Best Online Bank For Small Business October 2024 takes center stage as entrepreneurs seek the most advantageous financial partners. Navigating the digital banking landscape for small businesses can be overwhelming, but this guide simplifies the process by offering a comprehensive evaluation of key features, top contenders, and essential considerations.

The online banking world has exploded, offering a wealth of options for small businesses. But choosing the right one can make or break your financial success. We’ll explore the features that matter most, delve into the best online banks for small businesses in October 2024, and provide insights to help you make the right choice.

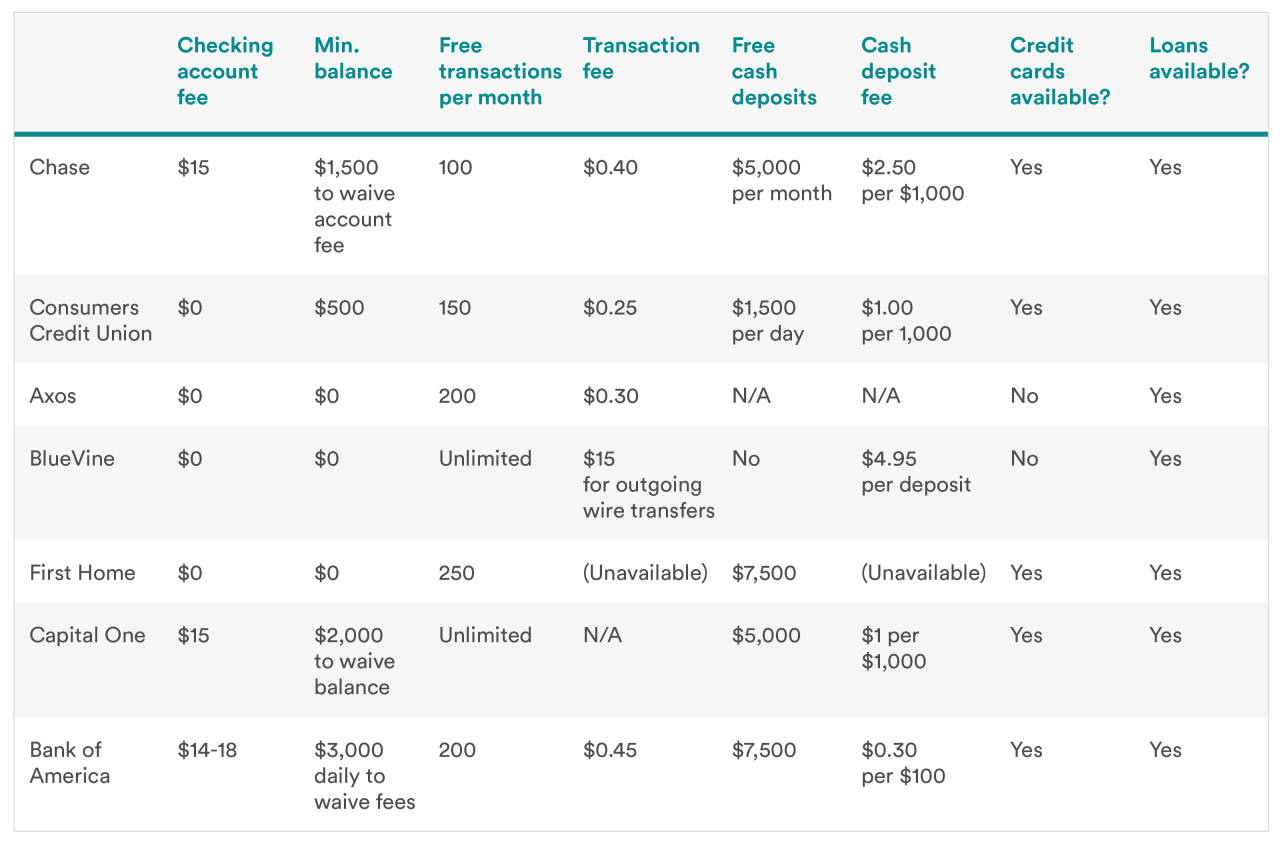

Top Online Banks for Small Businesses

Choosing the right online bank for your small business is crucial. It can make a significant difference in your financial management, efficiency, and overall success. Online banks offer a variety of features and benefits that can help you streamline your operations and save money.

Find out further about the benefits of Small Business Loan Near Me 2024 that can provide significant benefits.

Top 5 Online Banks for Small Businesses

| Bank Name | Key Features | Fees | Minimum Deposit |

|---|---|---|---|

| [Bank Name 1] | [Key Features] | [Fees] | [Minimum Deposit] |

| [Bank Name 2] | [Key Features] | [Fees] | [Minimum Deposit] |

| [Bank Name 3] | [Key Features] | [Fees] | [Minimum Deposit] |

| [Bank Name 4] | [Key Features] | [Fees] | [Minimum Deposit] |

| [Bank Name 5] | [Key Features] | [Fees] | [Minimum Deposit] |

Tips for Opening a Business Account: Best Online Bank For Small Business October 2024

Opening a business account with an online bank can be a seamless and convenient process, but it’s important to be prepared and understand the steps involved. By following these tips, you can ensure a smooth and successful application.

Finish your research with information from Small Business Loan Florida 2024.

Gathering Necessary Documentation

Before you start the application process, it’s crucial to have all the required documentation readily available. This will help you complete the application efficiently and avoid any delays.

When investigating detailed guidance, check out Small Business Loans Texas 2024 now.

- Business Registration Documents:This includes your business registration certificate, articles of incorporation, or partnership agreement. These documents verify the legal existence of your business.

- Tax Identification Number (TIN):Your TIN, also known as an Employer Identification Number (EIN), is essential for tax purposes. It allows the bank to identify your business for tax reporting.

- Personal Identification:You’ll need to provide your personal identification, such as a driver’s license or passport, to verify your identity and link your business account to your personal information.

- Proof of Address:You may need to provide a recent utility bill or bank statement to confirm your business address.

- Financial Statements:Depending on the bank’s requirements and the size of your business, you may need to provide financial statements, such as a balance sheet or income statement, to demonstrate your financial health.

Completing the Application Process

Once you’ve gathered all the necessary documents, you can start the online application process. Most online banks have streamlined application forms that can be completed quickly and easily.

Remember to click Online Small Business Loans October 2024 to understand more comprehensive aspects of the Online Small Business Loans October 2024 topic.

- Review the Terms and Conditions:Before submitting your application, take the time to carefully read and understand the bank’s terms and conditions. This includes information about fees, interest rates, and account limitations.

- Choose the Right Account Type:Online banks offer a variety of business account options. Choose an account that best suits your business needs and financial activity.

- Provide Accurate Information:Double-check all the information you provide on the application form to ensure accuracy. Any errors can lead to delays or complications.

- Submit Your Application:Once you’ve completed the application, review it thoroughly and submit it electronically.

- Verify Your Account:After submitting your application, the bank may require you to verify your account by phone or email. Follow the instructions provided to complete the verification process.

Understanding the Terms and Conditions, Best Online Bank For Small Business October 2024

It’s crucial to thoroughly understand the terms and conditions of your business account. This includes information about fees, interest rates, and account limitations.

For descriptions on additional topics like Resources For Women Owned Small Business 2024, please visit the available Resources For Women Owned Small Business 2024.

- Fees:Review the fee schedule carefully to understand any monthly maintenance fees, transaction fees, or overdraft fees.

- Interest Rates:If you’re looking for an account with interest-earning capabilities, understand the interest rates offered and any minimum balance requirements.

- Account Limitations:Pay attention to any limitations on the account, such as minimum deposit requirements, maximum transaction limits, or restrictions on certain types of transactions.

Last Word

Ultimately, the best online bank for your small business depends on your unique needs and preferences. By carefully considering factors like security, fees, customer service, and mobile banking capabilities, you can find a financial partner that supports your growth and helps you achieve your business goals.

Remember, research is key. Don’t hesitate to compare different options and explore the latest trends in online banking to ensure you’re making the most informed decision.

Commonly Asked Questions

What are the biggest benefits of using an online bank for a small business?

Online banks often offer lower fees, more convenient access, and a wider range of features compared to traditional brick-and-mortar banks. They’re also known for their user-friendly online platforms and mobile apps, making it easy to manage your finances on the go.

How do I choose the right online bank for my small business?

Consider your business needs, such as transaction volume, industry, and budget. Research online banks that specialize in serving small businesses, compare their fees, features, and customer service, and read reviews from other business owners.

What security measures should I look for in an online bank?

Ensure the online bank uses strong encryption, two-factor authentication, and other security protocols to protect your financial data. Look for banks that offer fraud protection and insurance to safeguard your funds.

Are there any hidden fees associated with online banking?

Yes, some online banks may have hidden fees, such as overdraft fees, insufficient funds fees, or inactivity fees. Carefully review the bank’s fee schedule and ask about any potential hidden costs before opening an account.

Browse the implementation of Get Small Business Loans 2024 in real-world situations to understand its applications.

You also can investigate more thoroughly about Local Business Listing Service 2024 to enhance your awareness in the field of Local Business Listing Service 2024.

Obtain direct knowledge about the efficiency of American Business Services Loans Reviews 2024 through case studies.

Investigate the pros of accepting Better Business Bureau Insurance 2024 in your business strategies.

Discover more by delving into Business Loan In Usa 2024 further.