Annuity Calculator With Steps 2024, navigating the world of retirement planning can feel overwhelming, especially when it comes to annuities. These financial instruments offer a steady stream of income during your golden years, but understanding their complexities can be challenging.

Figuring out how to calculate an annuity due on your BA II Plus 2024 calculator? It’s a common question, and luckily, it’s not that complicated. Check out this helpful guide on Calculating Annuity Due On Ba Ii Plus 2024 to learn the steps and get your calculations right.

This comprehensive guide will walk you through the ins and outs of annuity calculators, empowering you to make informed decisions about your future financial security.

Calculating lottery annuity payments can be complex, but it’s essential to understand the process. This article breaks down the steps and factors involved in calculating these payments: Calculating Lottery Annuity Payments 2024.

From defining annuities and their various types to understanding the essential inputs required for calculations, we’ll cover all the bases. We’ll delve into the steps involved in calculating annuities, explore the factors that influence these calculations, and showcase real-life examples of how annuity calculators can be used to make strategic financial decisions.

The “J” calculation is a common concept in various fields, including finance and engineering. Looking for a comprehensive explanation of the “J” calculation? This article explores its various applications and provides insights: J Calculation 2024.

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments for a set period of time. These payments can be used for various purposes, such as retirement income, income generation, or estate planning. Annuities are offered by insurance companies and can be tailored to meet individual needs and financial goals.

Types of Annuities

Annuities come in various forms, each with unique features and benefits. Some common types include:

- Fixed Annuities:These annuities guarantee a fixed rate of return on the invested principal, providing predictable and stable income payments.

- Variable Annuities:These annuities offer the potential for higher returns but also carry greater investment risk. The payments are linked to the performance of a specific investment portfolio, which can fluctuate in value.

- Immediate Annuities:These annuities begin making payments immediately after the purchase, providing an immediate source of income.

- Deferred Annuities:These annuities start making payments at a later date, allowing the investment to grow tax-deferred for a specific period.

Purpose and Benefits of Annuities

Annuities serve a crucial purpose in retirement planning by providing a guaranteed stream of income during retirement years. They can help individuals:

- Ensure a steady income stream:Annuities provide a reliable source of income, regardless of market fluctuations.

- Protect against longevity risk:Annuities can provide lifetime income, ensuring that individuals have financial security even if they live longer than expected.

- Supplement other retirement savings:Annuities can complement other retirement savings, such as 401(k)s and IRAs, to create a more comprehensive retirement plan.

- Offer tax advantages:Annuity payments may be tax-deferred, allowing individuals to defer paying taxes until they receive the payments.

Key Features of Annuities

Annuities have several key features that individuals should consider before purchasing one:

- Payment Options:Annuities offer various payment options, including fixed monthly payments, lump-sum payments, or a combination of both.

- Interest Rates:The interest rate on an annuity determines the growth rate of the investment and the amount of income payments.

- Guarantees:Some annuities offer guarantees, such as a minimum interest rate or a minimum death benefit.

Understanding Annuity Calculator Features: Annuity Calculator With Steps 2024

Annuity calculators are valuable tools that help individuals estimate their future annuity payments and understand the potential benefits of purchasing an annuity. These calculators require certain inputs to perform the calculations, and each input plays a crucial role in determining the final payout.

Winning the lottery can be life-changing, but you have a big decision to make: take a lump sum or an annuity? Understanding the pros and cons of each option is crucial. Explore the intricacies of this decision in this article: Annuity Or Lump Sum Lottery 2024.

Essential Inputs for an Annuity Calculator

The essential inputs for an annuity calculator typically include:

- Age:The individual’s current age is a crucial factor in determining the length of the annuity payout period.

- Investment Amount:The amount of money invested in the annuity is the principal amount that earns interest and generates income payments.

- Interest Rate:The interest rate applied to the investment determines the growth rate of the principal and the size of the annuity payments.

- Payment Period:The length of time over which the annuity payments are made is a key determinant of the total payout amount.

Impact of Inputs on Annuity Calculations

Each input has a significant impact on the final annuity calculation. For example:

- Age:A higher age generally results in a shorter payment period and smaller total payout.

- Investment Amount:A larger investment amount leads to higher annuity payments.

- Interest Rate:A higher interest rate results in faster growth of the principal and larger annuity payments.

- Payment Period:A longer payment period generally results in smaller annuity payments but a larger total payout.

Using an Annuity Calculator: Step-by-Step Example

To illustrate how to use an annuity calculator, let’s consider a hypothetical scenario. Suppose a 65-year-old individual wants to invest $100,000 in a fixed annuity with an annual interest rate of 3% and plans to receive monthly payments for 20 years.

Annuity 6 Guaranteed is a type of annuity that provides guaranteed payments for a specific period. Want to learn more about the features and benefits of this type of annuity? This article delves into the details: Annuity 6 Guaranteed 2024.

- Enter Age:Enter the individual’s age, which is 65.

- Enter Investment Amount:Enter the investment amount, which is $100,000.

- Enter Interest Rate:Enter the annual interest rate, which is 3%.

- Enter Payment Period:Enter the payment period, which is 20 years.

- Select Payment Frequency:Select the desired payment frequency, which is monthly in this case.

- Calculate:Click on the “Calculate” button to generate the annuity payout results.

The calculator will display the estimated monthly annuity payment amount, the total payout over the 20-year period, and other relevant information. This allows the individual to understand the potential benefits and financial implications of purchasing the annuity.

Annuity streams are a key concept in financial planning. Want to learn more about how annuity streams work and their implications? This article provides valuable insights: Is Annuity Stream 2024.

Steps to Calculate an Annuity

Calculating an annuity involves several steps that take into account the key inputs discussed earlier. The process can be broken down into clear and manageable steps, as illustrated below.

Determining the annual payment of an annuity is a crucial step in financial planning. This guide explains how to calculate annuity annual payments effectively: Calculating Annuity Annual Payment 2024.

Step-by-Step Guide to Annuity Calculation

To calculate an annuity, follow these steps:

- Determine the Present Value (PV):The present value is the initial investment amount, which is $100,000 in our example.

- Determine the Interest Rate (i):The interest rate is the annual rate of return on the investment, which is 3% in our example.

- Determine the Number of Periods (n):The number of periods is the total number of payment periods, which is 20 years x 12 months/year = 240 months in our example.

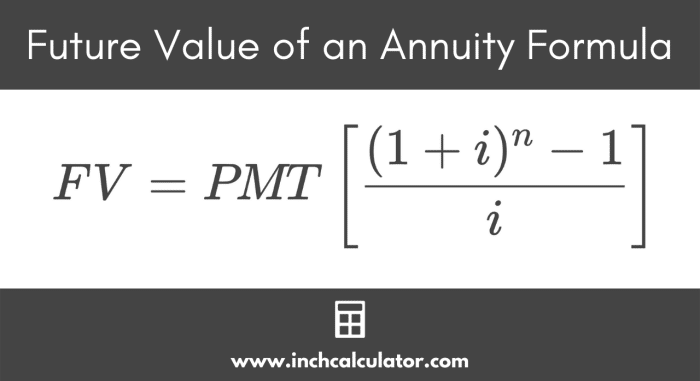

- Calculate the Annuity Payment (PMT):The annuity payment is the amount received each period. The formula for calculating PMT is:

- (i / (1

- (1 + i)^-n))

- Calculate the Total Payout:The total payout is the sum of all annuity payments over the payment period. The formula for calculating the total payout is:

PMT = PV

Total Payout = PMT

Growing annuities are designed to increase payments over time, providing a hedge against inflation. Want to understand how to calculate growing annuity payments? This resource provides the necessary information: Calculating Growing Annuity Payment 2024.

n

Index annuities are a type of annuity that links payments to the performance of a specific market index. Interested in learning more about index annuities and how they work? Check out this informative article: Index Annuity Is What 2024.

Using these formulas, we can calculate the annuity payment and total payout for our example:

| Input | Value |

|---|---|

| PV | $100,000 |

| i | 0.03 / 12 = 0.0025 (monthly interest rate) |

| n | 240 |

PMT = $100,000 – (0.0025 / (1 – (1 + 0.0025)^-240)) = $591.56 (approximately)

Total Payout = $591.56 – 240 = $141,974.40 (approximately)

Annuity payments are a series of equal payments made over a set period, often used in retirement planning or lottery winnings. Curious about how annuities work and what they can mean for your financial future? Learn more about the basics of annuities in this article: Annuity Is A Series Of Equal Payments 2024.

Therefore, the estimated monthly annuity payment is $591.56, and the total payout over 20 years is approximately $141,974.40. This calculation demonstrates how an annuity calculator uses the inputs to estimate the future payments and total payout.

Annuity 3 is a type of annuity that involves a specific set of conditions and calculations. Want to learn more about the nuances of Annuity 3? This article delves into the details: Annuity 3 2024.

Factors Affecting Annuity Calculations

Several factors can influence annuity calculations, affecting the final payout amount. Understanding these factors is crucial for making informed financial decisions related to annuities.

Annuity income is often subject to different tax rules. Wondering if annuity income is considered capital gains? This article clarifies the tax implications of annuity income: Is Annuity Income Capital Gains 2024.

Factors Influencing Annuity Calculations

Here are some key factors that can impact annuity calculations:

- Inflation:Inflation erodes the purchasing power of money over time. As inflation rises, the value of future annuity payments decreases, making it essential to consider inflation when calculating annuities.

- Interest Rates:Interest rates play a significant role in determining the growth rate of the annuity investment. Higher interest rates generally lead to larger annuity payments.

- Longevity:The longer an individual lives, the more annuity payments they will receive. This longevity risk is a crucial factor to consider, especially for individuals seeking lifetime income.

- Taxes:Annuity payments may be subject to taxes, which can impact the after-tax income received.

- Fees and Expenses:Annuities often come with fees and expenses, which can reduce the overall return on investment.

Impact of Factors on Annuity Payout

Each factor can have a significant impact on the final annuity payout. For example:

- Inflation:High inflation can significantly reduce the real value of future annuity payments, impacting the purchasing power of the income.

- Interest Rates:Higher interest rates can lead to larger annuity payments, while lower interest rates can result in smaller payments.

- Longevity:Longer life expectancies can lead to larger total payouts but also smaller individual payments.

- Taxes:Taxes can reduce the after-tax income received from annuity payments, affecting the overall financial benefits.

- Fees and Expenses:High fees and expenses can significantly reduce the overall return on investment, impacting the size of annuity payments.

Adjusting Annuity Calculations

Individuals can adjust their annuity calculations to account for these factors and make informed decisions. For example:

- Inflation:Consider using an inflation-adjusted interest rate when calculating annuities to account for the eroding purchasing power of money.

- Interest Rates:Explore annuities with higher interest rates to maximize potential returns and annuity payments.

- Longevity:Consider purchasing annuities with lifetime income guarantees to ensure financial security even if you live longer than expected.

- Taxes:Consult with a financial advisor to understand the tax implications of annuity payments and choose an annuity that minimizes tax liability.

- Fees and Expenses:Compare different annuity products and choose one with lower fees and expenses to maximize your returns.

Annuity Calculator Examples and Applications

Annuity calculators are versatile tools that can be used in various financial planning scenarios. They provide valuable insights into the potential benefits and financial implications of purchasing an annuity.

Planning for retirement involves careful consideration of various factors, including annuities. Wondering how to calculate your retirement annuity? This guide provides a step-by-step breakdown of the process: Calculating Retirement Annuity 2024.

Scenarios for Using Annuity Calculators

Annuity calculators can be helpful in the following scenarios:

- Retirement Planning:Annuity calculators can help individuals estimate their retirement income needs and determine how much they need to save for retirement.

- Income Generation:Annuity calculators can help individuals understand the potential income stream they can generate from an annuity investment.

- Estate Planning:Annuity calculators can help individuals determine how much they need to invest in an annuity to provide a specific income stream for their beneficiaries.

- Debt Management:Annuity calculators can help individuals determine how much they can withdraw from an annuity to pay off debts or cover other expenses.

Real-Life Examples

Here are some real-life examples of how annuity calculators can be used:

- A retiree wants to ensure a steady income stream:An annuity calculator can help them determine how much they need to invest in an annuity to receive a specific monthly payment amount for the rest of their lives.

- A couple wants to leave a legacy for their children:An annuity calculator can help them determine how much they need to invest in an annuity to provide a specific income stream for their children after they pass away.

- An individual wants to generate supplemental income:An annuity calculator can help them determine how much they need to invest in an annuity to receive a specific monthly payment amount to supplement their current income.

Advantages and Limitations, Annuity Calculator With Steps 2024

Annuity calculators offer several advantages, including:

- Easy to use:Most annuity calculators are user-friendly and require minimal input to generate results.

- Quick results:Annuity calculators provide instant results, allowing individuals to quickly understand the potential benefits and financial implications of purchasing an annuity.

- Comprehensive information:Annuity calculators typically provide comprehensive information, including estimated monthly payments, total payout, and other relevant details.

However, annuity calculators also have some limitations:

- Simplified calculations:Annuity calculators often use simplified assumptions, which may not fully reflect the complexities of real-world scenarios.

- No personalized advice:Annuity calculators cannot provide personalized financial advice or account for individual circumstances.

- Not a substitute for professional advice:It is essential to consult with a financial advisor to receive personalized advice and make informed financial decisions related to annuities.

Comparison of Annuity Calculators

Numerous online annuity calculators are available, each with unique features and capabilities. Comparing different calculators can help individuals find the best tool for their needs.

Using R to calculate annuity payments can be a powerful tool for financial analysis. If you’re looking to leverage the capabilities of R for annuity calculations, check out this resource on R Calculate Annuity 2024.

Key Features to Consider

When comparing annuity calculators, consider the following key features:

- Input Options:The range of inputs available, such as age, investment amount, interest rate, payment period, and payment frequency.

- Annuity Types:The types of annuities supported, such as fixed, variable, immediate, and deferred.

- Output Options:The information provided in the results, such as estimated monthly payments, total payout, and other relevant details.

- User Interface:The ease of use and navigation of the calculator interface.

- Accuracy:The reliability and accuracy of the calculations performed by the calculator.

- Additional Features:Any additional features offered, such as the ability to compare different annuity products or generate customized reports.

Comparison Table

Here is a table summarizing the key features of some popular online annuity calculators:

| Calculator | Input Options | Annuity Types | Output Options | User Interface | Accuracy | Additional Features |

|---|---|---|---|---|---|---|

| Calculator A | Age, investment amount, interest rate, payment period, payment frequency | Fixed, variable, immediate, deferred | Estimated monthly payments, total payout, present value, future value | User-friendly, easy to navigate | High | Annuity comparison tool, customized reports |

| Calculator B | Age, investment amount, interest rate, payment period, payment frequency, inflation rate | Fixed, variable, immediate, deferred | Estimated monthly payments, total payout, present value, future value, inflation-adjusted results | Simple, straightforward | High | None |

| Calculator C | Age, investment amount, interest rate, payment period, payment frequency, tax rate | Fixed, variable, immediate, deferred | Estimated monthly payments, total payout, present value, future value, tax-adjusted results | Advanced, customizable | High | Tax planning tools, personalized recommendations |

Recommendations for Choosing an Annuity Calculator

The best annuity calculator for an individual depends on their specific needs and preferences. Consider the following recommendations:

- For basic calculations:If you need a simple calculator to estimate basic annuity payments, Calculator B is a good option.

- For comprehensive analysis:If you want a calculator that provides detailed information and additional features, Calculator A or C may be better suited for your needs.

- For personalized advice:It is always recommended to consult with a financial advisor to receive personalized advice and make informed financial decisions related to annuities.

Last Word

By understanding the intricacies of annuity calculators, you can gain a clearer picture of your future financial landscape. Armed with this knowledge, you can confidently navigate the world of annuities, making informed decisions that align with your retirement goals and aspirations.

Remember, planning for the future is a journey, and an annuity calculator can be your trusted companion along the way.

The “J” calculation is an important part of HVAC design, determining the proper size and type of equipment for your needs. Want to learn more about this crucial calculation? Dive into the world of HVAC design with this informative article on J Calculation Hvac 2024.

FAQ Compilation

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments.

How does inflation affect annuity calculations?

Inflation can erode the purchasing power of your annuity payments over time. Annuity calculators can help you factor in inflation to estimate the real value of your future income.

Are there any fees associated with annuities?

Yes, annuities typically involve fees such as administrative fees, mortality charges, and surrender charges.