Are there any penalties for exceeding the Roth IRA contribution limit in 2024? This question is on the minds of many individuals looking to maximize their retirement savings. While the Roth IRA offers tax-free withdrawals in retirement, exceeding the contribution limit can lead to unexpected consequences, including penalties and potential tax liabilities.

Understanding the rules and regulations surrounding Roth IRA contributions is crucial for avoiding these pitfalls.

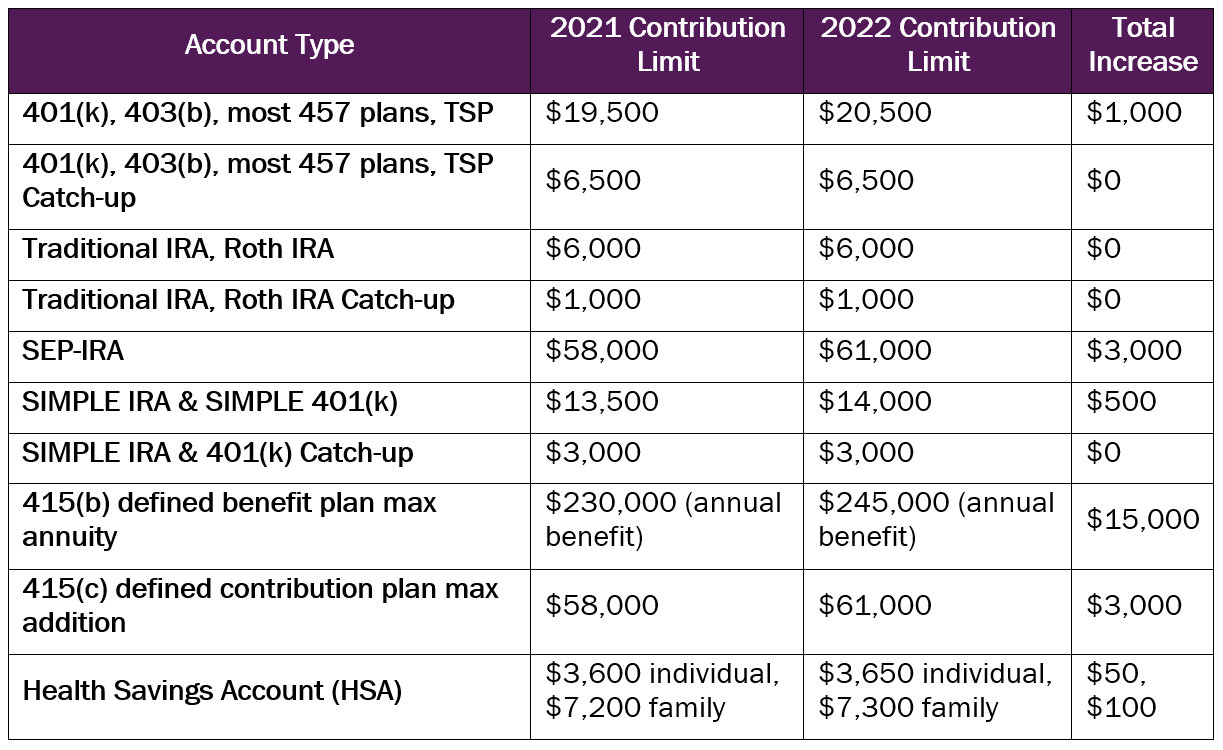

The Internal Revenue Service (IRS) sets annual contribution limits for Roth IRAs, which are designed to ensure fair and equitable treatment for all taxpayers. These limits are adjusted periodically to account for inflation and other economic factors. In 2024, the maximum contribution limit for individuals under age 50 is $6,500.

Individuals aged 50 and over can contribute an additional $1,000, bringing their total contribution limit to $7,500. However, exceeding these limits can result in penalties, making it essential to carefully track contributions and ensure compliance with IRS regulations.

Roth IRA Contribution Limits in 2024

The Roth IRA is a popular retirement savings plan that allows you to contribute after-tax dollars, which grow tax-free. However, there are contribution limits and income limitations to be aware of. Here’s a breakdown of the Roth IRA contribution limits for 2024.

Contribution Limits

The maximum contribution amount for a Roth IRA in 2024 is $7,000. This means that you can contribute up to $7,000 to your Roth IRA during the year. If you are 50 years of age or older, you can contribute an additional $1,000, bringing your total contribution limit to $8,000.

Age and Contribution Limits

The Roth IRA contribution limit is the same for everyone, regardless of age. This means that individuals of any age can contribute the maximum amount, which is $7,000 in 2024. However, the age limit for Roth IRA contributions is 72 years.

Saving for retirement is important, and a 401(k) plan is a great way to do it. But you need to know the limits on how much you can contribute each year. The 2024 401(k) contribution limits for employees can be found on the Aksi website.

Understanding these limits will help you plan your retirement savings effectively.

This means that individuals who are 72 years of age or older can no longer contribute to a Roth IRA.

Missing the October 2024 deadline for your taxes can result in penalties. It’s important to be aware of these penalties and file your taxes on time. You can find information on the tax penalties for missing the October 2024 deadline on the Aksi website.

This information will help you avoid any unnecessary financial burdens.

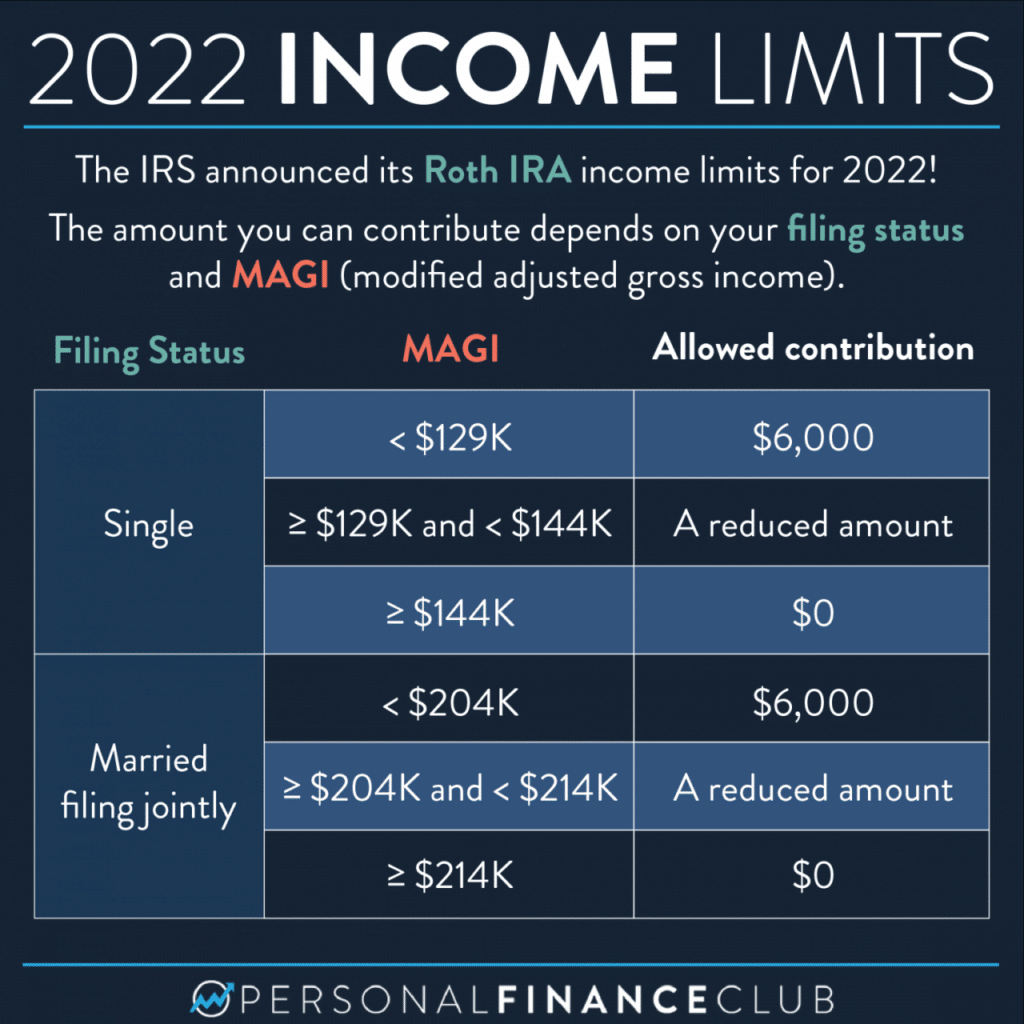

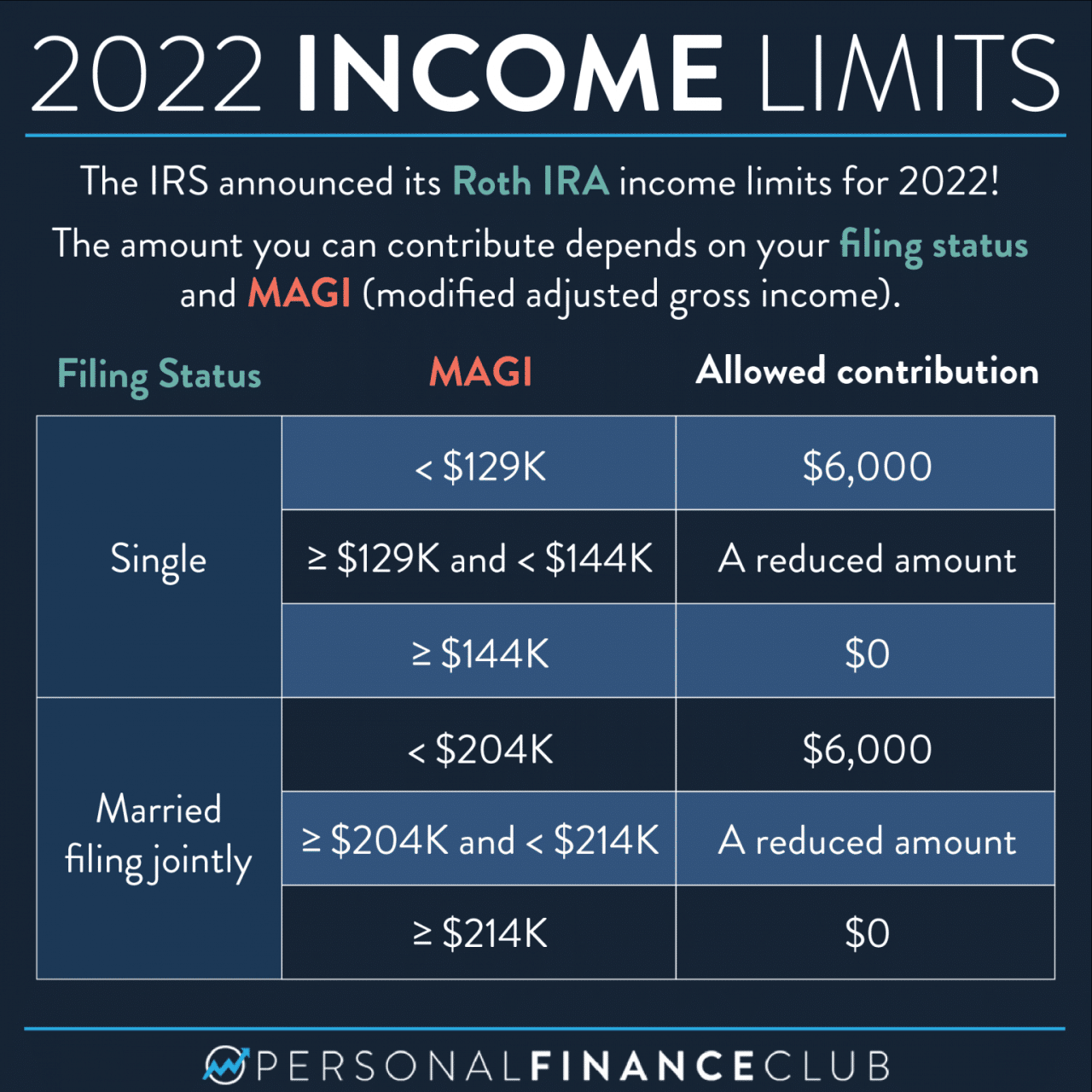

Income Limitations

While there is no age limit on Roth IRA contributions, there are income limitations that may prevent you from contributing the full amount or contributing at all. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may be phased out of contributing to a Roth IRA.

Tax brackets change from year to year. To stay up-to-date, you can use a tax calculator to determine your tax liability based on the latest tax brackets. The tax calculator for October 2024 on the Aksi website can help you understand your tax situation based on the latest tax brackets.

The 2024 income limitations for Roth IRA contributions are as follows:

| Filing Status | Phase-Out Begins | Phase-Out Ends |

|---|---|---|

| Single | $153,000 | $168,000 |

| Married Filing Jointly | $228,000 | $248,000 |

| Head of Household | $189,000 | $214,000 |

If your MAGI falls within the phase-out range, you can contribute a reduced amount to your Roth IRA. For example, if you are single and your MAGI is $158,000, you can only contribute a portion of the $7,000 limit. You will need to use the IRS’s contribution limit calculator to determine the exact amount you can contribute.

If your MAGI exceeds the phase-out limit, you will not be able to contribute to a Roth IRA.

If you’re planning to contribute to a traditional 401(k) plan, you’ll need to know the contribution limits. The 401(k) contribution limits for 2024 for traditional 401(k) can be found on the Aksi website. This information will help you make informed decisions about your retirement savings.

Penalties for Exceeding the Limit

If you contribute more than the Roth IRA contribution limit in 2024, you’ll face penalties. These penalties apply to the excess contribution amount, and they can be substantial. Understanding these penalties is crucial to avoid unnecessary financial burdens.

If you’re a student, you may be eligible for a standard deduction on your taxes. The amount of the deduction can vary depending on your circumstances. You can find information on the standard deduction for students in 2024 on the Aksi website.

This information can help you understand your tax obligations as a student.

Penalty Calculation

The penalty for exceeding the Roth IRA contribution limit in 2024 is a 6% excise tax on the excess contribution. This penalty applies each year the excess amount remains in the account. The penalty is calculated on the excess amount at the end of each tax year.

For example, if you contribute $7,000 to your Roth IRA in 2024, but the limit is $6,500, you’ll be penalized on the $500 excess contribution.

The standard deduction is an amount you can subtract from your taxable income. The amount of the standard deduction can vary each year. You can find the standard deduction for 2024 on the Aksi website. Knowing the standard deduction can help you understand your tax obligations.

The penalty is calculated as 6% of the excess contribution amount.

If you’re self-employed, you can contribute to a 401(k) plan. However, the contribution limits are different for self-employed individuals. You can find the 401(k) contribution limits for 2024 for self-employed on the Aksi website. This information is crucial for planning your retirement savings as a self-employed individual.

The penalty is typically paid when you file your tax return. The IRS may also assess interest on the underpayment of taxes, depending on the amount of the penalty and the time it takes to pay.

If you’re over 50, you might be eligible for catch-up contributions to your 401(k) plan. These allow you to save more for retirement, but it’s important to understand the limits. You can find the 2024 401(k) limits for catch-up contributions on the Aksi website.

This information can help you make informed decisions about your retirement savings.

Consequences of Exceeding the Limit

Exceeding the Roth IRA contribution limit can have serious consequences, including:

- Tax Implications:You’ll be subject to the 6% excise tax on the excess contribution, as explained above. This tax is in addition to any other taxes you may owe on your income.

- Potential IRS Audits:The IRS may audit your tax return if they suspect you have exceeded the Roth IRA contribution limit. This can be a time-consuming and stressful process.

- Account Growth Impact:The excess contribution may be subject to penalties and may not grow as quickly as the rest of your Roth IRA account. This is because you may have to withdraw the excess amount, potentially incurring taxes and penalties.

Common Scenarios and Examples

It’s important to understand the various scenarios where exceeding the Roth IRA contribution limit might occur, as well as the potential consequences. This knowledge helps you avoid penalties and ensures your retirement savings strategy remains on track.

Planning your finances for the year ahead? It’s a good idea to understand how your income will be taxed. You can use a tax bracket calculator to figure out what your tax liability will be. A useful tool for this is the 2024 tax bracket calculator which can help you understand your tax situation based on your income level.

Scenarios of Exceeding the Roth IRA Contribution Limit

Here’s a table illustrating some common scenarios where you might exceed the Roth IRA contribution limit, along with the potential penalties:

| Scenario | Amount Exceeded | Penalty | Other Details |

|---|---|---|---|

| Incorrect Calculation | $1,000 | 10% of the excess contribution ($100) plus any earnings on the excess amount. | This could happen if you mistakenly overestimate your income or underestimate the contribution limit. |

| Change in Income | $2,000 | 10% of the excess contribution ($200) plus any earnings on the excess amount. | If your income increases during the year, you might exceed the limit even if you initially contributed within the allowed range. |

| Multiple Contributions | $500 | 10% of the excess contribution ($50) plus any earnings on the excess amount. | If you contribute to multiple Roth IRAs, ensure you don’t exceed the total limit across all accounts. |

Examples of Exceeding the Roth IRA Contribution Limit

Let’s look at some real-life examples to illustrate how exceeding the limit might occur:* Mistake in Calculation:Imagine you’re self-employed and your income fluctuates. You might estimate your income for the year to be lower than it actually turns out to be. As a result, you contribute the full $6,500 to your Roth IRA, but your actual income exceeds the limit for eligible contributions.

The amount you can contribute to your 401(k) plan each year depends on your age. The 2024 401(k) contribution limits for all ages are available on the Aksi website. Knowing these limits will help you plan your retirement savings strategy.

This could lead to an excess contribution.

Change in Income

The Roth IRA is a great retirement savings option, but there are income limits to qualify. The Roth IRA income limits for 2024 can be found on the Aksi website. Understanding these limits will help you determine if you are eligible for a Roth IRA.

You’re employed full-time and earn a salary that qualifies you for the full Roth IRA contribution. However, you receive a significant bonus later in the year, pushing your income above the limit. Even though you contributed within the limit initially, the bonus could result in exceeding the limit for the entire year.

If you’re a sole proprietor, you’ll need to fill out a W9 form for any business transactions. This form provides your tax information to the payer. The W9 form for October 2024 can be found on the Aksi website and is essential for any sole proprietor to have.

Multiple Contributions

You contribute the maximum amount to your Roth IRA at work. You also open a separate Roth IRA and contribute to it, unaware that the combined contributions exceed the annual limit.These examples highlight the importance of carefully tracking your income and contributions to avoid exceeding the Roth IRA limit.

It’s always a good idea to consult with a financial advisor to ensure you’re contributing within the appropriate limits and maximizing your retirement savings.

The Roth IRA is a popular retirement savings option because it allows you to withdraw your earnings tax-free in retirement. But there are limits on how much you can contribute each year. The Roth IRA contribution limit for 2024 can be found on the Aksi website.

This information is important for maximizing your retirement savings.

Avoiding Penalties

Staying within the Roth IRA contribution limits is crucial to avoid penalties. The IRS imposes penalties on individuals who exceed these limits, and it’s essential to understand the rules and strategies for managing contributions effectively.

Understanding Contribution Limits

The IRS sets annual contribution limits for Roth IRAs. These limits are adjusted periodically to account for inflation. It’s crucial to be aware of the current limits and plan your contributions accordingly.

The contribution limits for IRAs can change from year to year. It’s important to stay up-to-date on these limits. The IRA contribution limits for 2024 vs 2023 can be found on the Aksi website. Understanding these limits will help you plan your retirement savings effectively.

- Contribution Limits:The annual contribution limit for 2024 is $6,500 for individuals under age 50. Individuals aged 50 and older can contribute an additional $1,000 as a “catch-up” contribution, bringing their total limit to $7,500.

- Income Limits:There are income limitations for contributing to a Roth IRA. For 2024, if your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA, or your contributions may be phased out.

The income limits are $153,000 for single filers and $228,000 for married couples filing jointly.

Strategies for Managing Contributions, Are there any penalties for exceeding the Roth IRA contribution limit in 2024

Here are some strategies for managing Roth IRA contributions effectively and avoiding penalties:

- Track Your Contributions:Keep accurate records of your Roth IRA contributions throughout the year. This includes contributions from all sources, such as direct deposits, rollovers, and transfers. This will help you stay informed about your total contributions and avoid exceeding the limit.

It’s important to stay within the contribution limits for your IRA. Exceeding these limits can lead to penalties. The penalties for exceeding IRA contribution limits can be significant, so it’s crucial to be aware of them.

- Consider a Contribution Schedule:Divide your contributions into smaller amounts throughout the year, making regular contributions. This can help you avoid making a large lump-sum contribution that might exceed the limit.

- Adjust Contributions for Income Changes:If your income changes during the year, adjust your contribution amount accordingly. For example, if you receive a raise or bonus, you may need to reduce your contributions to stay within the limit.

Seeking Professional Guidance

While these strategies can help, it’s always advisable to seek professional guidance from a tax advisor or financial planner. They can provide personalized advice based on your individual circumstances and help you navigate the complexities of Roth IRA contributions.

- Tax Advisor:A tax advisor can provide guidance on tax implications related to Roth IRA contributions and help you avoid potential penalties.

- Financial Planner:A financial planner can help you develop a comprehensive financial plan that includes Roth IRA contributions, taking into account your goals, risk tolerance, and time horizon.

Consequences of Exceeding the Limit

Exceeding the Roth IRA contribution limit can have serious financial consequences, including potential tax liabilities and penalties. The IRS considers any amount exceeding the limit as an overcontribution, and it can result in significant financial penalties and even limit your future contributions.

Understanding these consequences and the steps to correct them is crucial for ensuring the success of your Roth IRA.

Tax Penalties and Interest

If you exceed the Roth IRA contribution limit, you may be subject to a 6% excise tax on the excess contribution. This tax applies to the excess amount, and it’s calculated annually. The tax is assessed for each year the excess amount remains in the account.

In addition to the excise tax, you may also be subject to interest on the excess contribution, which can further increase your tax liability.

The IRS considers any amount exceeding the Roth IRA contribution limit as an overcontribution, and it can result in significant financial penalties and even limit your future contributions.

Correcting an Overcontribution

There are two primary ways to correct an overcontribution:

- Withdraw Excess Funds:You can withdraw the excess contribution, including any earnings on the excess amount, from your Roth IRA. This withdrawal is considered a tax-free return of contributions, and it can help you avoid the 6% excise tax. However, it is important to note that withdrawing excess funds may also impact your future contributions.

- Request a Waiver from the IRS:In some cases, you may be able to request a waiver from the IRS for the 6% excise tax on the excess contribution. This waiver is typically granted if the overcontribution was due to a reasonable error or mistake, such as a miscalculation or a change in your circumstances.

Impact on Future Contributions

Exceeding the Roth IRA contribution limit can also impact your ability to make contributions in subsequent years. If you have an overcontribution, the IRS may limit your ability to contribute to a Roth IRA in the following year. You will not be able to contribute to a Roth IRA until you have corrected the overcontribution and removed the excess amount from your account.

The IRS may limit your ability to contribute to a Roth IRA in the following year if you have an overcontribution.

Closing Notes: Are There Any Penalties For Exceeding The Roth IRA Contribution Limit In 2024

Navigating the complexities of Roth IRA contribution limits and potential penalties can be challenging. However, by understanding the rules, carefully tracking contributions, and seeking professional guidance when needed, individuals can maximize their retirement savings while minimizing the risk of penalties.

Remember, a little planning and attention to detail can go a long way in ensuring a secure and comfortable retirement.

Commonly Asked Questions

What happens if I accidentally overcontribute to my Roth IRA?

If you overcontribute to your Roth IRA, you have a few options. You can withdraw the excess contribution before the tax filing deadline (including extensions) to avoid penalties. Alternatively, you can request a waiver from the IRS if you meet certain criteria.

Can I still contribute to a Roth IRA if I’m over the income limit?

While you can’t contribute directly to a Roth IRA if you exceed the income limit, you may be eligible to convert a traditional IRA to a Roth IRA. Consult with a tax advisor to determine your eligibility.

Are there any exceptions to the Roth IRA contribution limit?

There are no exceptions to the Roth IRA contribution limit, but there are different contribution limits based on age and income. Always refer to the latest IRS guidelines for the most up-to-date information.