Annuity What Is It Definition 2024: In a world where financial security is paramount, annuities have emerged as a powerful tool for individuals seeking to ensure a steady stream of income, especially during retirement. Annuities are financial contracts that guarantee regular payments for a specific period, providing a sense of financial stability and peace of mind.

Joint ownership of an annuity can be a great way to ensure that your loved ones are taken care of after your passing. To learn more about this option, you can visit Annuity Joint Ownership 2024.

This comprehensive guide delves into the intricacies of annuities, exploring their various types, how they work, and the benefits they offer.

While the term “jackpot” might not be associated with annuities, there are certain types of annuities that can offer a large payout. To learn more about this, you can visit Annuity Jackpot 2024.

From fixed annuities that offer predictable payouts to variable annuities that provide potential growth, there’s an annuity type tailored to diverse financial goals and risk tolerances. Understanding the nuances of each type is crucial for making informed decisions that align with your financial aspirations.

Annuity rates in the UK can vary depending on the provider and the type of annuity you choose. You can find more information about these rates at Annuity Rates Uk 2024.

What is an Annuity?

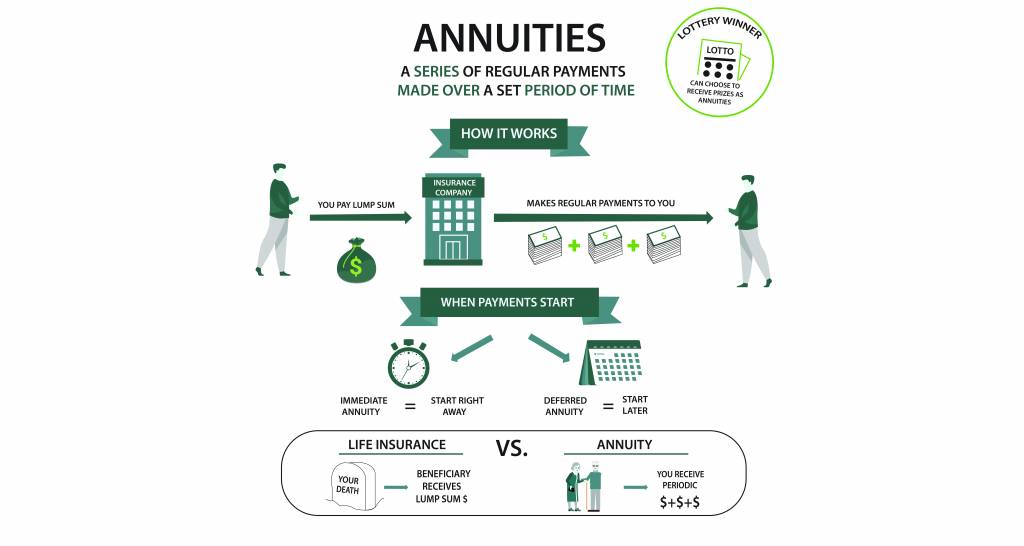

An annuity is a financial product that provides a stream of regular payments for a specific period of time. Think of it as a steady income source, like a pension, but with more flexibility. Annuities are often used to supplement retirement income, but they can also be used for other financial goals, such as long-term care funding or creating a legacy.

Definition of an Annuity, Annuity What Is It Definition 2024

In simple terms, an annuity is a contract between you and an insurance company. You give the insurance company a lump sum of money, and in return, they promise to pay you a series of regular payments for a certain period of time, which could be for life or for a set number of years.

For a financial audience, an annuity can be defined as a financial instrument that provides a guaranteed stream of income for a predetermined period, typically purchased with a lump-sum payment. The payments can be fixed or variable, depending on the type of annuity.

There are different types of annuities, each with its own features and benefits. To learn more about the different kinds of annuities, you can visit Annuity Kinds 2024.

Types of Annuities

Annuities can be categorized into different types, each with its own features and benefits. Here are some of the most common types:

Fixed Annuities

Fixed annuities provide a guaranteed rate of return, meaning that the payments you receive will remain the same throughout the term of the annuity. This makes them a good option for those who want a predictable income stream.

An annuity is a financial product that provides a stream of payments over a set period of time. To understand what an annuity is, you can check out this article on An Annuity Is Defined As 2024.

Variable Annuities

Variable annuities offer the potential for higher returns, but they also carry more risk. The payments you receive are linked to the performance of the underlying investments, so they can fluctuate in value.

If you’re worried about your annuity being out of surrender, you can find more information about this topic at My Annuity Is Out Of Surrender 2024.

Indexed Annuities

Indexed annuities are a hybrid of fixed and variable annuities. They offer a guaranteed minimum rate of return, but they also have the potential to participate in the growth of a specific market index, such as the S&P 500.

An annuity is a great way to ensure you have a steady income stream in retirement. You can learn more about the different types of annuities and how they work by visiting An Annuity Is 2024.

| Type | Features | Benefits | Risks |

|---|---|---|---|

| Fixed Annuity | Guaranteed rate of return | Predictable income stream, low risk | Limited growth potential, inflation risk |

| Variable Annuity | Returns linked to investment performance | Potential for higher returns | Higher risk, market volatility |

| Indexed Annuity | Guaranteed minimum rate of return, potential for index growth | Potential for higher returns, some downside protection | Market volatility, limited participation in index gains |

An annuity is not a loan, but it can be used to generate income that can help pay off debt. You can find more information about this at Annuity Is Loan 2024.

How Annuities Work

The process of purchasing and receiving payments from an annuity is relatively straightforward. First, you’ll need to choose an annuity provider and decide on the type of annuity that best suits your needs. You’ll then make a lump-sum payment to the insurance company, which will be invested in a pool of assets.

Deciding whether an annuity is better than drawdown depends on your individual financial situation and goals. To explore this comparison, you can check out this article on Is Annuity Better Than Drawdown 2024.

The insurance company will then use the investment returns to fund the annuity payments.

Factors Influencing Annuity Payouts

The amount of your annuity payments will be determined by several factors, including:

- Interest rates: Higher interest rates generally lead to higher annuity payments.

- Investment performance: For variable and indexed annuities, the performance of the underlying investments will affect the amount of your payments.

- Longevity: The longer you live, the more payments you’ll receive from your annuity.

Deciding between an annuity and an IRA can be a tough choice. You can find helpful information and comparisons on this topic at Annuity Or Ira 2024.

Payment Options

Annuities offer a variety of payment options, including:

- Lump sum: You can receive all of your annuity payments at once.

- Monthly payments: You can receive regular payments for a set period of time.

- Combination of both: You can receive a portion of your payments as a lump sum and the rest as monthly payments.

Annuity issuers are financial institutions that provide annuities. You can find more information about these institutions and their offerings at Annuity Issuer 2024.

Benefits of Annuities: Annuity What Is It Definition 2024

Annuities offer a number of benefits, including:

- Guaranteed income: Annuities can provide a steady stream of income that you can rely on, regardless of market conditions.

- Tax benefits: Annuity payments are generally taxed as ordinary income, but there may be tax advantages depending on the type of annuity you choose.

- Protection against inflation: Some annuities offer protection against inflation, meaning that your payments will increase over time to keep pace with rising prices.

The taxation of annuities can be complex. To understand how annuities are taxed, you can check out this article on How Annuity Is Taxed 2024.

Real-World Examples

Annuities can be used to achieve a variety of financial goals. For example, an individual might use an annuity to:

- Supplement retirement income: Annuities can provide a steady stream of income during retirement, helping to ensure that you have enough money to cover your expenses.

- Provide long-term care funding: Annuities can be used to pay for long-term care expenses, such as nursing home care or assisted living.

- Create a legacy: Annuities can be used to create a legacy for your loved ones, by providing them with a stream of income after your death.

Annuities are a popular financial product in the UK. You can find more information about annuities in the UK at Annuity Uk 2024.

Risks and Considerations

While annuities can be a valuable tool for achieving your financial goals, it’s important to be aware of the potential risks involved.

- Market volatility: Variable and indexed annuities are subject to market volatility, which means that the value of your annuity can fluctuate.

- Interest rate changes: Interest rate changes can affect the amount of your annuity payments, especially for fixed annuities.

- Surrender charges: Some annuities have surrender charges, which are fees you pay if you withdraw your money before a certain period of time.

Key Considerations

Before purchasing an annuity, it’s important to consider the following:

- Your financial goals: What are you hoping to achieve with an annuity?

- Your risk tolerance: How much risk are you willing to take?

- Your time horizon: How long do you need the income from the annuity?

- The terms and conditions of the annuity contract: Make sure you understand the terms of the contract before you sign it.

An annuity provides a fixed stream of payments for a set period, while a perpetuity offers payments indefinitely. You can find more information about the differences between these two at Annuity Vs Perpetuity 2024.

Annuities in 2024

The annuity market is constantly evolving, and there are a number of trends to watch in 2024.

- Rising interest rates: Rising interest rates are likely to make fixed annuities more attractive, as they offer a guaranteed rate of return.

- Inflation: Inflation is a major concern for retirees, and annuities can help to protect against inflation by providing a stream of income that increases over time.

- Increased demand for longevity products: As people are living longer, there is an increasing demand for products that can provide income for a longer period of time.

It’s important to consult with a financial advisor to determine if an annuity is right for you and to choose the type of annuity that best suits your needs.

Ending Remarks

As you navigate the financial landscape, annuities can serve as a valuable tool for securing your future. By carefully considering your individual circumstances, risk appetite, and financial goals, you can determine if an annuity is the right fit for you.

With their ability to provide guaranteed income, tax advantages, and protection against inflation, annuities offer a compelling avenue for achieving financial stability and peace of mind.

FAQs

What is the minimum age to purchase an annuity?

There is no minimum age requirement to purchase an annuity. However, the specific eligibility criteria may vary depending on the annuity provider and type of annuity.

An annuity is a financial product that can provide you with a steady stream of income for life. If you’re looking for a more comprehensive explanation, you can check out this article on An Annuity Is Best Defined As 2024.

Can I withdraw money from an annuity before retirement?

Yes, some annuities allow for withdrawals, but there may be penalties or restrictions. It’s crucial to review the terms and conditions of your specific annuity contract.

Are annuity payments taxable?

The taxability of annuity payments depends on the type of annuity and how it was funded. Generally, a portion of the payments is considered taxable income.

What are the fees associated with annuities?

Annuities typically involve various fees, such as administrative fees, mortality charges, and surrender charges. It’s important to understand the fee structure before purchasing an annuity.