Annuity Is Indefinite Duration 2024 explores the concept of annuities that provide income for an indefinite period, offering a potential solution for those seeking financial security and longevity protection. This guide delves into the fundamentals of annuities, their various types, and the unique advantages of choosing an annuity with an indefinite duration.

Developing Android apps for specific industries requires understanding the unique needs and challenges of those industries. You can learn more about Android app development for different industries in 2024 here: Android app development for specific industries in 2024.

We’ll examine the key factors influencing annuity decisions in 2024, including interest rate trends and the impact of inflation on the purchasing power of annuity income.

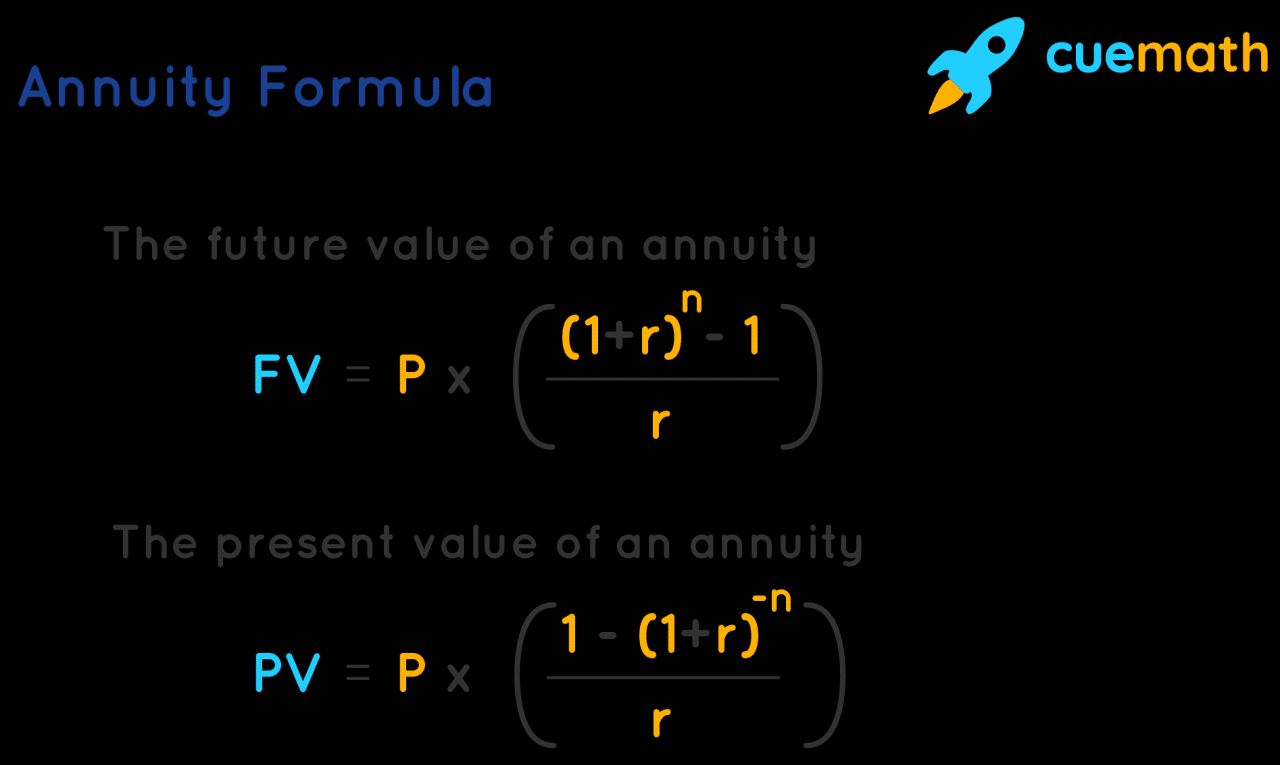

The formula for calculating an annuity depends on several factors, including the interest rate, the number of payments, and the amount of each payment. This article explores the annuity formula in more detail: Annuity Formula Is 2024.

The guide also provides a comprehensive overview of annuity options with indefinite duration, highlighting their features, potential benefits, and considerations. We’ll explore the potential risks associated with annuities, particularly those with indefinite duration, including the risk of outliving your annuity income and the impact of market volatility on variable annuities.

An annuity is defined as a series of payments made over a set period of time. If you’re looking for a more detailed explanation of how annuities are defined, this article provides a helpful overview: Annuity Is Defined As Mcq 2024.

Annuity: Indefinite Duration in 2024

Annuities have long been a cornerstone of retirement planning, offering a consistent stream of income throughout one’s golden years. While traditional annuities often have a fixed duration, a growing number of individuals are exploring annuities with indefinite duration, seeking the potential for lifetime income security.

Dollify is an AI-powered tool that lets you create custom avatars, and it’s become increasingly popular. You can learn more about the impact of AI on avatar creation with Dollify in 2024 here: Dollify 2024: The Impact of AI on Avatar Creation.

This article delves into the world of annuities, focusing on the concept of indefinite duration and its implications for financial planning in 2024.

Dollify allows for a lot of customization and advanced techniques to create unique and expressive avatars. You can learn more about these techniques and how to get the most out of Dollify in 2024 here: Dollify 2024: Advanced Techniques and Customization.

Annuity Fundamentals, Annuity Is Indefinite Duration 2024

An annuity is a financial product that provides a series of regular payments, typically for a specified period or for life. Annuities are often used to supplement retirement income, but they can also be utilized for other purposes, such as estate planning or long-term care.

Whether an annuity is good or bad depends on your individual financial situation and goals. You can learn more about the pros and cons of annuities in 2024 here: Annuity Is Good Or Bad 2024.

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable income payments. The rate is typically fixed for a specific period, after which it may be adjusted based on market conditions.

- Variable Annuities:These annuities offer the potential for higher returns but also carry more risk. The value of the annuity is linked to the performance of underlying investments, such as stocks or bonds, so the income payments can fluctuate.

- Indexed Annuities:These annuities offer a combination of guaranteed income and potential growth. The payments are linked to the performance of a specific index, such as the S&P 500, but they also have a minimum guaranteed return.

Annuities can be used in various ways to achieve financial goals. For example, they can be used to:

- Supplement retirement income:Annuities can provide a consistent stream of income to help cover living expenses during retirement.

- Create a guaranteed income stream:Fixed annuities offer a guaranteed income stream, which can provide peace of mind during retirement.

- Protect against outliving your savings:Annuities can help ensure that you don’t outlive your savings, as they provide income for life.

- Leave a legacy:Annuities can be structured to provide income to beneficiaries after your death.

Indefinite Duration

An annuity with indefinite duration, also known as a lifetime annuity, provides income payments for the duration of the annuitant’s life. This type of annuity offers the potential for income security for as long as the annuitant lives.

Android WebView is a powerful component for displaying web content within your Android app. To get the most out of it, it’s important to follow best practices. You can find helpful tips and tricks for using Android WebView in 2024 here: Android WebView 202 best practices.

- Income for Life:An indefinite duration annuity guarantees income payments until the annuitant passes away, providing a lifelong source of income.

- Protection Against Longevity Risk:These annuities help mitigate the risk of outliving your savings, as they provide income for as long as you live, regardless of how long you live.

- Comparison to Fixed Duration Annuities:Unlike fixed duration annuities, which have a predetermined end date, indefinite duration annuities provide income for the rest of your life, eliminating the risk of running out of income.

Annuity Benefits

Choosing an annuity with indefinite duration offers several potential benefits:

- Lifetime Income Security:Indefinite duration annuities provide a guaranteed stream of income for as long as you live, offering peace of mind and financial security.

- Longevity Protection:These annuities protect against the risk of outliving your savings, ensuring that you have a consistent income stream throughout your retirement years.

- Potential Tax Benefits:Annuity payments may be taxed differently depending on the type of annuity and the tax laws in your jurisdiction. Consult with a financial advisor to understand the tax implications of your specific annuity.

Considerations for 2024

Several factors influence annuity decisions in 2024, including:

- Interest Rate Trends:Current interest rate trends can impact annuity payouts. Higher interest rates generally lead to higher annuity payouts, while lower interest rates may result in lower payouts.

- Inflation:Inflation can erode the purchasing power of annuity income over time. It’s crucial to consider the potential impact of inflation when choosing an annuity.

- Market Volatility:Market volatility can affect the performance of variable annuities. If the market performs poorly, the value of your annuity may decrease, leading to lower income payments.

Annuity Options

| Annuity Type | Features | Potential Benefits | Considerations |

|---|---|---|---|

| Fixed Annuity | Guaranteed rate of return, predictable income payments. | Income security, predictable payments, protection against market volatility. | Lower potential returns compared to variable annuities, interest rate risk. |

| Variable Annuity | Growth potential, investment options, potential for higher returns. | Potential for higher returns, flexibility in investment choices. | Market risk, potential for lower returns, higher fees. |

| Indexed Annuity | Guaranteed minimum return, potential for growth linked to an index. | Potential for growth, guaranteed minimum return, protection against downside risk. | Limited growth potential compared to variable annuities, potential for lower returns. |

Annuity Risks

While annuities offer potential benefits, they also carry some risks, particularly those with indefinite duration:

- Outliving Your Annuity Income:The risk of outliving your annuity income is a concern for anyone considering an indefinite duration annuity. While these annuities provide lifetime income, they do not guarantee a specific amount of income. If you live longer than expected, your income may not keep pace with inflation, potentially leading to a decline in your standard of living.

- Market Volatility:Variable annuities are subject to market volatility, which can impact the value of your annuity and the income payments you receive. If the market performs poorly, the value of your annuity may decrease, leading to lower income payments.

Last Point

Understanding the intricacies of annuities, particularly those with indefinite duration, is crucial for making informed financial decisions. This guide has provided a comprehensive overview of annuity fundamentals, their advantages and disadvantages, and key considerations for 2024. By carefully evaluating your financial goals, risk tolerance, and the current market conditions, you can determine if an annuity with indefinite duration is a suitable option for your retirement planning.

An annuity contract outlines the terms and conditions of the annuity, including the payment schedule and the amount of the payments. You can find more information about annuity contracts in this article: Annuity Contract Is 2024.

FAQ Summary: Annuity Is Indefinite Duration 2024

What are the tax implications of annuities with indefinite duration?

Annuity is a financial product that provides a stream of payments over a period of time. You can learn more about what an annuity is and how it works by reading this article: Annuity Is Definition 2024.

The tax implications of annuities can vary depending on the specific type of annuity and the individual’s tax situation. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.

How do I choose the right annuity for my needs?

Choosing the right annuity depends on your individual circumstances, financial goals, risk tolerance, and time horizon. It’s recommended to consult with a financial advisor to determine the most suitable annuity for your needs.

Deciding whether to get an annuity is a big decision, and there are many factors to consider. You can find some useful insights about whether getting an annuity is worth it in 2024 here: Is Getting An Annuity Worth It 2024.

An annuity is best defined as a series of payments made over a period of time, usually in exchange for a lump sum payment. If you’re looking for a more comprehensive definition, you can find it here: An Annuity Is Best Defined As 2024.

Dollify’s AI-powered features allow you to create avatars with unique and expressive personalities. You can learn more about how to create unique and expressive avatars with Dollify in 2024 here: Dollify 2024: Creating Unique and Expressive Avatars.

A contingent annuity is a type of annuity where the payments are dependent on a specific event. You can find more information about contingent annuities in this article: Annuity Contingent Is 2024.

Monetizing an Android app can be done in various ways, and the best approach depends on your app and your target audience. You can find some helpful tips and strategies for monetizing your Android app in 2024 here: How to monetize an Android app in 2024.

You can receive an annuity and still work. However, there may be some implications for your income and taxes. This article provides more information about whether you can receive an annuity and still work in 2024: Can You Receive Annuity And Still Work 2024.