Apply For Small Business Loan November 2024: Your Guide to Funding. Navigating the world of small business loans can feel like a maze, especially with the ever-changing landscape of lending options. This guide aims to illuminate the path, providing insights into the various loan types, eligibility requirements, and essential factors to consider when seeking funding for your venture.

Whether you’re a seasoned entrepreneur or just starting out, understanding the nuances of small business loans is crucial for securing the financial resources you need to thrive. From SBA loans to conventional financing and online lending platforms, we’ll explore the pros and cons of each option, empowering you to make informed decisions about your funding strategy.

Introduction to Small Business Loans

Small business loans are a vital source of funding for entrepreneurs and established businesses alike. These loans can provide the financial resources needed to start, grow, or sustain a business, enabling entrepreneurs to pursue their dreams and businesses to achieve their goals.

Finish your research with information from Small Business Loan Company November 2024.

Types of Small Business Loans

Small business loans come in various forms, each designed to meet specific needs and circumstances. Here’s a breakdown of some common types:

- Term Loans:These are traditional loans with fixed interest rates and repayment terms. They offer a predictable payment schedule and are often used for long-term investments like equipment purchases or real estate.

- Lines of Credit:Lines of credit provide flexible access to funds as needed, similar to a credit card. Businesses can draw on the line of credit up to a pre-approved limit and pay interest only on the amount used.

- SBA Loans:Backed by the Small Business Administration (SBA), these loans offer favorable terms, including lower interest rates and longer repayment periods. They are typically offered by banks and credit unions that participate in the SBA program.

Key Features of Small Business Loans

The following table summarizes the key features of different types of small business loans:

| Loan Type | Loan Amount | Interest Rates | Repayment Terms | Eligibility Requirements | Typical Uses |

|---|---|---|---|---|---|

| Term Loans | $5,000 to $5 million+ | Variable or fixed, depending on the lender and loan terms | 5 to 25 years | Good credit history, strong financial statements, collateral may be required | Equipment purchases, real estate, business expansion, debt consolidation |

| Lines of Credit | $5,000 to $100,000+ | Variable, based on the prime rate or other benchmarks | Revolving credit, with minimum monthly payments required | Good credit history, strong financial statements, may require collateral | Working capital, seasonal expenses, inventory financing |

| SBA Loans | $500 to $5 million+ | Typically lower than conventional loans | Up to 25 years | Good credit history, strong business plan, collateral may be required, SBA eligibility criteria must be met | Start-up costs, expansion, equipment purchases, working capital |

Purpose of Small Business Loans

Small business loans are essential for entrepreneurs and existing businesses seeking to achieve various financial goals.

- Starting a New Business:Loans can provide the initial capital needed to cover start-up costs, such as rent, inventory, and marketing expenses.

- Expanding an Existing Business:Loans can help businesses expand their operations by opening new locations, adding product lines, or investing in new technologies.

- Purchasing Equipment or Inventory:Loans can finance the purchase of essential equipment or inventory, enabling businesses to improve efficiency or meet increased demand.

- Covering Operating Expenses:Loans can provide short-term financing to cover operating expenses, such as payroll, rent, and utilities, during periods of financial strain.

- Managing Cash Flow:Loans can help businesses manage cash flow by providing a source of working capital to bridge gaps between income and expenses.

- Refinancing Existing Debt:Loans can be used to refinance existing debt at lower interest rates, reducing monthly payments and freeing up cash flow.

Common Uses for Small Business Loans

Small business loans are versatile tools that can be used for a wide range of purposes, including:

- Expansion:A bakery might use a loan to open a second location or expand its product line to include cakes and pastries.

- Equipment Purchase:A landscaping company might use a loan to purchase a new truck and trailer to expand its services and reach more clients.

- Working Capital:A retail store might use a loan to cover seasonal expenses, such as inventory purchases during the holiday season, or to manage cash flow during periods of slow sales.

Understanding Small Business Loan Options in November 2024: Apply For Small Business Loan November 2024

Securing a small business loan can be a crucial step for entrepreneurs looking to expand, invest in new equipment, or manage cash flow. With a variety of loan options available, understanding the different types, eligibility requirements, interest rates, and repayment terms is essential for making an informed decision.

This guide will provide a comprehensive overview of small business loan options in November 2024, empowering you to navigate the lending landscape effectively.

You also can investigate more thoroughly about Loan For Small Business Owners October 2024 to enhance your awareness in the field of Loan For Small Business Owners October 2024.

Types of Small Business Loans

This section explores the diverse range of small business loans available, categorized into SBA loans, conventional loans, and online loans. Each category offers distinct features and benefits, catering to specific business needs and financial situations.

SBA Loans

The Small Business Administration (SBA) provides a range of loan programs designed to support small businesses. These programs offer favorable terms, including lower interest rates and longer repayment periods, making them an attractive option for many entrepreneurs.

- 7(a) Loans: This is the most common SBA loan program, offering flexible financing for various business purposes, including working capital, equipment purchases, and real estate acquisition. 7(a) loans typically have a maximum loan amount of $5 million, with interest rates determined by market conditions and the borrower’s creditworthiness.

The repayment term can extend up to 25 years, providing a longer timeframe to manage debt.

- 504 Loans: Specifically designed for fixed assets, such as land, buildings, and machinery, 504 loans offer long-term financing with low interest rates. These loans are typically used for expanding facilities, purchasing equipment, or refinancing existing debt. The maximum loan amount for 504 loans is $5.5 million, with a repayment term of up to 25 years.

- Disaster Loans: In the event of a natural disaster or other unforeseen circumstances, SBA disaster loans provide financial assistance to businesses affected by the event. These loans can be used to cover losses related to property damage, inventory, and other business expenses.

The maximum loan amount for disaster loans varies depending on the severity of the disaster and the business’s specific needs.

Eligibility Requirements for SBA Loans

To qualify for an SBA loan, businesses must meet specific eligibility criteria. These requirements typically include:

- Business Size: SBA loans are generally available to small businesses with fewer than 500 employees, depending on the specific industry.

- Industry: While SBA loans are available across a wide range of industries, certain sectors may have specific eligibility requirements or limitations.

- Credit Score: A good credit score is generally required for SBA loans, typically a minimum of 680. However, the SBA may consider borrowers with lower credit scores if they demonstrate strong business performance and a solid repayment history.

- Time in Business: Most SBA loan programs require businesses to have been in operation for at least two years. However, exceptions may be made for startups with strong business plans and experienced management teams.

Interest Rates and Repayment Terms for SBA Loans

SBA loans generally offer competitive interest rates, often lower than conventional loans. The specific interest rate depends on factors such as the loan amount, the borrower’s creditworthiness, and current market conditions. SBA loans can have variable or fixed interest rates, depending on the program and the borrower’s preference.

Remember to click Small Business Loans Florida October 2024 to understand more comprehensive aspects of the Small Business Loans Florida October 2024 topic.

Repayment terms for SBA loans can extend up to 25 years, providing a longer timeframe to manage debt and allowing for more manageable monthly payments.

Conventional Loans

Banks and credit unions offer a range of conventional small business loans, providing financing for various business purposes. These loans are typically based on the borrower’s creditworthiness, revenue, and cash flow.

- Term Loans: Term loans provide a fixed amount of money with a predetermined repayment schedule, typically with a fixed interest rate. These loans are commonly used for working capital, equipment purchases, or real estate acquisition.

- Lines of Credit: Lines of credit offer a flexible financing option, allowing businesses to borrow funds as needed, up to a predetermined credit limit. These loans are ideal for managing cash flow fluctuations, covering seasonal expenses, or funding short-term projects.

- Equipment Financing: Equipment financing specifically caters to the purchase of machinery, vehicles, or other equipment. These loans typically have a fixed interest rate and a repayment term that aligns with the asset’s useful life.

Eligibility Requirements for Conventional Loans

Conventional loans generally have stricter eligibility requirements than SBA loans, emphasizing factors such as revenue, cash flow, and collateral.

- Revenue and Cash Flow: Banks and credit unions typically require businesses to demonstrate a consistent revenue stream and healthy cash flow to qualify for a conventional loan.

- Collateral: Collateral is often required for conventional loans, providing the lender with security in case of default. This can include assets such as real estate, equipment, or inventory.

- Credit Score: A good credit score is essential for conventional loans, typically a minimum of 680.

- Time in Business: Banks and credit unions often require businesses to have been in operation for at least two years to qualify for a conventional loan.

Interest Rates and Repayment Terms for Conventional Loans

Interest rates for conventional loans are generally higher than SBA loans, reflecting the increased risk associated with these loans. The specific interest rate depends on the loan amount, the borrower’s creditworthiness, and market conditions. Conventional loans can have variable or fixed interest rates, depending on the lender’s policies and the borrower’s preference.

Repayment terms for conventional loans are typically shorter than SBA loans, ranging from five to ten years.

Online Loans

The rise of online lending platforms has revolutionized the small business loan market, offering alternative financing options beyond traditional banks and credit unions. These platforms often have more flexible eligibility requirements and faster approval processes.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual investors who provide loans. These platforms often have lower interest rates than traditional lenders, but they may have stricter eligibility requirements.

- Alternative Lenders: Alternative lenders are non-bank financial institutions that provide small business loans. These lenders often have more flexible eligibility requirements than banks and credit unions, but they may have higher interest rates.

Eligibility Requirements for Online Loans

Online lenders often have more flexible eligibility requirements than traditional lenders, making them an attractive option for businesses that may not meet the strict criteria of banks and credit unions.

- Credit Score: Online lenders typically have lower minimum credit score requirements than banks and credit unions, often accepting borrowers with credit scores as low as 600.

- Time in Business: Some online lenders may be willing to lend to businesses that have been in operation for less than two years, making them an option for startups.

- Revenue and Cash Flow: Online lenders often consider factors such as revenue and cash flow, but their requirements may be less stringent than those of traditional lenders.

Interest Rates and Repayment Terms for Online Loans

Interest rates for online loans can vary significantly, depending on the platform, the borrower’s creditworthiness, and the loan amount. Online lenders often have higher interest rates than traditional lenders, reflecting the higher risk associated with these loans. Repayment terms for online loans are typically shorter than those of SBA or conventional loans, ranging from one to five years.

Comparison of Loan Features

To provide a clear understanding of the different loan options, the following table compares key features of SBA loans, conventional loans, and online loans. This comparison highlights the unique characteristics of each loan type, enabling businesses to identify the most suitable option for their specific needs.

For descriptions on additional topics like Small Business Business Loan October 2024, please visit the available Small Business Business Loan October 2024.

| Loan Type | Loan Amount | Repayment Terms | Interest Rates | Fees | Eligibility Requirements |

|---|---|---|---|---|---|

| SBA 7(a) Loan | $50,000

|

Up to 25 years | Variable or fixed | 1%

|

Minimum credit score of 680, time in business of 2 years, specific industry requirements |

| SBA 504 Loan | $50,000

|

Up to 25 years | Fixed | 2%

|

Minimum credit score of 680, time in business of 2 years, specific industry requirements |

| Conventional Loan | $50,000

|

Up to 10 years | Variable or fixed | 1%

|

Minimum credit score of 680, time in business of 2 years, specific industry requirements |

| Online Loan | $1,000

|

Up to 5 years | Variable or fixed | 1%

Check what professionals state about California Loans For Small Business October 2024 and its benefits for the industry.

|

Minimum credit score of 600, time in business of 1 year, specific industry requirements |

3. Eligibility Requirements for Small Business Loans

Securing a small business loan is a crucial step for many entrepreneurs and business owners. To qualify for a loan, lenders typically evaluate various factors to assess the borrower’s creditworthiness and the viability of the business.

Understanding these eligibility requirements is essential for increasing the chances of loan approval.

Credit Score

A strong credit score is a fundamental requirement for obtaining a small business loan. Lenders use credit scores to assess the borrower’s financial responsibility and their ability to repay debt.

| Eligibility Criteria | Explanation | Tips for Improvement |

|---|---|---|

| Minimum Credit Score | Lenders typically require a minimum credit score, which can vary depending on the lender and loan type. A score of 680 or higher is generally considered good for small business loans. | Improve your credit score by paying bills on time, reducing credit card balances, and avoiding opening new credit accounts unnecessarily. |

| Factors Affecting Credit Score | Your credit score is based on several factors, including payment history, credit utilization, length of credit history, and types of credit. | Monitor your credit report regularly for errors and dispute any inaccuracies with the credit bureaus. |

| Strategies for Improving Credit Score | Strategies for improving your credit score include paying bills on time, reducing credit card balances, and avoiding opening new credit accounts unnecessarily. | Consider using a credit monitoring service to track your credit score and identify potential issues. |

Business Plan

A well-written business plan is essential for demonstrating the viability of your business to potential lenders. A comprehensive business plan Artikels your business goals, strategies, and financial projections.

- Market Analysis:A thorough market analysis demonstrates your understanding of the target market, industry trends, and competitive landscape. It should include information on market size, growth potential, and target customer demographics.

- Financial Projections:Accurate financial projections, including income statements, cash flow statements, and balance sheets, provide lenders with a clear picture of your business’s financial health and future growth potential.

- Management Team:Lenders want to see a qualified and experienced management team with a proven track record of success. Highlight the skills, expertise, and experience of your key personnel.

Revenue History

Lenders typically require evidence of consistent revenue to assess the business’s ability to generate cash flow and repay the loan.

Find out about how Set Up A Business October 2024 can deliver the best answers for your issues.

- Demonstrating Consistent Revenue:Provide accurate and detailed financial statements, including income statements and cash flow statements, to showcase your revenue history.

- Presenting Financial Statements:Financial statements should be presented in a clear and concise manner, adhering to generally accepted accounting principles (GAAP).

- Improving Revenue History:Focus on increasing sales, expanding your customer base, and optimizing your pricing strategies to improve your revenue history.

Collateral

Collateral is an asset that a borrower pledges to a lender as security for a loan. If the borrower defaults on the loan, the lender can seize the collateral to recover its losses.

- Types of Collateral:Common types of collateral include real estate, equipment, inventory, and accounts receivable.

- Role of Collateral:Collateral reduces the lender’s risk by providing a safety net in case of default. It can also help secure lower interest rates.

- Alternative Options for Securing Funding:If you lack sufficient collateral, consider exploring alternative funding sources, such as SBA loans or crowdfunding platforms.

Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a measure of your debt obligations relative to your income. Lenders use DTI to assess your ability to manage existing debt and make loan payments.

- Significance of DTI:A high DTI can indicate that you are already carrying a significant debt burden, which may make lenders hesitant to approve a loan.

- Acceptable Debt-to-Income Ratios:Acceptable DTI ratios vary depending on the lender, but generally, a DTI below 43% is considered favorable.

- Tips for Managing Debt Effectively:Reduce your debt levels by making extra payments, consolidating debt, and negotiating lower interest rates.

Industry and Business Type

Certain industries or business types may have specific eligibility requirements. For example, lenders may have stricter requirements for businesses in high-risk industries or those with a history of financial instability.

- Specific Eligibility Requirements:Research the specific eligibility requirements for your industry and business type to ensure you meet the lender’s criteria.

- Industry-Specific Regulations:Be aware of any industry-specific regulations or licensing requirements that may impact your loan application.

Time in Business

Lenders often prefer businesses with a proven track record of success. They may be more likely to approve loans for businesses that have been operating for a longer period.

- Demonstrating Business Longevity:Provide evidence of your business’s longevity, including tax returns, financial statements, and business licenses.

- Addressing Challenges Related to Startup Businesses:If you are a startup business, consider seeking funding from angel investors, venture capitalists, or crowdfunding platforms.

4. Finding the Right Lender for Your Business

Securing the right lender is crucial for your small business’s success. The lender you choose will directly impact the loan terms, interest rates, and overall cost of borrowing.

Understanding Loan Sources

A diverse range of lenders cater to small businesses, each with its own strengths and weaknesses.

- Traditional Banks:These institutions often have a reputation for stability and offer a wide range of loan products, including term loans and lines of credit. They tend to have stricter lending criteria and may require a strong credit history and collateral.

Typical loan amounts range from $50,000 to $5 million, with interest rates varying based on factors like creditworthiness and loan purpose.

- Credit Unions:Credit unions are member-owned financial institutions that often prioritize community support and may offer more favorable loan terms to small businesses. They often have a more flexible approach to lending and may be willing to work with borrowers who have less-than-perfect credit.

Credit unions typically offer lower interest rates and smaller loan amounts compared to traditional banks.

- Online Lenders:Online lending platforms have become increasingly popular for small businesses seeking quick and convenient access to capital. These platforms often have a streamlined application process and can provide loan decisions within days. Interest rates can be higher than traditional banks or credit unions, but online lenders offer transparency and flexibility.

- Government Programs:The government offers various loan programs designed to support small businesses, such as the Small Business Administration (SBA) loans. These programs often provide lower interest rates and longer repayment terms, making them attractive to businesses that may not qualify for conventional loans.

Comparing Lender Advantages and Disadvantages

Understanding the pros and cons of each lender type can help you make an informed decision.

Understand how the union of Business Loans Small Businesses October 2024 can improve efficiency and productivity.

| Lender Type | Advantages | Disadvantages |

|---|---|---|

| Traditional Bank | Strong reputation, diverse loan products, competitive interest rates | Strict lending criteria, lengthy application process, may require collateral |

| Credit Union | Community-focused, flexible lending policies, lower interest rates | Limited loan amounts, membership requirements, smaller network |

| Online Lender | Fast and convenient application process, transparent interest rates, flexible terms | Higher interest rates, potential for higher fees, limited customer support |

| Government Program | Lower interest rates, longer repayment terms, access to specialized programs | Complex application process, eligibility requirements, limited loan amounts |

Identifying Reputable Lenders

Here are some reputable lenders offering small business loans in November 2024:

- Lender Name:Bank of America Lender Type:Traditional Bank Loan Products Offered:Term Loans, Lines of Credit Loan Amounts:$5,000 – $5 million Interest Rates:Variable or Fixed, 5.00% – 10.00% APR Website:www.bankofamerica.com

- Lender Name:Wells Fargo Lender Type:Traditional Bank Loan Products Offered:Term Loans, Lines of Credit, SBA Loans Loan Amounts:$5,000 – $5 million Interest Rates:Variable or Fixed, 4.50% – 9.50% APR Website:www.wellsfargo.com

- Lender Name:LendingClub Lender Type:Online Lender Loan Products Offered:Term Loans, Lines of Credit Loan Amounts:$5,000 – $500,000 Interest Rates:Variable, 7.00% – 24.00% APR Website:www.lendingclub.com

- Lender Name:Kabbage Lender Type:Online Lender Loan Products Offered:Lines of Credit, Term Loans Loan Amounts:$1,000 – $150,000 Interest Rates:Variable, 8.00% – 36.00% APR Website:www.kabbage.com

- Lender Name:OnDeck Lender Type:Online Lender Loan Products Offered:Term Loans, Lines of Credit Loan Amounts:$5,000 – $250,000 Interest Rates:Variable, 7.00% – 35.00% APR Website:www.ondeck.com

- Lender Name:PayPal Working Capital Lender Type:Online Lender Loan Products Offered:Lines of Credit Loan Amounts:Up to $250,000 Interest Rates:Variable, 10.00% – 30.00% APR Website:www.paypal.com/us/business/working-capital

- Lender Name:Shopify Capital Lender Type:Online Lender Loan Products Offered:Lines of Credit Loan Amounts:Up to $200,000 Interest Rates:Variable, 10.00% – 30.00% APR Website:www.shopify.com/capital

- Lender Name:Square Capital Lender Type:Online Lender Loan Products Offered:Lines of Credit Loan Amounts:Up to $100,000 Interest Rates:Variable, 10.00% – 30.00% APR Website:www.squareup.com/capital

- Lender Name:SBA (Small Business Administration) Lender Type:Government Program Loan Products Offered:7(a) Loans, 504 Loans, Microloans Loan Amounts:$500 – $5 million Interest Rates:Variable or Fixed, 4.50% – 9.50% APR Website:www.sba.gov

- Lender Name:SCORE (Service Corps of Retired Executives) Lender Type:Government Program Loan Products Offered:Microloans, Business Counseling Loan Amounts:Up to $50,000 Interest Rates:Variable, 5.00% – 10.00% APR Website:www.score.org

Writing a Guide for Choosing the Right Lender

Selecting the right lender is a critical step in the loan application process.

- Evaluating Your Needs:Before you start comparing lenders, it’s essential to assess your business’s specific needs. Consider factors like the loan amount, loan term, interest rate, and any specific requirements you may have, such as collateral or credit score.

- Comparing Lender Options:Once you’ve determined your needs, you can start comparing different lenders based on their strengths and weaknesses. Consider factors like interest rates, fees, loan terms, and the lender’s reputation.

- Applying for a Loan:Once you’ve chosen a lender, it’s time to apply for a loan. Make sure you have all the necessary documentation, including your business plan, financial statements, and tax returns. Be prepared to answer questions about your business and your plans for using the loan.

The Application Process for Small Business Loans

The application process for a small business loan can seem daunting, but it’s a crucial step in securing the funding your business needs. Understanding the process and preparing your documentation can significantly increase your chances of approval.

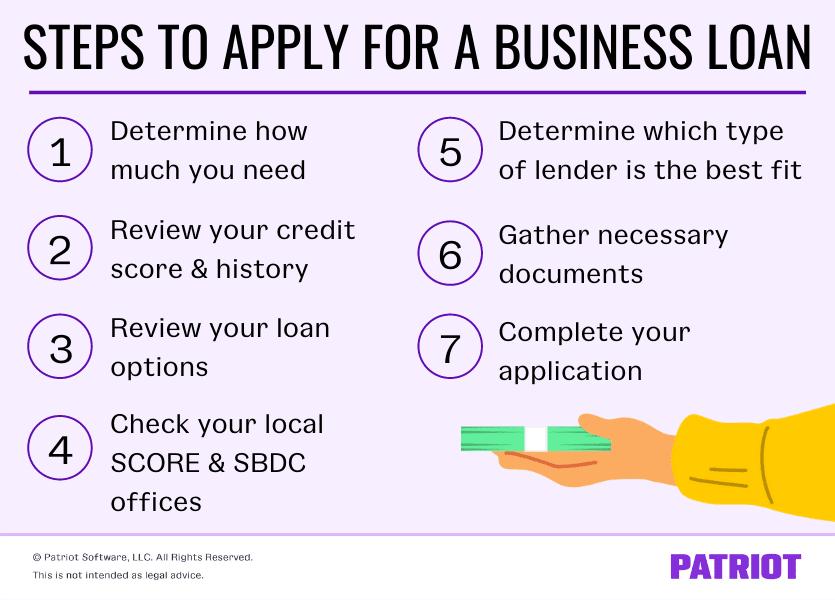

Steps Involved in Applying for a Small Business Loan

The application process typically involves the following steps:

- Choose the Right Loan Type:Determine which type of loan best suits your business needs and financial situation. Common options include term loans, lines of credit, SBA loans, and equipment financing.

- Research and Compare Lenders:Shop around and compare interest rates, fees, and repayment terms from various lenders. Consider factors like the lender’s reputation, experience with small businesses, and online reviews.

- Gather Necessary Documents:Prepare a comprehensive set of documents that demonstrate your business’s financial health and viability. This includes your business plan, financial statements, tax returns, and personal credit reports.

- Complete the Loan Application:Fill out the lender’s application form accurately and thoroughly, providing detailed information about your business and its financial history.

- Submit Your Application:Once you’ve completed the application, submit it to the lender. Be prepared to answer any questions they may have about your business.

- Wait for Approval:Lenders will review your application and supporting documentation. This process can take several weeks, depending on the complexity of your loan request and the lender’s processing time.

- Negotiate Loan Terms:If your application is approved, negotiate the final loan terms, including the interest rate, repayment period, and any fees. Ensure you understand the entire agreement before signing.

- Receive Loan Funds:Once the loan agreement is finalized, the lender will deposit the loan funds into your business account. You can then use the funds for your business’s intended purposes.

Required Documents for Loan Applications

- Business Plan:A detailed roadmap outlining your business’s goals, products or services, target market, marketing strategy, and financial projections.

- Financial Statements:Recent balance sheets, income statements, and cash flow statements that provide a snapshot of your business’s financial performance.

- Tax Returns:Copies of your business’s most recent tax returns (typically the past two to three years) to demonstrate profitability and revenue history.

- Personal Credit Reports:Lenders may require your personal credit history, especially if you’re seeking a loan backed by personal guarantees.

- Collateral:Depending on the loan type, you may need to provide collateral, such as equipment, inventory, or real estate, to secure the loan.

- Other Supporting Documents:Lenders may request additional documentation, such as licenses, permits, insurance policies, or contracts, to assess your business’s operations and risk profile.

Tips for Preparing a Strong Loan Application

- Present a Clear and Concise Business Plan:A well-structured business plan that Artikels your business’s vision, market analysis, and financial projections is essential.

- Demonstrate Financial Stability:Provide accurate and up-to-date financial statements that highlight your business’s revenue, expenses, and cash flow.

- Highlight Your Business’s Strengths:Emphasize your business’s unique selling propositions, strong management team, and positive track record (if applicable).

- Be Transparent and Honest:Provide complete and accurate information on your application, including any challenges or risks your business faces.

- Seek Professional Guidance:Consider consulting with a business advisor, accountant, or loan specialist to help you prepare a strong application and navigate the loan process.

Important Considerations for Small Business Loans

Before you sign on the dotted line for a small business loan, it’s crucial to thoroughly understand the terms and conditions. These details will significantly impact your repayment obligations and overall financial health.

Understanding Loan Terms and Conditions

Loan terms and conditions Artikel the specifics of the loan agreement, defining your responsibilities as the borrower. Carefully reviewing these documents ensures you’re aware of the financial commitments involved and can make informed decisions.

You also can investigate more thoroughly about Best Websites For Small Business October 2024 to enhance your awareness in the field of Best Websites For Small Business October 2024.

- Interest Rate:This represents the cost of borrowing money. A lower interest rate means lower monthly payments and less overall interest paid over the loan term.

- Fees:Various fees can be associated with small business loans, such as origination fees, closing costs, and late payment penalties. These fees can add up, so it’s essential to factor them into your overall loan cost.

- Repayment Terms:This includes the loan’s duration, the frequency of payments (monthly, quarterly, etc.), and the total number of payments required. Shorter loan terms often result in higher monthly payments but lower overall interest costs. Conversely, longer terms typically involve lower monthly payments but higher overall interest.

- Loan Covenants:These are specific conditions or restrictions imposed by the lender. Examples include maintaining a certain credit score, providing regular financial statements, or limiting your ability to take on additional debt. Failure to comply with covenants could result in loan default.

Key Factors to Consider

Several key factors should guide your decision-making process when evaluating small business loans:

- Loan Purpose:Determine how you intend to use the loan funds. Matching the loan purpose to the lender’s requirements increases your chances of approval.

- Your Credit History:A strong credit score can significantly influence your loan terms and interest rate. If your credit score is less than ideal, consider working on improving it before applying.

- Financial Projections:Prepare detailed financial projections to demonstrate your business’s ability to repay the loan. This can include cash flow statements, income statements, and balance sheets.

- Collateral Requirements:Some lenders require collateral, such as real estate or equipment, to secure the loan. If you’re asked to provide collateral, ensure you understand the risks involved and have a clear plan for securing it.

- Loan Amount:Requesting the right amount of funding is crucial. Don’t overborrow, but also ensure you have sufficient funds to achieve your business goals.

Negotiating Favorable Loan Terms, Apply For Small Business Loan November 2024

Negotiating favorable loan terms can help minimize your borrowing costs and maximize your financial flexibility.

- Shop Around:Compare loan offers from multiple lenders to find the most competitive rates and terms.

- Leverage Your Strengths:Highlight your strong credit history, solid financial performance, and business plan to negotiate better terms.

- Be Prepared to Walk Away:If you’re not satisfied with the offered terms, be prepared to walk away and explore other options. Don’t feel pressured to accept an unfavorable deal.

Alternative Funding Options for Small Businesses

Small businesses often face challenges securing traditional loans, especially during economic uncertainties. Fortunately, alternative funding options have emerged to bridge the gap and provide much-needed capital for growth and expansion. These options offer distinct advantages and disadvantages, requiring careful consideration based on your business needs and financial situation.

Crowdfunding

Crowdfunding platforms connect businesses with a large pool of potential investors seeking to support innovative projects. This approach allows entrepreneurs to raise funds from a diverse group of individuals, often through online platforms.

- Rewards-based crowdfunding:Businesses offer tangible rewards, such as products or services, to backers in exchange for their contributions. This approach is popular for startups and creative projects.

- Equity crowdfunding:Businesses offer equity in their company in exchange for investments. This option provides access to significant capital but requires sharing ownership and potential control.

- Donation-based crowdfunding:Businesses rely on the generosity of individuals who believe in their mission and are willing to donate funds without expecting any return. This approach is suitable for non-profit organizations or projects with strong social impact.

Grants

Grants are non-repayable funds provided by government agencies, foundations, or private organizations to support specific initiatives or projects. These grants often target businesses in specific industries, regions, or with a social mission.

- Government grants:The Small Business Administration (SBA) offers a range of grants for small businesses, including those focused on research and development, export assistance, and disaster recovery.

- Foundation grants:Private foundations often provide grants to support specific causes or initiatives aligned with their philanthropic goals. Researching foundation grants relevant to your business sector is crucial.

- Corporate grants:Some corporations offer grants to support community initiatives, environmental sustainability, or social responsibility projects.

Equity Financing

Equity financing involves selling a portion of your business ownership to investors in exchange for capital. This approach can provide significant funding but requires relinquishing control and sharing profits.

- Angel investors:High-net-worth individuals who invest in early-stage businesses with high growth potential. They often provide mentorship and guidance in addition to capital.

- Venture capitalists:Firms that invest in high-growth companies with the potential for significant returns. They typically invest larger sums and take a more active role in company management.

- Private equity firms:Investment firms that acquire controlling stakes in established companies with the goal of improving operations and increasing profitability.

Comparison of Alternative Funding Options

| Funding Option | Features | Eligibility Requirements | Potential Benefits |

|---|---|---|---|

| Crowdfunding | Raises funds from a large pool of individuals through online platforms. | Varies depending on the platform and funding type. | Access to a wide range of investors, potential for community building, increased brand awareness. |

| Grants | Non-repayable funds provided by government agencies, foundations, or private organizations. | Specific eligibility criteria based on industry, location, or project focus. | Free capital, no debt repayment obligations, potential for positive publicity. |

| Equity Financing | Selling a portion of business ownership to investors in exchange for capital. | Attractive business plan, strong management team, potential for high returns. | Significant funding, access to expertise and networks, potential for faster growth. |

Tips for Securing a Small Business Loan

Securing a small business loan can be a crucial step in your business journey, but it requires careful preparation and a strategic approach. Lenders evaluate applications based on various factors, and understanding these factors is key to improving your chances of success.

Building a Strong Business Plan

A well-written business plan is the foundation of a successful loan application. It serves as a roadmap for your business, outlining your goals, strategies, and financial projections. Lenders use the business plan to assess the viability of your venture and determine your ability to repay the loan.

- Define Your Business Goals:Clearly articulate your business objectives, including your target market, products or services, and anticipated revenue streams.

- Detail Your Market Analysis:Provide a thorough analysis of your target market, including its size, growth potential, and competitive landscape.

- Artikel Your Marketing Strategy:Explain how you plan to reach your target customers and promote your business.

- Present Financial Projections:Include detailed financial statements, such as profit and loss statements, cash flow projections, and balance sheets. These statements should demonstrate your financial health and ability to repay the loan.

Maintaining Strong Financial Statements

Strong financial statements are essential for demonstrating your business’s financial health and ability to manage finances effectively. Lenders scrutinize these statements to assess your creditworthiness and risk profile.

- Track Your Income and Expenses:Keep accurate records of your business income and expenses. This includes all sales, purchases, and operating costs.

- Prepare Financial Reports Regularly:Generate regular financial reports, such as income statements, balance sheets, and cash flow statements. These reports provide a clear picture of your business’s financial performance.

- Maintain a Healthy Cash Flow:Ensure that your business has sufficient cash flow to meet its operational expenses and debt obligations. This may involve managing inventory levels, optimizing payment terms, and collecting receivables promptly.

Improving Your Credit Score

Your personal credit score plays a significant role in the loan application process. Lenders often consider your credit history as an indicator of your financial responsibility.

- Pay Bills on Time:Make all payments on time, including credit card bills, utility bills, and loan payments.

- Keep Credit Utilization Low:Avoid maxing out your credit cards and strive to keep your credit utilization ratio below 30%.

- Monitor Your Credit Report:Regularly check your credit report for errors and ensure that all information is accurate.

Building Relationships with Lenders

Developing relationships with lenders can be beneficial in securing a loan. It allows you to establish trust and demonstrate your commitment to your business.

- Network with Bankers:Attend industry events and networking functions to connect with loan officers and bankers.

- Seek Professional Advice:Consult with a business advisor or financial consultant who can guide you through the loan application process and connect you with potential lenders.

Demonstrating Your Passion and Commitment

Lenders are more likely to approve loans for businesses that demonstrate passion, commitment, and a clear vision.

- Articulate Your Vision:Clearly explain your business goals, your passion for your industry, and your commitment to success.

- Showcase Your Experience:Highlight your relevant experience, skills, and expertise in your industry.

Resources for Small Business Loan Information

Navigating the world of small business loans can be overwhelming, but you don’t have to go it alone. There are many resources available to help you find the right loan, understand the application process, and make informed decisions about your financing.

Government Websites

Government agencies offer valuable information and resources for small business owners seeking loans.

- The U.S. Small Business Administration (SBA): The SBA is a primary source of information and assistance for small businesses. Their website provides details on various loan programs, including the popular SBA 7(a) loan program. You can also find resources on business planning, marketing, and more.

- The U.S. Department of Treasury: The Treasury Department offers information on government-backed loans and other financial assistance programs for small businesses. https://www.treasury.gov/

Industry Publications

Industry publications offer insights and analysis on the small business lending landscape.

Find out about how Business Loans For Small Businesses October 2024 can deliver the best answers for your issues.

- Entrepreneur: Entrepreneur magazine provides articles, resources, and advice for entrepreneurs, including information on small business loans. https://www.entrepreneur.com/

- Inc.: Inc. magazine focuses on small and medium-sized businesses, offering articles on financing, growth strategies, and other relevant topics. https://www.inc.com/

Financial Institutions

Banks, credit unions, and online lenders are key players in the small business lending market.

- Banks: Traditional banks offer a range of loan products, including business loans, lines of credit, and equipment financing. It’s important to compare interest rates, terms, and fees from different banks.

- Credit Unions: Credit unions are member-owned financial institutions that often offer competitive rates and personalized service to small businesses.

- Online Lenders: Online lenders have gained popularity in recent years, offering faster loan approvals and more flexible terms. However, it’s crucial to research online lenders carefully and ensure they are reputable.

Online Calculators and Tools

Online calculators and tools can help you estimate loan payments, compare loan options, and make informed decisions.

- Loan Payment Calculators: These calculators allow you to input the loan amount, interest rate, and loan term to estimate your monthly payments. https://www.bankrate.com/calculators/loans/loan-calculator.aspx

- Loan Comparison Tools: These tools allow you to compare loan offers from different lenders based on interest rates, terms, and fees. https://www.nerdwallet.com/loans/business-loans/

Business Counseling Services

Organizations that provide free or low-cost business counseling services can offer valuable guidance on financing options and the application process.

Discover how Business Loan For Small Business October 2024 has transformed methods in this topic.

- SCORE: SCORE is a non-profit organization that provides free mentoring and workshops for small business owners. Their website offers resources on financing, business planning, and other topics. https://www.score.org/

- Small Business Development Centers (SBDCs): SBDCs are government-funded organizations that provide counseling, training, and resources to small businesses. You can find an SBDC near you on the SBA website. https://www.sba.gov/tools/local-assistance/small-business-development-centers

Conclusion

Securing a small business loan is a crucial step for many entrepreneurs, but it’s important to approach the process strategically. While the prospect of accessing funding can be exciting, remember that careful planning and preparation are essential for a successful outcome.A well-structured business plan, strong credit history, and sufficient collateral are crucial components of a compelling loan application.

By demonstrating a clear vision for your business, a responsible financial track record, and the ability to secure your loan with assets, you’ll significantly increase your chances of approval.

Thorough Research and Planning

Before submitting any applications, it’s vital to thoroughly research different loan options, compare interest rates, and understand the terms and conditions associated with each. This research will empower you to make informed decisions and choose the loan that best aligns with your business needs and financial capabilities.

Seeking Professional Advice

Navigating the complex world of small business loans can be challenging, especially for first-time borrowers. Seeking guidance from financial experts or business advisors can provide valuable insights and support throughout the loan application process. These professionals can offer personalized advice, assess your financial situation, and help you develop a strong loan application package.

“Securing a small business loan is a significant step for any entrepreneur. It’s crucial to approach this process with careful planning and a clear understanding of your financial needs. By conducting thorough research, developing a comprehensive business plan, and seeking professional guidance, you can increase your chances of securing the loan you need to launch or grow your business.”

Last Point

Securing a small business loan is a significant milestone, and it’s essential to approach the process with meticulous planning and a clear understanding of your financial needs. By conducting thorough research, comparing interest rates, and understanding the terms and conditions before applying, you can increase your chances of securing the loan you need to launch or grow your business.

Remember, this guide is just the starting point; consulting with financial experts or business advisors can provide personalized guidance and support throughout the loan application process.

Helpful Answers

What are the most common types of small business loans?

Small business loans come in various forms, including SBA loans, conventional loans, and online loans. SBA loans are government-backed and often offer more favorable terms. Conventional loans are provided by banks and credit unions, while online loans are offered through online lending platforms.

What is the difference between a term loan and a line of credit?

A term loan provides a fixed amount of money with a set repayment schedule, while a line of credit allows you to borrow funds as needed up to a predetermined limit. Term loans are ideal for specific projects or investments, while lines of credit offer flexibility for managing cash flow.

What are the key factors to consider when choosing a small business loan?

Key factors include the interest rate, loan term, fees, eligibility requirements, and the lender’s reputation. It’s crucial to compare different loan options to find the most favorable terms for your business needs.

How can I improve my chances of getting a small business loan approved?

Improving your credit score, developing a comprehensive business plan, demonstrating consistent revenue history, and securing collateral can all enhance your loan approval chances. It’s also beneficial to network with lenders and seek professional advice from financial advisors.