Att Phone Insurance Claim is a lifeline for those who rely on their smartphones for everything. Whether you’re a busy professional, a social media enthusiast, or simply someone who can’t imagine life without their phone, this insurance plan offers peace of mind and financial protection in case of accidents, damage, or theft.

Many insurance companies are now using Smart Claims technology to streamline the claims process, making it faster and more efficient for both parties.

This comprehensive guide will explore the ins and outs of Att Phone Insurance Claim, from understanding the coverage options to navigating the claim process. We’ll cover everything from filing a claim to appealing a denial, ensuring you have the information you need to make informed decisions about protecting your investment.

If you need to file an Assurant Claim , it’s important to have your policy information and documentation ready.

Understanding AT&T Phone Insurance

AT&T phone insurance is a valuable option for protecting your expensive smartphone from accidental damage, theft, and other unforeseen events. It provides peace of mind knowing that you’re covered if something happens to your device. Let’s delve into the details of AT&T phone insurance to help you make an informed decision.

The State Farm Claim Center provides resources and information for filing a claim.

Types of Coverage

AT&T phone insurance offers comprehensive coverage for various situations. Here’s a breakdown of the key types of coverage:

- Accidental Damage:This covers damage resulting from drops, spills, and other accidents.

- Theft:Protection against theft, whether or not it’s reported to the police.

- Liquid Damage:Covers damage caused by accidental spills or submersion in water.

- Out-of-Warranty Repairs:Provides coverage for repairs beyond the manufacturer’s warranty period.

Plan Options and Costs

AT&T offers different plan options to suit various budgets and needs. The cost of each plan varies based on the type of device, coverage level, and deductible chosen. Here’s a general overview of the plan options and their associated costs:

- Basic Plan:This plan typically covers accidental damage, theft, and liquid damage. It’s the most affordable option and comes with a higher deductible.

- Premium Plan:This plan offers enhanced coverage, including out-of-warranty repairs, a lower deductible, and potentially additional benefits like device replacement.

Benefits and Limitations

AT&T phone insurance offers several benefits, but it’s essential to understand its limitations:

- Benefits:

- Financial protection against unexpected repair costs.

- Peace of mind knowing your device is insured.

- Convenient claim filing process.

- Limitations:

- Deductible: You’ll need to pay a deductible for each claim.

- Exclusions: Certain types of damage, such as intentional damage or wear and tear, are typically not covered.

- Limited Claims: There may be limits on the number of claims you can file within a specific period.

Filing a Claim

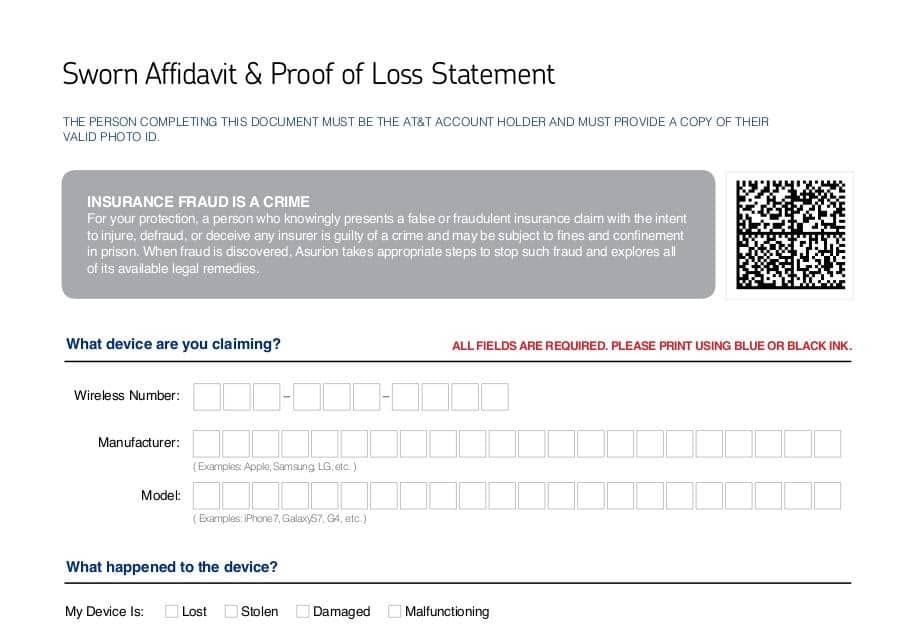

If you need to file a claim for your AT&T phone insurance, the process is relatively straightforward. Here’s a step-by-step guide:

Steps Involved

- Report the Incident:Contact AT&T immediately to report the damage or theft. Provide details about the incident, including the date, time, and location.

- Gather Necessary Documentation:You’ll need to provide certain documents to support your claim. This may include:

- Proof of purchase for your device.

- Police report (if applicable).

- Photos or videos of the damage.

- Submit Your Claim:You can submit your claim online through the AT&T website, by phone, or at an AT&T store.

- Claim Review:AT&T will review your claim and determine its validity.

- Claim Approval or Denial:You’ll be notified of the decision regarding your claim. If approved, you’ll receive instructions on how to proceed with the repair or replacement of your device.

Methods of Submission

You have several options for submitting your AT&T phone insurance claim:

- Online:Visit the AT&T website and follow the instructions to file your claim online. This is the most convenient method, as you can do it from anywhere with an internet connection.

- Phone:Call AT&T’s customer service line to file your claim over the phone. You’ll need to provide all the necessary details and documentation.

- In-Store:Visit an AT&T store to file your claim in person. This option is convenient if you prefer to speak with a representative directly.

Claim Processing and Timelines

Once you’ve submitted your claim, AT&T will begin the processing phase. The time it takes to process a claim can vary depending on several factors.

Many insurance companies have a Claims Link on their website where you can easily access information and file a claim.

Typical Processing Time

AT&T typically aims to process claims within a few business days. However, complex claims or those requiring additional investigation may take longer.

Filing an Asurion Phone Claim can be done online or through their customer service line.

Factors Influencing Processing Speed, Att Phone Insurance Claim

Several factors can influence how quickly your claim is processed:

- Claim Complexity:Simple claims with clear evidence are usually processed faster than complex claims requiring extensive investigation.

- Availability of Documentation:Providing all the required documentation promptly can expedite the process.

- Communication:Responding to AT&T’s requests for information promptly can help streamline the process.

Claim Processing Flowchart

Here’s a simplified flowchart illustrating the typical stages of claim processing:

| Stage | Description |

|---|---|

| 1. Claim Submission | You submit your claim online, by phone, or in-store. |

| 2. Claim Review | AT&T reviews your claim and gathers necessary information. |

| 3. Investigation (if needed) | AT&T may investigate the incident to verify the claim details. |

| 4. Claim Approval or Denial | AT&T notifies you of the decision regarding your claim. |

| 5. Repair or Replacement (if approved) | AT&T arranges for the repair or replacement of your device. |

Claim Approval and Coverage

AT&T phone insurance has specific criteria for claim approval and Artikels the types of damages covered and excluded.

If you’re considering filing a Geico Lawsuit , it’s important to understand the legal process and your rights.

Criteria for Claim Approval

To have your claim approved, you must meet the following criteria:

- Valid Policy:You must have an active AT&T phone insurance policy at the time of the incident.

- Covered Damage:The damage or theft must be covered under your policy.

- Proper Documentation:You must provide all the necessary documentation to support your claim.

- No Pre-Existing Damage:The damage must not have been pre-existing before the incident.

Covered and Excluded Damages

AT&T phone insurance covers a wide range of damages, but some are excluded. Here’s a general overview:

- Covered Damages:

- Accidental drops and spills.

- Theft (reported or unreported).

- Liquid damage.

- Out-of-warranty repairs (depending on the plan).

- Excluded Damages:

- Intentional damage.

- Wear and tear.

- Damage caused by natural disasters (unless covered by an additional rider).

- Cosmetic damage (unless it affects functionality).

Common Claim Scenarios

Here are some common claim scenarios and their potential outcomes:

- Scenario 1:You drop your phone and crack the screen.

- Outcome:Your claim is likely to be approved, and you’ll receive coverage for the screen repair, subject to your deductible.

- Scenario 2:Your phone is stolen from your car.

- Outcome:Your claim is likely to be approved, and you’ll receive coverage for a replacement device, subject to your deductible.

- Scenario 3:You accidentally drop your phone in a pool.

- Outcome:Your claim is likely to be approved if your policy covers liquid damage, and you’ll receive coverage for the repair or replacement, subject to your deductible.

Claim Denial and Appeals

While AT&T strives to approve valid claims, there are situations where a claim might be denied. Understanding the reasons for denial and the appeals process is crucial.

If you’re insured with Safeco Insurance , they have a dedicated claims process that you can follow.

Reasons for Claim Denial

Here are some common reasons why an AT&T phone insurance claim might be denied:

- Invalid Policy:You don’t have an active policy at the time of the incident.

- Uncovered Damage:The damage is not covered under your policy.

- Insufficient Documentation:You fail to provide the required documentation to support your claim.

- Pre-Existing Damage:The damage was present before the incident.

- Fraudulent Claim:You provide false or misleading information in your claim.

Appealing a Denied Claim

If your claim is denied, you have the right to appeal the decision. The appeals process typically involves the following steps:

- Request an Appeal:Contact AT&T to formally request an appeal of the denied claim.

- Provide Additional Information:You may need to provide additional information or documentation to support your appeal.

- Appeal Review:AT&T will review your appeal and make a final decision.

Policyholder Rights and Options

If your claim is denied, and you’re dissatisfied with the appeal outcome, you have several options:

- Contact the State Insurance Department:You can contact your state’s insurance department to file a complaint about the denial.

- Seek Legal Counsel:You may consider seeking legal advice from an attorney specializing in insurance law.

Customer Experience

Customer experiences with AT&T phone insurance claims vary, and it’s essential to consider different perspectives.

If you need to file a Assurant Phone Claim , it’s best to contact them directly for the most accurate information and assistance.

Customer Reviews and Experiences

Customer reviews and experiences with AT&T phone insurance claims are mixed. Some customers report positive experiences, praising the ease of filing claims and the prompt processing times. Others express dissatisfaction with lengthy processing times, claim denials, or issues with customer service.

A Legal Claim can be a complex process, so it’s wise to seek legal advice if you’re unsure about your rights or obligations.

Comparison with Other Providers

It’s valuable to compare AT&T phone insurance with other providers to understand the competitive landscape. Some providers may offer more comprehensive coverage, lower deductibles, or better customer service. Researching and comparing different options is crucial for finding the best fit for your needs.

Be aware of common Car Insurance Frauds Examples to protect yourself and your insurance company from fraudulent claims.

Factors Contributing to Positive or Negative Experiences

Several factors can influence a customer’s experience with AT&T phone insurance claims:

- Claim Processing Speed:Prompt and efficient processing can lead to positive experiences.

- Customer Service:Responsive and helpful customer service representatives can significantly improve the experience.

- Communication:Clear and timely communication throughout the process can build trust and satisfaction.

- Claim Approval or Denial:Fair and transparent decisions regarding claim approval or denial can contribute to a positive experience.

Tips and Best Practices: Att Phone Insurance Claim

To maximize the benefits of AT&T phone insurance and minimize claim risks, consider these tips and best practices:

Maximizing Benefits

- Read Your Policy Carefully:Understand the coverage details, exclusions, and limitations of your policy.

- Choose the Right Plan:Select a plan that provides the level of coverage you need at a price you can afford.

- Keep Your Phone Protected:Use a protective case and screen protector to help prevent accidental damage.

- Report Theft Immediately:If your phone is stolen, report it to the police and AT&T immediately.

Preventing Phone Damage

- Use a Protective Case:A durable case can help absorb shock from drops and falls.

- Use a Screen Protector:A screen protector can shield your phone’s screen from scratches and cracks.

- Be Careful Around Water:Avoid using your phone in wet environments, and use a waterproof case if necessary.

- Keep Your Phone Secure:Use a strong password and enable security features to prevent theft.

Frequently Asked Questions

Here are some frequently asked questions about AT&T phone insurance claims:

- Q: How much does AT&T phone insurance cost?

- A:The cost of AT&T phone insurance varies depending on the plan, device, and deductible you choose. You can find detailed pricing information on the AT&T website or by contacting customer service.

- Q: What happens if my claim is denied?

- A:If your claim is denied, you have the right to appeal the decision. Contact AT&T to request an appeal and provide any additional information or documentation that supports your claim.

- Q: How long does it take to process a claim?

- A:AT&T typically aims to process claims within a few business days. However, complex claims or those requiring additional investigation may take longer.

Final Thoughts

Navigating the world of phone insurance can feel overwhelming, but with a clear understanding of the process and your rights, you can confidently protect your device and minimize the stress of unexpected repairs or replacements. Att Phone Insurance Claim offers a valuable safety net, and this guide empowers you to make the most of it.

The UB04 form is a standard claim form used in the healthcare industry to process claims.

Expert Answers

How much does Att Phone Insurance Claim cost?

If you’re involved in an accident with an Uninsured Motorist , you may be able to file a claim with your own insurance company.

The cost of Att Phone Insurance Claim varies depending on the plan you choose and the type of phone you have. You can find detailed pricing information on the AT&T website or by contacting customer service.

Understanding the difference between First Party Insurance and third-party insurance is important when navigating claims.

What types of damage are covered by Att Phone Insurance Claim?

Att Phone Insurance Claim covers accidental damage, liquid damage, and theft. However, certain exclusions apply, such as damage caused by intentional acts or neglect. Review the policy details for a complete list of covered and excluded damages.

What is the deductible for Att Phone Insurance Claim?

The deductible for Att Phone Insurance Claim varies depending on the plan you choose. You can find this information on the AT&T website or by contacting customer service.

How do I cancel my Att Phone Insurance Claim?

To cancel your Att Phone Insurance Claim, you can contact AT&T customer service or visit an AT&T store. You may be subject to a cancellation fee depending on your plan and the terms of your policy.

Filing a Statefarm Insurance Claim can be a hassle, but understanding the process can make it easier.

If you’re married, you may be eligible to Apply For Marriage Allowance which can reduce your tax liability.