Annuity Or Ira 2024: Choosing the Right Retirement Savings Option – Navigating the world of retirement savings can feel overwhelming, especially when faced with choices like annuities and IRAs. Both offer potential benefits, but understanding their nuances is crucial to making the right decision for your individual needs and goals.

This guide delves into the complexities of annuities and IRAs, providing a comprehensive comparison of their features, tax implications, and suitability for different financial situations. We’ll explore the key differences, advantages, and disadvantages of each option, empowering you to make an informed choice for your retirement planning.

Understanding Annuities and IRAs

Retirement planning is a crucial aspect of financial well-being, and choosing the right savings and investment vehicles is essential. Annuities and IRAs are two popular options that offer distinct advantages and disadvantages. Understanding their core concepts, tax implications, investment strategies, and key features will help you make informed decisions about your retirement savings.

Annuity Basics

An annuity is a financial product that provides a stream of payments over a specified period. It essentially transforms a lump sum of money into a guaranteed income stream, often for life. Annuities are commonly used for retirement income planning, as they can provide a steady source of income during retirement years.

If you’re curious about how annuities work in general, take a look at Annuity How It Works 2024. Annuity funds are also a common topic, and you can find more information about them at Annuity Fund Is 2024.

It’s also important to understand the tax implications of death benefits, so check out Is Annuity Death Benefit Taxable 2024.

- Fixed Annuities:These annuities offer a guaranteed rate of return and a fixed payment amount. They are suitable for individuals seeking stability and predictability in their retirement income.

- Variable Annuities:These annuities offer a variable rate of return, typically tied to the performance of underlying investments. They can potentially offer higher returns but also carry higher risk.

- Indexed Annuities:These annuities offer a return linked to the performance of a specific market index, such as the S&P 500. They provide some growth potential while offering downside protection.

IRA Basics

An IRA (Individual Retirement Account) is a tax-advantaged retirement savings account. It allows individuals to contribute pre-tax or after-tax dollars, depending on the type of IRA chosen. The contributions grow tax-deferred, and withdrawals are typically taxed in retirement.

Deferred annuities are another type of annuity, and you can learn more about them at Annuity Is Deferred 2024. If you’re interested in the formula used to calculate annuity payments, check out Annuity Formula Is 2024. For those who speak Hindi, you can find information about the meaning of annuity in Annuity Meaning In Hindi 2024.

- Traditional IRA:Contributions to a traditional IRA are tax-deductible, reducing your current tax liability. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA:Contributions to a Roth IRA are made with after-tax dollars, meaning you won’t receive a tax deduction upfront. However, qualified withdrawals in retirement are tax-free.

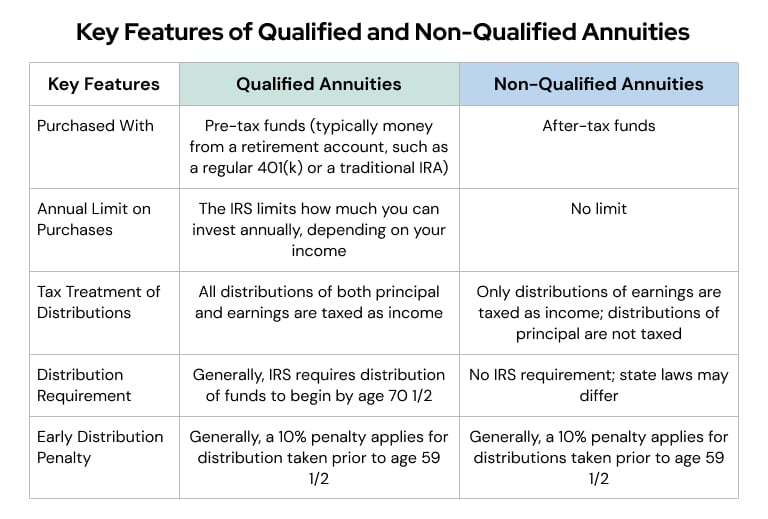

Key Differences

Annuities and IRAs differ significantly in their structure, tax treatment, and investment strategies. Understanding these differences is crucial for making informed decisions about your retirement savings.

- Guaranteed Income:Annuities offer guaranteed income streams, while IRAs provide the potential for growth but no guaranteed returns.

- Tax Treatment:Annuities typically have tax-deferred growth, but withdrawals are taxed as ordinary income. IRAs offer tax-deductible contributions (traditional IRA) or tax-free withdrawals (Roth IRA) depending on the type chosen.

- Investment Flexibility:Annuities offer limited investment options, often tied to specific investment vehicles within the annuity contract. IRAs provide greater investment flexibility, allowing you to choose from a wide range of assets, including stocks, bonds, mutual funds, and ETFs.

- Fees and Expenses:Annuities often come with higher fees and expenses compared to IRAs. IRAs typically have lower fees, but you may incur investment management fees depending on your investment choices.

Tax Implications

The tax implications of annuities and IRAs can vary significantly throughout different life stages, impacting your overall financial planning. Understanding these tax implications is crucial for maximizing your retirement savings and minimizing your tax burden.

Tax Treatment of Annuities

Annuities generally offer tax-deferred growth, meaning that earnings on your investment are not taxed until you withdraw them. This can be beneficial for long-term growth, as your investment has more time to compound without being subject to annual taxation.

- Withdrawals:When you withdraw funds from an annuity, the withdrawals are typically taxed as ordinary income. This means that your withdrawals will be taxed at your current income tax bracket, which can be substantial, especially if you are in a higher income bracket during retirement.

- Early Withdrawals:Early withdrawals from an annuity before age 59 1/2 may be subject to a 10% penalty, in addition to ordinary income tax.

Tax Treatment of IRAs

The tax treatment of IRAs depends on the type of IRA you choose. Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement.

- Traditional IRA:Contributions to a traditional IRA are tax-deductible, reducing your current tax liability. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA:Contributions to a Roth IRA are made with after-tax dollars, meaning you won’t receive a tax deduction upfront. However, qualified withdrawals in retirement are tax-free.

Tax Advantages and Disadvantages

The tax advantages and disadvantages of annuities and IRAs depend on your individual financial situation, income level, and tax bracket.

- Annuities:The main tax advantage of annuities is tax-deferred growth. However, the main disadvantage is that withdrawals are taxed as ordinary income, which can be significant during retirement.

- IRAs:Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. However, traditional IRA withdrawals are taxed as ordinary income, while Roth IRA contributions are not tax-deductible.

Investment Strategies

Annuities and IRAs offer different investment strategies, each with its own set of risks and potential returns. Understanding these strategies will help you align your retirement savings goals with the appropriate investment vehicle.

Annuities for Retirement Income

Annuities are often used for retirement income planning, as they can provide a guaranteed stream of income during retirement years. They are particularly suitable for individuals seeking stability and predictability in their retirement income.

Many people are interested in knowing if annuities are for life, and you can find the answer to that question in Is Annuity For Life 2024. You can also explore the concept of lifetime annuities at Is Annuity Lifetime 2024.

The joint life option is another important aspect of annuities, and you can learn more about it in Annuity Joint Life Option 2024.

- Fixed Annuities:Fixed annuities offer a guaranteed rate of return and a fixed payment amount. They are ideal for individuals who prioritize stability and want to avoid market volatility.

- Variable Annuities:Variable annuities offer a variable rate of return, typically tied to the performance of underlying investments. They can potentially offer higher returns but also carry higher risk.

- Indexed Annuities:Indexed annuities offer a return linked to the performance of a specific market index, such as the S&P 500. They provide some growth potential while offering downside protection.

IRAs for Retirement Savings

IRAs are versatile retirement savings accounts that offer a wide range of investment options. They are suitable for individuals who want to take a more active role in managing their retirement savings and potentially achieve higher returns.

- Traditional IRA:Traditional IRAs allow you to contribute pre-tax dollars, reducing your current tax liability. They offer tax-deferred growth and are suitable for individuals who expect to be in a lower tax bracket in retirement.

- Roth IRA:Roth IRAs allow you to contribute after-tax dollars, meaning you won’t receive a tax deduction upfront. However, qualified withdrawals in retirement are tax-free. They are suitable for individuals who expect to be in a higher tax bracket in retirement.

Risk and Return Considerations

The risks and potential returns associated with annuities and IRAs depend on the specific investment options chosen. It is important to carefully consider your risk tolerance and investment goals when making investment decisions.

- Annuities:Fixed annuities offer low risk but also lower potential returns. Variable annuities carry higher risk but also offer the potential for higher returns.

- IRAs:The risk and return of IRAs depend on the specific investments you choose. Stocks generally carry higher risk but also offer higher potential returns, while bonds typically carry lower risk but also offer lower potential returns.

Factors to Consider

Choosing between an annuity and an IRA is a personal decision that depends on several factors, including your age, income, risk tolerance, and financial goals. It is important to carefully consider these factors to make the right choice for your retirement savings.

Key Features Comparison

| Feature | Annuity | IRA |

|---|---|---|

| Contribution Limits | No annual contribution limits | Annual contribution limits vary by age |

| Withdrawal Rules | Withdrawals may be subject to penalties before age 59 1/2 | Withdrawals before age 59 1/2 may be subject to penalties |

| Fees and Expenses | Often higher fees and expenses | Typically lower fees, but investment management fees may apply |

| Investment Flexibility | Limited investment options | Greater investment flexibility |

| Guaranteed Income | Offers guaranteed income streams | No guaranteed income |

| Tax Treatment | Tax-deferred growth, withdrawals taxed as ordinary income | Traditional IRA: Tax-deductible contributions, withdrawals taxed as ordinary income. Roth IRA: After-tax contributions, tax-free withdrawals |

Checklist for Decision-Making, Annuity Or Ira 2024

- Age:Younger individuals may prefer IRAs for their investment flexibility and potential for growth. Older individuals may prefer annuities for their guaranteed income streams.

- Income:High-income earners may benefit from Roth IRAs, as they can contribute after-tax dollars and avoid future taxes on withdrawals. Lower-income earners may benefit from traditional IRAs, as they can deduct contributions from their taxable income.

- Risk Tolerance:Individuals with a high risk tolerance may prefer variable annuities or IRAs with a higher stock allocation. Individuals with a low risk tolerance may prefer fixed annuities or IRAs with a higher bond allocation.

- Financial Goals:Individuals seeking a guaranteed income stream during retirement may prefer annuities. Individuals seeking to grow their retirement savings aggressively may prefer IRAs.

Examples and Case Studies

Here are some hypothetical scenarios and case studies that illustrate how annuities and IRAs can be used effectively for retirement planning.

Annuity for Retirement Income

Imagine a 65-year-old retiree, Sarah, who is concerned about outliving her savings. She wants a guaranteed income stream to cover her living expenses during retirement. Sarah decides to purchase a fixed annuity with a lump sum of $500,000. This annuity provides her with a guaranteed monthly income of $3,000 for life.

This provides Sarah with peace of mind, knowing that she will have a steady source of income regardless of market fluctuations.

Annuity payments can be a source of fixed income, which can be helpful for retirement planning. Check out Is Annuity Fixed Income 2024 to learn more about how annuities work in this context. The healthcare industry also utilizes annuities, and you can explore career opportunities in Annuity Health Careers 2024.

IRA for Retirement Savings

John, a 35-year-old professional, wants to start saving for retirement. He decides to contribute the maximum amount allowed to a Roth IRA each year. John chooses a diversified portfolio of stocks and bonds, aiming for long-term growth. As his investments grow tax-free within the Roth IRA, he can potentially accumulate a significant retirement nest egg by the time he reaches retirement age.

John plans to withdraw funds from his Roth IRA in retirement, enjoying tax-free income.

Real-World Examples

Many individuals have successfully used annuities and IRAs to achieve their financial goals. For example, some individuals have used annuities to provide a guaranteed income stream during retirement, while others have used IRAs to accumulate significant retirement savings.

Summary: Annuity Or Ira 2024

Ultimately, the decision between an annuity and an IRA depends on your individual circumstances, financial goals, and risk tolerance. By carefully considering the factors Artikeld in this guide, you can make a well-informed decision that aligns with your retirement aspirations and sets you on a path towards financial security.

FAQ Summary

What are the minimum contribution limits for annuities and IRAs?

Contribution limits vary depending on the specific annuity or IRA plan. It’s best to consult with a financial advisor or review the plan documents for detailed information.

Understanding the tax implications of annuities is crucial. Find out if annuity interest is taxable in Is Annuity Interest Taxable 2024. You can also explore the Annuity Number Of Periods Calculator 2024 to help you calculate the duration of your annuity payments.

Can I contribute to both an annuity and an IRA?

Curious about what’s happening with Kathy’s annuity in 2024? You can find out more about Kathy’s Annuity Is Currently Experiencing 2024. It’s important to understand that an annuity is a series of equal payments, which you can learn more about at Annuity Is A Series Of Equal Payments 2024.

Yes, you can generally contribute to both an annuity and an IRA, as long as you meet the eligibility requirements for each. However, it’s essential to consider the overall impact on your tax liability and investment strategy.

How do I choose the right annuity or IRA for my needs?

The best annuity or IRA for you depends on your individual circumstances, including age, income, risk tolerance, and financial goals. Consulting with a financial advisor can provide personalized guidance and recommendations.