Annuity Explained 2024: In a world where retirement planning is paramount, annuities have emerged as a powerful tool to secure your financial future. This comprehensive guide delves into the intricacies of annuities, demystifying their workings, benefits, and potential drawbacks.

Qualcomm’s Snapdragon processors are the driving force behind many of today’s flagship smartphones. The Snapdragon 2024 promises to deliver even better performance and efficiency , setting a new standard for mobile computing.

We’ll explore the different types of annuities available, how they generate income, and how to choose the right one for your unique needs and goals. Prepare to unlock the secrets of annuity investing and discover how they can contribute to a comfortable and secure retirement.

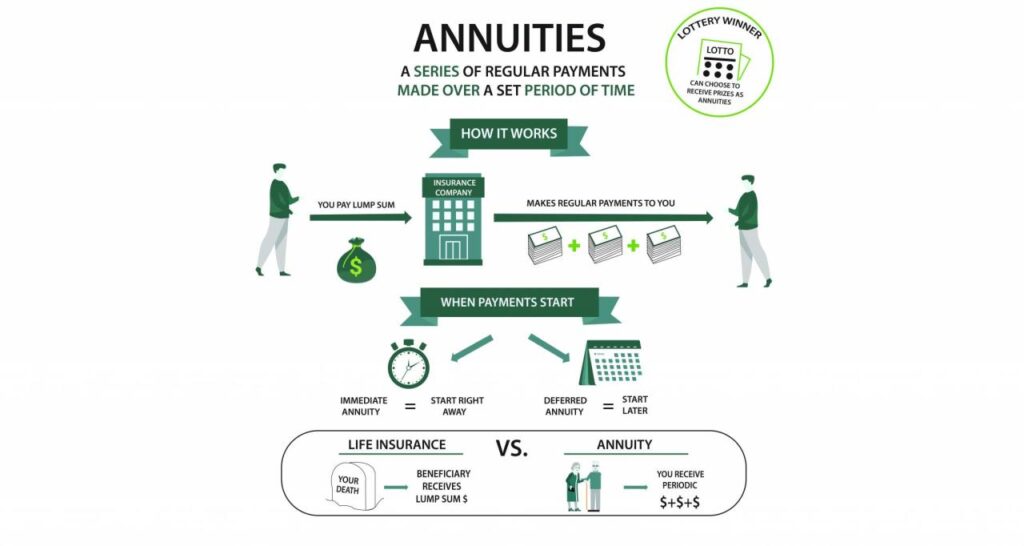

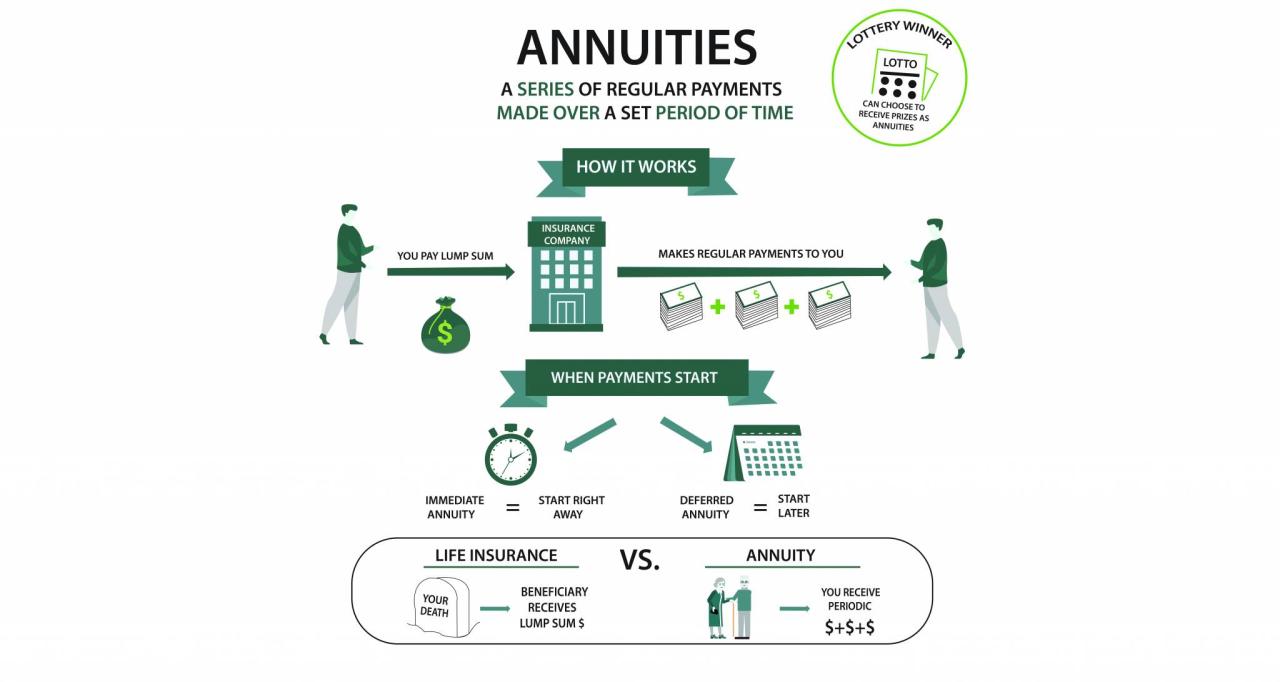

An annuity is essentially a stream of payments, typically received over a set period of time. This stream of income can provide financial stability and security , especially during retirement when other income sources may be limited.

Annuities are financial contracts that provide a stream of regular payments, either for a fixed period or for the lifetime of the annuitant. They are often used as a retirement savings tool, as they can provide a guaranteed income stream that can help to supplement other sources of income.

Dollify continues to evolve with new features and updates. The app is constantly being improved with new customization options, backgrounds, and accessories , ensuring that users have a wide range of creative possibilities.

Annuities are also a popular way to protect against the risk of outliving your savings, as they provide a guaranteed income stream for life.

Security is a top priority for Snapdragon processors, with advanced features designed to protect your data and devices. The Snapdragon 2024 includes enhanced security features to combat emerging threats , ensuring a safe and secure mobile experience.

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments for a set period of time, typically used for retirement planning. It is a contract between you and an insurance company, where you make a lump-sum payment or a series of payments in exchange for guaranteed future income.

Annuity can be a single sum payment, allowing you to invest a lump sum and receive regular payouts over time. This can be a great option for those looking to generate a consistent income stream from their savings , while also potentially benefitting from tax advantages.

Types of Annuities, Annuity Explained 2024

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These offer a guaranteed fixed rate of return, providing predictable income payments. The payout amount remains constant throughout the contract, regardless of market fluctuations.

- Variable Annuities:These link your payments to the performance of a specific investment portfolio, such as stocks or bonds. The payout amount can fluctuate based on the market’s performance, offering potential for higher returns but also carrying greater risk.

- Immediate Annuities:These start providing payments immediately after you purchase the contract. They are ideal for those seeking immediate income, such as retirees who want to supplement their existing savings.

- Deferred Annuities:These start providing payments at a later date, typically in retirement. They allow you to grow your savings over time and receive payments later.

Examples of Annuity Use in Retirement Planning

Annuities can be used in various ways to secure your retirement income:

- Supplementing Social Security:Annuities can provide an additional income stream alongside Social Security benefits, ensuring a more comfortable retirement.

- Generating Guaranteed Income:Annuities can provide guaranteed lifetime income, protecting you from outliving your savings and ensuring a steady stream of income in retirement.

- Protecting Against Inflation:Some annuities offer protection against inflation, adjusting payments to keep pace with rising costs of living.

- Long-Term Care Planning:Annuities can be structured to provide funds for long-term care expenses, ensuring you have financial resources available if you require assisted living or nursing home care.

How Annuities Work

Annuities function by accumulating your initial investment and generating income through a combination of interest and principal payments.

The basis of an annuity is the principal amount invested, which is used to calculate the annuity payments. Understanding the basis of your annuity is important for tax purposes , as it can affect the amount of taxes you pay on your annuity payments.

Mechanics of Annuity Income Generation

The income you receive from an annuity depends on several factors:

- Interest Rates:Fixed annuities offer a guaranteed interest rate, while variable annuities are linked to the performance of underlying investments.

- Investment Performance:The returns on variable annuities are tied to the performance of the chosen investment portfolio.

- Mortality Rates:Annuities are based on actuarial calculations, which consider the expected lifespan of the annuitant. As the annuitant ages, the mortality rate increases, potentially leading to higher payouts.

Factors Affecting Annuity Payouts

Several factors influence the amount of income you receive from an annuity:

- Initial Investment:The larger your initial investment, the higher your potential payout.

- Annuity Type:Fixed annuities typically offer lower payouts than variable annuities, but they provide greater certainty.

- Annuity Term:The longer the term of the annuity, the lower the initial payouts but the longer you receive income.

Purchasing an Annuity: A Step-by-Step Guide

Here’s a step-by-step guide on purchasing an annuity:

- Determine Your Financial Goals:Define your retirement income needs and how an annuity can contribute to your overall financial plan.

- Research Annuity Providers:Compare different annuity providers based on their financial strength, product offerings, and customer service.

- Choose an Annuity Type:Select an annuity that aligns with your risk tolerance and financial goals.

- Negotiate the Contract:Carefully review the terms and conditions of the annuity contract, including fees, surrender charges, and payout options.

- Fund the Annuity:Make the initial investment to activate the annuity contract and start accumulating funds.

Benefits of Annuities

Annuities offer several advantages for retirement income planning:

Guaranteed Income for Life

One of the primary benefits of annuities is their ability to provide guaranteed lifetime income. This ensures you have a steady stream of income throughout your retirement years, regardless of market fluctuations or longevity.

Dollify has become a popular tool for creating unique and expressive avatars. With its wide range of customization options, users can create avatars that reflect their personality and style , making them stand out in the digital world.

Protection Against Inflation and Market Volatility

Some annuities offer inflation protection, adjusting payments to keep pace with rising costs of living. This helps preserve your purchasing power in retirement. Additionally, fixed annuities provide a stable income stream, shielding you from market volatility.

As AI technology advances, it’s crucial to consider the ethical implications of its use in avatar creation. Dollify, for example, raises questions about privacy and the potential for misuse of AI-generated images , highlighting the need for responsible development and use of this technology.

Other Advantages

Annuities can also offer:

- Tax-Deferred Growth:Earnings on annuities typically grow tax-deferred, meaning you won’t pay taxes on the gains until you start receiving payments.

- Estate Planning:Annuities can be structured to provide income for your beneficiaries after your death.

- Long-Term Care Planning:Annuities can be used to fund long-term care expenses, ensuring you have financial resources available if you need assisted living or nursing home care.

Drawbacks of Annuities: Annuity Explained 2024

While annuities offer benefits, they also come with potential risks and disadvantages:

Potential Risks and Disadvantages

Here are some key drawbacks to consider:

- Limited Liquidity:Annuities typically have surrender charges, which can make it difficult to access your funds before a certain period.

- Fees and Expenses:Annuities can involve various fees, such as administrative fees, mortality and expense charges, and surrender charges.

- Market Risk:Variable annuities carry market risk, as their returns are tied to the performance of underlying investments.

- Inflation Risk:Fixed annuities may not keep pace with inflation, eroding the purchasing power of your payments over time.

Surrender Charges

Surrender charges are penalties imposed if you withdraw funds from an annuity before a specified period. These charges can significantly reduce your returns, especially in the early years of the contract.

Annuity payments are not considered earned income, as they are derived from a previous investment. This can have tax implications, as annuity payments may be taxed differently than earned income. It’s important to understand the tax implications of annuities before investing.

Comparing Annuities to Other Retirement Savings Options

Annuities should be compared to other retirement savings options, such as IRAs, 401(k)s, and Roth IRAs, to determine the best fit for your individual circumstances.

Dollify has taken the internet by storm, allowing users to create adorable cartoon avatars of themselves. The rise of AI has played a significant role in the app’s success , enabling users to personalize their avatars with unprecedented detail and expressiveness.

- IRAs and 401(k)s:These offer tax-deferred growth and flexibility in investment choices, but they don’t provide guaranteed income.

- Roth IRAs:These offer tax-free withdrawals in retirement, but contributions are made with after-tax dollars.

Choosing the Right Annuity

Selecting the right annuity involves careful consideration of your individual needs and goals.

Dollify has become a popular tool for creating avatars for social media. Users can share their unique and expressive avatars on platforms like Instagram and Twitter , adding a personal touch to their online presence.

Factors to Consider

Here are some factors to consider when choosing an annuity:

- Your Risk Tolerance:Fixed annuities are suitable for those seeking guaranteed income, while variable annuities offer potential for higher returns but also carry greater risk.

- Your Retirement Income Needs:Determine how much income you’ll need in retirement and how an annuity can contribute to your overall financial plan.

- Your Time Horizon:If you need income immediately, an immediate annuity is suitable. If you’re saving for retirement in the future, a deferred annuity may be more appropriate.

Selecting an Annuity Provider and Contract

When selecting an annuity provider, consider their financial strength, product offerings, and customer service. Carefully review the terms and conditions of the annuity contract, including fees, surrender charges, and payout options.

Annuity is defined as a series of payments made over a period of time. This can be a fixed amount or a variable amount, depending on the terms of the annuity contract. Annuity payments can be used for a variety of purposes, such as retirement income, income for life, or to provide financial security for loved ones.

Importance of Consulting a Financial Advisor

It’s crucial to consult with a qualified financial advisor before purchasing an annuity. They can help you assess your financial situation, understand your options, and choose an annuity that aligns with your individual needs and goals.

Annuities in 2024

The annuity market is constantly evolving, with new products and trends emerging.

Current Market Trends and Outlook

In 2024, the annuity market is expected to continue growing, driven by an aging population and increasing demand for guaranteed income solutions.

Annuity bonds are a type of investment that offers a guaranteed return on your investment. While they may not offer the same potential for high returns as other investments , they can provide a stable and predictable income stream, making them a popular choice for risk-averse investors.

Regulatory Changes and Developments

The annuity industry is subject to ongoing regulatory changes and developments, which can affect product offerings and investor choices.

Opportunities and Challenges

Annuity investors face both opportunities and challenges in the coming year.

- Opportunities:The increasing demand for guaranteed income solutions presents opportunities for annuity investors.

- Challenges:Rising interest rates and market volatility can impact annuity payouts and returns.

Closing Summary

As we’ve explored, annuities offer a compelling path towards a financially secure retirement, but it’s crucial to approach them with careful consideration. By understanding the different types of annuities, their benefits, and potential drawbacks, you can make an informed decision that aligns with your individual financial goals and risk tolerance.

Remember, seeking guidance from a qualified financial advisor can provide invaluable insights and help you navigate the complexities of annuity investments.

Developing Android apps in 2024 presents a unique set of challenges. From the fragmentation of Android devices to the ever-evolving landscape of Google’s development tools , developers face an uphill battle in creating engaging and reliable apps for a diverse user base.

FAQ Section

Are annuities right for everyone?

Annuities aren’t a one-size-fits-all solution. Factors like your risk tolerance, investment goals, and financial situation influence whether an annuity is suitable for you. Consulting a financial advisor can help you determine the best course of action.

How do I find a reputable annuity provider?

Look for providers with a strong track record, good financial ratings, and transparent fees. You can also seek recommendations from trusted financial professionals or research online reviews.

What are the tax implications of annuities?

Annuity is a powerful tool for securing your retirement, offering a consistent stream of income in your golden years. It’s a voluntary retirement vehicle that can provide peace of mind knowing your financial needs will be met , even as your income from work dwindles.

The tax treatment of annuities can vary depending on the type of annuity and how it’s structured. It’s essential to consult with a tax professional to understand the specific tax implications for your situation.