Annuity Is Sequence Of Mode Of Payment 2024 – Annuity: A Sequence of Payment Options in 2024, delves into the world of financial planning and provides a comprehensive understanding of how annuities work. An annuity is a financial product that provides a stream of regular payments over a specified period, offering a structured way to manage income and savings.

Deciding between an annuity and a 401k can be tough. Learn more about the pros and cons of each in our article: Is Annuity Better Than 401k 2024.

This guide explores the different types of annuities, their applications, advantages, and disadvantages, helping you make informed decisions about incorporating annuities into your financial strategy.

From defining annuities and explaining their payment structures to discussing their uses in retirement planning, income generation, and estate planning, this guide covers a wide range of aspects. It also delves into the factors to consider when choosing an annuity, including regulations, tax implications, and emerging trends in the annuity market.

If you’re in Sarasota and need an annuity expert, consider contacting Annuity King Sarasota for personalized advice.

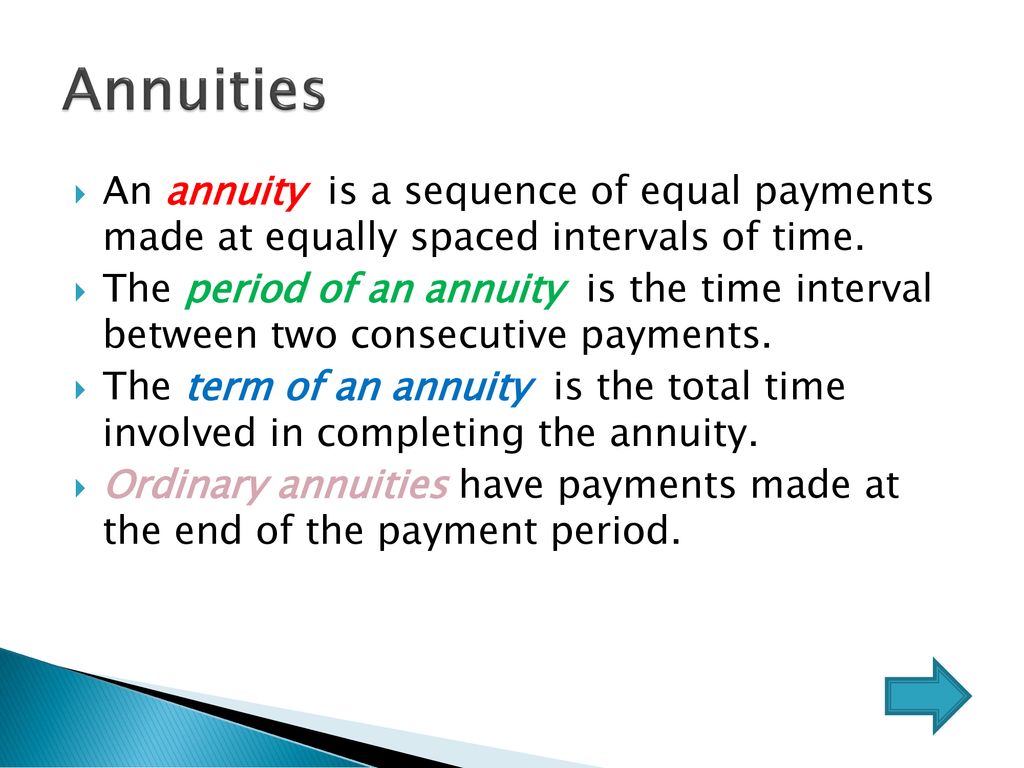

Defining Annuities

An annuity is a financial product that provides a series of regular payments over a specified period of time. It’s a valuable tool for financial planning, especially for retirement, income generation, and estate planning. Understanding the basics of annuities is essential for anyone seeking to secure their financial future.

Understanding Annuity Payments

An annuity is essentially a sequence of payments. The payments can be made at regular intervals, such as monthly, quarterly, or annually. The frequency and duration of payments are predetermined and agreed upon when the annuity is set up. This predictable flow of income makes annuities attractive for individuals looking for financial stability and a reliable source of income.

One of the biggest questions about annuities is their taxability. Find out if annuities are exempt from tax in 2024.

Types of Annuities

- Fixed Annuities:These offer a guaranteed rate of return, providing a predictable stream of income. The interest rate is fixed for the duration of the annuity, making it suitable for those seeking stability and risk aversion.

- Variable Annuities:These offer the potential for higher returns but come with greater risk. The interest rate fluctuates based on the performance of underlying investments, such as stocks or mutual funds.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity. This type is ideal for individuals who need immediate income, such as retirees.

- Deferred Annuities:Payments are delayed until a future date, typically after a specified period or at a specific age. These are often used for long-term savings and retirement planning.

Annuity Payments

Annuity payments are the heart of the product, providing the financial security that individuals seek. Understanding how these payments are structured and calculated is crucial for making informed decisions.

Frequency and Duration of Annuity Payments

The frequency of annuity payments can vary, with options ranging from monthly to annual payments. The duration of payments is also determined at the outset, with some annuities offering payments for a fixed period, while others provide lifetime income. The choice of frequency and duration depends on individual needs and financial goals.

Calculating Annuity Payments

The calculation of annuity payments involves several factors, including the initial investment amount, the interest rate, and the chosen payment frequency and duration. The formula used for calculating annuity payments considers the time value of money, ensuring that the present value of future payments is equivalent to the initial investment.

Financial institutions and online calculators can help determine the estimated payment amounts for various annuity options.

Khan Academy offers a wealth of educational resources, including information on annuities. Explore their annuity resources for a deeper understanding.

Payment Options

- Lump Sum:This option provides a single, large payment at the start of the annuity period. It is suitable for individuals who need a substantial amount of money upfront, such as for a major purchase or debt consolidation.

- Monthly Installments:This option distributes the annuity payments over a specified period, providing a regular stream of income. It is ideal for individuals seeking a predictable and consistent source of income, such as retirees or those living on a fixed budget.

Annuity Uses and Applications

Annuities are versatile financial tools with diverse applications. They can be tailored to meet various financial needs, from retirement planning to income generation and estate planning.

Are you curious about how annuity income is taxed? Discover whether annuity income is considered capital gains in 2024.

Retirement Planning

Annuities are widely used for retirement planning, providing a reliable stream of income during retirement years. By converting a lump sum of savings into a series of regular payments, annuities help ensure financial stability and a comfortable lifestyle in retirement.

Annuity payments are a key feature of these financial instruments. Explore the different types of annuity payments and how they work.

Income Generation, Annuity Is Sequence Of Mode Of Payment 2024

Annuities can also be used for income generation, providing a steady stream of income for individuals who are not yet retired. This can be particularly beneficial for individuals seeking supplemental income or those who have experienced a job loss or career change.

Estate Planning

Annuities can be incorporated into estate planning strategies. Deferred annuities can be used to provide a legacy for beneficiaries, ensuring that they receive a stream of income after the annuitant’s death. Annuities can also be used to reduce estate taxes, as the death benefit may be exempt from taxation.

Annuity drawdown allows you to withdraw money from your annuity as needed. Learn more about annuity drawdown and its implications.

Annuity Advantages and Disadvantages: Annuity Is Sequence Of Mode Of Payment 2024

Like any financial product, annuities come with both advantages and disadvantages. It’s essential to weigh these factors carefully before making an investment decision.

Are you wondering about the tax implications of annuities in India? Find out if annuity income is taxable in India in 2024.

Advantages of Annuities

- Guaranteed Income:Fixed annuities provide a guaranteed rate of return, ensuring a predictable stream of income.

- Tax-Deferred Growth:The earnings within an annuity grow tax-deferred, meaning that taxes are not paid until withdrawals are made.

- Protection from Market Volatility:Annuities can provide protection from market fluctuations, offering a stable source of income during uncertain economic times.

- Long-Term Income Security:Annuities can provide a lifetime stream of income, ensuring financial security for the long term.

Disadvantages of Annuities

- Limited Liquidity:Accessing funds from an annuity may be restricted, with penalties potentially applied for early withdrawals.

- Potential for Low Returns:Fixed annuities typically offer lower returns compared to other investment options, such as stocks or bonds.

- Fees and Expenses:Annuities often involve fees and expenses, which can impact the overall return on investment.

- Complexity:Annuities can be complex financial products, requiring careful consideration and understanding of their terms and conditions.

Comparison with Other Investment Options

Annuities should be compared with other investment options, such as stocks, bonds, and mutual funds, to determine the best fit for individual financial goals and risk tolerance. Factors to consider include investment goals, time horizon, risk tolerance, and tax implications.

If you’re in Kenya and looking for information on annuities, check out our article on annuities in Kenya for 2024.

Choosing the Right Annuity

Selecting the right annuity requires careful consideration and a thorough understanding of individual financial needs and goals. Several factors should be taken into account to ensure that the chosen annuity aligns with your financial objectives.

If you’re considering an annuity, you might have questions about how it works. Check out these common annuity questions and answers for more information.

Factors to Consider

- Investment Goals:Determine the primary purpose of the annuity, whether it’s retirement planning, income generation, or estate planning.

- Risk Tolerance:Assess your comfort level with risk and choose an annuity that aligns with your risk profile. Fixed annuities are suitable for risk-averse individuals, while variable annuities offer higher potential returns but come with greater risk.

- Time Horizon:Consider your investment time horizon and choose an annuity with a suitable duration of payments.

- Fees and Expenses:Compare the fees and expenses associated with different annuity products and choose an option that minimizes these costs.

- Tax Implications:Understand the tax implications of annuity payments and choose a product that minimizes your tax burden.

Evaluating Annuity Products

When evaluating different annuity products, consider the following factors:

- Guaranteed Rate of Return:For fixed annuities, compare the guaranteed interest rates offered by different providers.

- Investment Options:For variable annuities, assess the performance of the underlying investments and the investment options available.

- Fees and Expenses:Compare the fees and expenses associated with different annuity products, including surrender charges, administrative fees, and mortality and expense charges.

- Death Benefit:Consider the death benefit provided by the annuity, which may provide a lump sum payment to beneficiaries upon the annuitant’s death.

- Customer Service and Reputation:Research the reputation of the annuity provider and their customer service record.

Consulting with a Financial Advisor

It’s highly recommended to consult with a qualified financial advisor before investing in an annuity. A financial advisor can provide personalized guidance based on your individual financial circumstances, goals, and risk tolerance. They can help you understand the complexities of annuities, evaluate different product options, and choose the annuity that best aligns with your needs.

Looking for a new career in 2024? The annuity industry offers a variety of opportunities for professionals with different backgrounds and skillsets.

Annuity Regulations and Tax Implications

Annuities are subject to specific regulations and tax implications. Understanding these aspects is crucial for making informed decisions and maximizing the benefits of annuity investments.

Regulations Governing Annuities

Annuities are regulated by state and federal laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934. These regulations aim to protect investors and ensure that annuities are sold fairly and transparently. Specific regulations may vary by state, so it’s essential to research the regulations in your jurisdiction.

Tax Implications of Annuity Payments

The tax implications of annuity payments depend on the type of annuity and the specific terms of the contract. Generally, the earnings within an annuity grow tax-deferred, meaning that taxes are not paid until withdrawals are made. However, withdrawals from an annuity are typically taxed as ordinary income.

It’s important to consult with a tax advisor to understand the specific tax implications of your annuity contract.

Tax Advantages and Disadvantages

- Tax-Deferred Growth:The tax-deferred growth of earnings within an annuity can be a significant advantage, as it allows for compounding growth without immediate tax liability.

- Potential for Tax-Free Withdrawals:In some cases, withdrawals from an annuity may be tax-free, such as withdrawals from a qualified annuity used for education expenses or medical expenses.

- Taxable Income:Withdrawals from an annuity are typically taxed as ordinary income, which can be a disadvantage, especially if your tax bracket is high.

Future Trends in Annuities

The annuity market is constantly evolving, driven by technological advancements, changing demographics, and evolving financial needs. Understanding emerging trends can help individuals make informed decisions about annuity investments.

You might hear annuities referred to by other names. Discover some of the common alternate names for annuities.

Emerging Trends in the Annuity Market

- Increased Demand for Income Annuities:As individuals live longer and face rising healthcare costs, the demand for annuities that provide a guaranteed stream of income is expected to increase.

- Growth of Variable Annuities:Variable annuities offer the potential for higher returns but come with greater risk. As investors seek growth potential, variable annuities are expected to continue to gain popularity.

- Innovation in Annuity Products:Annuity providers are constantly innovating, developing new products and features to meet the evolving needs of investors. This includes products that offer greater flexibility, customization, and access to investment options.

Impact of Technological Advancements

Technological advancements are transforming the annuity market, making it easier for individuals to research, compare, and purchase annuities online. This includes online platforms that provide personalized recommendations, automated calculations, and seamless online transactions.

Need to compare annuity quotes from different providers? Check out our guide to getting annuity quotes in 2024.

Future of Annuity Products

Annuities are expected to play a significant role in financial planning in the future. As individuals seek financial security and a reliable source of income, annuities are likely to become increasingly popular. Innovation in product design and technology will continue to shape the annuity market, offering investors greater choice and flexibility.

The annuity industry offers a range of career opportunities for those interested in healthcare, including financial advisors, actuaries, and more.

Conclusion

Understanding annuities can be a valuable step towards achieving your financial goals. By carefully evaluating the different types of annuities, considering their advantages and disadvantages, and seeking professional guidance, you can make informed decisions about incorporating annuities into your financial plan.

Whether you are aiming to secure your retirement income, generate a steady stream of income, or plan for your legacy, annuities can be a valuable tool in achieving your financial objectives.

FAQ Insights

What are the different types of annuities?

Wondering if inheriting an annuity means you’ll have to pay taxes on it? Find out if inherited annuities are taxable in 2024.

Annuities can be categorized into various types based on their payment structure and features. Common types include fixed annuities, variable annuities, immediate annuities, and deferred annuities. Each type offers different benefits and risks, so it’s crucial to understand the characteristics of each before making a decision.

How do I choose the right annuity for my needs?

Choosing the right annuity depends on your individual financial goals, risk tolerance, and time horizon. Factors to consider include the type of annuity, the payment structure, the interest rate or investment options, and the fees associated with the product. Consulting with a financial advisor can help you determine the best annuity for your circumstances.