Best Immediate Annuity 2021 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. An immediate annuity is a financial product that provides a guaranteed stream of income for life, starting immediately after purchase.

It’s a popular choice for retirees looking for a reliable source of income to supplement their savings and Social Security benefits.

This guide will explore the intricacies of immediate annuities, delving into the factors to consider when choosing one, highlighting the best providers in 2021, and providing insights into the importance of professional advice. We’ll also touch upon alternative retirement income options to give you a comprehensive understanding of your choices.

What is an Immediate Annuity?

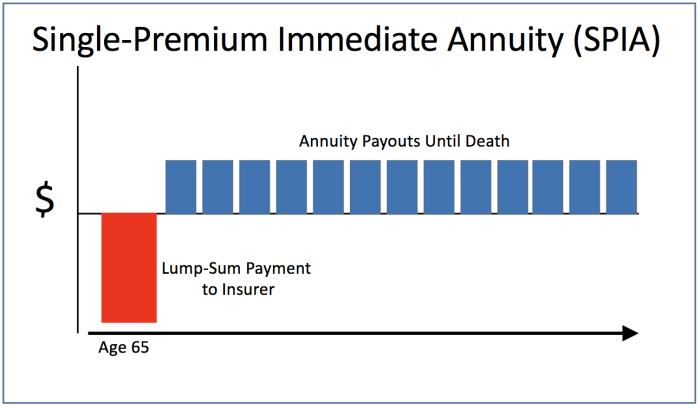

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments for life, starting immediately after you purchase the annuity. It’s a popular option for retirees who want to convert a lump sum of money into a steady income stream.

How Immediate Annuities Work

When you buy an immediate annuity, you make a one-time payment to the insurance company. In exchange, the company agrees to pay you a fixed amount of money each month, quarter, or year for the rest of your life. The amount of your payments will depend on several factors, including the size of your initial investment, your age, and the interest rates at the time you purchase the annuity.

Benefits of Immediate Annuities

- Guaranteed income for life:Immediate annuities provide a guaranteed stream of income that you can rely on, regardless of how long you live. This can be especially helpful for retirees who are concerned about outliving their savings.

- Protection from market volatility:Unlike stocks or bonds, immediate annuities are not subject to market fluctuations. This means that your payments will not be affected by changes in the stock market or interest rates.

- Tax advantages:Depending on the type of annuity you purchase, some of your payments may be tax-free.

If you’re using Excel to calculate annuity values, a Pv Annuity Excel 2024 formula can help. You might also come across the term “T-C Annuity”, which refers to a T-C Annuity 2024 and is a type of annuity that’s often used for tax-efficient retirement planning.

Drawbacks of Immediate Annuities, Best Immediate Annuity 2021

- Lower returns:Immediate annuities generally offer lower returns than other investments, such as stocks or bonds. This is because the insurance company is guaranteeing you a fixed income stream.

- Lack of flexibility:Once you purchase an immediate annuity, you generally cannot withdraw your money or change your payment options. This can be a drawback if your financial needs change.

- Potential for inflation risk:The value of your annuity payments may be eroded by inflation over time. This means that your purchasing power may decrease as prices rise.

Factors to Consider When Choosing an Immediate Annuity

Before purchasing an immediate annuity, it’s important to carefully consider your financial goals and risk tolerance. Here are some key factors to keep in mind:

Interest Rates

Interest rates play a significant role in determining the amount of your annuity payments. Higher interest rates generally result in higher payments. However, it’s important to note that interest rates can fluctuate over time, so it’s essential to compare rates from different providers before making a decision.

Fees

Immediate annuities come with various fees, including administrative fees, surrender charges, and mortality charges. It’s crucial to understand these fees and how they will affect your overall return.

Payment Options

Immediate annuities offer various payment options, such as monthly, quarterly, or annual payments. You can also choose to receive payments for a fixed period or for the rest of your life. Consider your income needs and lifestyle when deciding on the best payment option for you.

When it comes to annuities, there are different types to consider. If you’re seeking an annuity that increases over time, a How To Calculate A Growing Annuity 2024 guide can be helpful. An An Immediate Annuity Begins Making Payments After The initial investment, making it a popular choice for those looking for immediate income.

Terms and Conditions

It’s crucial to carefully read and understand the terms and conditions of the annuity contract before making a purchase. Pay close attention to factors such as the guarantee period, the death benefit, and any restrictions on withdrawals or changes to your payments.

Types of Immediate Annuities

There are several types of immediate annuities available, each with its own features and benefits:

Fixed Annuities

Fixed annuities provide a guaranteed stream of income payments for life, with the amount of the payments determined at the time you purchase the annuity. They offer stability and predictability, but they may not keep up with inflation.

An Immediate Income Annuity provides a regular income stream right away, but it’s essential to do your research and understand the terms and conditions before making a decision.

Variable Annuities

Variable annuities allow you to invest your money in a variety of sub-accounts, such as stocks, bonds, or mutual funds. Your payments will vary depending on the performance of your chosen investments. Variable annuities offer the potential for higher returns but also carry more risk.

Indexed Annuities

Indexed annuities link your payments to the performance of a specific market index, such as the S&P 500. They offer the potential for growth while providing some protection from market downturns. However, they may have limitations on how much your payments can increase.

Finding the Best Immediate Annuity for Your Needs

To find the best immediate annuity for your needs, it’s essential to compare quotes from different providers and carefully consider the factors discussed above.

Immediate Annuity Provider Comparison

| Provider Name | Interest Rate | Fees | Payment Options ||—|—|—|—|| Provider A | 3.5% | $50 per year | Monthly, quarterly, annual || Provider B | 3.0% | $25 per year | Monthly, annual || Provider C | 3.2% | $75 per year | Monthly, quarterly |

Financial Strength and Reputation

When choosing an annuity provider, it’s essential to consider their financial strength and reputation. Look for companies with a strong track record of paying out claims and a high rating from financial institutions like A.M. Best.

Questions to Ask Potential Annuity Providers

Looking for a way to ensure a steady stream of income in retirement? An Annuity Calculator Hmrc 2024 can help you estimate how much you might receive from an annuity, but it’s important to understand the tax implications. Annuity Under Income Tax Act 2024 outlines the tax treatment of annuities, so be sure to factor that into your calculations.

- What is the current interest rate for your immediate annuities?

- What fees are associated with your annuities?

- What payment options do you offer?

- What is the guarantee period for your annuities?

- What is the death benefit for your annuities?

- What are the restrictions on withdrawals or changes to payments?

- What is your company’s financial strength and reputation?

Working with annuities can lead to career opportunities. Variable Annuity Jobs 2024 are becoming increasingly popular as more people seek financial security. But before investing in an annuity, it’s important to consider its safety. Is Annuity Safe 2024 is a question many people ask, and the answer depends on the specific type of annuity and the financial institution issuing it.

The Importance of Professional Advice

Consulting with a qualified financial advisor can be invaluable when considering an immediate annuity. A financial advisor can help you:

Evaluate Your Financial Goals and Risk Tolerance

A financial advisor will work with you to understand your financial goals and risk tolerance. They can help you determine if an immediate annuity is the right choice for you and, if so, what type of annuity best suits your needs.

Compare Different Annuity Options

Financial advisors have access to a wide range of annuity products and can help you compare different options from various providers. They can also provide insights into the pros and cons of each option and help you choose the best one for your situation.

Understand the Terms and Conditions

Financial advisors are familiar with the complex terms and conditions of annuity contracts. They can help you understand the key provisions and ensure you are making an informed decision.

The cost of an annuity can vary, especially when considering an Immediate Needs Annuity Cost Uk. An annuity is essentially a sequence of payments, and the Annuity Is Sequence Of Mode Of Payment 2024 can be either fixed or variable.

For example, a Jackson Immediate Annuity offers a guaranteed income stream for life.

Finding a Reputable Financial Advisor

When seeking financial advice, it’s important to find a reputable and qualified advisor. Look for someone with experience in retirement planning and annuities, as well as the appropriate credentials and certifications. You can ask for referrals from friends, family, or your accountant, or search for advisors on websites like the Certified Financial Planner Board of Standards (CFP Board).

Alternatives to Immediate Annuities

While immediate annuities can be a valuable retirement income option, they are not the only choice. Here are some alternatives to consider:

Traditional and Roth IRAs

Traditional and Roth IRAs allow you to save for retirement on a tax-advantaged basis. With a traditional IRA, you can deduct your contributions from your taxable income, while with a Roth IRA, your withdrawals in retirement are tax-free.

401(k)s

(k)s are employer-sponsored retirement plans that allow you to contribute pre-tax dollars to a retirement account. Your employer may also offer a matching contribution.

Social Security

Social Security is a government-funded retirement program that provides monthly benefits to eligible retirees. The amount of your Social Security benefits will depend on your earnings history.

Ending Remarks: Best Immediate Annuity 2021

As you embark on your retirement planning journey, understanding the nuances of immediate annuities can be invaluable. By carefully weighing the benefits and drawbacks, exploring the various options available, and seeking professional guidance, you can make informed decisions that align with your financial goals and ensure a comfortable and secure retirement.

Key Questions Answered

What are the tax implications of an immediate annuity?

An Immediate Annuity Contract is a legal agreement outlining the terms of the annuity. This type of annuity is also known as an Immediate Annuity Is Also Known As a fixed annuity, as the payments are guaranteed. To get a better grasp of annuity calculations, you can use Calculating Annuity Excel 2024 to perform calculations.

The payments you receive from an immediate annuity are generally taxed as ordinary income. However, the portion of each payment that represents a return of your principal investment is tax-free. Consult with a tax professional for personalized advice.

Can I withdraw my principal investment from an immediate annuity?

Immediate annuities are generally considered non-liquid assets. Once you purchase an immediate annuity, you cannot withdraw your principal investment. However, some annuities may offer limited withdrawal options, typically with penalties.

How do I choose the right annuity provider?

When choosing an annuity provider, consider factors such as their financial strength, reputation, interest rates, fees, and payment options. It’s essential to compare quotes from multiple providers and consult with a financial advisor to find the best fit for your needs.