Average Health Insurance Cost 2024 is a topic of great interest for individuals and families, as well as employers. The cost of healthcare is a significant expense, and understanding the factors that influence health insurance premiums is essential for making informed decisions.

From age and location to health conditions and lifestyle choices, a multitude of factors contribute to the cost of health insurance.

Planning for long-term care can be daunting, but it’s essential. Learn about the costs and options available with Long Term Care Insurance Cost 2024 and make informed decisions for your future.

In 2024, health insurance costs are expected to continue rising, driven by inflation, economic factors, and the ever-evolving healthcare landscape. Understanding these trends and exploring strategies to mitigate the impact of rising costs is crucial for navigating the complexities of the health insurance market.

Factors Influencing Health Insurance Costs

The cost of health insurance is a significant factor for individuals and families, and it can vary widely based on several factors. Understanding these factors can help you make informed decisions about your health insurance coverage.

Young drivers often face higher insurance premiums. Get a quote for Young Driver Insurance 2024 and find affordable coverage options.

Age, Average Health Insurance Cost 2024

Age is one of the most significant factors influencing health insurance premiums. Younger individuals generally have lower premiums because they tend to be healthier and less likely to require expensive medical care. As people age, their risk of developing health conditions increases, leading to higher premiums.

Go Compare offers a convenient way to compare house insurance quotes from different providers. Check out Go Compare House Insurance 2024 and find the best deal.

This is why older adults often pay significantly more for health insurance.

Location

The cost of health insurance can vary considerably depending on your location. This is influenced by factors such as the cost of living, the availability of healthcare providers, and the prevalence of certain health conditions in a particular area. For example, areas with a higher concentration of specialists or a greater demand for healthcare services may have higher insurance premiums.

Term insurance provides affordable life insurance protection for a specific period. Learn more about Term Insurance Plans 2024 and find the right plan for your financial situation.

Health Insurance Plan Type

Different health insurance plans offer varying levels of coverage and cost. Here’s a comparison of some common plan types:

- HMO (Health Maintenance Organization):HMOs typically have lower premiums but require you to choose a primary care physician (PCP) within their network. You need a referral from your PCP to see specialists. HMOs generally have lower out-of-pocket costs.

- PPO (Preferred Provider Organization):PPOs offer more flexibility, allowing you to see any doctor within their network without a referral. However, they usually have higher premiums than HMOs. You can also choose to see out-of-network providers but will face higher out-of-pocket costs.

- EPO (Exclusive Provider Organization):EPOs are similar to HMOs in that they require you to choose a PCP within their network. However, they offer slightly more flexibility than HMOs, allowing you to see specialists without a referral in some cases. EPOs generally have lower premiums than PPOs.

Family Size and Dependents

The number of people covered by your health insurance plan can impact the premium. Generally, plans covering multiple individuals, including dependents, will have higher premiums than individual plans. This is because insurance companies factor in the increased likelihood of healthcare needs for a larger family.

Compare The Market makes it easy to find the right travel insurance for your trip. Explore Compare The Market Travel Insurance 2024 and get the best coverage for your needs.

Health Conditions

Pre-existing health conditions can significantly increase health insurance premiums. Insurance companies assess your health history to determine your risk profile. If you have a chronic condition, such as diabetes, heart disease, or cancer, you may face higher premiums. This is because these conditions are associated with higher healthcare costs.

HPSO insurance specializes in providing coverage for healthcare professionals. Discover the benefits of Hpso Insurance 2024 and protect your career.

Lifestyle Choices

Your lifestyle choices can also influence your health insurance premiums. For instance, smokers often pay higher premiums than non-smokers because smoking increases the risk of developing health problems. Similarly, individuals who engage in regular exercise and maintain a healthy weight may qualify for lower premiums due to their reduced risk profile.

Trends in Health Insurance Costs

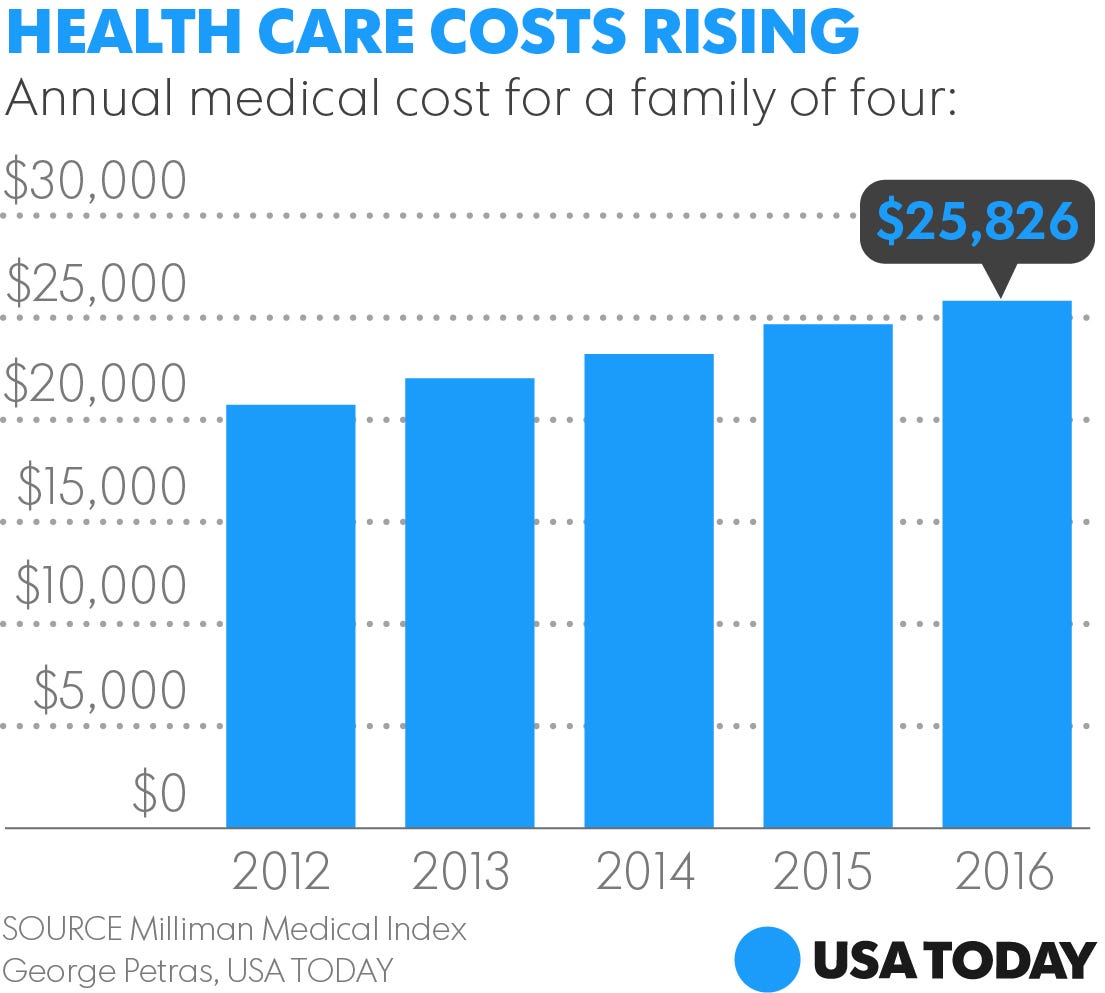

Health insurance costs have been steadily increasing over the past decade, driven by various factors. Understanding these trends can help you prepare for future expenses.

Historical Overview

According to the Kaiser Family Foundation, the average annual premium for employer-sponsored health insurance has increased by over 100% since 2010. This rise can be attributed to factors such as inflation, technological advancements in healthcare, and an aging population.

AARP UnitedHealthcare offers a range of health insurance plans for seniors. Explore Aarp Unitedhealthcare 2024 and find the right plan for your needs.

Projected Trends for 2024

Experts predict that health insurance costs will continue to rise in 2024, albeit at a slower pace than in previous years. Factors such as inflation, increased utilization of healthcare services, and the rising cost of prescription drugs are expected to contribute to this trend.

Maintaining good oral health shouldn’t break the bank. Discover Affordable Dental Insurance 2024 options and find a plan that fits your budget.

However, government policies and regulations, such as the Affordable Care Act, may play a role in moderating these increases.

Impact of Inflation and Economic Factors

Inflation has a significant impact on healthcare costs, including insurance premiums. As the prices of goods and services rise, healthcare providers also need to increase their charges, leading to higher insurance costs. Economic factors such as unemployment and wage stagnation can also influence health insurance costs, as individuals may have less disposable income to afford coverage.

Getting a term life insurance quote is easy and can help you make an informed decision. Request a quote for Term Life Insurance Quotes 2024 and secure your family’s future.

Role of Government Policies and Regulations

Government policies and regulations can influence health insurance costs in various ways. For example, the Affordable Care Act has introduced regulations aimed at expanding health insurance coverage and controlling costs. However, these regulations can also lead to increased administrative burdens for insurance companies, potentially contributing to higher premiums.

Strategies for Reducing Health Insurance Costs: Average Health Insurance Cost 2024

While health insurance costs are rising, there are strategies you can employ to reduce your expenses. Here are some tips:

Cost-Effectiveness of Different Health Insurance Plans

| Plan Type | Premiums | Out-of-Pocket Costs | Flexibility |

|---|---|---|---|

| HMO | Low | Low | Limited |

| PPO | High | High | High |

| EPO | Moderate | Moderate | Moderate |

Strategies for Lowering Premiums

- Shop around for the best rates:Compare quotes from multiple insurance providers to find the most competitive premiums.

- Take advantage of discounts:Many insurance companies offer discounts for factors such as non-smoking, good health, or group enrollment.

- Consider a high-deductible plan:High-deductible plans typically have lower premiums but require you to pay a higher deductible before insurance coverage kicks in. This option may be suitable for individuals who are healthy and rarely require medical care.

- Negotiate with your employer:If your employer offers health insurance, discuss the possibility of contributing more towards your premium to lower your out-of-pocket costs.

- Consider a health savings account (HSA):HSAs allow you to set aside pre-tax dollars for healthcare expenses. This can help you save money on taxes and reduce your out-of-pocket costs.

Benefits of Preventive Care

Preventive care can significantly reduce your healthcare costs in the long run. Regular checkups, screenings, and vaccinations can help detect and prevent health problems before they become serious and expensive to treat. By investing in preventive care, you can lower your overall healthcare expenses and potentially reduce your health insurance premiums.

Insure And Go offers travel insurance with comprehensive coverage. Learn more about Insure And Go Travel Insurance 2024 and protect your trip from unexpected events.

Negotiating Health Insurance Rates

- Research your options:Compare rates from different insurance providers and understand the coverage they offer.

- Be prepared to negotiate:Be willing to discuss your needs and budget with insurance providers. You may be able to negotiate a lower premium by demonstrating your good health and low-risk profile.

- Consider alternative plans:Explore different plan types and coverage options to find a plan that meets your needs at a reasonable cost.

- Be persistent:Don’t be afraid to ask for a better rate or negotiate with the insurance provider. It’s important to be assertive and advocate for yourself.

Impact of Health Insurance Costs on Individuals and Businesses

Rising health insurance costs have a significant impact on individuals, families, and businesses. Understanding these consequences can help us address the challenges posed by increasing healthcare expenses.

Don’t let insurance costs ruin your vacation! Discover affordable options with Cheap Holiday Insurance 2024 and travel with peace of mind.

Financial Burden on Individuals and Families

The rising cost of health insurance places a significant financial burden on individuals and families. For many, healthcare expenses are a major source of stress and financial hardship. This can lead to difficulties in meeting other essential needs, such as housing, food, and education.

General liability insurance is a must-have for businesses, protecting you from claims arising from accidents or injuries on your property. Find out more about General Liability Insurance 2024 and how it can safeguard your business.

Impact on Employee Benefits and Employer Expenses

Health insurance costs are a major expense for employers, and these costs are often passed on to employees in the form of higher premiums or reduced benefits. Rising health insurance costs can make it challenging for businesses to attract and retain employees, especially in a competitive job market.

Business Adaptations to Rising Costs

Businesses are increasingly adopting strategies to manage rising health insurance costs. Some common approaches include:

- Offering high-deductible plans:This can help businesses reduce their premiums, but it may shift some of the financial burden onto employees.

- Implementing wellness programs:Encouraging healthy lifestyles among employees can reduce healthcare utilization and lower costs.

- Partnering with self-insured health plans:This allows businesses to manage their own health insurance risk and potentially save on premiums.

Consequences of Unaffordable Health Insurance

When health insurance becomes unaffordable, individuals may face a range of consequences, including:

- Delayed or forgone care:People may postpone or avoid necessary medical care due to the high cost of insurance.

- Financial instability:Unpaid medical bills can lead to debt, bankruptcy, and other financial challenges.

- Health disparities:Individuals with lower incomes or who are uninsured may experience poorer health outcomes due to limited access to healthcare.

Final Conclusion

The cost of health insurance is a complex and ever-changing landscape. By understanding the factors that influence premiums, exploring strategies for reducing costs, and staying informed about industry trends, individuals and businesses can make informed decisions about their health insurance coverage.

Geico offers comprehensive renters insurance coverage, protecting your belongings from unexpected events. Explore Geico Renters Insurance 2024 and find the right policy for your needs.

As we move into 2024 and beyond, it is essential to stay proactive and engaged in the health insurance market to ensure access to affordable and comprehensive healthcare.

National Insurance offers a wide range of policies to meet your needs. Visit National Insurance 2024 and find the right coverage for you and your family.

Frequently Asked Questions

What are the main factors influencing health insurance costs in 2024?

Toggle insurance is a unique type of policy that can be adjusted to fit your changing needs. Check out Toggle Insurance 2024 and see if it’s the right solution for you.

Age, location, health plan type, family size, health conditions, and lifestyle choices all play a role in determining health insurance premiums.

How can I reduce my health insurance costs?

Strategies include choosing a plan with a higher deductible, taking advantage of preventive care, and negotiating with insurance providers.

What are the potential consequences of unaffordable health insurance?

Individuals may face financial hardship, limited access to healthcare, and potential health complications due to delayed or forgone care.