Best CD Rates October 2023: In today’s fluctuating financial landscape, securing the best CD rates can make a significant difference in your savings goals. Certificates of Deposit (CDs) offer a secure way to grow your money with guaranteed interest rates, but finding the optimal rate requires careful consideration of factors like term length, minimum deposit, and the issuing bank’s financial stability.

Understanding the current economic climate is crucial. Interest rates and inflation play a significant role in determining CD rates. When the Federal Reserve raises interest rates, banks typically offer higher CD rates to attract deposits. However, inflation can erode the purchasing power of your savings, making it essential to choose a CD with an interest rate that outpaces inflation.

Best CD Rates October 2023

Certificate of Deposit (CD) rates are an important factor to consider when saving and investing your money. CDs are a type of time deposit offered by banks and credit unions that allows you to earn a fixed interest rate for a specific period of time.

The higher the CD rate, the more interest you earn on your investment. The current economic climate plays a significant role in shaping CD rates. With interest rates rising and inflation remaining elevated, CD rates have been steadily increasing in recent months.

This presents a potential opportunity for investors to earn a higher return on their savings.”Best CD rates” are those that offer the highest return for a given term and deposit amount, considering factors such as the bank’s financial stability and the associated risks.

It’s crucial to remember that “best” is relative and depends on your individual needs and risk tolerance.

Top CD Rates in October 2023

Finding the best CD rates can be a challenge, especially with so many banks and institutions offering various options. To help you make an informed decision, we’ve compiled a list of the top CD rates available in October 2023.

Top CD Rates in October 2023

Here’s a table showcasing the top 5 highest CD rates, including the bank/institution, CD term, APY, and minimum deposit requirement:

| Bank/Institution | CD Term | APY | Minimum Deposit |

|---|---|---|---|

| First Internet Bank | 12 months | 5.25% | $100 |

| CIT Bank | 12 months | 5.15% | $1,000 |

| Discover Bank | 12 months | 5.00% | $2,500 |

| Synchrony Bank | 12 months | 4.95% | $1,000 |

| Capital One | 12 months | 4.85% | $1,000 |

It’s important to note that these rates are subject to change and may vary depending on the specific CD term, minimum deposit, and other factors. It’s always a good idea to compare rates from multiple banks and institutions before making a decision.

Choosing the Right CD: Best CD Rates October 2023

Choosing the right certificate of deposit (CD) involves considering your individual financial goals, risk tolerance, and investment horizon. CDs offer a guaranteed rate of return for a fixed period, making them a suitable option for those seeking a safe and predictable investment.

Traditional CDs

Traditional CDs are the most common type, offering a fixed interest rate for a specific term. The interest rate is determined at the time of purchase and remains constant throughout the CD’s duration. Early withdrawal from a traditional CD usually incurs penalties.

- Pros:

- Guaranteed rate of return

- Predictable investment

- Suitable for short-term savings goals

- Cons:

- Limited flexibility

- Early withdrawal penalties

- Interest rates may be lower than other investments

Bump-Up CDs

Bump-up CDs offer the potential for higher interest rates based on market conditions. These CDs allow you to adjust your interest rate upward, typically a limited number of times, if market rates rise.

- Pros:

- Potential for higher returns if interest rates increase

- More flexibility than traditional CDs

- Cons:

- Limited number of rate increases

- Interest rate increases may be small

- May not be suitable for long-term investments

Callable CDs

Callable CDs allow the issuing institution to redeem the CD before its maturity date. This means the issuer can call back the CD and repay the principal, even if you haven’t reached your desired investment horizon.

- Pros:

- Potentially higher interest rates

- Cons:

- Risk of the CD being called before maturity

- May not be suitable for long-term savings goals

Brokered CDs

Brokered CDs are purchased through a brokerage firm, not directly from a bank or credit union. They often offer higher interest rates than traditional CDs, but may involve higher fees.

- Pros:

- Potentially higher interest rates

- Access to a wider range of CDs

- Cons:

- Higher fees

- May not be FDIC-insured

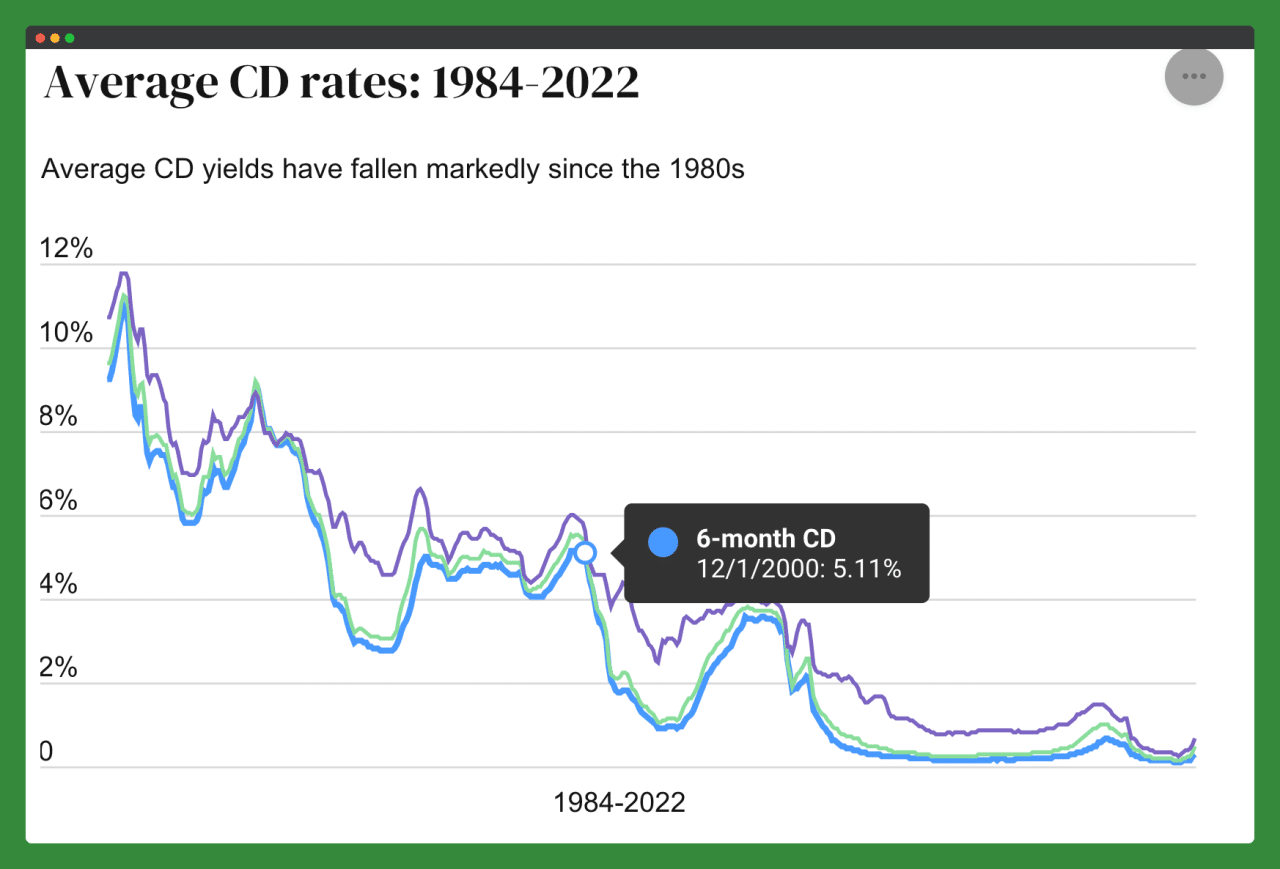

5. CD Rate Trends

Understanding the historical trends in CD rates can provide valuable insights into potential future movements and help investors make informed decisions. This section examines CD rate trends over the past five years, analyzes factors influencing these trends, and explores potential future rate movements.

Historical CD Rate Trends, Best CD Rates October 2023

CD rates have been on an upward trajectory over the past five years, mirroring the Federal Reserve’s interest rate hikes. This upward trend has been particularly pronounced since early 2022, when the Fed began aggressively raising interest rates to combat inflation.

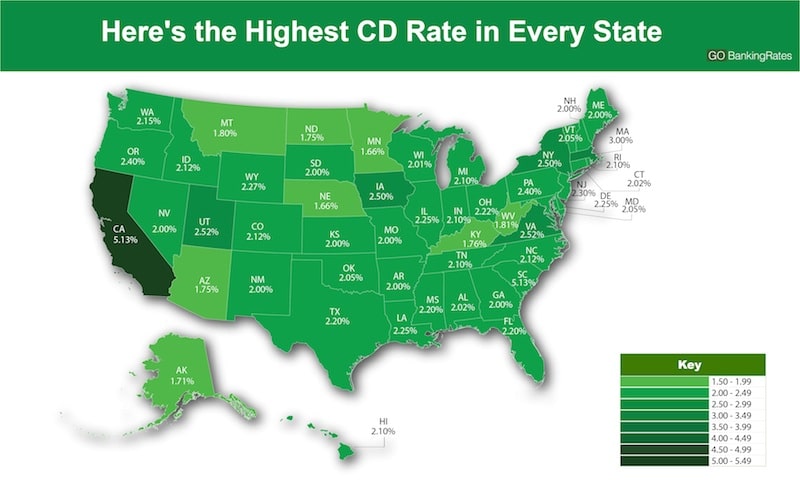

- Average CD Rates by Term:The average CD rate for different terms has increased significantly over the past five years. For example, the average 1-year CD rate was around 0.5% in October 2018, compared to over 4% in October 2023. Similarly, 5-year CD rates have climbed from around 2% to over 5% during the same period.

- Rate Changes by Institution:Major banks and financial institutions have generally followed similar trends in CD rates. However, some institutions have been more aggressive in raising rates, potentially reflecting their individual lending strategies or competitive pressures.

- Economic Indicators:Inflation and interest rates have been key drivers of CD rate changes. As inflation has risen, the Federal Reserve has raised interest rates to cool the economy, leading to higher CD rates.

Factors Influencing CD Rates

Several factors influence CD rates, including:

- Federal Reserve Monetary Policy:The Federal Reserve’s actions directly impact CD rates. When the Fed raises interest rates, banks typically increase CD rates to attract deposits and compete for funds. Conversely, when the Fed lowers rates, CD rates tend to decline.

- Inflation Expectations:Inflation erodes the purchasing power of money. To compensate for inflation, banks tend to offer higher CD rates, particularly when inflation expectations are high.

- Economic Growth Projections:Strong economic growth can lead to higher CD rates as banks seek to attract deposits for lending opportunities. However, weak economic growth can lead to lower CD rates as banks become more cautious about lending.

- Competition Among Financial Institutions:Intense competition among financial institutions can drive CD rates down as banks try to attract customers with lower rates. However, when competition is less intense, banks may have more flexibility to offer higher CD rates.

Predicting Future CD Rates

Predicting future CD rates is challenging due to the complex interplay of factors. However, statistical and machine learning models can provide insights into potential future trends.

- Statistical Models:Simple statistical models, such as linear regression, can be used to predict future CD rates based on historical data and key economic indicators. These models can identify trends and patterns in CD rates over time.

- Machine Learning Models:More sophisticated machine learning models, such as neural networks, can capture complex relationships between CD rates and various factors. These models can potentially provide more accurate predictions, but they require large datasets and careful validation.

“CD rates are likely to remain volatile in the coming months, driven by a combination of factors, including the Federal Reserve’s monetary policy and inflation expectations.”

Alternatives to CDs

While Certificates of Deposit (CDs) offer a fixed interest rate and guaranteed return, they come with the drawback of limited flexibility. If you’re seeking higher returns and need more control over your savings, exploring alternatives to CDs can be a wise move.

Let’s delve into some compelling options.

High-Yield Savings Accounts

High-yield savings accounts (HYSA) offer a higher interest rate than traditional savings accounts, making them an attractive option for earning a competitive return on your savings. These accounts are insured by the FDIC, ensuring the safety of your funds.

- Typical Interest Rates:HYSAs typically offer interest rates that are significantly higher than traditional savings accounts, often exceeding 4% APY.

- Flexibility of Deposits and Withdrawals:HYSAs generally allow for easy deposits and withdrawals, providing you with greater flexibility compared to CDs.

- Fees and Minimum Balance Requirements:Some HYSAs may have minimum balance requirements or charge fees for certain transactions. It’s crucial to review the terms and conditions before opening an account.

Money Market Accounts

Money market accounts (MMAs) are similar to HYSAs but often offer slightly higher interest rates, albeit with more stringent withdrawal restrictions. They are also FDIC-insured, providing peace of mind regarding the safety of your funds.

- Interest Rates and Fluctuations:Interest rates on MMAs tend to fluctuate based on market conditions, but they generally offer higher rates than HYSAs. These rates are typically variable, meaning they can change over time.

- Liquidity and Withdrawal Options:MMAs provide greater liquidity than CDs, allowing you to withdraw funds more easily, but they may have limited withdrawal options or a certain number of free withdrawals per month.

- Fees and Minimum Balance Requirements:MMAs often have minimum balance requirements and may charge fees for exceeding the number of allowed free withdrawals or for specific transactions.

Treasury Bills

Treasury bills (T-bills) are short-term debt securities issued by the U.S. government. They are considered one of the safest investments, offering a relatively low risk of default.

- Maturity Periods and Interest Rates:T-bills have maturities ranging from 4 weeks to 52 weeks, with interest rates determined at auction. They are typically sold at a discount to their face value, and the difference between the purchase price and the face value represents the interest earned.

- Risk Level:T-bills are considered very low-risk investments due to the backing of the U.S. government. They are a safe haven asset, meaning their value tends to hold up well during periods of market uncertainty.

- Fees and Purchase Requirements:T-bills are generally purchased through a TreasuryDirect account or a brokerage firm. There are no fees associated with buying or selling T-bills, but they are typically sold in denominations of $100 or more.

Short-Term Bonds

Short-term bonds are debt securities issued by corporations or municipalities with maturities ranging from one to five years. They offer higher potential returns than T-bills but also carry a higher level of risk.

- Maturity Periods and Interest Rates:Short-term bonds have maturities ranging from one to five years, with interest rates determined by factors such as the issuer’s creditworthiness and prevailing market conditions.

- Risk Level:Short-term bonds carry a higher risk of default than T-bills, as the issuer may be unable to repay the debt. The risk level is generally lower than that of longer-term bonds, but it’s important to consider the issuer’s credit rating before investing.

- Fees and Purchase Requirements:Short-term bonds can be purchased through brokerage firms or online platforms. There may be fees associated with buying or selling bonds, depending on the broker or platform.

Comparison Table

| Feature | High-Yield Savings Accounts | Money Market Accounts | Treasury Bills | Short-Term Bonds |

|---|---|---|---|---|

| Interest Rates (Typical Range) | 4%+ APY | 4%+ APY (Variable) | Variable, determined at auction | Variable, determined by issuer and market conditions |

| Minimum Balance Requirements | May vary | May vary | None | May vary |

| Deposit/Withdrawal Flexibility | High | Moderate | Low | Low |

| Fees | May vary | May vary | None | May vary |

| Risk Level | Low | Low | Very low | Moderate |

| Liquidity | High | Moderate | Low | Low |

| FDIC Insurance Coverage | Yes | Yes | Not applicable | Not applicable |

Benefits and Drawbacks

- High-Yield Savings Accounts:

- Benefits:High interest rates, FDIC insurance, easy access to funds.

- Drawbacks:May have minimum balance requirements, interest rates may be lower than other options.

- Money Market Accounts:

- Benefits:Higher potential interest rates than HYSAs, FDIC insurance, greater liquidity than CDs.

- Drawbacks:May have minimum balance requirements, interest rates may fluctuate, limited withdrawal options.

- Treasury Bills:

- Benefits:Extremely low risk, backed by the U.S. government, no fees.

- Drawbacks:Relatively low interest rates, limited liquidity, minimum purchase amount.

- Short-Term Bonds:

- Benefits:Higher potential returns than T-bills, diversified investment options.

- Drawbacks:Higher risk of default than T-bills, potential for capital loss, fees associated with trading.

Investment Considerations

When choosing an alternative to CDs, consider the following factors:

- Risk Tolerance:How much risk are you comfortable taking with your investments? Higher-risk investments have the potential for higher returns, but they also carry a greater chance of losing money.

- Investment Goals:What are you hoping to achieve with your investments? Are you saving for retirement, a down payment on a house, or a short-term goal? Your goals will influence your investment strategy.

- Time Horizon:How long do you plan to invest your money? Short-term investments are typically less risky than long-term investments, but they may also offer lower returns.

- Liquidity Needs:How much access do you need to your funds? If you need to access your money quickly, you may want to choose a more liquid investment option.

Disclaimer

The information provided is for general knowledge purposes only and does not constitute financial advice. Individuals should consult with a qualified financial advisor before making any investment decisions.

Risks Associated with CDs

While CDs offer a relatively safe way to earn interest on your savings, they are not without risk. Understanding these potential risks can help you make informed decisions about whether CDs are the right investment for you.

Interest Rate Risk

Interest rate risk is the possibility that the interest rate you earn on your CD will be lower than the prevailing market rate. This can happen if interest rates rise after you’ve locked in your CD’s rate.

- For example, if you invest in a 1-year CD at a 5% interest rate and interest rates rise to 6% the following year, you’ll be earning a lower return than you could have if you had waited to invest.

Inflation Risk

Inflation risk is the possibility that the purchasing power of your CD earnings will be eroded by inflation. This means that the money you earn in interest may not be worth as much as it was when you invested it.

- If inflation is higher than the interest rate on your CD, you’ll actually be losing money in real terms.

Early Withdrawal Penalties

Early withdrawal penalties are fees that you may have to pay if you withdraw your money from your CD before its maturity date. These penalties can be substantial, so it’s important to consider your need for liquidity before investing in a CD.

- Penalties are typically calculated as a percentage of the principal or interest earned, and can vary depending on the CD’s term and the financial institution issuing it.

Tips for Maximizing CD Returns

CDs offer a reliable way to earn interest on your savings, but maximizing your returns requires a strategic approach. By taking advantage of various strategies, you can potentially enhance your CD earnings and achieve your financial goals.

Shop Around for the Best Rates

Interest rates on CDs can vary significantly between financial institutions. To secure the best possible rate, it is crucial to shop around and compare offers from multiple banks and credit unions. Online banks and credit unions often offer more competitive rates than traditional brick-and-mortar institutions.

You can use online comparison tools or consult with a financial advisor to help you find the best rates available.

Consider Laddering CDs

Laddering CDs involves investing in a series of CDs with staggered maturity dates. This strategy allows you to diversify your CD portfolio and potentially benefit from rising interest rates. For example, you could invest in a one-year CD, a two-year CD, and a three-year CD.

When the one-year CD matures, you can reinvest the proceeds in a new CD with a longer term, potentially at a higher rate. This process can be repeated as each CD matures, allowing you to gradually shift your investments to higher-yielding CDs.

Take Advantage of Bonus Offers

Some financial institutions offer bonus interest rates or incentives for opening new CDs. These bonuses can significantly enhance your overall returns. It’s worth exploring these offers and considering them when making your CD investment decisions. For instance, a bank might offer a 0.25% bonus on CDs opened during a specific promotion period.

Reinvest CD Proceeds

When your CD matures, you have the option to reinvest the proceeds in a new CD. This can help you continue earning interest and potentially benefit from higher rates if interest rates have increased since you initially invested. You can also consider reinvesting in a different type of investment, such as a high-yield savings account or a money market account, depending on your financial goals and risk tolerance.

Conclusion

This article has explored the world of Certificates of Deposit (CDs), highlighting their potential as a valuable tool for growing your savings. We’ve delved into the intricacies of CD rates, providing insights into how to find the best options and understand the factors influencing their fluctuations.

We’ve also shed light on the importance of carefully considering your financial goals and risk tolerance before investing in CDs.

Key Takeaways

This article has provided a comprehensive overview of CDs, covering essential aspects such as:

- Understanding CD Rates:The article explained how CD rates work, the factors influencing them, and how to find the best rates available in the market.

- Choosing the Right CD:The article emphasized the importance of aligning your CD choice with your financial goals and risk tolerance.

- CD Rate Trends:We discussed the current trends in CD rates, providing insights into potential future movements.

- Alternatives to CDs:The article explored alternative investment options, offering a broader perspective on your savings strategy.

- Risks Associated with CDs:We highlighted the potential risks associated with CDs, emphasizing the importance of understanding these factors before investing.

- Tips for Maximizing CD Returns:The article provided practical tips to maximize your returns from CDs, including strategies for choosing the right term and understanding early withdrawal penalties.

Epilogue

Finding the best CD rates in October 2023 involves researching, comparing, and understanding the nuances of different CD options. Whether you’re a seasoned investor or just starting, this guide provides valuable insights to help you navigate the CD landscape and make informed decisions to maximize your savings potential.

FAQ Overview

What is the difference between APY and APR?

APY (Annual Percentage Yield) reflects the actual interest earned on a CD, taking compounding into account. APR (Annual Percentage Rate) is the simple interest rate without considering compounding.

Are CD rates guaranteed?

Yes, CD rates are fixed for the term of the CD, meaning the interest rate will not change even if market interest rates rise. However, if you withdraw your money before maturity, you may face penalties.

Is my money insured in a CD?

Yes, CDs offered by FDIC-insured banks are protected up to $250,000 per depositor, per insured bank. This means your money is safe even if the bank fails.