Best 10 Year Fixed Rate Mortgage 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In an era marked by fluctuating interest rates and evolving financial landscapes, securing a mortgage that aligns with your financial goals and aspirations is paramount.

Looking for a mortgage specifically tailored for veterans? Check out the latest VA mortgage rates in 2024. These rates can offer competitive options and unique benefits for those who have served our country.

This comprehensive guide delves into the intricacies of 10-year fixed-rate mortgages, empowering you with the knowledge to make informed decisions about your future homeownership journey.

Chase Bank is a well-known lender, and you can find information about their mortgage offerings in 2024 to see if they meet your needs.

Navigating the mortgage market can be daunting, but understanding the nuances of 10-year fixed-rate mortgages can provide a sense of stability and predictability. This guide will explore the benefits and drawbacks of this mortgage type, analyze the factors that influence interest rates, and provide valuable tips for finding the best deal.

Quicken Loans is another popular mortgage lender. Check out their current mortgage rates in 2024 to see if they align with your financial goals.

We’ll also delve into qualification requirements, closing costs, and the potential financial impact of this mortgage option, equipping you with the knowledge to make a confident choice that aligns with your individual circumstances.

Want to know the current landscape for refinancing? Our page on current mortgage refinance rates in 2024 provides insights to help you make an informed decision.

Understanding 10-Year Fixed Rate Mortgages: Best 10 Year Fixed Rate Mortgage 2024

A 10-year fixed-rate mortgage is a type of home loan where the interest rate remains the same for the entire 10-year term. This means your monthly payments will be predictable and consistent throughout the life of the loan.

If you’re looking to purchase rural property, explore the possibilities of a USDA guaranteed loan in 2024. These loans can offer unique benefits for eligible borrowers.

Benefits and Drawbacks of a 10-Year Fixed Rate Mortgage

- Lower Interest Rates:10-year fixed-rate mortgages typically have lower interest rates compared to longer-term mortgages like 15-year or 30-year loans.

- Predictable Monthly Payments:With a fixed interest rate, you’ll know exactly how much your monthly mortgage payment will be for the next 10 years, making budgeting easier.

- Faster Payoff:The shorter loan term means you’ll pay off your mortgage faster, saving you money on interest over the long run.

- Potential for Lower Overall Interest Costs:Although you’ll have higher monthly payments, you’ll end up paying less in interest over the life of the loan compared to longer-term mortgages.

- Build Equity Quickly:You’ll build equity in your home more quickly with a 10-year mortgage due to the faster payoff period.

- Higher Monthly Payments:The shorter term means you’ll have higher monthly payments compared to longer-term mortgages.

- Less Flexibility:If your financial situation changes, you might not have the same flexibility as you would with a longer-term mortgage.

- Potential for Financial Strain:The higher monthly payments might put a strain on your budget, especially if you have other financial obligations.

Comparing a 10-Year Fixed Rate Mortgage to Other Mortgage Options, Best 10 Year Fixed Rate Mortgage 2024

- 15-Year Fixed Rate Mortgage:Offers a balance between lower interest rates and manageable monthly payments, but takes longer to pay off than a 10-year mortgage.

- 30-Year Fixed Rate Mortgage:Has the lowest monthly payments, but comes with higher interest rates and a longer payoff period.

- Adjustable-Rate Mortgages (ARMs):Start with lower interest rates but can fluctuate over time, potentially leading to higher payments later on.

Factors Influencing 10-Year Fixed Rate Mortgage Rates in 2024

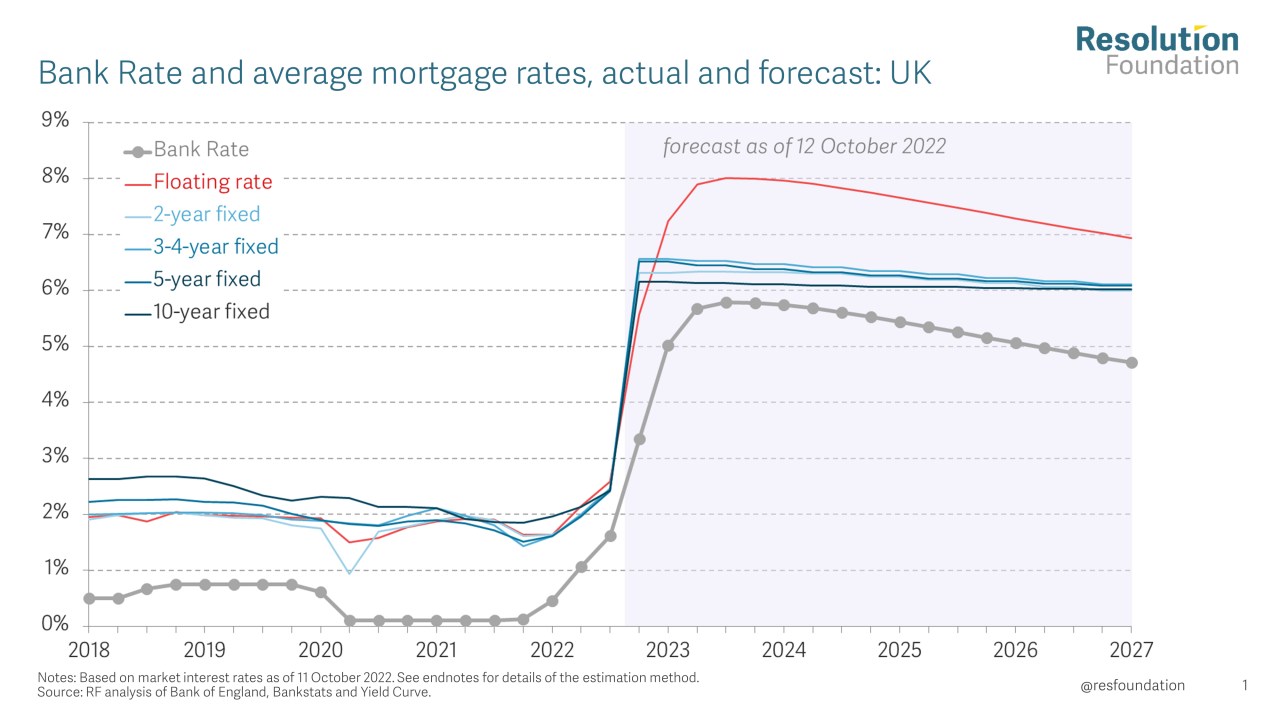

Mortgage rates are influenced by various economic factors, including inflation, the Federal Reserve’s monetary policy, and investor demand.

Keep up-to-date with the latest mortgage rate trends in 2024 to make informed decisions about your home financing.

Key Economic Factors Impacting Mortgage Rates

- Inflation:High inflation can lead to higher interest rates as lenders adjust their rates to compensate for the erosion of purchasing power.

- Federal Reserve’s Monetary Policy:The Federal Reserve’s actions, such as raising or lowering interest rates, directly impact mortgage rates.

- Investor Demand:The demand for mortgage-backed securities by investors can influence mortgage rates.

Current Economic Climate and its Potential Impact on Mortgage Rates

- Inflation:The current inflation rate is [Insert current inflation rate]. This can put upward pressure on mortgage rates.

- Federal Reserve’s Actions:The Federal Reserve is currently [Insert current Federal Reserve policy regarding interest rates]. This will likely [Insert potential impact of Federal Reserve policy on mortgage rates].

- Economic Growth:The current economic growth rate is [Insert current economic growth rate]. Strong economic growth can lead to higher mortgage rates.

Finding the Best 10-Year Fixed Rate Mortgage in 2024

- Shop Around:Get quotes from multiple lenders to compare interest rates and loan terms.

- Consider Online Lenders:Online lenders often offer competitive rates and a streamlined application process.

- Check for Discounts:Some lenders offer discounts for things like autopay, loyalty programs, or credit score bonuses.

- Compare Loan Terms and Fees:Pay attention to closing costs, origination fees, and other charges.

Reputable Mortgage Lenders to Consider

- [Insert name of reputable mortgage lender 1]:[Insert brief description of lender 1].

- [Insert name of reputable mortgage lender 2]:[Insert brief description of lender 2].

- [Insert name of reputable mortgage lender 3]:[Insert brief description of lender 3].

Qualification and Eligibility for a 10-Year Fixed Rate Mortgage

To qualify for a 10-year fixed-rate mortgage, you’ll need to meet certain credit score and debt-to-income ratio requirements.

Considering a shorter-term loan? Explore the current 15-year refinance rates in 2024 to see if this option aligns with your financial goals.

Credit Score and Debt-to-Income Ratio Requirements

- Credit Score:Lenders typically prefer borrowers with a credit score of at least [Insert typical minimum credit score for 10-year fixed-rate mortgage]. A higher credit score can lead to lower interest rates.

- Debt-to-Income Ratio (DTI):Lenders look at your DTI, which is the percentage of your monthly income that goes towards debt payments. A DTI of [Insert typical maximum DTI for 10-year fixed-rate mortgage] or lower is generally considered favorable.

Documentation Needed for Mortgage Application

- Proof of Income:Pay stubs, tax returns, W-2 forms, etc.

- Credit Report:A copy of your credit report from all three major credit bureaus.

- Bank Statements:Recent bank statements showing your savings and checking account balances.

- Property Information:Information about the property you’re buying, such as an appraisal or a purchase agreement.

Improving Your Credit Score and Financial Standing

- Pay Bills on Time:Make all your payments on time and avoid late fees.

- Reduce Debt:Pay down existing debt to lower your DTI.

- Avoid Opening New Credit Accounts:Opening new credit accounts can temporarily lower your credit score.

- Check for Errors on Your Credit Report:Dispute any inaccurate information on your credit report.

Concluding Remarks

As you embark on your homeownership journey, remember that the decision to opt for a 10-year fixed-rate mortgage is a significant one. This guide has provided you with the tools and insights to navigate the complexities of this mortgage type, empowering you to make an informed choice that aligns with your financial goals and aspirations.

Stay up-to-date on the ever-changing landscape of interest rates with our current interest rate information for 2024. Understanding these fluctuations can be key when making major financial decisions.

By carefully considering the factors discussed, understanding the potential risks and benefits, and seeking professional advice when necessary, you can embark on a path to secure and sustainable homeownership.

Get a personalized understanding of your mortgage options by requesting mortgage quotes in 2024. This can help you compare different rates and terms.

General Inquiries

What are the potential risks associated with a 10-year fixed-rate mortgage?

One potential risk is that interest rates could decline significantly after you secure your mortgage. While you’ll enjoy the stability of a fixed rate, you might miss out on the opportunity to refinance at a lower rate. Additionally, a shorter mortgage term may result in higher monthly payments, which could strain your budget.

How do I know if a 10-year fixed-rate mortgage is right for me?

The best way to determine if a 10-year fixed-rate mortgage is suitable for you is to carefully evaluate your financial situation, goals, and risk tolerance. Consider your income, debt obligations, and long-term financial plans. It’s also wise to consult with a financial advisor or mortgage lender to discuss your options and make an informed decision.

Looking for the best fixed-rate home loans? Our page on best fixed-rate home loans in 2024 can help you find the right option for your situation.

Discover the benefits of a VA home loan. Explore our page on VA home loan benefits in 2024 to learn more about this program.

Understanding your mortgage affordability is crucial. Check out our guide on mortgage affordability in 2024 to help you determine what you can realistically afford.

Choosing the right bank for your home loan is important. Our page on the best banks for home loans in 2024 can help you narrow down your options.

Connect with a mortgage loan officer for personalized advice and guidance. Find information on mortgage loan officers in 2024 to help you navigate the process.

Fannie Mae is a major player in the mortgage market. Learn about their mortgage offerings in 2024 to see if they’re a good fit for your needs.