Best Online Bank For Small Business November 2024 takes center stage, as the landscape of financial services continues to evolve. Choosing the right online bank for your small business is a crucial decision, impacting everything from daily operations to long-term financial growth.

This guide delves into the key features to consider, analyzes top contenders, and empowers you to make an informed choice.

Navigating the complexities of small business finances can be daunting. From managing cash flow to handling transactions, the right banking partner can make a world of difference. Online banks offer a range of advantages, including streamlined account management, convenient mobile access, and often lower fees compared to traditional brick-and-mortar institutions.

Choosing the Right Online Bank for Your Small Business

In today’s digital landscape, online banking has become an indispensable tool for businesses of all sizes. However, for small businesses, choosing the right online bank can be crucial for their financial success. This is because small businesses often face unique challenges in managing their finances, including limited resources, fluctuating cash flow, and the need for efficient and secure banking solutions.

Browse the multiple elements of Apply For Small Business Loan October 2024 to gain a more broad understanding.

Online banking offers numerous advantages for small businesses, simplifying financial management, saving time and money, and enhancing security.

Do not overlook the opportunity to discover more about the subject of Small Business Loans Financing November 2024.

Benefits of Online Banking for Small Businesses

Online banking offers numerous advantages for small businesses, simplifying financial management, saving time and money, and enhancing security.

Examine how Apply For Small Business Loans October 2024 can boost performance in your area.

- 24/7 Access:Online banking allows business owners to access their accounts and manage their finances from anywhere with an internet connection, providing flexibility and convenience.

- Reduced Costs:Online banking can significantly reduce the costs associated with traditional banking, such as transaction fees and branch visits.

- Improved Efficiency:Online banking tools streamline financial tasks, such as making payments, transferring funds, and reconciling accounts, saving valuable time and resources.

- Enhanced Security:Online banks typically have robust security measures in place, such as encryption and multi-factor authentication, protecting sensitive financial data from unauthorized access.

- Advanced Features:Many online banks offer advanced features specifically designed for small businesses, such as mobile payments, expense tracking, and budgeting tools.

2. Key Features to Consider for Small Business Online Banking

Choosing the right online banking platform can significantly impact a small business’s financial management and operational efficiency. Understanding the key features offered by different platforms and their implications for your specific business needs is crucial.

Do not overlook explore the latest data about Meta Business Ads Manager October 2024.

Account Types

Online banking platforms typically offer a range of account types designed to cater to the diverse financial needs of small businesses.

- Checking Accounts: These accounts are essential for daily transactions, such as paying suppliers, employees, and utilities. They often come with features like overdraft protection, debit cards, and mobile banking capabilities.

- Savings Accounts: These accounts allow businesses to set aside funds for future expenses or emergencies. They generally offer lower interest rates than checking accounts but provide a secure place to store surplus cash.

- Money Market Accounts: These accounts offer higher interest rates than savings accounts but typically require a higher minimum balance. They can be a good option for businesses with excess funds that they want to earn interest on.

- Line of Credit: This provides businesses with access to short-term financing, allowing them to borrow funds as needed. They can be useful for covering unexpected expenses or managing seasonal fluctuations in cash flow.

- Merchant Accounts: These accounts enable businesses to accept credit and debit card payments. They are essential for businesses that conduct online or in-person transactions.

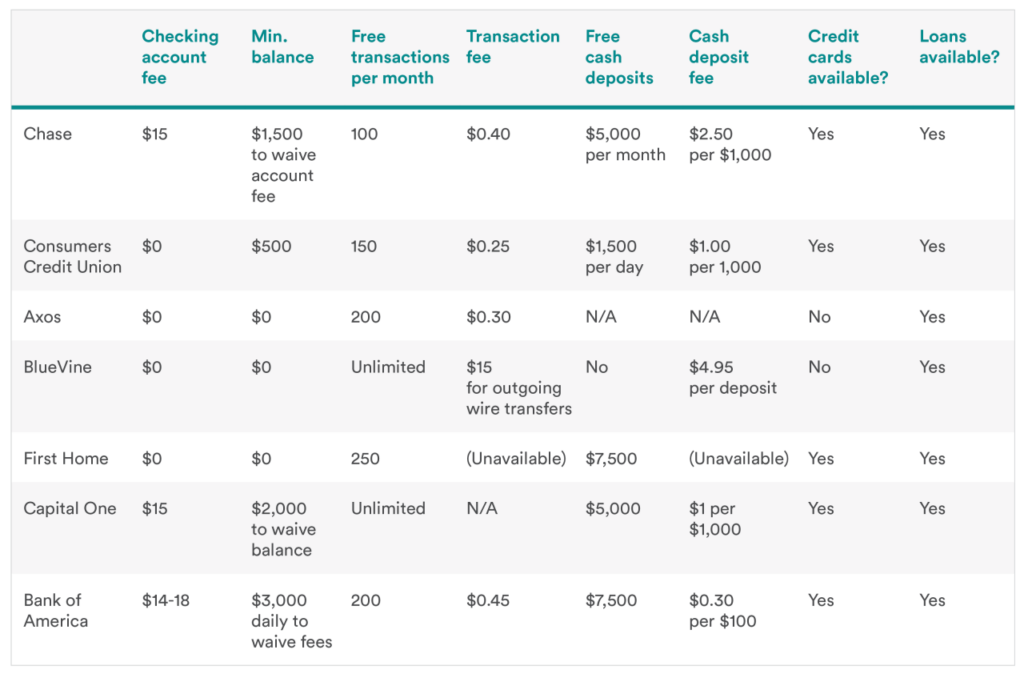

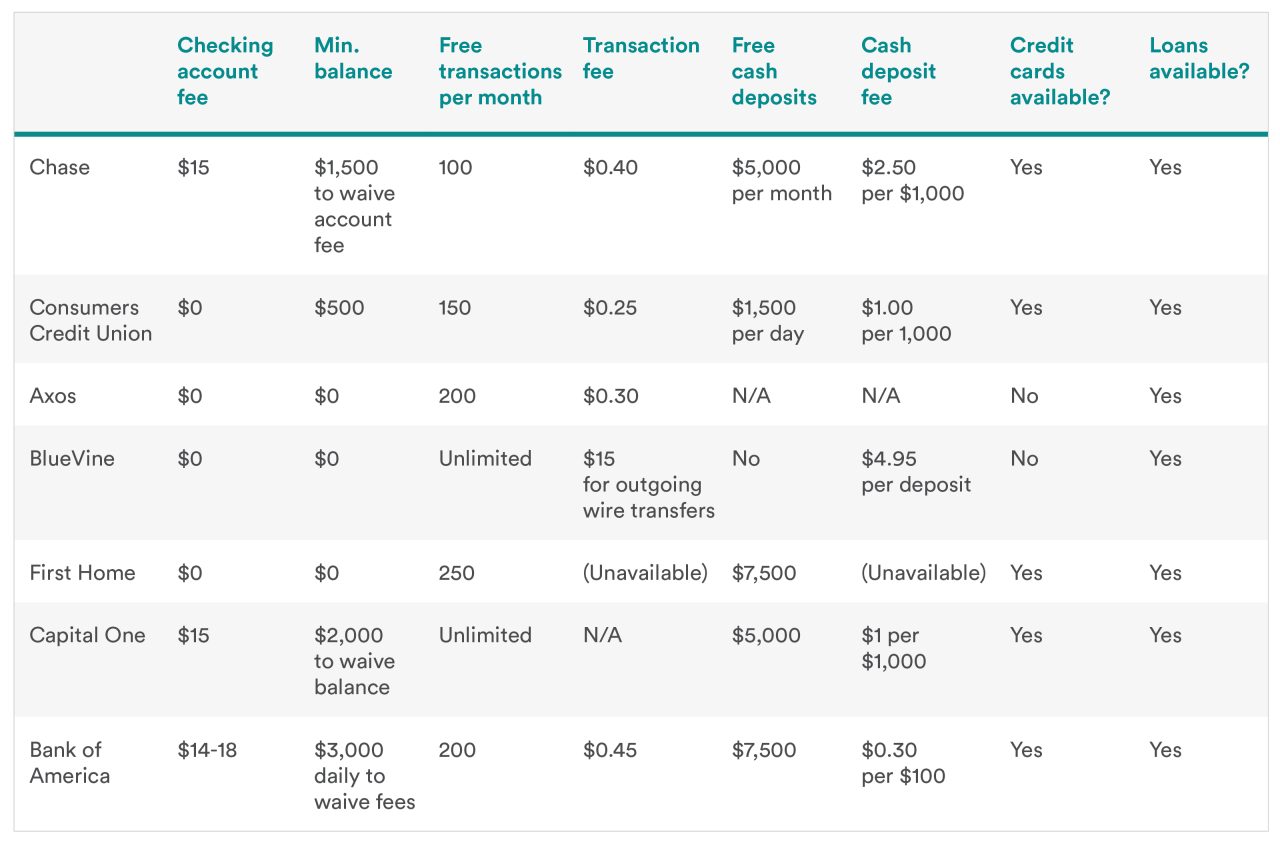

Transaction Fees and Limits

Transaction fees are a significant consideration when choosing an online banking platform. Different platforms have varying fee structures, which can impact a business’s bottom line.

- Monthly Fees: Some platforms charge a monthly fee for maintaining an account. Others may waive this fee if a certain minimum balance is maintained.

- Per-Transaction Fees: Fees can be charged for various transactions, such as wire transfers, ATM withdrawals, or bill payments. These fees can add up quickly, especially for businesses with high transaction volumes.

- ATM Fees: Businesses may incur fees when using ATMs outside of their bank’s network. It’s essential to consider the availability of free ATMs and the potential for out-of-network fees.

- Wire Transfer Fees: Wire transfers are often used for large transactions or urgent payments. Platforms may charge fees for initiating wire transfers, and these fees can vary significantly.

Mobile Banking and App Functionality

Mobile banking apps have become an integral part of managing finances for businesses of all sizes.

In this topic, you find that Website For Small Business Owners October 2024 is very useful.

- Mobile Check Deposit: This feature allows businesses to deposit checks directly from their smartphones, saving time and effort. It’s particularly beneficial for businesses that receive checks frequently.

- Bill Pay: Mobile banking apps often include bill pay features, allowing businesses to schedule and track payments electronically. This can help businesses avoid late fees and improve cash flow management.

- Account Transfers: Businesses can easily transfer funds between accounts using mobile banking apps, providing greater flexibility and control over their finances.

- Transaction History Access: Mobile banking apps provide access to transaction history, allowing businesses to track their spending and identify any discrepancies.

- Security Features: Mobile banking apps should incorporate robust security features, such as multi-factor authentication and data encryption, to protect sensitive financial information.

Security Features

Protecting sensitive financial data is paramount for any business. Online banking platforms employ various security measures to safeguard accounts and transactions.

- Multi-Factor Authentication: This security measure requires users to provide multiple forms of identification, such as a password and a one-time code, before granting access to their accounts. This helps prevent unauthorized access.

- Fraud Detection Systems: Online banking platforms use sophisticated fraud detection systems to identify and prevent suspicious activity. These systems monitor transactions and account behavior for unusual patterns.

- Data Encryption: Data encryption safeguards financial information by converting it into an unreadable format, making it difficult for unauthorized individuals to access it.

Integration with Accounting Software

Seamless integration with accounting software can streamline financial management and improve efficiency for small businesses.

For descriptions on additional topics like Small Business Loans Application October 2024, please visit the available Small Business Loans Application October 2024.

- Automated Reconciliation: Integration with accounting software allows for automatic reconciliation of bank transactions with accounting records, reducing the risk of errors and saving time.

- Improved Financial Reporting: Integration enables businesses to generate comprehensive financial reports directly from their bank accounts, providing a real-time view of their financial position.

Customer Support Availability and Responsiveness

Access to reliable and responsive customer support is crucial for businesses that rely on online banking platforms.

Obtain access to Florida Small Business Loan October 2024 to private resources that are additional.

- Availability of Support Channels: Platforms should offer multiple customer support channels, such as phone, email, and live chat, to cater to different preferences and urgency levels.

- Responsiveness of Support Staff: The customer support staff should be knowledgeable, responsive, and able to resolve issues efficiently. Factors such as wait times, resolution rates, and customer satisfaction are important indicators of customer support quality.

Top Online Banks for Small Businesses

Choosing the right online bank can be a game-changer for your small business. Online banks offer a streamlined and efficient way to manage your finances, often with lower fees and more competitive interest rates than traditional brick-and-mortar banks.

Examine how American Business Services Loans Reviews October 2024 can boost performance in your area.

Top Online Banks for Small Businesses

Online banks cater to the specific needs of small businesses, providing a range of features and services to support their growth. Here’s a breakdown of some of the top contenders:

| Bank Name | Key Features | Pros | Cons |

|---|---|---|---|

| Bluevine | Business checking accounts, lines of credit, invoice factoring, and business credit cards. | User-friendly platform, competitive rates, fast funding options, and excellent customer support. | Limited branch network, may not be suitable for businesses with complex financial needs. |

| Novo | Business checking accounts, free debit cards, and integration with popular accounting software. | No monthly fees, generous rewards program, and a focus on supporting entrepreneurs. | Limited lending options, fewer features compared to some other banks. |

| Brex | Business checking accounts, credit cards, expense management tools, and travel rewards. | High spending limits, robust expense management features, and personalized financial insights. | Higher fees for some services, primarily caters to high-growth startups. |

| Mercury | Business checking accounts, credit cards, and integration with leading fintech platforms. | Modern platform, seamless integration with other tools, and a focus on innovation. | Limited branch network, may not be suitable for businesses with traditional banking needs. |

| Kabbage | Business checking accounts, lines of credit, and small business loans. | Fast funding options, competitive interest rates, and a streamlined application process. | Limited features compared to some other banks, may not be suitable for businesses with complex financial needs. |

| Radius Bank | Business checking accounts, savings accounts, lines of credit, and SBA loans. | Competitive rates, strong customer support, and a focus on serving small businesses. | Limited branch network, may not be suitable for businesses with complex financial needs. |

Additional Resources and Information

Choosing the right online bank for your small business is an important decision that requires thorough research and careful consideration. This section will provide you with additional resources, tips, and insights to help you make an informed choice and manage your finances effectively.

Learn about more about the process of Small Business Management Services October 2024 in the field.

Essential Resources for Small Business Owners

- Small Business Administration (SBA):The SBA is a government agency that provides resources, guidance, and support to small businesses. Their website offers information on loans, grants, training, and other programs. You can find their website at https://www.sba.gov/ .

- SCORE:SCORE is a non-profit organization that provides free mentorship and advice to small business owners. Their website offers resources on business planning, marketing, finance, and more. Visit their website at https://www.score.org/ .

- National Federation of Independent Business (NFIB):The NFIB is a non-profit organization that advocates for the interests of small businesses. Their website offers resources on policy issues, legal advice, and other relevant information. You can find their website at https://www.nfib.com/ .

- Financial Industry Regulatory Authority (FINRA):FINRA is a non-profit organization that regulates the securities industry. Their website offers resources on investor protection, financial literacy, and fraud prevention. Visit their website at https://www.finra.org/ .

Conclusion

Choosing the right online bank for your small business is crucial for maximizing convenience, cost savings, and efficiency. By carefully considering your specific needs and comparing different options, you can find a banking partner that empowers your business growth.

Check Best Business Payment Apps October 2024 to inspect complete evaluations and testimonials from users.

Key Factors to Consider, Best Online Bank For Small Business November 2024

The decision to choose an online bank should be based on a comprehensive assessment of your business needs and priorities. Several key factors should be carefully considered, such as:

- Fees and Charges:Thoroughly compare transaction fees, monthly maintenance fees, and overdraft fees across different online banks. Look for banks that offer competitive fee structures that align with your business’s transaction volume and financial habits.

- Features and Services:Evaluate the availability of features like mobile banking, bill pay, online transfers, and other tools that streamline your financial processes. Choose a bank that provides a comprehensive suite of features that meet your business’s specific requirements.

- Customer Support:Research the bank’s reputation for customer service and responsiveness. Look for banks with a proven track record of providing reliable and efficient support, especially for small business owners who often require personalized assistance.

Ultimate Conclusion: Best Online Bank For Small Business November 2024

As you embark on your search for the ideal online banking solution, remember that the best choice is not a one-size-fits-all proposition. By carefully considering your business needs, comparing features and fees, and leveraging the insights provided in this guide, you can confidently select an online bank that empowers your small business to thrive.

Query Resolution

What are the benefits of using online banking for small businesses?

Online banking offers several benefits for small businesses, including increased convenience, lower fees, improved security, and access to advanced features like mobile check deposit and real-time transaction tracking.

How do I choose the right online bank for my business?

Consider your business needs, such as transaction volume, industry-specific requirements, and desired features. Compare banks based on fees, account types, interest rates, customer support, and integration with accounting software.

Are there any risks associated with online banking?

While online banking is generally secure, it’s important to be aware of potential risks like phishing scams and data breaches. Choose banks with robust security measures, including multi-factor authentication and encryption, and practice safe online banking habits.