Annuity Vs IRA 2024: Deciding between an annuity and an IRA can feel like navigating a financial maze. Both offer tax advantages and the promise of a comfortable retirement, but they operate differently, catering to different needs and risk tolerances.

Tax implications are an important consideration when evaluating annuities. Is Annuity Tax Deferred 2024 sheds light on the tax treatment of annuities, explaining whether they are tax-deferred or not.

This article explores the intricacies of each option, helping you make an informed decision for your unique financial journey.

The calculation of annuity payments involves specific factors and formulas. How Annuity Is Calculated 2024 provides an overview of the calculation process, explaining how annuity payments are determined.

Annuities and IRAs are both retirement savings vehicles, but they differ significantly in how they function and the benefits they offer. Annuities, often described as “guaranteed income streams,” provide a steady flow of income during retirement, while IRAs offer tax advantages on contributions and withdrawals.

Tax implications of annuities can be complex and vary depending on the specific type and provider. Is Annuity From Lic Taxable 2024 explores the tax treatment of annuities from LIC.

Understanding these differences is crucial to determining which option aligns best with your individual financial goals and risk appetite.

The decision of whether an annuity is a good or bad choice depends on your individual circumstances and financial goals. Annuity Is Good Or Bad 2024 provides insights to help you determine if an annuity is right for you.

Annuities vs. IRAs: Which is Right for You in 2024?

Planning for retirement is a crucial part of financial well-being. As you approach your golden years, it’s essential to consider various investment options that can help you secure your future. Two popular retirement savings vehicles that often come up in discussions are annuities and IRAs.

Both offer unique advantages and disadvantages, and understanding the nuances of each can help you make an informed decision.

This article will delve into the intricacies of annuities and IRAs, providing a comprehensive comparison to help you determine which option best suits your individual needs and financial goals in 2024.

Annuity Gator is a platform that offers resources and information on annuities. Annuity Gator 2024 can be a valuable resource for those exploring annuity options.

Annuities, Annuity Vs Ira 2024

Annuities are insurance contracts that provide a stream of income payments, either for a fixed period or for life. They are often used as a way to generate guaranteed income during retirement, and they can also offer tax advantages.

Required Minimum Distributions (RMDs) apply to retirement accounts, including annuities. Is Annuity Subject To Rmd 2024 explores whether annuities are subject to RMDs and the implications for retirees.

- Fixed Annuities:These annuities provide a guaranteed rate of return, meaning your payments will remain the same regardless of market fluctuations. While this offers stability, it also means your returns may be limited compared to other investment options.

- Variable Annuities:These annuities allow you to invest your money in a variety of sub-accounts, similar to a mutual fund. Your income payments will vary depending on the performance of your investments. This provides potential for higher returns but also exposes you to market risk.

- Indexed Annuities:These annuities offer a return that is tied to the performance of a specific index, such as the S&P 500. They provide potential for growth while also offering some protection against market losses.

Advantages of Annuities:

- Guaranteed Income:Annuities can provide a steady stream of income during retirement, which can help you plan for your expenses and avoid outliving your savings.

- Tax Deferral:The earnings on annuities are generally not taxed until you start receiving payments, which can help you save on taxes in the long run.

- Protection from Market Volatility:Fixed annuities offer protection from market fluctuations, which can provide peace of mind during times of economic uncertainty.

Disadvantages of Annuities:

Choosing between an annuity and a drawdown strategy depends on individual circumstances and financial goals. Is Annuity Better Than Drawdown 2024 compares these two approaches, highlighting their pros and cons.

- Potential for Lower Returns:Fixed annuities often offer lower returns than other investment options, which can impact your overall retirement savings.

- Limited Access to Funds:You may face penalties if you withdraw your money from an annuity before a certain age or for a certain period of time.

- High Fees:Annuities can come with high fees, which can eat into your returns.

IRAs

IRAs are retirement savings accounts that offer tax advantages. They allow you to save money for retirement and potentially grow your investments tax-deferred or tax-free.

While both annuities and pensions provide income streams, they differ in their structure and funding. Is Annuity The Same As Pension 2024 clarifies the distinctions between annuities and pensions.

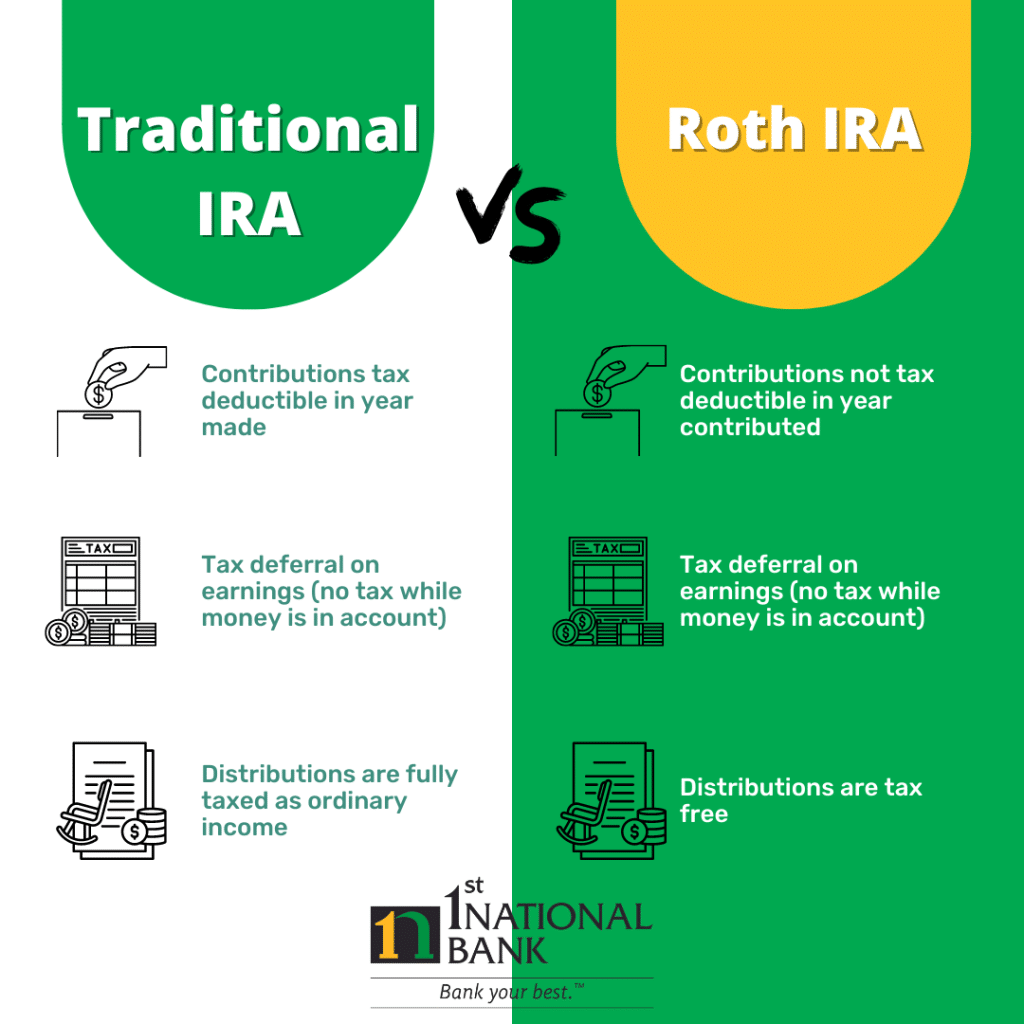

- Traditional IRAs:Contributions to a traditional IRA may be tax-deductible, reducing your taxable income in the present. However, you will need to pay taxes on withdrawals during retirement.

- Roth IRAs:Contributions to a Roth IRA are not tax-deductible, but withdrawals in retirement are tax-free. This can be beneficial if you expect to be in a higher tax bracket during retirement.

Advantages of IRAs:

- Tax-Deductible Contributions:Traditional IRA contributions may be tax-deductible, which can help you save on taxes in the present.

- Tax-Free Withdrawals in Retirement:Roth IRA withdrawals in retirement are tax-free, which can help you maximize your retirement income.

- Potential for Higher Returns:IRAs offer a wide range of investment options, including stocks, bonds, and mutual funds, which can potentially provide higher returns than annuities.

Disadvantages of IRAs:

- Potential for Higher Taxes in Retirement:Traditional IRA withdrawals are taxed during retirement, which can impact your overall retirement income.

- Limited Access to Funds Before Age 59 1/2:You may face penalties if you withdraw your money from an IRA before age 59 1/2.

Annuity vs. IRA: Key Comparisons

| Feature | Annuity | IRA |

|---|---|---|

| Contribution Limits | Vary by annuity type | $6,500 (2024) |

| Tax Treatment | Tax-deferred earnings; withdrawals taxed in retirement | Traditional: Tax-deductible contributions; withdrawals taxed in retirementRoth: Non-deductible contributions; tax-free withdrawals in retirement |

| Withdrawal Rules | Penalties may apply for early withdrawals | Penalties may apply for withdrawals before age 59 1/2 |

| Investment Options | Fixed, variable, or indexed | Wide range of investment options, including stocks, bonds, and mutual funds |

| Risk Level | Fixed: Low risk; Variable: Moderate to high risk; Indexed: Moderate risk | Variable depending on investment choices |

Choosing the Right Option

The best choice between an annuity and an IRA depends on your individual circumstances, including:

- Age:Annuities may be more suitable for individuals who are nearing retirement and want a guaranteed stream of income.

- Risk Tolerance:If you are risk-averse, a fixed annuity may be a better choice. If you are willing to take on more risk, a variable annuity or an IRA with a more aggressive investment strategy may be more suitable.

- Income Level:If you are in a high tax bracket, a Roth IRA may be more advantageous as withdrawals are tax-free in retirement.

- Retirement Goals:Consider your retirement income needs and how you plan to spend your retirement years. If you require a guaranteed income stream, an annuity may be a better option.

For example, if you are a young professional with a high risk tolerance and a long time horizon, an IRA may be a better choice as it offers the potential for higher returns. However, if you are approaching retirement and are concerned about market volatility, a fixed annuity may provide more security.

Additional Considerations

It’s important to understand the tax implications of both annuities and IRAs. Annuities can be subject to taxes on the earnings and withdrawals, while IRAs have specific tax rules depending on the type of IRA.

The Annuity Equation 2024 is a mathematical formula used to calculate the present or future value of an annuity. This equation helps determine the value of annuity payments over time.

It’s always advisable to seek professional financial advice before making any investment decisions. A qualified financial advisor can help you assess your financial situation, understand your goals, and develop a personalized retirement plan.

The UK annuity market has its own set of rules and regulations. Annuity Uk 2024 provides insights into the UK annuity landscape, including options and considerations for individuals in the UK.

Diversification is crucial for any retirement plan. Don’t put all your eggs in one basket. Consider investing in a mix of assets, such as stocks, bonds, and real estate, to reduce your overall risk.

Annuities are often used as a voluntary retirement vehicle, offering a stream of income during retirement. Annuity Is A Voluntary Retirement Vehicle 2024 explores the role of annuities in retirement planning.

Ultimate Conclusion: Annuity Vs Ira 2024

Ultimately, the choice between an annuity and an IRA depends on your individual circumstances, financial goals, and risk tolerance. While annuities provide guaranteed income and tax advantages, they may come with higher fees and limited access to funds. IRAs, on the other hand, offer greater flexibility and potential for higher returns, but they come with potential tax implications in retirement.

Tax treatment of annuities can vary across different countries. Is Annuity Taxable In India 2024 addresses the tax implications of annuities in India, outlining relevant regulations and guidelines.

Consulting a financial advisor is essential to navigate this complex decision and create a personalized retirement plan that aligns with your unique needs.

Detailed FAQs

What are the tax implications of an annuity?

The tax implications of an annuity depend on the type of annuity. Fixed annuities typically provide tax-deferred growth, while variable annuities offer tax-deferred growth and potential tax-free withdrawals. However, withdrawals from an annuity are generally taxed as ordinary income.

Can I withdraw money from an IRA before age 59 1/2?

Understanding the basics of annuities is crucial for informed decision-making. An Annuity Is A Series Of Equal Periodic Payments 2024 explains the concept of annuities and their key characteristics.

You can withdraw money from an IRA before age 59 1/2, but you may face a 10% penalty in addition to your regular income tax rate. However, there are exceptions to this rule, such as for first-time home purchases, medical expenses, or certain educational expenses.

Taxability of annuities can vary depending on the source. Is Annuity Received From Lic Taxable 2024 addresses the tax implications of annuities received from LIC, providing specific details.

How do I choose the right annuity for me?

The best annuity for you depends on your individual circumstances, such as your age, risk tolerance, and financial goals. It’s important to consider the different types of annuities available, including fixed, variable, and indexed annuities, and to consult with a financial advisor to determine which option is right for you.

How do I choose the right IRA for me?

Annuity options for 2024 are diverse, offering different structures and features to suit individual needs. Annuity Options 2024 provides a comprehensive overview of the various types available, helping you make an informed decision.

The best IRA for you depends on your individual circumstances, such as your income level, tax bracket, and financial goals. If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more beneficial. If you expect to be in a lower tax bracket in retirement, a traditional IRA may be more beneficial.