Annuity Estimator 2024 is your guide to understanding how much retirement income you can expect from an annuity. Annuities offer a guaranteed stream of income for life, making them a valuable tool for retirement planning. By considering your age, life expectancy, and financial goals, you can use an annuity estimator to project your future income potential and determine if an annuity is right for you.

Android WebView 202 is a game-changer for hybrid app development. Discover its benefits and how it can enhance your app’s performance in Android WebView 202 for hybrid apps.

This guide delves into the world of annuities, explaining different types, key factors influencing calculations, and how to choose the right annuity for your individual needs. We’ll also explore the advantages and disadvantages of annuities, comparing them to other retirement savings options.

Dollify has been making waves in the digital art world. Find out what’s new and different with this popular app in Dollify 2024: What’s New and Different.

Annuity Estimators: A Comprehensive Guide for 2024: Annuity Estimator 2024

Annuity estimators are valuable tools that help individuals understand the potential income they could receive from an annuity contract. They provide personalized estimates based on various factors, including age, life expectancy, and investment choices. This guide will explore the intricacies of annuity estimators, delve into the different types of annuities, and guide you through the process of using an estimator effectively.

New to Dollify? Get started with ease using the tips and tricks outlined in Dollify 2024: Tips and Tricks for Beginners.

Introduction to Annuity Estimators

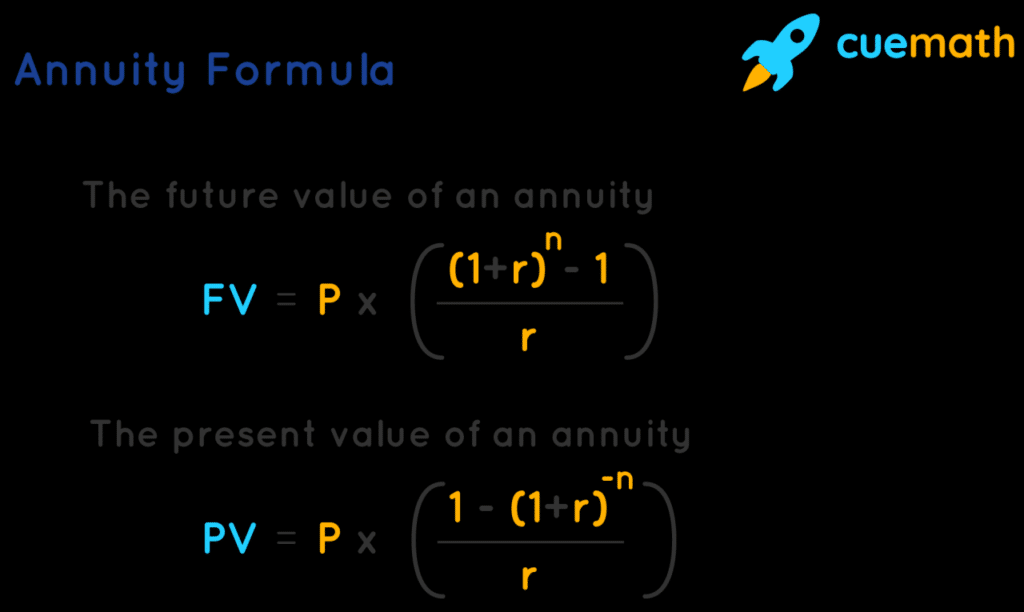

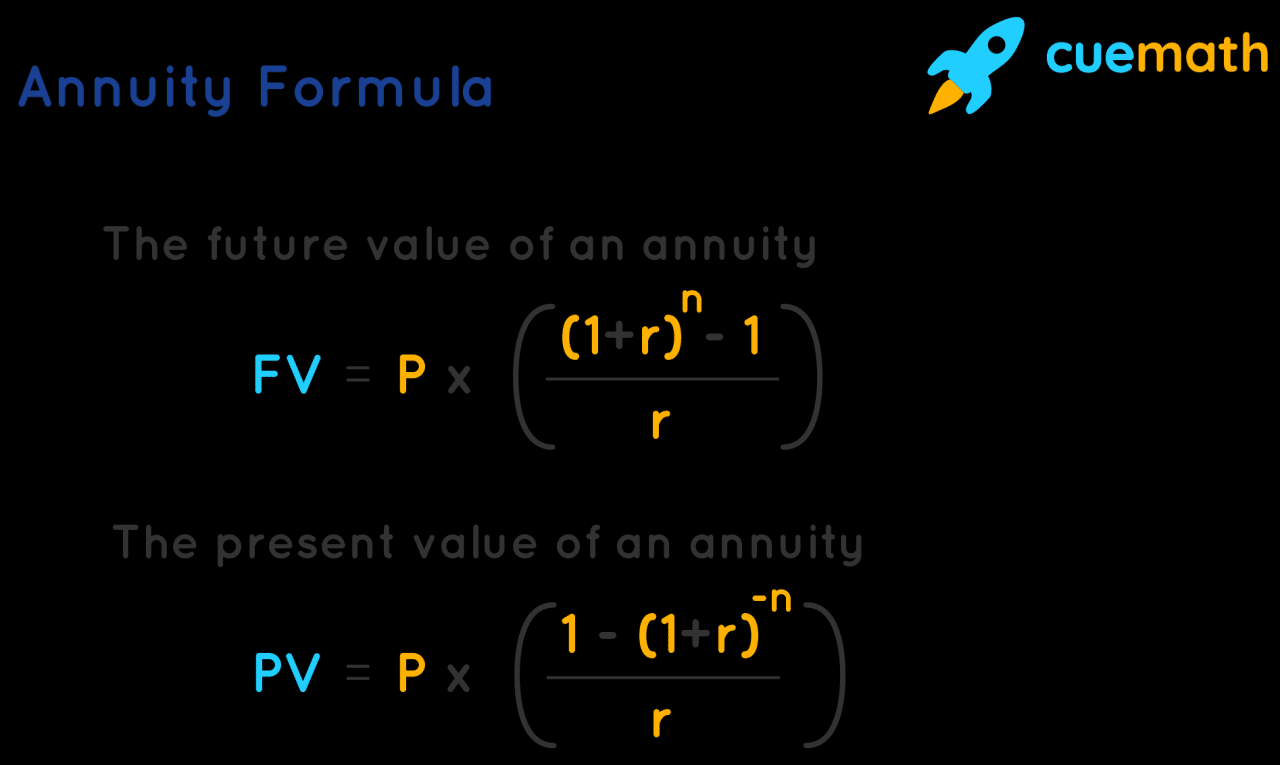

Annuity estimators are online calculators or software programs that simulate the potential income stream you could receive from an annuity. They take into account various factors, such as your age, life expectancy, the amount of money you invest, and the type of annuity you choose.

Planning for the future of your annuity? Consider setting up a trust as your beneficiary. Learn more about this strategy in Annuity Beneficiary Is A Trust 2024.

By inputting these factors, you can obtain an estimated monthly or annual payment amount you might receive throughout your retirement years.

Google Tasks is getting a makeover in 2024! Explore the latest updates and enhancements in Google Tasks 2024: New Features and Enhancements to streamline your task management.

Types of Annuities

Annuities come in various forms, each with unique features and benefits. Here are some common types:

- Fixed Annuities:These annuities provide a guaranteed fixed payment stream for a specified period, offering predictable income and protection against market volatility.

- Variable Annuities:These annuities offer the potential for higher returns, but they also carry higher risks. The payments are tied to the performance of underlying investment accounts, which can fluctuate.

- Indexed Annuities:These annuities offer a guaranteed minimum return, but they also have the potential to participate in the growth of a specific market index, such as the S&P 500.

- Immediate Annuities:These annuities begin paying out immediately after purchase. They are often used for retirement income or to provide a steady stream of income for a specific purpose.

- Deferred Annuities:These annuities begin paying out at a future date, such as upon retirement. They allow you to accumulate funds over time and then convert them into a stream of income later.

Factors Affecting Annuity Payments

Several factors influence the amount of annuity payments you receive. These factors include:

- Interest Rates:Interest rates play a crucial role in annuity calculations. Higher interest rates generally result in larger annuity payments, while lower interest rates lead to smaller payments.

- Age and Life Expectancy:Your age and life expectancy are significant factors. Younger individuals with longer life expectancies typically receive lower annuity payments than older individuals with shorter life expectancies.

- Health:Your health status can also influence annuity calculations. Individuals with better health and longer life expectancies might receive lower payments than those with health concerns.

- Investment Performance:The performance of underlying investments in variable annuities directly affects payment amounts. Strong investment returns can lead to higher payments, while poor returns can result in lower payments.

- Market Conditions:Market conditions, such as inflation and economic growth, can impact annuity payments. High inflation can erode the purchasing power of annuity payments, while strong economic growth might lead to higher returns on variable annuities.

Using an Annuity Estimator

Using an annuity estimator is a straightforward process:

- Choose an Estimator:There are many annuity estimators available online, both from insurance companies and independent websites.

- Input Your Information:Provide your age, life expectancy, investment amount, and the type of annuity you’re interested in.

- Review the Results:The estimator will generate an estimated monthly or annual payment amount. You can adjust your inputs to see how different factors affect the outcome.

- Consider the Limitations:Remember that annuity estimators provide estimates, not guarantees. Actual payments may vary based on market conditions and other factors.

Advantages and Disadvantages of Annuities, Annuity Estimator 2024

Annuities offer potential benefits, but they also come with drawbacks:

- Advantages:

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income for life, offering financial security in retirement.

- Protection from Market Volatility:Fixed annuities protect your principal from market downturns.

- Tax Advantages:Annuity payments are typically taxed as ordinary income, but some annuities offer tax-deferred growth.

- Longevity Protection:Annuities can provide income for your entire life, ensuring you don’t outlive your savings.

- Disadvantages:

- Limited Flexibility:Annuities can be illiquid, making it difficult to access your funds before the payout period.

- Fees and Expenses:Annuities often involve fees, including surrender charges, administrative fees, and mortality charges.

- Inflation Risk:Fixed annuities offer no protection against inflation, which can erode the purchasing power of your payments over time.

- Potential for Low Returns:Fixed annuities typically offer lower returns than other investment options, such as stocks or bonds.

Choosing the Right Annuity

Selecting the right annuity requires careful consideration:

- Financial Goals:Determine your retirement income needs and how an annuity can help you achieve those goals.

- Risk Tolerance:Assess your risk tolerance and choose an annuity that aligns with your comfort level.

- Time Horizon:Consider your time horizon and whether you need immediate income or can defer payments.

- Provider Reputation:Research the reputation of annuity providers and choose a reputable company with a strong track record.

- Terms and Conditions:Carefully review the terms and conditions of the annuity contract, including fees, surrender charges, and guarantees.

Annuity Estimators for 2024

The annuity estimation landscape is constantly evolving, with new tools and features emerging. Some popular and reliable annuity estimators include:

- [Annuity Estimator 1]:This estimator offers comprehensive features, including a wide range of annuity types, personalized projections, and interactive charts.

- [Annuity Estimator 2]:This estimator focuses on simplicity and ease of use, providing quick estimates and straightforward results.

- [Annuity Estimator 3]:This estimator provides detailed analysis and insights, including comparisons of different annuity options and personalized recommendations.

Final Summary

In conclusion, understanding how annuity estimators work is crucial for making informed retirement decisions. By utilizing the latest tools and resources available, you can gain valuable insights into your potential retirement income. Remember to consider your financial goals, risk tolerance, and the various factors that influence annuity calculations.

Annuity is a complex financial product, and Annuity Is A Life Insurance Product That 2024 provides a comprehensive guide to understanding its intricacies.

With careful planning and the right annuity strategy, you can secure a comfortable and financially stable retirement.

Quizlet is a great resource for learning about annuities, and An Annuity Is Quizlet 2024 offers a comprehensive overview of the topic with flashcards, practice questions, and more.

FAQ Guide

What is the difference between a fixed and variable annuity?

Glovo isn’t just for customers! Restaurant owners and businesses can leverage the platform’s features to reach new audiences and streamline their operations. Discover the key features in Glovo app features for restaurant owners and businesses.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of underlying investments.

Need a comprehensive guide to annuities in Excel? Look no further than Annuity Is Excel 2024 , which provides step-by-step instructions and formulas for calculating annuities.

How do I find a reputable annuity provider?

Looking for real-world examples of annuities in action? Check out Annuity Examples 2024 for a breakdown of different annuity types and how they can work for you.

Look for providers with a strong financial rating, positive customer reviews, and a clear understanding of your financial needs.

Can I withdraw money from an annuity before retirement?

Some annuities allow for partial withdrawals, but penalties may apply. Consult your annuity contract for details.

While Android WebView 202 offers numerous advantages, it’s essential to be aware of potential compatibility issues. Android WebView 202 compatibility issues explores these challenges and provides solutions.

Glovo is expanding rapidly! Discover their future plans and strategic expansion initiatives in Glovo app future plans and expansion strategy.

Building a successful Android app requires the right tools. Explore the top choices for 2024 in Top Android app development tools in 2024.

Mastering Android WebView 202 is key to building robust and efficient hybrid apps. Android WebView 202 best practices provides essential tips and guidelines for optimal performance.

Deferred annuities offer a unique way to plan for the future. Learn more about their benefits and how they work in Annuity Is Deferred 2024.