Annuity Is A Single Sum 2024: Your Guide to Secure Retirement Income, annuities offer a unique approach to retirement planning, allowing individuals to convert a lump sum into a steady stream of income. This strategy provides a sense of financial security, particularly in an era of market volatility and increasing longevity.

Pushbullet can also be used to send notifications from your computer to your phone, keeping you connected across devices. Learn how to use Pushbullet to send notifications from your computer to your phone and stay informed wherever you are.

Understanding the intricacies of annuities, especially those purchased with a single sum, is crucial for making informed decisions about your financial future. This guide delves into the workings of annuities, explores their advantages and potential drawbacks, and provides insights into the current market landscape for 2024.

Android Authority offers insightful predictions and trends for the smartphone market in 2024. Explore the anticipated trends and predictions for smartphones in 2024 and get a glimpse into the future of mobile technology.

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a specified period of time. It’s essentially a contract between you and an insurance company, where you make a lump sum payment or series of payments, and in return, you receive guaranteed payments for life or for a set period.

Google Tasks is a versatile tool that can be incredibly useful for students. Discover how Google Tasks can help students stay organized and productive with its intuitive interface and powerful features.

Annuities can be a valuable tool for retirement planning, providing a steady income stream during your golden years.

The Snapdragon 2024 processor is anticipated to be a powerful addition to the mobile landscape. Learn about the release date and price of the Snapdragon 2024 and prepare for the latest advancements in mobile processing.

Types of Annuities

There are several types of annuities, each with its own unique features and benefits. Some common types include:

- Fixed Annuities:These offer guaranteed payments for a specific period or for life, with a fixed interest rate. This provides predictable income, but the growth potential is limited.

- Variable Annuities:These offer payments that fluctuate based on the performance of underlying investments. This provides potential for higher returns, but also carries greater risk.

- Immediate Annuities:These start making payments immediately after you purchase them. This is a good option if you need income right away.

- Deferred Annuities:These start making payments at a future date, allowing you to grow your savings over time. This is a good option if you’re planning for retirement in the future.

Key Features of Annuities

- Guaranteed Payments:Many annuities offer guaranteed payments for life or for a specific period, providing peace of mind about your income stream.

- Potential Growth:Some annuities, like variable annuities, offer the potential for growth based on investment performance.

- Tax Implications:The tax implications of annuities can vary depending on the type of annuity and how it’s structured. It’s important to consult with a financial advisor to understand the tax implications of your specific annuity.

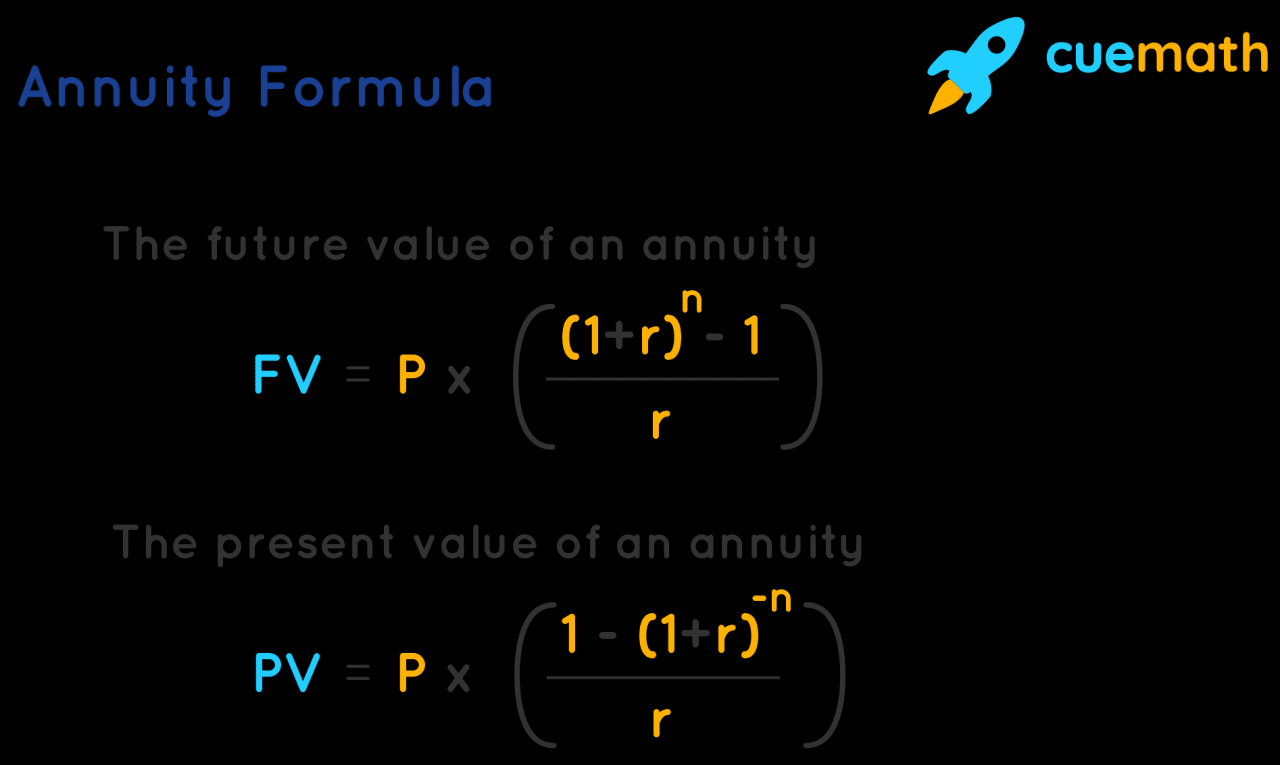

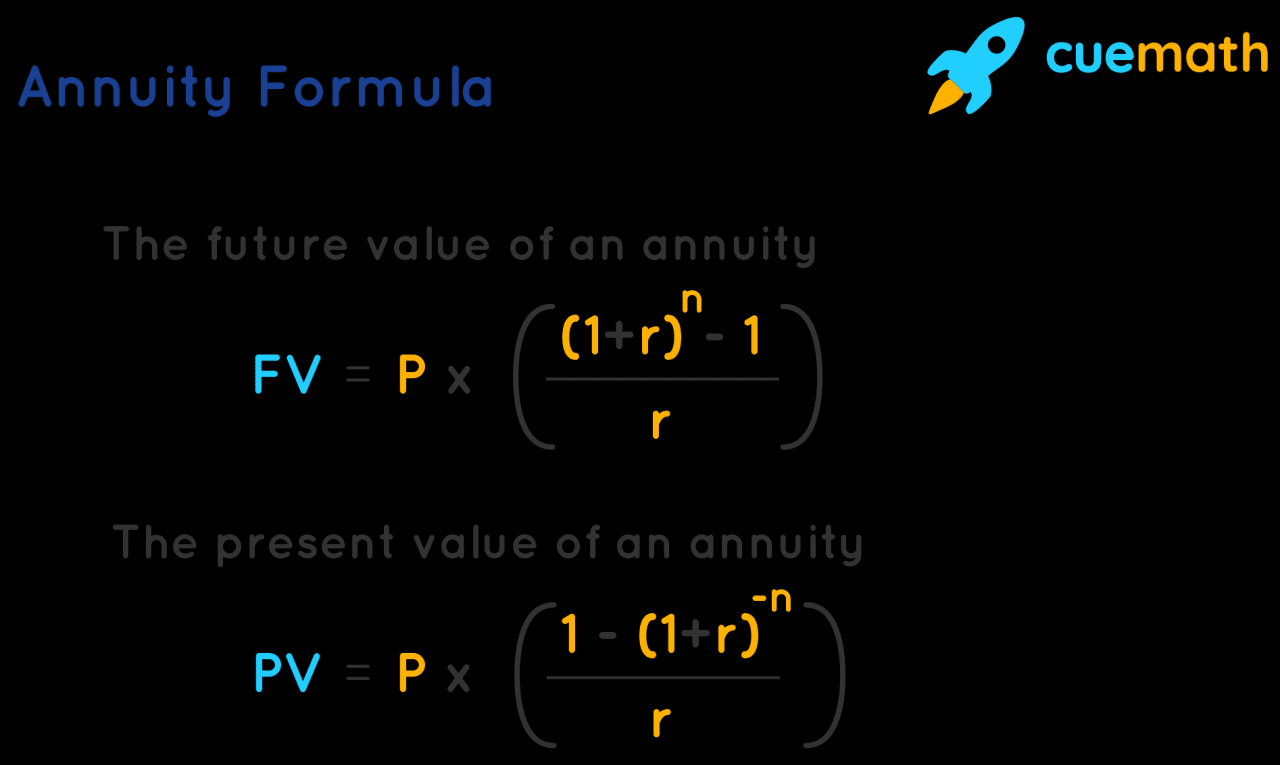

How Annuities Work with a Single Sum: Annuity Is A Single Sum 2024

An annuity purchased with a single sum payment is a straightforward process. You make a one-time payment to the insurance company, and they agree to provide you with a stream of income payments for a specified period or for life.

Android 14 is packed with exciting new features and updates, and Android Authority provides a comprehensive overview. Explore the latest features and updates in Android 14 and learn how they can enhance your mobile experience.

Annuitization, Annuity Is A Single Sum 2024

The process of converting a lump sum into a stream of income is called annuitization. This is the core function of an annuity. When you annuitize your lump sum, you essentially trade a large amount of money upfront for a guaranteed stream of smaller payments over time.

In the ever-evolving world of Android app development, staying updated on best practices is crucial. Discover the best practices for Android app development in 2024 and ensure your apps are optimized for performance, security, and user experience.

Factors Influencing Payout Amount

The amount of your annuity payments depends on several factors, including:

- Interest Rates:Higher interest rates generally lead to larger annuity payments.

- Age:Younger annuitants typically receive smaller payments than older annuitants, as they are expected to live longer.

- Life Expectancy:Your life expectancy plays a significant role in determining the payout amount.

- Annuity Type:The type of annuity you choose will also impact the payout amount.

Advantages of Annuities with a Single Sum

Purchasing an annuity with a single sum can offer several advantages:

Guaranteed Income

Annuities provide a guaranteed income stream, which can be a valuable asset in retirement. This helps to protect you from the uncertainties of market volatility and inflation.

Android WebView 202 brings a host of new features to enhance your app’s web integration. Explore the new features of Android WebView 202 and discover how they can improve your app’s performance and user experience.

Protection Against Market Volatility

By locking in your investment with a single sum, you are essentially removing it from the market’s ups and downs. This can provide peace of mind and protect your principal from losses.

Foldable phones are becoming increasingly popular, and the Snapdragon 2024 is designed to power these innovative devices. Explore the capabilities of the Snapdragon 2024 for foldable phones and witness the future of mobile technology.

Longevity Risk Mitigation

Annuities can help to mitigate longevity risk, which is the risk of outliving your savings. With a guaranteed income stream for life, you can be sure that you’ll have income even if you live longer than expected.

Android WebView 202 offers a powerful way to integrate web content within your Android apps. Discover the specific use cases for Android WebView 202 and learn how it can enhance your app’s functionality.

Examples of Advantages

- Retirement Planning:Annuities can provide a steady income stream during retirement, helping to cover essential expenses.

- Estate Planning:Annuities can be used to provide income for beneficiaries after your death.

- Long-Term Care:Annuities can help to cover the costs of long-term care, which can be a significant expense.

Considerations for Choosing an Annuity

Selecting the right annuity is crucial to ensure that it meets your individual needs and financial goals. Here are some factors to consider:

Provider’s Reputation

It’s important to choose an annuity provider with a solid reputation for financial stability and customer service.

Pushbullet is a handy tool for seamless file transfer between your phone and computer. Learn how to use Pushbullet to send files from your phone to your computer and streamline your workflow.

Contract Terms

Carefully review the contract terms of any annuity you’re considering. Pay attention to the payout structure, surrender charges, and other fees.

Glovo offers a variety of payment methods to suit your preferences, and security is a top priority. Explore the different payment methods and security features offered by Glovo and ensure your transactions are safe and convenient.

Fees

Annuities can have various fees associated with them, such as administrative fees, surrender charges, and mortality charges. Make sure you understand all the fees involved before purchasing an annuity.

The landscape of Android app development is constantly evolving, and 2024 promises exciting advancements. Discover the future of Android app development in 2024 and explore the latest trends, technologies, and best practices to stay ahead of the curve.

Types of Annuities

Consider the different types of annuities available and their suitability for your individual needs. For example, if you’re seeking guaranteed income, a fixed annuity might be a good choice. However, if you’re comfortable with some risk and want the potential for higher returns, a variable annuity might be more suitable.

Google Tasks is a valuable tool for enhancing productivity, and this comprehensive guide explores its capabilities. Learn more about Google Tasks and its features for productivity and unlock its potential to streamline your workflow.

Risks

It’s important to understand the risks associated with annuities. For example, fixed annuities may offer lower returns compared to other investments. Variable annuities carry investment risk, and your payments could fluctuate based on the performance of the underlying investments.

The Snapdragon processor is known for its performance, and the 2024 iteration is no exception. Learn more about the performance benchmarks of the Snapdragon 2024 and see how it stacks up against previous generations.

Annuities in 2024

The annuity market is constantly evolving, and there are several trends and changes to be aware of in 2024.

Market Trends

- Increased Demand for Guaranteed Income:With rising interest rates and market volatility, many individuals are seeking the security of guaranteed income. This is driving increased demand for annuities.

- Innovation in Annuity Products:Annuity providers are introducing new products and features to meet the evolving needs of consumers.

- Focus on Longevity Risk Mitigation:As people are living longer, annuities are becoming increasingly popular as a way to mitigate longevity risk.

Regulatory Updates

Regulatory changes can impact the annuity market. Keep an eye on any new regulations or updates that may affect annuity offerings.

If you’re a restaurant owner or business looking to expand your reach, Glovo offers a range of features designed to streamline your operations. Learn more about the features available for restaurant owners and businesses and discover how Glovo can help you connect with new customers and boost your sales.

Evolving Landscape

Annuities are becoming increasingly important in retirement planning. As the landscape of retirement savings continues to evolve, annuities are likely to play a more prominent role in helping individuals secure their financial futures.

Concluding Remarks

By carefully considering your financial goals, risk tolerance, and the current market conditions, you can determine if an annuity with a single sum is a suitable option for your retirement plan. Remember, seeking advice from a qualified financial advisor can help you navigate the complexities of annuity investments and make informed choices that align with your individual circumstances.

Expert Answers

What are the tax implications of annuity payments?

The tax treatment of annuity payments depends on the type of annuity and the specific contract terms. Generally, a portion of each payment is considered a return of your original investment (tax-free), while the remaining portion is taxed as ordinary income.

Are there any fees associated with annuities?

Yes, annuities typically involve fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can vary depending on the annuity provider and the specific contract terms. It’s important to carefully review the fee structure before making a decision.

Can I withdraw my money from an annuity before retirement?

Some annuities allow for partial withdrawals, while others may have restrictions or penalties for early withdrawals. It’s essential to understand the withdrawal provisions of your specific annuity contract before making any withdrawals.