Annuity Formula Quarterly 2024 takes center stage, offering a comprehensive exploration of this financial tool. Annuities are a vital component of retirement planning, investment strategies, and other financial goals, providing a steady stream of income for a predetermined period. Understanding the intricacies of annuity formulas, particularly in the context of quarterly payments, is crucial for making informed financial decisions in 2024.

When considering an annuity, it’s helpful to use a calculator to estimate potential payouts. The UK government offers a tool specifically for this purpose. You can find out more about the Annuity Calculator Gov Uk 2024 and explore its features.

This guide delves into the fundamental concepts of annuities, dissecting the formula used to calculate quarterly payments. We’ll explore the factors that influence these payments, such as interest rates, inflation, and market volatility, and analyze their impact on annuity values in the current economic landscape.

Practical examples and hypothetical scenarios will illuminate the real-world applications of quarterly annuities, equipping you with the knowledge to navigate the complexities of this financial instrument.

Understanding Annuities

Annuity is a financial product that provides a series of regular payments over a specified period of time. It’s a popular choice for individuals looking for a steady stream of income during retirement or for other financial goals. Annuities are essentially contracts between an individual and an insurance company where the individual pays a lump sum or a series of payments in exchange for regular payments in the future.

Defining Annuities and Their Types

Annuities are financial contracts that guarantee a series of regular payments over a set period. They are typically used for retirement planning, but can also be used for other financial goals, such as funding college expenses or providing income during a period of disability.

- Fixed Annuities:These annuities offer a guaranteed rate of return on the principal invested, providing predictable income payments. The interest rate remains fixed for the duration of the annuity, offering stability and security.

- Variable Annuities:These annuities offer the potential for higher returns, but also carry a higher risk. The interest rate on a variable annuity is linked to the performance of a specific investment portfolio, such as a mutual fund or a collection of stocks.

- Indexed Annuities:These annuities offer a guaranteed minimum return, but also allow the potential for higher returns based on the performance of a specific index, such as the S&P 500.

- Immediate Annuities:These annuities begin making payments immediately after the purchase.

- Deferred Annuities:These annuities begin making payments at a later date, such as at retirement.

Key Components of an Annuity, Annuity Formula Quarterly 2024

Annuity calculations involve several key components, each influencing the final payment amount and the overall value of the annuity.

- Principal:The initial amount of money invested in the annuity. This is the foundation upon which interest accrues and future payments are based.

- Interest Rate:The rate at which the principal grows over time. This rate is determined by the type of annuity and the current market conditions.

- Payment Period:The frequency at which payments are made, which can be monthly, quarterly, annually, or even semi-annually.

Annuity Formula: Quarterly Payments

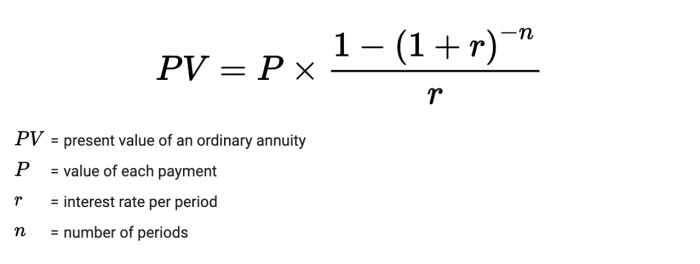

The annuity formula is a mathematical equation that calculates the present or future value of a stream of regular payments. For quarterly payments, the formula is adjusted to reflect the shorter payment period.

Annuity income is often taxed differently than other types of income. If you’re unsure if annuity income is considered capital gains, you can find more information on Is Annuity Income Capital Gains 2024.

Derivation and Application of the Quarterly Annuity Formula

The formula for calculating the present value of an annuity with quarterly payments is:

PV = PMT

The BA II Plus is a popular financial calculator that can be used to calculate annuities. If you’re not familiar with how to use this calculator for annuity calculations, you can find a detailed guide on Calculating Annuity Ba Ii Plus 2024.

- [1

- (1 + r/4)^-n] / (r/4)

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Annual Interest Rate

- n = Number of Quarters

The formula for calculating the future value of an annuity with quarterly payments is:

FV = PMT

- [(1 + r/4)^n

- 1] / (r/4)

Where:

- FV = Future Value

- PMT = Payment Amount

- r = Annual Interest Rate

- n = Number of Quarters

Examples of Calculating Present and Future Values

Let’s say you want to invest $100,000 in an annuity that pays 5% annual interest, compounded quarterly, for 10 years. The quarterly payment would be:

PMT = PV

Annuity and pension are often confused. While both provide income in retirement, they have key differences. To understand these differences, you can check out the article on Is Annuity Same As Pension 2024.

If you’re planning to use a financial calculator like the BA II Plus, you might need to learn how to calculate a growing annuity. The article on Calculate Growing Annuity Ba Ii Plus 2024 can provide helpful instructions.

- (r/4) / [1

- (1 + r/4)^-n]

PMT = $100,000

- (0.05/4) / [1

- (1 + 0.05/4)^-40]

PMT = $2,820.96

Annuity calculators can be helpful in different regions. If you’re in Kenya and need an annuity calculator, you can find one on Annuity Calculator Kenya 2024.

The present value of this annuity is $100,000, and the future value after 10 years is:

FV = PMT

- [(1 + r/4)^n

- 1] / (r/4)

FV = $2,820.96

- [(1 + 0.05/4)^40

- 1] / (0.05/4)

FV = $153,862.82

Factors Influencing Quarterly Annuity Payments

Several factors influence the amount of quarterly annuity payments. Understanding these factors can help you make informed decisions about your annuity investments.

Impact of Interest Rates

Interest rates play a crucial role in determining the value of annuity payments. Higher interest rates lead to larger future value payments, while lower interest rates result in smaller payments.

Spreadsheets like Excel can be useful for managing finances, including annuity calculations. If you’re looking for guidance on calculating annuity cash flows in Excel, you can find a tutorial on Calculating Annuity Cash Flows Excel 2024.

For example, if the interest rate on a $100,000 annuity increases from 5% to 6%, the quarterly payment would increase from $2,820.96 to $3,033.82. This demonstrates how even a small change in interest rates can significantly impact the value of annuity payments.

Annuity contracts can be complex, and understanding their nature is crucial. If you’re wondering if an annuity is considered insurance, you can find the answer on Is Annuity Insurance 2024.

Time Value of Money

The time value of money is a fundamental concept in finance that states that a dollar today is worth more than a dollar in the future. This is due to the potential for investment and the erosion of purchasing power through inflation.

In annuity calculations, the time value of money is reflected in the interest rate used to discount future payments to their present value. Higher interest rates imply a higher discount rate, making future payments worth less in today’s dollars.

While £600,000 is a substantial amount, some individuals may be looking at smaller annuities. For example, you might be interested in an annuity of £300,000. To learn more about this option, check out the article on Annuity 300 000 2024.

Practical Applications of Quarterly Annuities

Quarterly annuities have various practical applications in financial planning and investment strategies.

Retirement Planning

Quarterly annuities can be a valuable tool for retirement planning. They provide a steady stream of income that can help cover living expenses during retirement.

For example, a person retiring at age 65 with a $500,000 annuity that pays 4% annual interest, compounded quarterly, would receive $5,102.36 per quarter. This income stream can help supplement other retirement income sources, such as Social Security and savings.

Fixed annuities offer guaranteed payments, which can be appealing to those seeking stability. If you’re considering a fixed annuity with a 4% return, you can find more information on 4 Fixed Annuity 2024.

Investment Strategies

Quarterly annuities can also be used as part of a diversified investment portfolio. They can provide a stable source of income while allowing other investments to grow over time.

Hypothetical Scenario for Retirement Income

Let’s consider a hypothetical scenario where a person named John is planning for retirement. John is 55 years old and wants to ensure a steady income stream starting at age 65. He decides to invest $250,000 in a fixed annuity that pays 3% annual interest, compounded quarterly.

The quarterly payment for John’s annuity would be:

PMT = PV

- (r/4) / [1

- (1 + r/4)^-n]

PMT = $250,000

- (0.03/4) / [1

- (1 + 0.03/4)^-40]

PMT = $1,954.62

This means John would receive $1,954.62 every quarter for the rest of his life, starting at age 65. This income stream can help cover his essential expenses during retirement, providing financial security and peace of mind.

Analyzing the Annuity Formula: 2024 Perspective

The economic landscape in 2024 is likely to influence the value of annuity formulas and calculations. Factors such as inflation, interest rate trends, and market volatility will play a significant role.

Annuity options can vary significantly. Some individuals might be interested in a fixed annuity, while others may prefer a variable annuity. If you’re interested in a fixed annuity with a 5% return, you can find more information on Annuity 5 2024.

Impact of Economic Conditions

Inflation can erode the purchasing power of annuity payments, making them less valuable over time. If inflation is high, the interest rates on annuities may need to rise to compensate for the loss of purchasing power.

The TI-84 is another popular calculator that can be used for annuity calculations. If you’re unsure how to calculate annuities on this calculator, you can find instructions on Calculate Annuity On Ti 84 2024.

Interest rate trends also impact annuity values. If interest rates rise, the value of existing annuities may decline, as investors can earn higher returns on new investments. Conversely, if interest rates fall, the value of existing annuities may increase.

Annuity payments can be used for various purposes, including loans. If you’re interested in learning more about annuity loan calculators, you can find information on Annuity Loan Calculator 2024.

Market volatility can also affect annuity values. During periods of market uncertainty, investors may demand higher returns on annuities to compensate for the increased risk.

It’s important to understand the terms and conditions of your annuity, including surrender charges. If you’re wondering what happens when your annuity is out of surrender, you can find more information on My Annuity Is Out Of Surrender 2024.

Potential Outcomes of Different Annuity Scenarios

The following table summarizes the potential outcomes of different annuity scenarios based on projected economic conditions in 2024:

| Scenario | Inflation | Interest Rate | Market Volatility | Potential Outcome |

|---|---|---|---|---|

| Scenario 1: Moderate Inflation, Rising Interest Rates, Low Volatility | 2.5% | 4.0% | Low | Annuity payments may increase slightly, but the value of existing annuities may decline. |

| Scenario 2: High Inflation, Falling Interest Rates, High Volatility | 4.0% | 3.0% | High | Annuity payments may decrease, and the value of existing annuities may decline significantly. |

| Scenario 3: Low Inflation, Stable Interest Rates, Moderate Volatility | 1.5% | 3.5% | Moderate | Annuity payments may remain stable, and the value of existing annuities may remain relatively unchanged. |

Closing Notes

By understanding the intricacies of the Annuity Formula Quarterly 2024, you gain a powerful tool for navigating your financial future. Whether you’re planning for retirement, seeking investment opportunities, or simply aiming to secure a stable income stream, this guide provides the essential knowledge to make informed decisions.

The insights presented here can empower you to optimize your financial strategies and achieve your financial goals in 2024 and beyond.

FAQ Resource: Annuity Formula Quarterly 2024

What are the key advantages of using quarterly annuities?

Quarterly annuities offer several advantages, including predictable income streams, potential tax benefits, and the ability to customize payment terms to suit your individual needs.

Annuity payments can be a significant source of income for retirees, and understanding the different types of annuities available is important. If you’re considering an annuity of £600,000, you might want to explore the options available in 2024. You can find more information on Annuity 600k 2024.

How do inflation and interest rates impact annuity payments?

Inflation can erode the purchasing power of annuity payments over time. Conversely, higher interest rates generally lead to larger annuity payments.

Are there any risks associated with annuities?

While annuities can provide financial security, they also carry certain risks, such as the potential for low returns, limited access to funds, and potential market fluctuations.