Annuity Joint Life Option 2024 offers couples a unique way to secure their financial future, providing a steady stream of income throughout their retirement years. This option, a specialized type of annuity, is designed to ensure both partners receive a guaranteed income stream, even after the death of one partner.

Understanding the taxability of annuities from LIC is crucial for financial planning. Is Annuity From Lic Taxable 2024 sheds light on this specific type of annuity and its tax implications.

The “Option 2024” designation refers to a specific set of features and payment structures that can be tailored to meet individual needs.

Android WebView is a powerful tool for integrating web content within your apps. Android WebView 202 for web-based applications delves into the capabilities and uses of this technology.

Joint life annuities, as they are known, are particularly attractive for couples seeking to simplify their retirement planning and guarantee a predictable income stream. By combining their resources, they can create a secure financial foundation that lasts beyond the lifetime of either individual.

An annuity is a financial instrument with a specific definition. Annuity Is Defined As 2024 provides a clear and concise explanation of what constitutes an annuity.

This approach eliminates the uncertainty of individual annuities, where income ceases upon the death of the annuitant.

Tax implications are a significant factor when considering annuities. Is Annuity Income Taxable 2024 provides insights into the tax treatment of annuity income.

Introduction to Annuities: Annuity Joint Life Option 2024

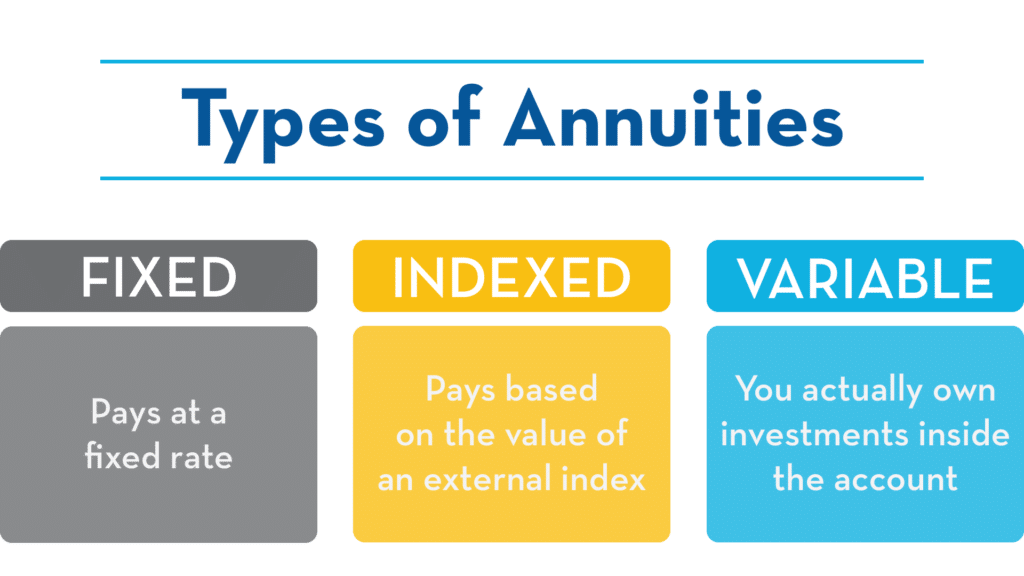

Annuities are financial products designed to provide a stream of regular payments over a set period of time. They are often used as a way to generate retirement income, but can also be used for other purposes, such as supplementing income during a period of disability or providing a guaranteed income stream for a loved one.

An annuity is essentially a series of payments. An Annuity Is A Series Of 2024 breaks down the concept of annuities as a stream of regular payments.

A joint life annuity is a type of annuity that pays out to two people, typically a married couple. The payments continue as long as at least one of the annuitants is alive. This type of annuity can be particularly beneficial for couples who want to ensure that they both have a guaranteed income stream throughout their retirement years.

Creating a user-friendly Android app is essential for success. How to design a user-friendly Android app in 2024 provides valuable tips and strategies for achieving a great user experience.

“Option 2024” refers to a specific type of joint life annuity that has become increasingly popular in recent years. This option is characterized by certain features and payment structures that can make it a more attractive choice for some individuals.

Annuity is a financial term with multiple names. Annuity Is Also Known As 2024 delves into the various ways annuities are referred to in the financial world.

How Joint Life Annuities Work, Annuity Joint Life Option 2024

Joint life annuities operate on the principle of providing a regular income stream to two individuals as long as one of them is alive. The payments are typically made monthly, but can also be made quarterly, semi-annually, or annually.

A common type of annuity is the annuity certain. Annuity Certain Is An Example Of 2024 provides a comprehensive explanation of this specific type of annuity and its characteristics.

“Option 2024” joint life annuities have a unique payment structure that is designed to provide a higher initial payout compared to other types of joint life annuities. This is achieved by factoring in certain actuarial assumptions related to the longevity of the annuitants.

Inheriting an annuity can be a positive event, but it’s important to know if it’s subject to taxes. I Inherited An Annuity Is It Taxable 2024 provides guidance on the tax implications of inherited annuities.

- Fixed-period payout:Payments are made for a specific number of years, regardless of how long the annuitants live.

- Life annuity:Payments continue as long as at least one annuitant is alive.

- Joint and survivor annuity:Payments continue until the death of the last surviving annuitant.

Benefits of Joint Life Annuities

Joint life annuities offer several advantages for couples planning for their retirement.

Annuities often play a role in life insurance planning. An Annuity Is A Life Insurance Product That 2024 explores the relationship between annuities and life insurance.

- Guaranteed income:Joint life annuities provide a guaranteed stream of income that cannot be outlived, providing peace of mind for couples.

- Income security for both partners:The annuity continues to pay out even if one partner passes away, ensuring the surviving partner has a steady income source.

- Potential tax benefits:The payments received from a joint life annuity may be partially or fully tax-free, depending on the specific terms of the annuity and the individual’s tax situation.

Considerations for Choosing a Joint Life Annuity

When selecting a joint life annuity, it’s crucial to carefully consider several factors.

The date associated with an annuity is a key factor in its operation. Annuity Date Is 2024 discusses the significance of this date and how it affects the annuity’s terms.

- Payout options:Choose a payout option that aligns with your income needs and longevity expectations.

- Interest rates:Compare interest rates offered by different annuity providers to maximize your returns.

- Fees and expenses:Be aware of any fees associated with the annuity, such as administrative fees, surrender charges, and mortality and expense charges.

- Inflation protection:Consider whether the annuity offers inflation protection to maintain the purchasing power of your income over time.

Comparing Joint Life Annuities with Other Options

Joint life annuities are just one of many retirement income options available. It’s important to compare them with other alternatives to make an informed decision.

Annuity contracts can offer financial security, but it’s crucial to assess if they’re the right choice for you. Annuity Is Good Or Bad 2024 explores the pros and cons of annuities in detail.

- Individual retirement accounts (IRAs):IRAs offer tax advantages and flexibility in investment choices but don’t provide guaranteed income.

- 401(k) plans:Employer-sponsored retirement plans offer tax benefits and potential employer matching contributions but don’t provide guaranteed income.

- Reverse mortgages:Reverse mortgages allow homeowners to access equity in their homes but can come with high fees and interest rates.

Key Features of “Option 2024”

“Option 2024” joint life annuities are characterized by several specific features.

Curious about how annuities work? Annuity How It Works 2024 breaks down the process, explaining how these financial instruments generate income over time.

- Higher initial payout:“Option 2024” annuities typically offer a higher initial payout compared to other types of joint life annuities.

- Actuarial assumptions:The payment structure is based on actuarial assumptions related to the longevity of the annuitants.

- Longevity risk:This option may carry a higher risk of outliving the annuity payments, especially if the annuitants live longer than expected.

Financial Implications of Joint Life Annuities

Purchasing a joint life annuity can have significant financial implications.

- Income growth:Annuities may offer potential for income growth through interest accumulation.

- Inflation protection:Some annuities offer inflation protection to help maintain the purchasing power of your income over time.

- Liquidity:Annuities typically have restrictions on withdrawals, limiting access to your funds.

- Fees and expenses:Annuities can come with various fees and expenses that can impact your returns.

Legal and Regulatory Aspects

Joint life annuities are subject to legal and regulatory oversight.

- State insurance regulations:Annuities are regulated by state insurance departments to protect consumers.

- Consumer protection measures:There are consumer protection measures in place to ensure fair and transparent annuity practices.

End of Discussion

Choosing the right annuity option requires careful consideration of your individual circumstances, financial goals, and risk tolerance. Joint life annuities, particularly “Option 2024,” can offer valuable benefits for couples seeking financial security in retirement. However, it’s essential to understand the terms and conditions, explore different payout options, and consult with a financial advisor to determine if this approach aligns with your long-term financial strategy.

FAQ Insights

How does “Option 2024” affect the payout amount?

Ready to dive into the world of mobile app development? Android app development for beginners in 2024 offers a great starting point for those interested in creating their own Android apps.

The “Option 2024” designation influences the calculation of the annuity payment, often leading to a lower initial payout compared to other options. However, it provides a guaranteed income stream for the surviving partner even after the death of the first annuitant.

What are the tax implications of joint life annuities?

The tax treatment of joint life annuities can vary depending on the specific type of annuity and the jurisdiction. Generally, the income received from a joint life annuity is considered taxable income, but the specific tax rules may differ.

If you’re considering naming a trust as the beneficiary of your annuity, it’s important to understand the implications. Annuity Beneficiary Is A Trust 2024 provides insights into this complex financial decision.

It’s important to consult with a tax advisor to understand the tax implications for your specific situation.

Are there any fees associated with joint life annuities?

Yes, joint life annuities may have associated fees, such as administrative fees, surrender charges, and mortality charges. These fees can vary depending on the insurance company and the specific annuity product. It’s essential to review the fee schedule carefully before making a decision.

How do joint life annuities compare to other retirement income options?

Joint life annuities offer a guaranteed income stream, unlike other options like stocks or bonds, which carry investment risk. However, other options may provide potential for higher returns, but also expose you to greater risk. The best choice depends on your risk tolerance and financial goals.