Annuity Unit Is 2024: A term that might sound technical but is crucial for anyone planning for retirement. Annuity units are the building blocks of retirement income, offering a structured way to receive regular payments during your golden years. This article delves into the world of annuity units, exploring their value, calculation, investment strategies, and how they fit into your retirement planning.

From understanding the basics of annuity units to analyzing their value in 2024, we’ll cover the essential aspects of this retirement income tool. We’ll also discuss the factors influencing annuity unit value, explore different investment strategies, and address the tax implications of investing in annuity units.

Annuity income is often guaranteed, providing financial security for the future. You can learn more about this by reading Is Annuity Income Guaranteed 2024. Additionally, Annuity Statement Is 2024 explains the importance of understanding your annuity statement.

Annuity Units: A Guide to Understanding and Investing in 2024

Annuity Units are a crucial aspect of retirement planning, particularly in countries with defined contribution pension schemes. Understanding Annuity Units is essential for making informed investment decisions and ensuring a comfortable retirement. This guide will delve into the fundamentals of Annuity Units, their value in 2024, and how they can be utilized for retirement planning.

Annuity income is subject to taxation, and How Annuity Is Taxed 2024 explains the tax implications. Annuity General 2024 provides a comprehensive overview of annuities, covering their general features and benefits.

Annuity Unit Basics

An Annuity Unit represents a unit of ownership in a pension fund. It represents a portion of the total assets held by the fund, which are invested in a variety of financial instruments. The value of an Annuity Unit fluctuates based on the performance of these investments.Annuity Units are directly linked to retirement income.

Inheriting an annuity can raise questions about its tax implications. I Inherited An Annuity Is It Taxable 2024 provides guidance on this matter. You might also be interested in learning that an annuity is sometimes called the flip side of An Annuity Is Sometimes Called The Flip Side Of 2024.

The amount of retirement income you receive is determined by the number of Annuity Units you accumulate during your working years. The value of these units at retirement will dictate the amount of pension you receive.Consider a simplified example. Let’s say you contribute to a pension fund for 30 years, accumulating 1000 Annuity Units.

Annuity contracts come in different types, each with its own set of features and benefits. Annuity Kinds 2024 provides a breakdown of the different types available. You can also find information about Annuity Contingent Is 2024 to gain a better understanding of this specific type of annuity.

At retirement, if the value of each unit is $100, your total pension fund value would be $100,000. This amount can be used to purchase an annuity, which provides a regular income stream throughout your retirement years.

Annuity Unit Value in 2024

Several factors influence the value of Annuity Units, including:

- Investment Performance:The performance of the underlying assets in the pension fund directly impacts the value of Annuity Units. Positive returns on investments lead to higher unit values, while negative returns result in lower values.

- Interest Rates:Interest rates play a significant role in the valuation of Annuity Units. When interest rates rise, the value of existing Annuity Units may decrease as investors seek higher returns elsewhere.

- Inflation:Rising inflation can erode the purchasing power of Annuity Units. Pension funds need to generate returns that outpace inflation to maintain the real value of units.

- Government Policies:Government policies, such as changes in tax regulations or pension laws, can also impact the value of Annuity Units.

Comparing the value of Annuity Units in 2024 to previous years requires specific data on the performance of pension funds and the economic conditions prevailing in those years. However, general trends can be observed. For instance, if interest rates have been consistently low, as in recent years, the value of Annuity Units might have grown steadily due to favorable investment conditions.Looking ahead, the value of Annuity Units is likely to be influenced by factors such as global economic growth, inflation, and interest rate policies.

When considering an annuity, it’s important to choose a reputable provider. Is Annuity Gator Legit 2024 can help you determine the legitimacy of a specific provider. Understanding the term “annuity” is crucial. Annuity Is Term 2024 explains the term in detail.

Predicting future trends is challenging, but a cautious approach is essential, considering potential risks and opportunities.

An annuity is a financial product that provides a stream of regular payments for a set period of time. You can learn more about how an annuity works by reading about An Annuity Is A Series Of Equal Periodic Payments 2024 and what it means in Hindi by visiting Annuity Ka Hindi Meaning 2024.

Annuity Unit Calculation, Annuity Unit Is 2024

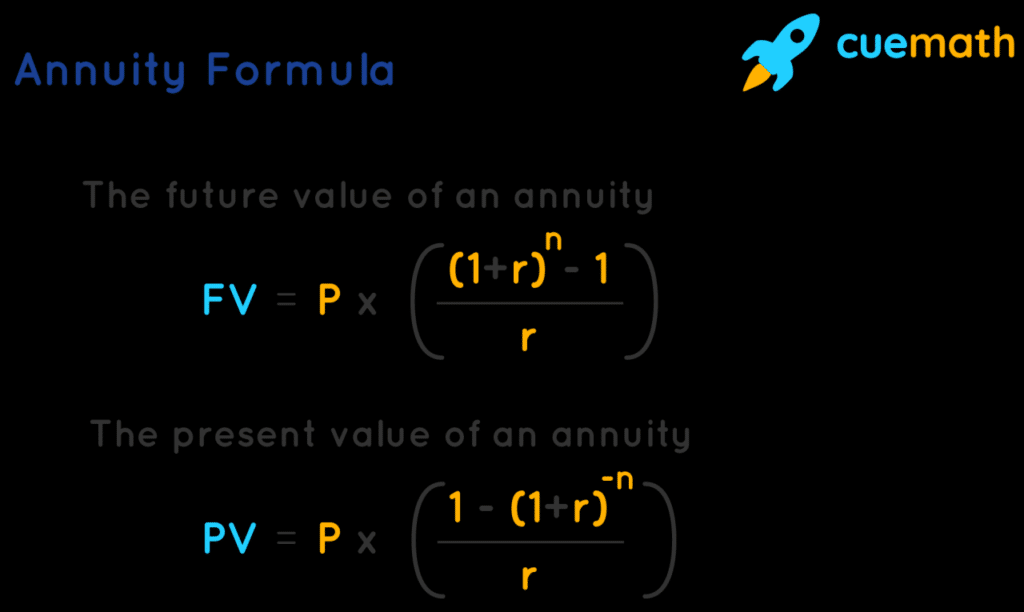

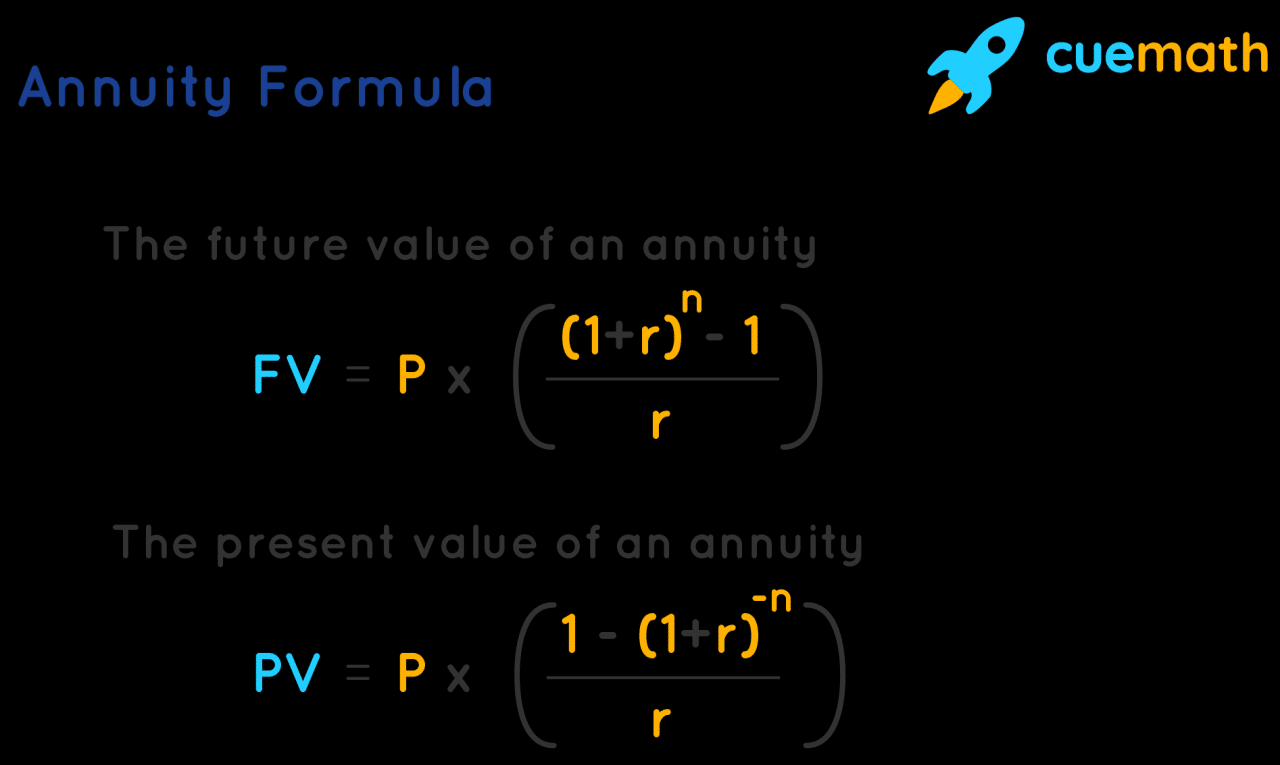

The value of an Annuity Unit is calculated by dividing the total value of the pension fund’s assets by the total number of outstanding Annuity Units. This can be represented by the following formula:

Annuity Unit Value = Total Fund Assets / Total Number of Annuity Units

Let’s illustrate this with a hypothetical example:

| Item | Value |

|---|---|

| Total Fund Assets | $100,000,000 |

| Total Number of Annuity Units | 1,000,000 |

| Annuity Unit Value | $100,000,000 / 1,000,000 = $100 |

This calculation provides a snapshot of the current value of an Annuity Unit. It’s important to note that this value can fluctuate daily, reflecting changes in the fund’s assets and the number of outstanding units.

Annuity Unit Investment Strategies

Investing in Annuity Units involves choosing a strategy that aligns with your risk tolerance and retirement goals. Here are some common approaches:

- Regular Contributions:This strategy involves making consistent contributions to your pension fund over time. This approach allows you to benefit from compounding returns and accumulate a substantial number of Annuity Units.

- Lump Sum Investment:This strategy involves making a single, large contribution to your pension fund. It can be beneficial for individuals with a significant amount of capital available for investment.

- Diversification:Diversifying your investment portfolio within the pension fund can mitigate risk. This involves investing in a mix of assets, such as stocks, bonds, and real estate, to reduce the impact of market fluctuations on your Annuity Units.

Each strategy has its own risks and rewards. Regular contributions provide consistent growth but may not generate substantial returns in the short term. Lump sum investments can offer significant gains but carry higher risk. Diversification helps mitigate risk but may not always deliver the highest returns.

Not all annuities are created equal. Annuity Is Qualified 2024 explains the concept of a qualified annuity and its tax advantages. Understanding these concepts can help you make informed decisions about your financial future.

Choosing the right strategy requires careful consideration of your individual circumstances and financial goals.

Annuity Unit and Retirement Planning

Annuity Units play a crucial role in retirement planning. They can be used to generate a steady income stream throughout your retirement years. Here’s how:

- Pension Income:At retirement, your accumulated Annuity Units are converted into a pension income. The amount of income you receive depends on the number of units you have and their value at the time of retirement.

- Annuity Purchase:You can use your accumulated pension fund value, represented by your Annuity Units, to purchase an annuity. An annuity provides a guaranteed income stream for a fixed period or for the rest of your life.

The advantages of using Annuity Units for retirement planning include:

- Regular Income:Annuity Units provide a predictable income stream, which can help you budget for your retirement expenses.

- Tax Benefits:Pension income and annuity payments are often subject to favorable tax treatment, reducing your overall tax burden.

- Long-Term Growth:Investing in Annuity Units over the long term can potentially generate significant growth, allowing you to accumulate a substantial retirement nest egg.

However, there are also some disadvantages:

- Market Volatility:The value of Annuity Units can fluctuate based on market conditions, which can impact your retirement income.

- Limited Flexibility:Once you convert your Annuity Units into a pension, you may have limited flexibility to access your funds.

- Inflation Risk:Inflation can erode the purchasing power of your pension income, reducing the real value of your retirement savings.

To illustrate how Annuity Units can be incorporated into a retirement plan, consider a hypothetical case study: Case Study:John is 30 years old and starts contributing to a pension fund. He aims to retire at 60. He decides to invest $1,000 per month in the fund, accumulating Annuity Units over the next 30 years.

At retirement, assuming an average annual return of 7%, John may have accumulated a significant number of Annuity Units, resulting in a substantial pension fund value. This value can then be used to purchase an annuity, providing him with a regular income stream throughout his retirement.

Annuity Unit Regulations and Tax Implications

Annuity Units are subject to specific regulations and tax implications, which vary depending on the country and pension scheme. It’s crucial to understand these regulations to ensure you’re making informed investment decisions.For example, some countries may impose limits on the amount of money you can contribute to your pension fund each year.

There may also be restrictions on how you can access your pension funds before retirement. Tax implications can be complex. In some cases, pension contributions may be tax-deductible, while pension income and annuity payments may be subject to different tax rates.

It’s essential to consult with a financial advisor or tax professional to understand the specific regulations and tax implications applicable to your situation. They can provide personalized advice on how to maximize your pension benefits and minimize your tax liability.

Ultimate Conclusion

As we conclude our exploration of Annuity Unit Is 2024, it’s clear that understanding these units is essential for anyone seeking a secure and sustainable retirement. By grasping the factors influencing their value, exploring investment strategies, and considering the tax implications, you can make informed decisions that align with your retirement goals.

Understanding the definition of an annuity is essential before making any financial decisions. Annuity Is Defined As 2024 provides a clear explanation. You might also be interested in understanding what happens when an annuity is out of surrender, as detailed in My Annuity Is Out Of Surrender 2024.

Whether you’re just starting your retirement planning journey or looking to optimize your existing strategies, Annuity Unit Is 2024 provides valuable insights for a comfortable and fulfilling future.

Answers to Common Questions: Annuity Unit Is 2024

What are the different types of annuity units?

Annuity units can be categorized into various types, including fixed annuities, variable annuities, and indexed annuities. Each type has its own characteristics, risks, and rewards, and the best choice for you depends on your individual circumstances and financial goals.

How do I choose the right annuity unit for my needs?

Choosing the right annuity unit involves considering your risk tolerance, time horizon, and financial goals. It’s essential to consult with a qualified financial advisor to determine the most suitable option for your specific situation.

What are the potential risks associated with investing in annuity units?

While annuity units offer potential benefits, it’s important to understand the associated risks. These can include market volatility, interest rate fluctuations, and the possibility of losing principal if the annuity is not structured appropriately.