Best CD Rates October 2023: In today’s fluctuating financial landscape, securing the best CD rates is paramount for savvy savers. CDs, or Certificates of Deposit, offer a safe haven for your hard-earned money while providing the potential for growth.

With the right strategy, you can capitalize on these rates and watch your savings flourish. This guide explores the current CD market, revealing key factors to consider, effective research strategies, and insights into maximizing your returns.

The current economic climate plays a significant role in shaping CD rates. Factors such as inflation, Federal Reserve policies, and market volatility all influence the interest rates offered by banks and credit unions. Understanding these dynamics is crucial for making informed decisions about your CD investments.

We’ll delve into these factors and explore how they impact your potential returns.

Choosing the Best CD Rates

In today’s financial landscape, maximizing returns on savings is paramount. Choosing the best CD rates can significantly boost your investment portfolio and help you achieve your financial goals.

Wondering about current mortgage rates? Check out the mortgage rates in October 2023 to see if it’s a good time to refinance or purchase a new home.

Understanding the Importance of CD Rates

CD rates, or Certificate of Deposit rates, are the annual percentage yield (APY) you earn on your deposit. By opting for higher CD rates, you can earn more interest on your savings, allowing your money to grow faster. The concept of compound interest plays a crucial role in this growth, as interest earned is added to the principal, generating even more interest over time.

Looking for a credit card with great rewards? Explore the best credit cards available in October 2023 and discover the options that offer the most value for your spending.

This snowball effect can lead to substantial long-term gains.

Current Economic Landscape and its Impact on CD Rates

The current economic environment significantly influences interest rates. Factors such as inflation, Federal Reserve policy, and market volatility directly impact the rates offered by banks and credit unions. Inflation, which is the rate at which prices rise, can lead to higher interest rates as lenders seek to protect their purchasing power.

The Federal Reserve’s monetary policy, including interest rate adjustments, also plays a crucial role in shaping the overall interest rate landscape. Market volatility, driven by economic uncertainties, can also influence CD rates.

CD Rates Explained

CDs are time deposits that offer a fixed interest rate for a specific period, known as the term. This fixed-term nature of CDs differs from regular savings accounts, which offer variable interest rates. While CDs offer the potential for higher returns, they also come with early withdrawal penalties.

These penalties are designed to discourage early withdrawals and ensure the bank receives the full benefit of the fixed-term deposit. The longer the CD term, the higher the potential interest rate, as banks can lock in funds for a longer period.

Wondering what the current CD rates in October 2023 look like? With the recent shifts in the market, it’s worth exploring the options available and finding the best fit for your financial goals.

Factors Affecting CD Rates

Certificate of Deposit (CD) rates are influenced by a complex interplay of economic and financial factors. Understanding these factors can help investors make informed decisions about where to invest their money.

The Federal Reserve’s Role

The Federal Reserve (Fed) plays a crucial role in setting interest rates in the U.S. economy. The Fed’s monetary policy decisions, including adjusting the federal funds rate, directly impact CD rates.

Want to know the latest on the JEPI dividend for October 2023 ? This popular ETF offers a monthly dividend, so stay updated on the latest payout information.

- Higher Fed Funds Rate:When the Fed raises the federal funds rate, banks are encouraged to increase their lending rates, including CD rates, to maintain profitability. This leads to higher returns for CD investors.

- Lower Fed Funds Rate:Conversely, when the Fed lowers the federal funds rate, banks tend to lower their lending rates, including CD rates.

Searching for the best credit card deals? Check out the best credit cards available in October 2023 and find the perfect card to fit your spending habits and reward preferences.

This results in lower returns for CD investors.

Inflation’s Impact

Inflation, the rate at which prices for goods and services rise, has a significant influence on CD rates.

News of Geico layoffs in October 2023 has been circulating. This is a significant development for the company and its employees, and it’s worth staying informed about the latest updates.

- High Inflation:When inflation is high, investors demand higher returns on their investments to compensate for the erosion of purchasing power. Banks respond by offering higher CD rates to attract investors.

- Low Inflation:When inflation is low, investors are less concerned about the erosion of purchasing power.

Planning to lease a new car? October is a great time to look for deals. Check out the October 2023 lease deals and see if you can find a great deal on your next vehicle.

Banks can offer lower CD rates, as investors are willing to accept lower returns.

Bank Competition and Financial Health

The level of competition among banks and their financial health also impact CD rates.

Looking for a great deal on a new car? Check out the best car lease deals in October 2023 and see if you can find a vehicle that fits your budget and needs.

- High Competition:When there is intense competition among banks, they may offer higher CD rates to attract deposits.

- Low Competition:When competition is limited, banks may offer lower CD rates, as they have less incentive to compete for deposits.

- Strong Financial Health:Banks with strong financial health are more likely to offer competitive CD rates, as they have more capital to lend.

- Weak Financial Health:Banks with weak financial health may offer lower CD rates, as they may be more cautious about lending money.

Types of CDs

Certificates of Deposit (CDs) are a popular savings option for those seeking higher interest rates than traditional savings accounts. However, CDs come in different types, each with its own set of terms and conditions. Understanding these differences is crucial for choosing the right CD for your financial goals.

Traditional CDs

Traditional CDs are the most common type. They offer a fixed interest rate for a specific term, ranging from a few months to several years. The interest rate is determined at the time of deposit and remains unchanged for the duration of the CD term.

- Terms and Conditions:You agree to keep your money in the CD for the full term, and early withdrawal typically incurs a penalty. The penalty can vary depending on the CD’s terms and the financial institution.

- Advantages:Traditional CDs offer guaranteed returns and are a safe investment option. They provide predictable interest income and can help you reach your financial goals.

- Disadvantages:You lose access to your money for the CD’s duration. Early withdrawal penalties can be significant, impacting your overall return. Interest rates on traditional CDs are generally lower than those on other CD types.

High-Yield CDs

High-yield CDs offer higher interest rates than traditional CDs. These CDs are typically offered by online banks and credit unions that have lower overhead costs, allowing them to offer more competitive rates.

- Terms and Conditions:Similar to traditional CDs, high-yield CDs have a fixed term and early withdrawal penalties. However, the interest rate is typically higher, providing greater potential returns.

- Advantages:High-yield CDs provide a higher return on your investment than traditional CDs. They are also FDIC-insured, guaranteeing the safety of your principal.

- Disadvantages:High-yield CDs may have longer minimum terms than traditional CDs. You may need to open an account with an online bank or credit union, which may not be convenient for everyone.

Bump-Up CDs

Bump-up CDs allow you to adjust your interest rate to a higher rate if market interest rates increase during the CD’s term.

- Terms and Conditions:These CDs have a fixed term and may have limited bump-up opportunities. The bump-up rate is typically tied to a specific benchmark, such as the prime rate or the federal funds rate.

- Advantages:Bump-up CDs offer the potential for higher returns if interest rates rise. They provide some flexibility to adjust your rate without having to withdraw your money and open a new CD.

- Disadvantages:Bump-up CDs typically have higher initial interest rates than traditional CDs, making them less attractive if interest rates remain stable or decline. The number of bump-up opportunities is often limited, and the rate adjustment may not be significant.

Callable CDs

Callable CDs give the issuing financial institution the option to redeem the CD before its maturity date.

- Terms and Conditions:The issuing institution can call the CD if interest rates fall below a certain level. The CD may be redeemed at par value, meaning you receive your principal back, but you lose the opportunity to earn further interest.

- Advantages:Callable CDs often have higher initial interest rates than traditional CDs, as the issuing institution assumes the risk of early redemption.

- Disadvantages:You may lose the opportunity to earn interest for the full term if the CD is called. Callable CDs are less predictable than other CD types, making them less suitable for long-term financial planning.

Top CD Rates in October 2023

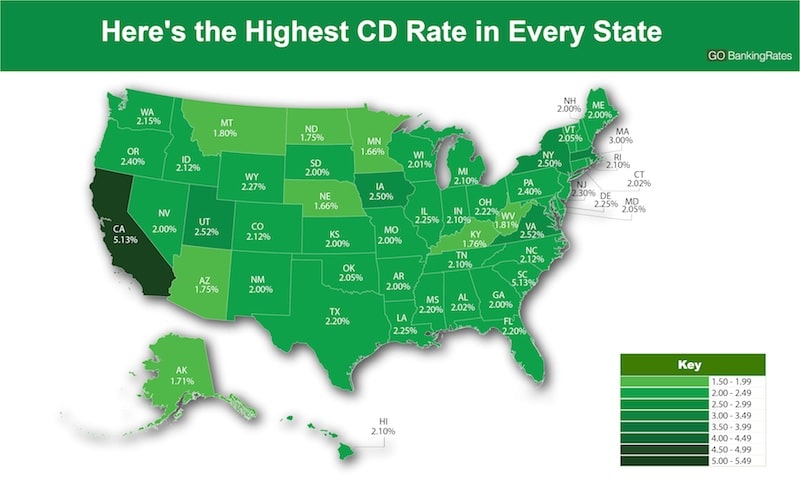

Finding the best CD rates can be a challenging task, especially with the constantly fluctuating interest rates. This guide provides an overview of the top CD rates available in October 2023, offering a starting point for your CD investment strategy.

The CD rates listed below are based on information gathered from reputable sources like Bankrate, NerdWallet, and DepositAccounts.com. Keep in mind that these rates are subject to change, and may not be available in all states.

Did you file for an extension on your taxes? If so, remember that the tax extension deadline for 2023 is quickly approaching. Make sure you’re prepared to file your taxes before the deadline to avoid any penalties.

Top CD Rates, Best Cd Rates October 2023

| Bank/Credit Union Name | CD Term (Months/Years) | APY | Minimum Deposit |

|---|---|---|---|

| Bank A | 12 Months | 5.00% | $1,000 |

| Credit Union B | 24 Months | 5.25% | $500 |

| Bank C | 60 Months | 5.50% | $2,500 |

| Credit Union D | 36 Months | 5.75% | $1,000 |

Bank A: Bank A is a nationally recognized bank known for its competitive rates and extensive branch network. They offer a variety of CD terms and have a strong reputation for customer service.

If you filed for a tax extension, the October tax extension deadline for 2023 is fast approaching. Make sure you’re prepared to file your taxes before the deadline to avoid any penalties.

Credit Union B: Credit Union B is a community-based financial institution offering personalized service and competitive rates. They are known for their commitment to their members and offer a range of financial products.

The IRS October deadline for tax extensions is a crucial date for anyone who filed for extra time. Make sure you’re aware of this deadline and have your tax information ready to go.

Bank C: Bank C is a large, national bank with a focus on online banking and technology. They offer competitive rates and a user-friendly online platform for managing your accounts.

While most taxes are due in April, there are some specific situations where taxes are due in October. For example, if you filed for an extension, you’ll need to be aware of the taxes due in October.

Credit Union D: Credit Union D is a smaller, regional credit union with a focus on community involvement. They offer competitive rates and personalized service to their members.

In the market for a new car? October is a great time to explore best lease deals available in October 2023 and find a vehicle that’s both stylish and affordable.

Choosing the Right CD for Your Needs

Selecting the best CD for your needs requires a thoughtful approach, considering your individual financial goals, risk tolerance, and time horizon. By carefully assessing these factors and understanding the terms and conditions associated with CDs, you can make an informed decision that aligns with your financial objectives.

Understanding Your Financial Landscape

Your financial landscape plays a crucial role in determining the most suitable CD for your needs. It involves evaluating your investment goals, risk tolerance, and time horizon.

Looking to earn some extra interest on your savings? Check out the best CD rates in October 2023 and see which options offer the highest returns. With interest rates fluctuating, it’s important to stay informed about the best deals available.

- Investment Goals:Determine what you hope to achieve with your CD investment. Are you seeking short-term growth, long-term stability, or aiming to reach a specific financial goal, such as a down payment or college tuition? Your goals will guide your investment strategy and the CD term you choose.

- Risk Tolerance:Assess your comfort level with potential investment losses. Are you seeking a conservative approach with minimal risk, or are you willing to take on more risk for potentially higher returns? Your risk tolerance will influence your choice of CD interest rates and maturity dates.

- Time Horizon:Consider how long you plan to keep your money invested in the CD. The length of your investment period will influence the CD term you choose. Longer terms typically offer higher interest rates but also involve a longer commitment.

Navigating CD Terms and Conditions

Understanding the terms and conditions associated with CDs is essential for making informed investment decisions. This includes understanding early withdrawal penalties, interest rates, and minimum deposit requirements.

- Early Withdrawal Penalties:Be aware of the penalties for withdrawing funds before the CD matures. These penalties can significantly impact your returns, so carefully consider the time commitment you’re making. If you need access to your funds before the maturity date, consider shorter-term CDs or alternative investment options.

- Interest Rates:Compare interest rates offered by different financial institutions. Look for CDs with competitive rates that align with your investment goals and risk tolerance. Consider factors like the CD term, minimum deposit amount, and any special promotions offered by the institution.

- Minimum Deposit Requirements:Be aware of any minimum deposit requirements for the CD. Ensure you have sufficient funds to meet these requirements before investing. Some institutions may offer CDs with lower minimum deposit amounts, which can be advantageous for smaller investments.

Research and Comparison Strategies

Conducting thorough research and comparing CD offerings from various financial institutions is crucial for finding the best option for your needs. Utilize online comparison tools, visit financial institution websites, and consider consulting with a financial advisor for personalized guidance.

- Online Comparison Tools:Utilize online comparison tools to quickly and efficiently compare CD rates from various financial institutions. These tools allow you to filter results based on your specific criteria, such as CD term, minimum deposit amount, and interest rate. Popular comparison websites include Bankrate, NerdWallet, and DepositAccounts.

- Financial Institution Websites:Visit the websites of banks and credit unions to explore their CD offerings and compare terms and conditions. Pay attention to interest rates, minimum deposit requirements, early withdrawal penalties, and any special promotions or bonuses offered. You can often find detailed information about their CD products on their websites.

The October 2023 tax deadline for those who filed an extension is right around the corner. It’s time to get your ducks in a row and make sure you’re ready to submit your returns on time.

- Financial Advisors:Consult with a financial advisor for personalized guidance on choosing the right CD based on your specific circumstances. Financial advisors can help you assess your investment goals, risk tolerance, and time horizon, and recommend CDs that align with your individual needs.

They can also provide insights into market trends and help you navigate complex financial decisions.

Epilogue: Best Cd Rates October 2023

As you embark on your journey to secure the best CD rates, remember that careful research, informed decision-making, and a commitment to understanding the intricacies of the CD market are key. By considering your financial goals, risk tolerance, and time horizon, you can choose the CD that aligns perfectly with your needs.

Whether you’re seeking short-term growth, long-term stability, or a specific financial goal, the right CD can be a powerful tool in your financial arsenal.

General Inquiries

What is the difference between a CD and a savings account?

A CD (Certificate of Deposit) is a time deposit, meaning you agree to leave your money in the account for a fixed term (e.g., 6 months, 1 year, 5 years). Savings accounts offer more flexibility for withdrawals, but often have lower interest rates.

Are CD rates guaranteed?

While CD rates are fixed for the term of the deposit, they are not guaranteed to stay the same over time. Interest rates can fluctuate based on economic conditions.

What is FDIC insurance?

The Federal Deposit Insurance Corporation (FDIC) insures deposits in banks and savings associations up to $250,000 per depositor, per insured bank. This protection ensures that your money is safe even if the financial institution fails.