Applying for a Stimulus Check by Mail in California can be a straightforward process if you understand the requirements and follow the steps carefully. This guide will walk you through the process of applying for the California stimulus check by mail, covering eligibility criteria, necessary documents, application procedures, and important considerations for successful submission.

The California stimulus check program aims to provide financial relief to eligible residents. To be eligible, you must meet certain income requirements and reside in California. The application process involves completing a form, gathering necessary documents, and mailing it to the designated address.

You also will receive the benefits of visiting Residency Requirements for Stimulus Checks in NY & CA today.

This guide will provide detailed information and tips to ensure a smooth application process.

Eligibility for California Stimulus Check

The California stimulus check, officially known as the Golden State Stimulus, is a one-time payment designed to provide financial relief to eligible residents. To qualify for this payment, you must meet specific criteria related to your income and residency status.

Income Limits and Qualifications

The eligibility for the California stimulus check is based on your adjusted gross income (AGI) reported on your 2020 federal tax return. The income limits vary depending on your filing status:

- Single filers:AGI must be $75,000 or less.

- Head of household:AGI must be $112,500 or less.

- Married filing jointly:AGI must be $150,000 or less.

In addition to income limits, you must also meet the following requirements:

- You must have been a California resident for at least half of 2020.

- You must have filed a 2020 California tax return.

- You must not be claimed as a dependent on someone else’s tax return.

Examples of Qualifying Individuals and Families

Here are some examples of individuals and families who might qualify for the California stimulus check:

- A single parent with an AGI of $70,000 who filed a California tax return in 2020.

- A married couple filing jointly with an AGI of $140,000 who were California residents for at least half of 2020.

Applying for the Stimulus Check by Mail

If you are eligible for the California stimulus check and did not receive it automatically, you can apply by mail. This process involves completing an application form and submitting it to the California Franchise Tax Board (FTB).

Required Documents for the Application

To complete the application, you will need the following documents:

- Your 2020 federal tax return (Form 1040 or equivalent).

- Your 2020 California tax return (Form 540 or equivalent).

- A valid form of identification, such as a driver’s license or passport.

- Your Social Security number.

Step-by-Step Guide for Applying by Mail

- Download the application form:Visit the California Franchise Tax Board website and download the Golden State Stimulus application form.

- Complete the form:Carefully fill out all sections of the form, providing accurate information from your tax returns and identification documents.

- Sign and date the form:Sign and date the application form in the designated areas.

- Gather supporting documents:Make copies of your tax returns, identification, and any other required documents.

- Mail the application:Send the completed application form and supporting documents to the address provided on the form.

Understanding the Application Form

The California stimulus check application form is designed to gather essential information from eligible applicants. The form is structured into distinct sections, each requesting specific details.

Key Sections of the Application Form

The application form typically includes the following sections:

- Personal Information:This section collects your name, address, Social Security number, and other identifying details.

- Income Information:This section asks for your adjusted gross income (AGI) from your 2020 federal tax return.

- Residency Information:This section verifies your residency status in California for at least half of 2020.

- Tax Return Information:This section requests information about your 2020 California tax return, such as the filing status and the tax year.

- Declaration and Signature:This section requires you to certify the accuracy of the information provided and sign and date the application.

Purpose of Each Question

Each question on the application form serves a specific purpose, ensuring that the California Franchise Tax Board can accurately verify your eligibility for the stimulus check. The questions are designed to gather information related to your income, residency, and tax filing status, which are key factors in determining your eligibility.

Important Considerations for Mailing the Application

When mailing your application for the California stimulus check, it is crucial to ensure that it is sent to the correct address and packaged appropriately to prevent delays or loss.

Notice Stimulus Checks Application Process in California for recommendations and other broad suggestions.

Proper Mailing Address

The application form will provide the specific mailing address for submitting your application. It is essential to use this address to ensure that your application reaches the California Franchise Tax Board promptly.

Packaging and Labeling the Envelope

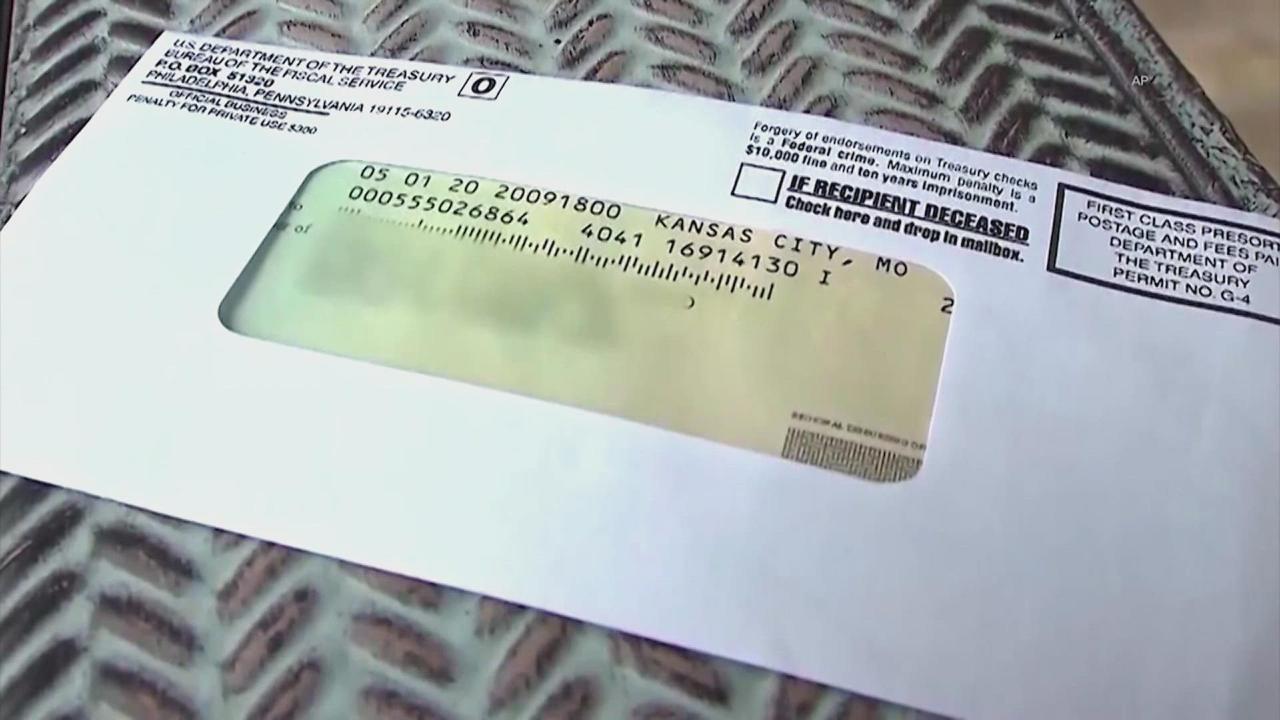

To protect your application and supporting documents, it is recommended to use a sturdy envelope. Clearly label the envelope with your name, address, and the return address. Use a tracking service, such as certified mail or registered mail, to ensure that the application is delivered and to provide proof of delivery.

Tips for Timely Delivery, Applying for a Stimulus Check by Mail in California

To ensure timely delivery of your application, consider the following tips:

- Mail the application early, leaving ample time for it to reach the California Franchise Tax Board before the deadline.

- Use a reliable mailing service and track the delivery status of your application.

- Keep a copy of the application and supporting documents for your records.

Tracking the Application Status

Once you have mailed your application for the California stimulus check, you can track its status to stay informed about its processing progress. The California Franchise Tax Board provides various methods for tracking your application.

Methods for Tracking the Application Status

- Online portal:The California Franchise Tax Board website may offer an online portal where you can track your application status using your Social Security number or other identifying information.

- Phone call:You can contact the California Franchise Tax Board by phone to inquire about the status of your application.

- Email:Some government agencies may offer email updates on the status of your application.

Timeline for Processing and Receiving the Stimulus Check

The processing time for stimulus check applications can vary depending on the volume of applications received and other factors. The California Franchise Tax Board may provide an estimated timeline for processing and receiving your stimulus check. However, it is advisable to be patient and allow sufficient time for processing.

Potential Delays and How to Address Them

There may be potential delays in processing your application. These delays could be due to factors such as incomplete or inaccurate information, a high volume of applications, or unforeseen circumstances. If you experience delays, you can contact the California Franchise Tax Board to inquire about the reason for the delay and to obtain updates on the status of your application.

Alternative Methods for Applying

Besides applying by mail, there may be other methods available for applying for the California stimulus check. These alternative methods can offer different advantages and disadvantages compared to applying by mail.

Comparison of Application Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Convenient for those without internet access or who prefer traditional methods. | Can take longer to process compared to online methods. | |

| Online | Faster processing time, typically within a few days. | Requires internet access and may not be suitable for everyone. |

| Phone Call | Provides immediate assistance and allows for clarification of any questions. | May have long wait times and limited availability. |

Frequently Asked Questions (FAQs): Applying For A Stimulus Check By Mail In California

| Question | Answer |

|---|---|

| What if I did not file a California tax return in 2020? | If you did not file a California tax return in 2020, you may not be eligible for the stimulus check. However, you can contact the California Franchise Tax Board to inquire about potential exceptions or alternative options. |

| What if I received a partial stimulus check? | If you received a partial stimulus check, you may be eligible for the remaining amount. You can apply by mail or through other available methods to claim the remaining payment. |

| How long will it take to receive the stimulus check? | The processing time for stimulus check applications can vary. The California Franchise Tax Board may provide an estimated timeline, but it is advisable to allow sufficient time for processing. |

| What if I am experiencing difficulties with the application process? | If you are facing difficulties with the application process, you can contact the California Franchise Tax Board for assistance. They can provide guidance, answer questions, and help you resolve any issues. |

Additional Resources and Support

For further information and assistance related to the California stimulus check, you can access various resources and support options.

Relevant Government Websites and Contact Details

The California Franchise Tax Board website provides comprehensive information about the Golden State Stimulus, including eligibility requirements, application procedures, and frequently asked questions. You can also contact the California Franchise Tax Board by phone or email for assistance.

Helpful Resources for Guidance and Assistance

There are numerous organizations and websites that offer guidance and support for individuals seeking information about government programs and financial assistance. These resources can provide valuable information and resources to help you navigate the application process and understand your eligibility.

Support Options for Individuals Facing Difficulties

If you are facing difficulties with the application process or need assistance with financial matters, there are organizations and programs that can provide support. These organizations can offer guidance, financial assistance, and other resources to help you overcome challenges and access the support you need.

Notice Long-Term Implications of the Stimulus Check Program for recommendations and other broad suggestions.

Concluding Remarks

Applying for a stimulus check by mail in California is a process that requires careful attention to detail and adherence to specific guidelines. By understanding the eligibility criteria, gathering necessary documents, and following the application steps Artikeld in this guide, you can increase your chances of receiving your stimulus check.

Remember to track your application status and address any potential delays promptly to ensure a successful outcome.

Remember to click Common Misconceptions About Stimulus Check Eligibility to understand more comprehensive aspects of the Common Misconceptions About Stimulus Check Eligibility topic.

Essential Questionnaire

What if I don’t have access to a printer to print the application form?

Do not overlook the opportunity to discover more about the subject of Stimulus Check Program and the Upcoming Election.

You can request a paper application form by calling the California Franchise Tax Board at (800) 852-5711.

For descriptions on additional topics like Stimulus Check Program and Consumer Spending Trends, please visit the available Stimulus Check Program and Consumer Spending Trends.

Can I apply for the stimulus check online?

Yes, you can apply for the stimulus check online through the California Franchise Tax Board’s website. However, if you prefer to apply by mail, this guide will provide detailed instructions.

What happens if I miss the deadline to apply for the stimulus check?

The deadline for applying for the stimulus check is [insert deadline date]. If you miss the deadline, you will not be eligible to receive the check.

What if I need assistance with the application process?

You can contact the California Franchise Tax Board at (800) 852-5711 for assistance with the application process. You can also find helpful resources and information on their website.