Arm Rates, or adjustable-rate mortgages, offer a unique approach to home financing, allowing borrowers to potentially benefit from lower initial interest rates. These rates, unlike their fixed-rate counterparts, can fluctuate over time, adjusted based on market conditions and specific loan terms.

Need money fast? Quick Cash loans can provide a solution when you need money quickly. However, these loans often come with high interest rates and fees, so it’s crucial to carefully consider the terms before applying.

This dynamic nature presents both opportunities and risks for homeowners, requiring careful consideration of individual financial circumstances and long-term goals.

When you need money quickly, Instant Loans Online can provide a convenient solution. These loans are often processed and funded quickly, making them a good option for urgent financial needs. However, it’s essential to carefully consider the terms and fees associated with these loans before applying.

Understanding the intricacies of Arm Rates is crucial for making informed decisions about homeownership. This guide delves into the mechanics of Arm Rates, exploring their advantages and disadvantages, and providing insights into the factors that influence their behavior. By examining real-world examples and analyzing current trends, this comprehensive overview empowers you to navigate the complexities of Arm Rates and make choices that align with your financial aspirations.

If you’re a Chase customer and need access to your home’s equity, a Chase Heloc could be a convenient option. These lines of credit can provide flexible financing options for home improvements, debt consolidation, or other major expenses.

What are ARM Rates?

An ARM rate, or adjustable-rate mortgage, is a type of mortgage loan where the interest rate is not fixed for the entire loan term. Instead, the interest rate can change periodically based on a specific index. This means your monthly mortgage payments can go up or down over time, depending on how the index fluctuates.

For a quick and convenient way to access personal loans, Upstart Loans can be a great option. They utilize a unique credit scoring model that considers factors beyond traditional credit history, making it possible for borrowers with limited credit to qualify for loans.

Understanding ARM Rates

ARM rates are often presented in a format like 5/1 ARM, 7/1 ARM, or 10/1 ARM. The first number represents the fixed-rate period, during which the interest rate remains the same. After the fixed-rate period ends, the interest rate becomes adjustable and can change based on the index and margin.

Finding the Cheapest Mortgage Rates can save you a significant amount of money over the life of your loan. Comparing rates from different lenders and considering factors like your credit score and loan amount can help you secure the most affordable mortgage.

The second number indicates the frequency of adjustments, which is usually annually in the case of a 1/1 ARM.

Getting the Best Car Loan Rates can save you thousands of dollars over the life of your loan. Comparing rates from different lenders and considering factors like your credit score, loan amount, and vehicle type can help you secure the most favorable terms.

Examples of ARM Rate Structures

- 5/1 ARM:The interest rate is fixed for the first five years of the loan. After that, the rate can adjust annually based on the index and margin.

- 7/1 ARM:The interest rate is fixed for the first seven years of the loan, and then adjusts annually.

- 10/1 ARM:The interest rate is fixed for the first ten years of the loan, and then adjusts annually.

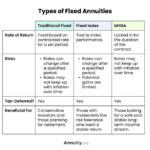

Comparing ARM Rates to Fixed-Rate Mortgages

The main difference between an ARM rate and a fixed-rate mortgage is that the interest rate on a fixed-rate mortgage stays the same for the entire loan term. This provides predictability and stability in your monthly payments. However, ARM rates can offer lower initial interest rates compared to fixed-rate mortgages, making them attractive to borrowers who plan to stay in their home for a shorter period or anticipate rising interest rates.

If you’re looking to purchase a home in a rural area, a Usda Rural Development Loan can be a valuable tool. These loans offer competitive interest rates and flexible terms, making homeownership in rural areas more accessible.

How ARM Rates Work

ARM rates are based on a combination of a specific index and a margin. The index is a benchmark interest rate that is publicly available and reflects current market conditions. The margin is a fixed percentage that the lender adds to the index to determine your individual ARM rate.

Looking to buy a home in a rural area? Usda Loans can help you achieve your dream of homeownership with competitive rates and flexible terms. These loans are specifically designed to help individuals purchase homes in eligible rural areas, making homeownership more accessible to a wider range of borrowers.

Factors Influencing ARM Rate Adjustments

The following factors can influence ARM rate adjustments:

- Index:The chosen index, such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR), determines the base rate for your ARM.

- Margin:The margin is set by the lender and remains constant throughout the life of the loan.

- Adjustment Cap:This cap limits how much your interest rate can increase or decrease at each adjustment period.

- Lifetime Cap:This cap sets a maximum limit on how much your interest rate can increase over the entire life of the loan.

Calculating ARM Rates

To calculate your ARM rate, the lender adds the margin to the current index value. For example, if the index is 3% and the margin is 2%, your ARM rate would be 5%.

When you need access to financial services, it’s helpful to know where to find Finance Companies Near Me. These companies can provide a range of financial products and services, including personal loans, mortgages, and credit cards.

Fluctuations in ARM Rates Over Time

ARM rates can fluctuate over time, depending on changes in the index. If the index rises, your ARM rate will also rise, resulting in higher monthly payments. Conversely, if the index falls, your ARM rate will decrease, leading to lower monthly payments.

A Home Equity Line of Credit (HELOC) can be a useful way to access funds using your home’s equity. However, it’s important to understand Heloc Rates before taking out a HELOC. Rates can vary significantly based on factors like your credit score and the amount of equity you have in your home.

Advantages and Disadvantages of ARM Rates

ARM rates can offer both advantages and disadvantages, depending on your individual circumstances and financial goals.

Benefits of Choosing an ARM Rate

- Lower Initial Interest Rates:ARM rates typically have lower initial interest rates compared to fixed-rate mortgages, allowing you to potentially save money on your monthly payments during the fixed-rate period.

- Potential for Lower Overall Interest Costs:If interest rates decline during the adjustable period, your ARM rate could adjust downward, resulting in lower interest costs over the life of the loan.

Risks Associated with ARM Rates

- Potential for Rate Increases:If interest rates rise during the adjustable period, your ARM rate could increase, leading to higher monthly payments.

- Payment Shock:A significant increase in your ARM rate could result in a sudden jump in your monthly payments, potentially straining your budget.

- Uncertainty:ARM rates involve uncertainty as you don’t know what your interest rate will be after the fixed-rate period ends.

Scenarios Where an ARM Rate Might Be Suitable

An ARM rate might be a suitable option for you if:

- You plan to stay in your home for a shorter period:If you don’t anticipate living in your home for the full loan term, an ARM rate could be beneficial as you’ll benefit from the lower initial interest rate.

- You expect interest rates to decline:If you believe that interest rates will decrease in the future, an ARM rate could potentially save you money on interest costs.

- You have a strong financial foundation:You should have a solid financial plan in place to handle potential rate increases and payment adjustments.

ARM Rate Trends and Predictions

ARM rates have been historically lower than fixed-rate mortgages, especially during periods of low interest rates. However, recent trends have shown that ARM rates have been increasing along with fixed-rate mortgages, reflecting the Federal Reserve’s efforts to combat inflation.

Looking for a loan with low interest rates? Low Apr Loans can help you save money on interest charges. These loans typically have lower interest rates than traditional loans, making them a good option for borrowers with good credit.

Factors Influencing Future ARM Rate Movements

Future ARM rate movements will be influenced by various factors, including:

- Economic conditions:Inflation, economic growth, and unemployment rates can all impact interest rate movements.

- Federal Reserve policy:The Federal Reserve’s actions, such as raising or lowering interest rates, will directly affect mortgage rates.

- Investor demand:Investor demand for mortgage-backed securities can influence interest rates.

Current Average ARM Rates

As of [current date], the average ARM rates for different loan terms are as follows:

| Loan Term | Average ARM Rate |

|---|---|

| 5/1 ARM | [Average rate] |

| 7/1 ARM | [Average rate] |

| 10/1 ARM | [Average rate] |

Choosing the Right ARM Rate

Choosing the right ARM rate involves careful consideration of your individual financial situation, long-term goals, and risk tolerance.

A Home Loan Pre Approval can give you a clear picture of how much you can borrow before you start shopping for a home. This pre-approval letter can strengthen your offer and make you a more competitive buyer in the real estate market.

Factors to Consider

- Your financial situation:Assess your income, expenses, and debt levels to determine your ability to handle potential rate increases.

- Long-term goals:Consider your plans for your home and how long you intend to stay there.

- Interest rate expectations:Research current interest rate trends and forecasts to make an informed decision about whether an ARM rate aligns with your expectations.

- Loan terms:Compare the fixed-rate period, adjustment frequency, and caps offered by different lenders.

Negotiating an ARM Rate

When negotiating an ARM rate with a lender, it’s important to:

- Shop around:Compare rates and terms from multiple lenders to secure the best deal.

- Negotiate the margin:Aim for a lower margin to minimize the potential for rate increases.

- Understand the caps:Ensure that the adjustment and lifetime caps are reasonable and provide you with adequate protection.

ARM Rate Examples and Case Studies: Arm Rates

Let’s consider a case study to illustrate the potential impact of ARM rate adjustments over time. Suppose you take out a $300,000 mortgage with a 5/1 ARM at an initial interest rate of 3%. Your monthly payments during the fixed-rate period would be [calculate monthly payment].

It’s important to understand Personal Loan Interest Rates before taking out a loan. Interest rates can vary significantly based on factors like your credit score, loan amount, and loan term. It’s crucial to shop around and compare offers from multiple lenders to find the best deal.

Scenario 1: Interest Rates Rise

After the fixed-rate period ends, assume interest rates rise to 5%. Your ARM rate could adjust to 5%, resulting in a new monthly payment of [calculate monthly payment]. This represents a [calculate percentage] increase in your monthly payment.

A 30 Year Mortgage Rate can be a good option for borrowers who want lower monthly payments. However, it’s important to consider the total interest paid over the life of the loan. It’s wise to compare different loan terms and interest rates to determine the best fit for your financial situation.

Scenario 2: Interest Rates Decline

Alternatively, if interest rates decline to 2% after the fixed-rate period, your ARM rate could adjust to 2%, leading to a new monthly payment of [calculate monthly payment]. This represents a [calculate percentage] decrease in your monthly payment.

Knowing the Average 30 Year Mortgage Rate Today can help you understand the current market conditions. Rates can fluctuate daily, so it’s important to stay informed about current trends. This knowledge can help you make informed decisions about your home financing options.

Real-World Examples

Many homeowners have successfully used ARM rates to their advantage, particularly during periods of low interest rates. For example, a homeowner who took out a 7/1 ARM in 2010 benefited from the low initial interest rate, saving money on their monthly payments during the fixed-rate period.

However, when interest rates rose in 2017, their ARM rate adjusted upward, leading to higher monthly payments. They ultimately decided to refinance their loan to a fixed-rate mortgage to secure predictable payments.

End of Discussion

Arm Rates, with their fluctuating interest rates, present a compelling alternative to fixed-rate mortgages. While offering the potential for lower initial payments, they also carry the risk of future rate increases. By understanding the factors that influence Arm Rates, carefully assessing your financial situation, and considering your long-term goals, you can determine whether this type of mortgage aligns with your needs.

Arm Rates can be a powerful tool for savvy homeowners, but they require careful planning and a clear understanding of the potential implications.

Essential FAQs

What is the typical fixed-rate period for an ARM?

Common fixed-rate periods for ARMs range from 5 to 10 years, after which the interest rate adjusts.

How often do ARM rates adjust?

ARM rates typically adjust annually or every six months, depending on the loan terms.

What is the difference between an ARM and a fixed-rate mortgage?

A fixed-rate mortgage has a constant interest rate throughout the loan term, while an ARM’s interest rate can change based on market conditions.

Are ARM rates always lower than fixed-rate mortgages?

While ARMs often start with lower rates, they can increase over time, potentially leading to higher monthly payments.