Asurion Insurance Claim offers a lifeline for those seeking protection for their valuable electronic devices. Whether it’s a cracked screen, water damage, or unexpected malfunction, Asurion provides a pathway to repair or replacement, aiming to ease the burden of unforeseen circumstances.

This comprehensive guide delves into the intricacies of Asurion insurance claims, covering everything from the initial filing process to navigating the complexities of claim approval and denial. We’ll explore the benefits and costs associated with Asurion coverage, providing insights into customer experiences and potential pitfalls.

By understanding the nuances of Asurion insurance, you can make informed decisions about your electronic device protection needs.

Aetna members can access their claims portal and find resources for managing their health insurance at Aetna Claims. Erie Insurance policyholders can find information on filing claims and accessing support on their website at Erie Insurance Claims.

From the initial steps of filing a claim to the final outcome, this guide provides a detailed roadmap to help you navigate the Asurion insurance claim process effectively. We’ll address common questions, explore coverage limitations, and offer tips for maximizing your chances of a successful claim.

Whether you’re a seasoned Asurion customer or considering their services for the first time, this guide offers valuable information to help you make informed decisions and understand your rights as a policyholder.

Asurion Insurance Claim Process

Asurion is a leading provider of insurance and support services for electronic devices. If you have an Asurion insurance plan, you may need to file a claim if your device is damaged, lost, or stolen. The claim process is relatively straightforward, but it’s important to understand the steps involved and the documentation required.

This article will guide you through the Asurion insurance claim process, providing insights into the coverage, claim approval, customer support, and costs.

For specific inquiries related to your T-Mobile account, you can access their online claims portal at My Tmo Claim Com. If you’re dealing with a claim through Gallagher Bassett, their dedicated team is ready to assist you at Gallagher Bassett Claims.

Steps Involved in Filing a Claim

Filing an Asurion insurance claim typically involves the following steps:

- Contact Asurion: The first step is to contact Asurion to report your claim. You can do this by phone, online, or through the Asurion mobile app. Be prepared to provide your policy details, the device information, and a description of the incident.

You will also be asked to choose a preferred method for receiving updates and communications.

- Submit a Claim Form: After reporting your claim, you will be provided with a claim form to complete. This form will require information about the device, the incident, and your contact details. You will need to include details such as the device’s make, model, serial number, and purchase date, as well as the date and location of the incident.

- Provide Supporting Documentation: Depending on the nature of your claim, you may need to provide supporting documentation, such as a police report for a stolen device, a receipt for repairs, or a photo of the damage.

- Claim Review and Processing: Once you have submitted your claim form and any necessary documentation, Asurion will review your claim. This process may take a few days to a week, depending on the complexity of the claim and the availability of supporting documents.

- Claim Decision: After reviewing your claim, Asurion will notify you of their decision. If your claim is approved, you will receive instructions on how to proceed with the repair or replacement of your device. If your claim is denied, you will be provided with an explanation for the denial and information about your appeal options.

Required Documentation and Information

The specific documentation required for an Asurion insurance claim may vary depending on the nature of the claim and the device involved. However, some common documents include:

- Policy information: Your policy number, name, and contact details.

- Device information: The make, model, serial number, and purchase date of the device.

- Incident details: A detailed description of the incident that led to the damage, loss, or theft of the device, including the date, time, and location.

- Supporting documentation: This may include a police report for a stolen device, a receipt for repairs, a photo of the damage, or any other relevant documentation.

Claim Processing Timeline

The timeline for processing an Asurion insurance claim can vary depending on several factors, including the type of claim, the availability of supporting documentation, and the workload of Asurion’s claim processing team. In general, the claim process can take anywhere from a few days to a few weeks.

For assistance with insurance-related inquiries, Trexis Insurance provides dedicated customer service support through their website at Trexis Insurance Customer Service.

Here is a typical claim processing timeline:

- Initial claim reporting: Within 24 hours of reporting your claim, you should receive an email or text message acknowledging receipt of your claim.

- Claim review: Asurion will review your claim and any supporting documentation within 3-5 business days.

- Claim decision: You will be notified of Asurion’s decision within 7-10 business days of the claim review.

- Device repair or replacement: If your claim is approved, the repair or replacement process may take an additional 7-14 business days, depending on the availability of parts and the shipping location.

Tips for Streamlining the Claim Process

To ensure a smooth and efficient claim process, consider the following tips:

- Keep your policy information handy: Having your policy number, name, and contact details readily available will speed up the initial reporting process.

- Gather all necessary documentation: Before contacting Asurion, gather all relevant documentation, such as receipts, photos, or police reports. This will help you avoid delays in the claim processing.

- Be clear and concise in your communication: When communicating with Asurion, provide clear and concise information about the incident and your device.

- Follow up regularly: If you haven’t heard back from Asurion within a reasonable timeframe, follow up with them to check on the status of your claim.

Asurion Coverage and Exclusions

Asurion insurance plans offer coverage for a variety of electronic devices, including smartphones, tablets, laptops, and other personal electronics. However, there are certain limitations and exclusions that you should be aware of before purchasing an Asurion plan. This section will delve into the details of Asurion coverage and exclusions, comparing it with other insurance providers and outlining the specific terms and conditions of the policy.

Types of Devices and Situations Covered

Asurion insurance typically covers the following situations:

- Accidental damage: This includes damage caused by drops, spills, and other accidental events.

- Mechanical or electrical failure: This covers issues with the device’s internal components that are not caused by user negligence.

- Theft or loss: Coverage for theft or loss may vary depending on the specific plan and the device. Some plans may require a police report or other documentation to file a claim.

Asurion coverage may extend to:

- Smartphones: iPhones, Android phones, and other popular smartphone models.

- Tablets: iPads, Android tablets, and other tablet models.

- Laptops: MacBooks, Windows laptops, and other laptop models.

- Wearables: Smartwatches, fitness trackers, and other wearable devices.

- Other personal electronics: Headphones, cameras, and other electronic devices may be covered depending on the specific plan.

Common Exclusions or Limitations

While Asurion insurance offers coverage for a range of situations, there are certain common exclusions or limitations that you should be aware of:

- Pre-existing damage: Damage that occurred before the policy was purchased is typically not covered.

- Cosmetic damage: Scratches, dents, and other cosmetic damage are generally not covered.

- Water damage: Some plans may exclude coverage for water damage, especially if the device was submerged in water for an extended period.

- Abuse or neglect: Damage caused by abuse, neglect, or intentional acts is typically not covered.

- Certain types of theft: Some plans may exclude coverage for theft from unattended vehicles, or theft that occurs in certain locations, such as public transportation.

Comparison with Other Insurance Providers

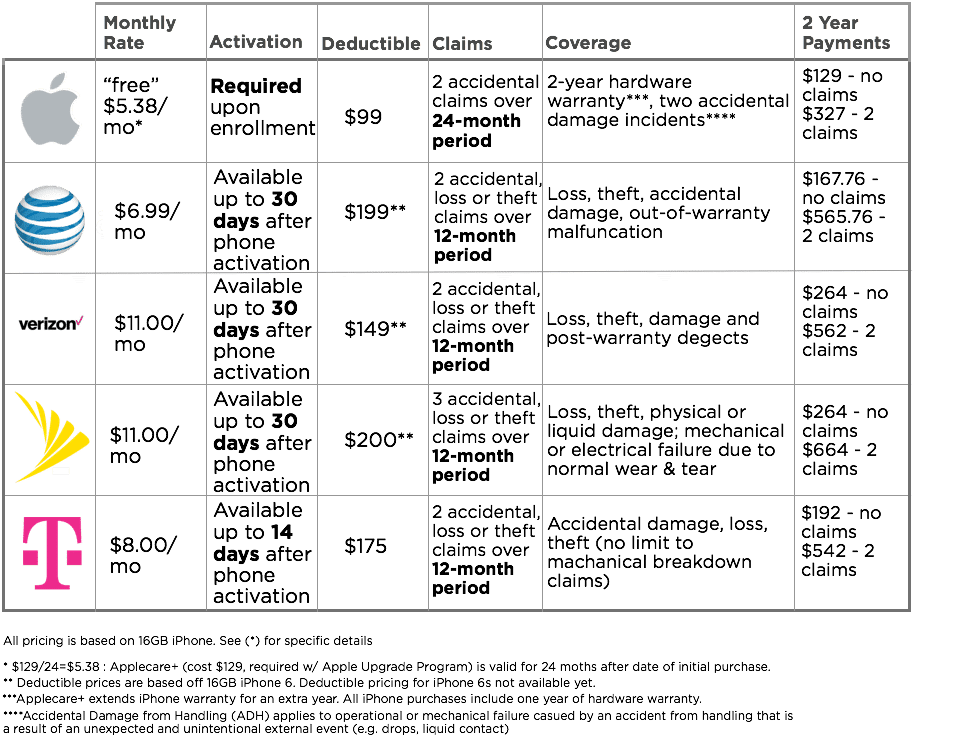

Asurion is not the only insurance provider for electronic devices. Other providers, such as SquareTrade, Allstate, and Verizon, also offer similar insurance plans. When comparing Asurion with other providers, it’s essential to consider the following factors:

- Coverage: Compare the types of devices and situations covered by each provider.

- Deductibles: The deductible is the amount you pay out of pocket when you file a claim. Compare the deductibles offered by different providers.

- Premiums: The premium is the monthly or annual cost of the insurance plan. Compare the premiums offered by different providers.

- Customer service: Read customer reviews and testimonials to get an idea of the customer service experience with each provider.

Terms and Conditions of the Policy

It’s crucial to carefully review the terms and conditions of your Asurion insurance policy before purchasing a plan. The policy will Artikel the specific coverage details, exclusions, and limitations. You should understand the following key aspects of the policy:

- Coverage period: The length of time the insurance coverage is valid.

- Deductible: The amount you pay out of pocket when you file a claim.

- Maximum coverage amount: The maximum amount Asurion will pay for a claim.

- Claim process: The steps involved in filing a claim.

- Cancellation policy: The process for canceling the insurance policy.

Asurion Claim Approval and Denial

When you file an Asurion insurance claim, the company will review your request to determine whether it meets the criteria for approval. Asurion uses a set of guidelines to evaluate claims, and they may deny claims for various reasons. This section will discuss the criteria used by Asurion to approve or deny claims, providing examples of common reasons for denial and explaining the appeal process for denied claims.

Criteria for Claim Approval

Asurion uses several criteria to determine whether to approve or deny a claim, including:

- Policy coverage: The claim must fall within the scope of the policy coverage. For example, if your device is damaged due to a pre-existing condition, the claim may be denied.

- Supporting documentation: You must provide sufficient supporting documentation to validate your claim. This may include a police report for a stolen device, a receipt for repairs, or photos of the damage.

- Incident details: The details of the incident must be consistent with the policy coverage. For example, if you claim that your device was damaged due to a drop, but the evidence suggests otherwise, the claim may be denied.

- Device history: Asurion may review the history of your device to determine if there have been any previous claims or repairs.

Common Reasons for Claim Denial

Here are some common reasons why Asurion may deny a claim:

- Pre-existing damage: Damage that occurred before the policy was purchased.

- Cosmetic damage: Scratches, dents, and other cosmetic damage.

- Water damage: Damage caused by submersion in water.

- Abuse or neglect: Damage caused by intentional acts or negligence.

- Insufficient documentation: Lack of supporting documentation to validate the claim.

- Inconsistent incident details: Discrepancies between the reported incident and the evidence.

- Device history: Previous claims or repairs that suggest a pattern of device damage.

Appeal Process for Denied Claims

If your Asurion insurance claim is denied, you have the right to appeal the decision. The appeal process typically involves the following steps:

- Submit an appeal request: You can submit an appeal request by contacting Asurion customer support or by using the online appeal form.

- Provide additional documentation: You may need to provide additional documentation to support your appeal, such as a repair estimate or a statement from a witness.

- Appeal review: Asurion will review your appeal request and any supporting documentation.

- Appeal decision: You will be notified of the appeal decision in writing.

Factors Influencing Claim Approval

Several factors can influence the likelihood of your Asurion insurance claim being approved, including:

- Policy coverage: The specific coverage details of your insurance plan.

- Incident details: The clarity and consistency of the incident details you provide.

- Supporting documentation: The quality and relevance of the supporting documentation you submit.

- Device history: The history of claims and repairs on your device.

- Customer service interactions: Your communication with Asurion customer support.

Asurion Customer Support and Communication

Having a reliable customer support system is crucial for any insurance provider, especially when dealing with claims. This section will explore the various channels for contacting Asurion customer support, providing insights into the responsiveness and helpfulness of their support team, and discussing the communication process during the claim process.

Channels for Contacting Customer Support

Asurion offers various channels for contacting customer support, including:

- Phone: You can reach Asurion customer support by phone, and they typically have dedicated lines for different types of inquiries, such as claims, technical support, or general inquiries.

- Email: You can also contact Asurion customer support via email. They have a dedicated email address for customer inquiries.

- Live chat: Asurion may offer live chat support on their website, allowing you to communicate with a customer service representative in real time.

- Social media: You can reach out to Asurion through their social media channels, such as Twitter or Facebook.

- Mobile app: If you have the Asurion mobile app, you may be able to contact customer support through the app’s messaging feature.

Responsiveness and Helpfulness of Support

Customer feedback regarding Asurion’s customer support varies. Some customers have reported positive experiences with prompt and helpful support, while others have experienced delays or difficulty getting assistance.

For individuals seeking information about applying for maternity allowance , it’s essential to familiarize yourself with the eligibility criteria and application process. Unum policyholders can find support and resources for managing their disability claims at Unum Claims.

It’s essential to remember that customer support experiences can vary depending on the individual representative you interact with, the time of day, and the complexity of your inquiry.

Communication Process During the Claim Process

Asurion typically communicates with customers through various channels, including email, text message, and phone calls. They will keep you updated on the status of your claim and will notify you of any decisions or next steps.

It’s essential to provide accurate contact information and to be responsive to Asurion’s communications. This will help ensure that you receive timely updates and information about your claim.

Geico customers can find helpful information and resources for filing claims on their website at Geico Com Claims. If you’re dealing with a Select Home Warranty claim , be sure to review the terms and conditions of your policy carefully.

Examples of Successful Interactions with Support, Asurion Insurance Claim

Many customers have reported positive experiences with Asurion customer support, especially when they encountered a specific issue or needed assistance with a complex claim.

It’s always a good idea to double-check your coverage with your insurer and consider using tools like Insuranceclaimcheck to ensure you’re not missing anything. If you’re involved in a situation where you might need to file a subrogation claim , it’s important to consult with your insurance provider.

For example, some customers have praised Asurion’s ability to resolve issues quickly and efficiently, while others have appreciated the patience and understanding shown by their customer support representatives.

Navigating the process of filing a Zurich Insurance claim can feel overwhelming, but understanding the basics of claims processing can help you get started. Whether you’re dealing with a National General Insurance claim or a more complex civil claim , having a clear understanding of your rights and responsibilities is crucial.

It’s important to note that these are just a few examples of successful interactions, and individual experiences may vary.

Outcome Summary

Navigating the world of insurance claims can be a daunting task, but understanding the intricacies of Asurion insurance claims can empower you to approach the process with confidence. From familiarizing yourself with the required documentation and claim processing timeline to understanding the factors that influence claim approval, this guide provides a comprehensive overview of the key aspects of Asurion insurance.

By understanding your rights and responsibilities, you can navigate the claim process effectively and maximize your chances of a successful outcome.

FAQ Compilation: Asurion Insurance Claim

How long does it take to process an Asurion insurance claim?

The processing time for an Asurion insurance claim can vary depending on the complexity of the claim and the availability of required documentation. Generally, it can take anywhere from a few days to a few weeks for a claim to be processed and approved.

What are the common reasons for Asurion insurance claim denial?

Some common reasons for claim denial include exceeding the coverage limit, pre-existing damage, unauthorized repairs, and failure to provide required documentation. It’s important to carefully review the terms and conditions of your Asurion policy to understand the specific exclusions and limitations.

How do I contact Asurion customer support for assistance with a claim?

You can contact Asurion customer support through their website, phone number, or mobile app. They offer 24/7 support to assist with claim filing, tracking, and any other questions you may have.

What are the alternative options to Asurion insurance?

There are several alternative insurance providers that offer device protection plans, such as SquareTrade, Allstate, and Verizon. It’s important to compare the coverage, costs, and customer reviews of different providers before making a decision.