a raise.

Tips for Tracking Expenses and Adjusting Spending Habits

Tracking expenses and adjusting spending habits are crucial for managing inflation. Some effective tips include:

- Use Budgeting Apps:Utilize budgeting apps to track expenses, categorize spending, and identify areas for savings.

- Set Spending Limits:Establish spending limits for different categories and stick to them.

- Avoid Impulse Purchases:Resist the temptation to make unplanned purchases, especially for non-essential items.

- Cook at Home:Prepare meals at home instead of eating out frequently to save on food costs.

- Reduce Energy Consumption:Conserve energy at home by turning off lights and appliances when not in use.

Impact of Inflation on Specific Expenses

Inflation affects different categories of household expenses differently. Understanding the impact of inflation on specific expenses can help individuals make informed decisions about their spending habits.

Expand your understanding about CPI and the Changing Consumer Landscape in November 2024 with the sources we offer.

Food

Food prices are often sensitive to inflation, as they are influenced by factors such as commodity prices, transportation costs, and labor costs. To reduce food costs, individuals can:

- Shop at Discount Stores:Purchase groceries from discount stores or warehouse clubs.

- Buy in Bulk:Stock up on non-perishable items when they are on sale.

- Plan Meals:Create a weekly meal plan to avoid impulse purchases and reduce food waste.

- Grow Your Own Food:Consider gardening or growing herbs to supplement your food supply.

Housing

Housing costs, including rent and mortgage payments, can be significantly impacted by inflation. Strategies for reducing housing costs include:

- Negotiate Rent:Discuss rent reductions with landlords, especially if your lease is up for renewal.

- Downsize:Consider moving to a smaller or less expensive home if your current housing costs are too high.

- Reduce Energy Consumption:Lower your energy bills by improving insulation, using energy-efficient appliances, and reducing your thermostat settings.

Transportation

Transportation costs, including gasoline, car maintenance, and public transportation fares, can fluctuate due to inflation. Here are some tips for managing transportation costs:

- Carpool or Use Public Transportation:Reduce gasoline consumption by carpooling or using public transportation.

- Maintain Your Vehicle:Regular car maintenance can improve fuel efficiency and reduce repair costs.

- Consider a Fuel-Efficient Vehicle:If you need a new car, consider purchasing a fuel-efficient model.

Healthcare

Healthcare costs are often subject to inflation, as medical technology advances and demand for healthcare services increases. To mitigate the impact of inflation on healthcare expenses, individuals can:

- Shop Around for Insurance:Compare health insurance plans to find the most affordable option.

- Utilize Preventive Care:Engage in preventive healthcare measures to avoid costly medical treatments.

- Negotiate Medical Bills:Negotiate payment plans or discounts with healthcare providers.

Negotiating Prices and Seeking Discounts

Negotiating prices and seeking discounts can help individuals save money on essential goods and services. Effective negotiation strategies include:

- Research Prices:Compare prices at different retailers before making a purchase.

- Be Prepared to Walk Away:Don’t be afraid to walk away from a deal if the price is too high.

- Be Polite but Firm:Be respectful but assertive when negotiating prices.

- Offer Alternatives:Suggest alternative solutions, such as a lower price or a payment plan.

Managing Income and Savings in an Inflationary Environment

Managing income and savings is crucial during periods of high inflation. By adopting effective strategies, individuals can protect their purchasing power and achieve their financial goals.

Strategies for Increasing Income

Increasing income can help offset the impact of inflation on purchasing power. Some strategies for boosting income include:

- Ask for a Raise:Negotiate a salary increase with your employer.

- Take on a Side Hustle:Explore freelance work, part-time jobs, or online gigs to earn extra income.

- Invest in Skills:Develop new skills or enhance existing ones to increase your earning potential.

- Sell Unused Assets:Declutter your home and sell unwanted items to generate cash.

Importance of Saving and Investing

Saving and investing are essential for protecting purchasing power during inflation. Savings provide a financial cushion during unexpected expenses, while investments can help your money grow over time.

Diversifying Investment Portfolios

Diversifying investment portfolios can help mitigate inflation risks. By investing in a mix of assets, such as stocks, bonds, and real estate, individuals can reduce the impact of inflation on their overall investment returns.

Long-Term Financial Planning in an Inflationary Environment: Budgeting In An Inflationary Environment: Using The November 2024 CPI

Inflation can have significant long-term implications for financial goals, such as retirement planning and homeownership. It is essential to adjust financial plans to account for rising prices and protect assets from the effects of inflation.

In this topic, you find that November 2024 CPI and Credit Card Interest Rates: What Consumers Need to Know is very useful.

Long-Term Implications of Inflation

- Retirement Planning:Inflation can erode the purchasing power of retirement savings, making it challenging to maintain the same standard of living in retirement.

- Homeownership:Rising interest rates and housing prices can make homeownership more expensive and challenging to achieve.

Strategies for Adjusting Financial Plans, Budgeting in an Inflationary Environment: Using the November 2024 CPI

To mitigate the long-term impact of inflation, individuals can adjust their financial plans by:

- Increase Savings Rate:Save more to compensate for the erosion of purchasing power.

- Invest in Inflation-Protected Assets:Consider investing in assets that tend to rise in value during inflationary periods, such as commodities or real estate.

- Review Retirement Plans:Reassess retirement savings goals and adjust contribution amounts to account for inflation.

- Seek Professional Financial Advice:Consult with a financial advisor to develop a comprehensive financial plan that addresses inflation risks.

Protecting Assets and Wealth

Protecting assets and wealth from the effects of inflation is crucial for long-term financial security. Some strategies for asset protection include:

- Diversify Investments:Spread investments across different asset classes to reduce risk.

- Consider Real Estate:Invest in real estate, which can act as a hedge against inflation.

- Pay Down Debt:Reduce debt levels to free up cash flow and reduce the impact of rising interest rates.

- Stay Informed:Stay informed about inflation trends and economic conditions to make informed financial decisions.

Government Policies and Inflation Management

Governments play a significant role in managing inflation through various economic policies. These policies aim to control price increases and stabilize the economy.

Enhance your insight with the methods and methods of CPI and Social Inequality in November 2024.

Government Policies for Controlling Inflation

- Monetary Policy:Central banks can adjust interest rates to influence the money supply and control inflation. Higher interest rates can slow down economic growth and reduce inflation.

- Fiscal Policy:Governments can use spending and taxation policies to influence economic activity. Reducing government spending or increasing taxes can help curb inflation.

- Supply-Side Policies:Policies that promote economic growth and productivity, such as deregulation and tax incentives, can help reduce inflation by increasing the supply of goods and services.

Effectiveness of Inflation Management Policies

The effectiveness of government policies in managing inflation depends on various factors, including the underlying causes of inflation, the timing and implementation of policies, and the overall economic conditions. Some policies may be more effective than others, and their impact can vary over time.

Impact of Government Actions on Consumer Budgets

Government actions to control inflation can have both positive and negative impacts on consumer budgets. For example, raising interest rates can make borrowing more expensive but also encourage saving. Fiscal policies, such as tax cuts or increased government spending, can stimulate economic activity but may also lead to higher inflation.

You also can understand valuable knowledge by exploring CPI and the Evolution of the US Economy Leading to November 2024.

End of Discussion

In an inflationary environment, budgeting effectively is not just about saving money; it’s about maintaining your financial security and achieving your long-term goals. By understanding the dynamics of inflation, utilizing strategic budgeting techniques, and exploring income-generating opportunities, you can navigate these challenging times and build a resilient financial foundation.

Clarifying Questions

What are some practical ways to reduce my grocery expenses during inflation?

Consider buying generic brands, comparing prices at different stores, utilizing coupons and loyalty programs, and planning meals to minimize food waste.

How can I protect my savings from inflation?

Diversify your investment portfolio, consider investing in assets that historically outpace inflation, and consult with a financial advisor to create a personalized plan.

What are some income-generating opportunities during inflationary periods?

Explore side hustles, freelance work, or part-time employment to supplement your income and maintain financial stability.