Annuity Is Ordinary 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, a financial instrument that provides a steady stream of income, have become increasingly popular in recent years, particularly as individuals seek reliable sources of retirement income.

This guide delves into the world of annuities, exploring their different types, how they work, and their potential benefits and risks in the current economic climate. We’ll also discuss the key factors to consider when choosing an annuity in 2024, providing you with the knowledge you need to make informed decisions about your financial future.

From understanding the basics of annuity calculations to navigating the complexities of annuity regulations and tax implications, this comprehensive guide will equip you with the knowledge and insights you need to confidently navigate the world of annuities. Whether you’re a seasoned investor or just starting your financial journey, this exploration of annuities will provide you with a valuable framework for making informed decisions about your financial future.

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. Think of it as a financial plan that ensures you have a steady source of income, especially during retirement.

Types of Annuities

Annuities can be categorized based on how the payments are structured and how the investment grows:

- Fixed Annuities: These offer guaranteed payments for a specific duration. They’re ideal for those seeking predictable income, as the payment amount remains constant, regardless of market fluctuations.

- Variable Annuities: In this type, your payments are linked to the performance of a specific investment portfolio. The payment amount can fluctuate based on market performance, potentially leading to higher returns but also carrying greater risk.

- Immediate Annuities: Payments start right away after you purchase the annuity. This is often used for immediate income needs, like retirement or supplementing current income.

- Deferred Annuities: Payments are delayed, usually for a specific period, often used for long-term savings goals like retirement planning.

Examples of Annuity Use

- Retirement Income: Annuities can provide a steady stream of income throughout retirement, supplementing other retirement savings.

- Long-Term Care: Annuities can help cover the costs of long-term care, providing financial security in case of unexpected health issues.

- Estate Planning: Annuities can be used to provide a steady income stream for beneficiaries after your passing.

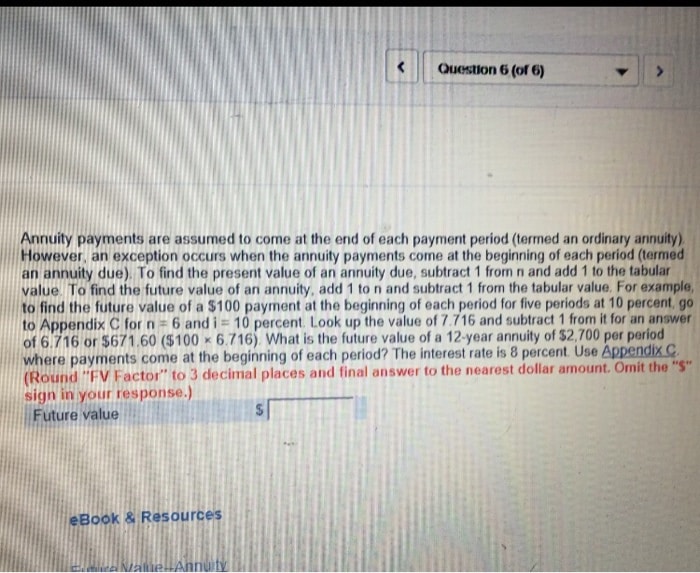

Ordinary Annuity vs. Annuity Due

The key difference between an ordinary annuity and an annuity due lies in the timing of the payments.

Ordinary Annuity

Payments are made at the end of each period. For instance, if you have a monthly ordinary annuity, your payment would be due at the end of each month.

Annuity Due

Payments are made at the beginning of each period. So, for a monthly annuity due, your payment would be due at the start of each month.

Real-World Examples

- Ordinary Annuity: A typical car loan where you make monthly payments at the end of each month is an example of an ordinary annuity.

- Annuity Due: A rent payment where you pay at the beginning of each month is an example of an annuity due.

Annuity Calculations

Calculating the future value of an annuity involves determining the total amount you’ll have accumulated after a certain period, considering the interest earned on your payments.

Formula for Future Value of an Ordinary Annuity

The formula for calculating the future value of an ordinary annuity is:

FV = P

- [((1 + r)^n

- 1) / r]

Where:

- FV = Future Value

- P = Payment amount

- r = Interest rate per period

- n = Number of periods

Factors Affecting Future Value, Annuity Is Ordinary 2024

- Interest Rate: A higher interest rate generally leads to a larger future value.

- Time Period: The longer the investment period, the more time for interest to compound, resulting in a larger future value.

- Payment Amount: Larger payment amounts naturally lead to a larger future value.

Calculating Future Value Using Tools

Financial calculators and spreadsheet software can help you easily calculate the future value of an annuity. Simply input the necessary information, and the tool will calculate the future value for you.

Annuities in 2024

The economic landscape in 2024 presents both opportunities and challenges for annuity investments.

Economic Climate and Annuities

The current economic climate is marked by [insert current economic trends and their impact on annuity investments].

Key Factors to Consider in 2024

- Interest Rates: [Discuss how interest rates might impact annuity returns and investment decisions].

- Inflation: [Explain how inflation could affect the purchasing power of annuity payments].

- Market Volatility: [Discuss the potential impact of market volatility on variable annuities].

Comparing Annuity Products

[Provide a brief overview of different annuity products available in the market, highlighting their key features, benefits, and risks].

Annuity Risks and Benefits

Like any investment, annuities come with both potential risks and benefits.

Annuity Risks

- Interest Rate Risk: Fixed annuities may offer lower returns if interest rates rise after you’ve purchased the annuity.

- Market Risk: Variable annuities are subject to market fluctuations, which can impact your returns.

- Liquidity Risk: Accessing your annuity funds before the designated period can result in penalties.

Benefits of Annuities

- Guaranteed Income: Fixed annuities provide a guaranteed stream of income, offering financial security.

- Tax-Deferred Growth: Earnings within an annuity grow tax-deferred, potentially leading to greater returns over time.

- Protection Against Outliving Your Savings: Annuities can provide a lifetime income stream, helping you avoid running out of money in retirement.

Achieving Financial Goals

[Provide examples of how annuities can be used to achieve specific financial goals, such as retirement income, long-term care, or estate planning].

Annuity Regulations and Tax Implications

Understanding the regulations and tax implications of annuities is crucial for making informed investment decisions.

Annuity Regulations

[Discuss the regulations surrounding annuity investments, including the rules governing the sale, distribution, and taxation of annuities].

Tax Implications of Annuities

- Tax-Deferred Growth: Earnings within an annuity are generally not taxed until they are withdrawn.

- Taxation of Withdrawals: Withdrawals from an annuity are typically taxed as ordinary income.

- Tax Implications of Death Benefits: The death benefit from an annuity may be subject to estate taxes.

Examples of Annuity Income Taxation

[Provide examples of how annuity income is taxed in different situations, such as withdrawals before and after retirement].

Annuity Alternatives: Annuity Is Ordinary 2024

While annuities can be a valuable tool for financial planning, there are other investment options that can achieve similar goals.

Alternative Investment Options

- Individual Retirement Accounts (IRAs): Traditional and Roth IRAs offer tax advantages for retirement savings.

- 401(k) Plans: Employer-sponsored retirement plans allow pre-tax contributions to grow tax-deferred.

- Mutual Funds: Mutual funds provide diversified investment options, allowing you to invest in a basket of assets.

- Exchange-Traded Funds (ETFs): ETFs offer similar diversification as mutual funds but trade on exchanges like stocks.

Comparing Risks and Benefits

[Compare and contrast the risks and benefits of these alternative investment options with annuities, considering factors like potential returns, tax implications, and liquidity].

Choosing the Best Investment Strategy

[Provide examples of how to choose the best investment strategy for your individual needs, considering your financial goals, risk tolerance, and time horizon].

Last Recap

As we conclude our journey through the world of annuities, it’s clear that they can be a powerful tool for achieving your financial goals, especially in today’s uncertain economic environment. By carefully considering the various types of annuities available, understanding their risks and benefits, and seeking professional guidance when needed, you can make informed decisions that align with your individual needs and aspirations.

Whether you’re seeking a secure source of retirement income, protecting your loved ones, or simply growing your wealth, annuities offer a range of options to help you achieve your financial objectives. Remember, the key to success lies in understanding the nuances of annuities and choosing the right strategy for your unique circumstances.

Q&A

What are the most common types of annuities?

The most common types of annuities include fixed annuities, variable annuities, immediate annuities, and deferred annuities. Each type has its own unique features and benefits, and the best choice for you will depend on your individual circumstances and financial goals.

How do I choose the right annuity for me?

Choosing the right annuity requires careful consideration of your financial goals, risk tolerance, and time horizon. It’s essential to consult with a financial advisor to determine the best option for your specific needs.

Are annuities right for everyone?

Annuities are not a one-size-fits-all solution. They can be a valuable tool for some individuals, but they may not be appropriate for everyone. It’s important to weigh the potential benefits and risks before making a decision.

What are the tax implications of owning an annuity?

The tax implications of owning an annuity can vary depending on the type of annuity and the specific terms of the contract. It’s essential to understand the tax implications before investing in an annuity.

What are some alternatives to annuities?

There are a number of alternatives to annuities, including traditional investments like stocks, bonds, and mutual funds. It’s important to compare the risks and benefits of different investment options before making a decision.