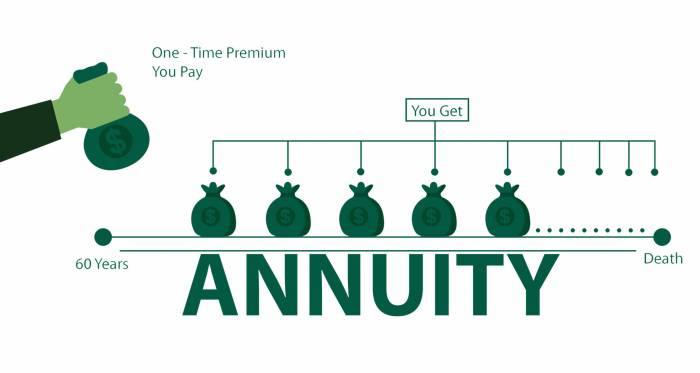

Best Immediate Annuity – Best Immediate Annuities provide a guaranteed stream of income for life, offering peace of mind and financial security during retirement. These annuities convert a lump sum of money into regular payments, ensuring a steady income stream regardless of market fluctuations.

Depending on your location, you might need a specific annuity calculator. Annuity Calculator Kenya 2024 is a helpful tool for Kenyan residents. An annuity is essentially a stream of payments. 1 An Annuity Is 2024 provides a basic definition.

This makes them a valuable tool for individuals seeking to secure their retirement income and protect against longevity risk.

If you’re banking with BMO, you can use their annuity calculator. Annuity Calculator Bmo 2024 provides a convenient option. Understanding how to calculate annuities is important for making informed financial decisions. Calculating Annuity Formula 2024 offers a step-by-step guide.

Immediate annuities offer several advantages over other retirement income options. They provide a guaranteed income stream, regardless of market performance, and can be used to supplement existing retirement savings. Additionally, immediate annuities offer protection against longevity risk, ensuring that you have a steady income stream for as long as you live.

Annuities are a sequence of payments, and understanding the different modes of payment is important. Annuity Is Sequence Of Mode Of Payment 2024 provides valuable information. For a visual explanation, you can also explore Annuity Formula Youtube 2024 for a deeper understanding.

Understanding Immediate Annuities: Best Immediate Annuity

Immediate annuities are a type of insurance product that provides a guaranteed stream of income for life. They are a popular choice for retirees who want to ensure they have a steady source of income to cover their living expenses.

In essence, you trade a lump sum of money for a guaranteed stream of payments, often for the rest of your life.

Key Features of Immediate Annuities

Immediate annuities have several key features that make them attractive to retirees. These features include:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, regardless of how long you live. This can provide peace of mind for retirees who are concerned about outliving their savings.

- Payout Options:There are a variety of payout options available with immediate annuities, such as a fixed monthly payment, a variable payment, or a combination of the two. You can choose the payout option that best meets your individual needs and financial goals.

Planning for your retirement? You might want to consider an annuity. To get started, use a Calculator Annuity Savings 2024 to estimate how much you’ll need to save. Understanding the annuity factor is also crucial. You can find resources on Calculating The Annuity Factor 2024 to help you make informed decisions.

- Guarantees:Immediate annuities typically offer a number of guarantees, such as a minimum payout amount or a guaranteed death benefit. These guarantees can help to protect your principal and ensure that your beneficiaries receive a lump sum payment upon your death.

For retirement planning, it’s essential to know how to calculate your retirement annuity payments. Calculating Retirement Annuity Payments 2024 helps you determine your potential income stream. A specific annuity with a value of 75,000 can be explored in more detail on Annuity 75000 2024.

Advantages of Immediate Annuities, Best Immediate Annuity

Immediate annuities offer a number of advantages for retirees, including:

- Guaranteed Income:One of the biggest advantages of immediate annuities is that they provide a guaranteed stream of income for life. This can help to ensure that you have a steady source of income to cover your living expenses in retirement, regardless of how long you live.

Variable annuities have unique characteristics, especially after annuitization. Variable Annuity After Annuitization 2024 provides insights into this stage of the annuity.

- Protection Against Longevity Risk:Immediate annuities can help to protect you against longevity risk, which is the risk of outliving your savings. By providing a guaranteed stream of income for life, immediate annuities can help to ensure that you have enough money to cover your expenses even if you live a long time.

- Income Security:Immediate annuities can provide income security in retirement. This is because they provide a guaranteed stream of income that is not subject to market fluctuations.

- Simplicity:Immediate annuities are relatively simple to understand and manage. Once you purchase an immediate annuity, you don’t have to worry about managing your investments or making investment decisions.

Considerations for Choosing an Immediate Annuity

When choosing an immediate annuity, there are a number of factors to consider, including:

- Interest Rates:Interest rates play a significant role in determining the amount of income you will receive from an immediate annuity. Higher interest rates generally result in higher payouts.

- Payout Options:There are a variety of payout options available with immediate annuities. It is important to choose the payout option that best meets your individual needs and financial goals.

- Fees:Immediate annuities come with a variety of fees, such as administrative fees, surrender charges, and mortality and expense charges. It is important to carefully review the fees associated with any annuity before you purchase it.

- Guarantees:Immediate annuities typically offer a number of guarantees, such as a minimum payout amount or a guaranteed death benefit. It is important to understand the guarantees offered by any annuity before you purchase it.

Finding the Best Immediate Annuity

The process of finding the best immediate annuity involves researching and comparing different providers. Here are some tips to help you in your search:

- Compare Rates and Terms:Get quotes from multiple annuity providers to compare rates and terms. Be sure to compare apples to apples, meaning that you are comparing annuities with similar features and guarantees.

- Negotiate:Don’t be afraid to negotiate with annuity providers. You may be able to get a better rate or terms if you are willing to shop around and negotiate.

- Evaluate Provider Credibility:Check the financial stability and reputation of any annuity provider before you purchase an annuity. You can do this by checking the provider’s financial ratings and reading reviews from other customers.

Final Review

Immediate annuities offer a powerful solution for individuals seeking to secure their retirement income. By converting a lump sum into a guaranteed income stream, you can eliminate the worry of outliving your savings and enjoy peace of mind knowing you have a reliable source of income for life.

Annuities can grow over time, especially with growth factored in. Fv Annuity With Growth 2024 explains this concept. If you’re inheriting an annuity, it’s crucial to know how it’s taxed. How Is Inherited Annuity Taxed 2024 provides helpful information.

While they may not be the right choice for everyone, for those seeking financial security and guaranteed income, immediate annuities can be an invaluable tool for retirement planning.

Essential FAQs

How do immediate annuities work?

An immediate annuity is a contract where you give an insurance company a lump sum of money, and they agree to pay you a regular income stream for life, starting immediately.

What are the different types of immediate annuities?

There are various types of immediate annuities, including fixed, variable, and indexed annuities, each with its own features and risks. The best option for you depends on your individual circumstances and financial goals.

There are various types of annuities, including deferred annuities. Learn more about Annuity Is Deferred 2024 to understand how they work and if they’re right for you. If you’re inheriting an annuity, you’ll need to understand the implications. What Happens When I Inherit An Annuity 2024 will guide you through the process.

Are immediate annuities right for everyone?

Immediate annuities are not suitable for everyone. They may be a good option for those seeking guaranteed income and protection against longevity risk, but they can also be less flexible than other retirement income options.

How do I choose the right immediate annuity provider?

It’s important to research and compare different annuity providers carefully, considering factors like interest rates, fees, and payout options. You should also ensure the provider is reputable and financially sound.