Annuity Is A Series Of Equal Payments 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, essentially a series of regular payments, are a cornerstone of financial planning, offering individuals a reliable stream of income during retirement.

Android WebView 202 is the latest version of the web rendering engine for Android. Discover what’s new and different in this version compared to its predecessors by reading the Android WebView 202 vs previous versions article.

They provide a structured approach to managing finances, allowing individuals to anticipate future income streams and plan accordingly.

Looking to streamline task management for your team? The Google Tasks 2024: Setting Up Google Tasks for Teams article provides a comprehensive guide to setting up Google Tasks for efficient collaboration.

This guide explores the intricacies of annuities, delving into their various types, payment structures, and applications in different financial scenarios. We’ll examine the factors that influence annuity payments, including interest rates, principal amounts, and payment frequencies. Furthermore, we’ll explore the diverse applications of annuities in retirement planning, investment strategies, and estate planning, highlighting their potential benefits and risks.

Defining Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It’s essentially a contract between you and an insurance company, where you make a lump-sum payment or a series of payments, and in return, the insurance company guarantees you a steady income stream for a predetermined duration.

Google Tasks can be a powerful tool for businesses to manage projects and tasks efficiently. Explore the Google Tasks 2024: Google Tasks for Businesses article to discover how Google Tasks can benefit your organization.

Annuities are often used for retirement planning, but they can also serve other financial goals.

Encountering issues with Android WebView 202? The Android WebView 202 debugging tools article provides insights on effective tools and techniques for troubleshooting and resolving problems.

Key Features of Annuities

- Regular Payments:Annuities provide a consistent income stream, making them ideal for planning predictable expenses like retirement living costs.

- Fixed Duration:The payment period is defined in advance, ensuring a set timeframe for income generation.

- Potential Growth:Depending on the type of annuity, your payments may grow over time, potentially exceeding the initial investment.

Types of Annuities

- Fixed Annuities:These offer a guaranteed interest rate, providing predictable payments. However, the returns may be limited, especially in periods of low interest rates.

- Variable Annuities:These tie the returns to the performance of a specific investment portfolio, potentially offering higher returns but also carrying greater risk.

- Immediate Annuities:Payments begin immediately after the purchase, making them suitable for immediate income needs.

- Deferred Annuities:Payments start at a later date, allowing for potential growth before income generation begins. This can be a good option for long-term savings.

Understanding Annuity Payments: Annuity Is A Series Of Equal Payments 2024

Annuity payments are calculated based on several factors, including the principal amount, the interest rate, and the payment frequency. Understanding these factors is crucial for determining the amount of income you can expect from an annuity.

Android WebView 202 comes with exciting new features that enhance the web browsing experience. Discover these features in the Android WebView 202 new features article.

Calculating Annuity Payments

The formula for calculating annuity payments is:

Payment = (Principal

Looking for great deals and discounts on your favorite food and groceries? The Glovo app best deals and discounts for customers article provides insights on how to maximize your savings with Glovo’s offers.

- Interest Rate) / (1

- (1 + Interest Rate)^-Number of Payments)

Where:

- Principal:The initial investment or lump sum paid into the annuity.

- Interest Rate:The rate at which the principal earns interest, typically expressed as an annual percentage.

- Number of Payments:The total number of payments you will receive over the life of the annuity.

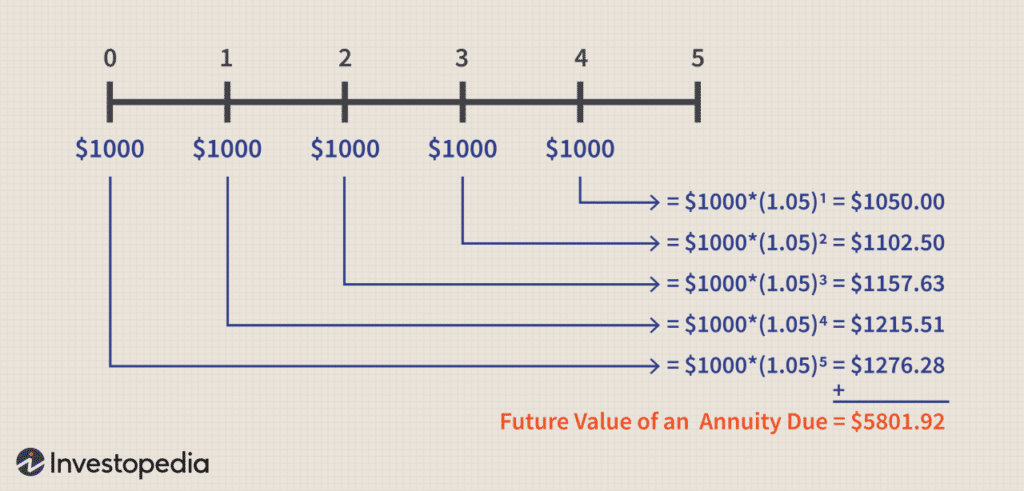

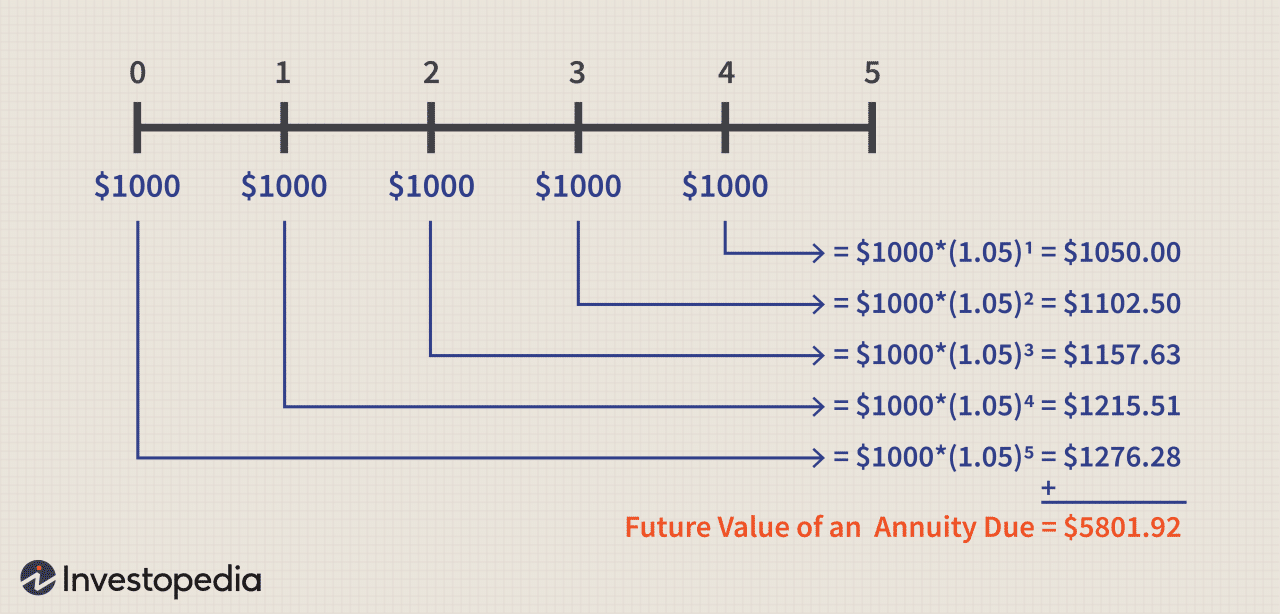

Ordinary Annuities vs. Annuities Due, Annuity Is A Series Of Equal Payments 2024

There are two main types of annuities based on the payment schedule:

- Ordinary Annuities:Payments are made at the end of each period (e.g., monthly, quarterly, annually). This is the most common type of annuity.

- Annuities Due:Payments are made at the beginning of each period. This type of annuity generally results in higher overall returns due to the earlier compounding of interest.

Annuity Payment Schedule

| Payment Number | Payment Amount | Interest Earned | Accumulated Value |

|---|---|---|---|

| 1 | $1,000 | $0 | $1,000 |

| 2 | $1,000 | $50 | $2,050 |

| 3 | $1,000 | $102.50 | $3,152.50 |

| 4 | $1,000 | $157.63 | $4,310.13 |

This table illustrates the structure of an annuity payment schedule, showing the payment amount, interest earned, and accumulated value for each period. The interest earned is calculated based on the accumulated value at the beginning of each period. The accumulated value represents the total amount of money in the annuity at the end of each period.

Annuity Applications

Annuities are versatile financial tools with a wide range of applications, particularly in retirement planning, investment strategies, and estate planning.

Android 14 is the latest version of Google’s mobile operating system. Dive into the exciting new features and updates in the Android Authority 2024 Android 14 features and updates article.

Retirement Income

Annuities are often used to provide a guaranteed stream of income during retirement. By purchasing an annuity with a lump sum or a series of payments, you can ensure a steady flow of income for a specified period, helping you cover essential expenses and maintain your lifestyle.

Interested in becoming a delivery driver with Glovo? Find out about potential earnings and tips for maximizing your income in the Glovo app delivery driver earnings and tips article.

Investment Strategies

Annuities can be incorporated into investment strategies to diversify your portfolio and provide a source of guaranteed income. They can complement other investments like stocks, bonds, and real estate, helping you achieve your financial goals.

Estate Planning

Annuities can play a role in estate planning by providing a legacy for your beneficiaries. You can use an annuity to create a stream of income for your heirs after your passing, ensuring their financial security.

Dollify is a popular app for creating adorable avatars. Discover what’s new and different in the latest version with the Dollify 2024: What’s New and Different article.

Tax Implications

The tax implications of annuities can vary depending on the type of annuity and how it is structured. It is crucial to consult with a financial advisor to understand the tax implications of any annuity you are considering. Some annuities may offer tax-deferred growth, while others may be subject to taxes on the income received.

Annuity Considerations

While annuities can be valuable financial tools, it is essential to consider the risks and benefits associated with them before making a purchase.

Snapdragon processors are known for their powerful performance. Learn about the enhanced security features built into the latest Snapdragon chips in the Snapdragon 2024 security features article.

Risks and Benefits

- Potential Interest Rate Fluctuations:Fixed annuities may offer limited returns if interest rates decline, potentially impacting your income stream.

- Surrender Charges:Some annuities may have surrender charges if you withdraw funds before a specified period, which can reduce your returns.

- Impact of Inflation:The purchasing power of your annuity payments may erode over time due to inflation, potentially reducing their value.

- Guaranteed Income Stream:Annuities provide a secure and predictable income stream, reducing the risk of outliving your savings.

- Potential for Growth:Some annuities, such as variable annuities, offer the potential for higher returns through investments.

- Protection Against Market Volatility:Annuities can offer protection against market downturns, providing a stable income stream even in volatile economic times.

Important Considerations

- Financial Situation:Assess your current financial situation, including your income, expenses, and savings, to determine if an annuity aligns with your needs and goals.

- Risk Tolerance:Consider your risk tolerance and investment objectives. Fixed annuities are less risky but may offer lower returns, while variable annuities carry greater risk but have the potential for higher returns.

- Investment Goals:Define your financial goals, such as retirement income, legacy planning, or income supplementation, to choose an annuity that best suits your objectives.

Comparing Annuity Types

Different types of annuities offer unique features and benefits. It is essential to compare and contrast various annuity options to find the one that best meets your individual needs and circumstances.

Annuity Market in 2024

The annuity market is constantly evolving, with new trends and developments emerging regularly. It’s important to stay informed about the latest trends in the market to make informed decisions about annuity investments.

Want to seamlessly send notifications from your computer to your phone? Pushbullet 2024: How to use Pushbullet to send notifications from your computer to your phone guides you through the process, making cross-device communication a breeze.

Current Trends and Developments

- Increased Demand for Guaranteed Income:As individuals seek financial security and stability, the demand for guaranteed income products like annuities is on the rise.

- Innovation in Product Design:Insurance companies are introducing new annuity products with enhanced features and benefits, catering to diverse needs and preferences.

- Focus on Flexibility:There is a growing emphasis on flexible annuity options that allow for withdrawals, changes in payment schedules, and other adjustments to meet changing circumstances.

Regulatory Changes and Innovations

The regulatory landscape for annuities is evolving, with potential changes and innovations impacting the market. These changes can affect product availability, pricing, and consumer protection measures.

Pushbullet is a popular tool for cross-platform communication. Explore the Pushbullet 2024: What are the best Pushbullet alternatives for cross-platform communication? article to discover other great options.

Opportunities and Challenges

The annuity market presents both opportunities and challenges for investors seeking annuity products. While annuities offer potential for guaranteed income and financial security, it’s crucial to understand the risks and complexities associated with them. It’s advisable to seek guidance from a financial advisor to navigate the market and make informed decisions.

What’s in store for the future of smartphones? Android Authority provides insights and predictions in their Android Authority 2024 smartphone trends and predictions article, exploring key trends and innovations.

End of Discussion

Understanding annuities is crucial for anyone seeking financial security, especially during retirement. By carefully considering their features, risks, and benefits, individuals can make informed decisions about whether annuities align with their financial goals. This guide has provided a comprehensive overview of annuities, offering insights into their structure, applications, and considerations.

Whether you’re seeking a reliable source of income or exploring diverse investment strategies, understanding annuities is essential for navigating the complex world of financial planning.

Annuity is a financial tool that can provide a steady stream of income during retirement. Learn more about its purpose and how it can benefit you in the Annuity Is Primarily Used To Provide 2024 article.

Questions Often Asked

What are the main types of annuities?

Looking for the best accessories for your Android phone? Check out the Android Authority 2024 Android phone accessories review for top recommendations and reviews on everything from cases and chargers to headphones and smartwatches.

Annuities are categorized into various types based on their payment structures and features. Common types include fixed annuities, variable annuities, and immediate annuities. Each type offers unique benefits and risks, making it essential to carefully consider your financial goals and risk tolerance when choosing an annuity.

How do I calculate the value of an annuity?

The value of an annuity is determined by several factors, including the principal amount, interest rate, payment frequency, and duration of the annuity. There are specific formulas and online calculators available to calculate the present value or future value of an annuity, which can help you estimate your potential returns.

What are the tax implications of annuities?

Tax implications of annuities can vary depending on the type of annuity and the specific provisions of the tax laws in your jurisdiction. It’s important to consult with a financial advisor or tax professional to understand the tax implications of annuities and their potential impact on your overall financial plan.