Annuity Calculator NZ 2024 is your guide to navigating the world of retirement income in New Zealand. Whether you’re nearing retirement or just starting to plan, understanding annuities is crucial for securing your financial future. Annuities provide a steady stream of income throughout your retirement years, offering peace of mind and financial stability.

Annuity growth refers to the increase in the value of an annuity over time, typically due to interest accrual. Calculating annuity growth helps you understand the potential returns on your investment. You can find a comprehensive guide to calculating annuity growth here.

But with different types of annuities available, it’s important to understand how they work and which one best suits your needs.

An annuity’s present value is a crucial factor in determining its overall worth. Understanding the present value allows you to compare different annuity options and make informed decisions about your investment. You can find more information about the present value of annuities here.

This guide will delve into the intricacies of annuities in New Zealand, explaining their various types, tax implications, and how to use an annuity calculator to estimate your potential payouts. We’ll also discuss the factors that influence annuity payouts and provide tips on choosing the right annuity for your individual financial goals.

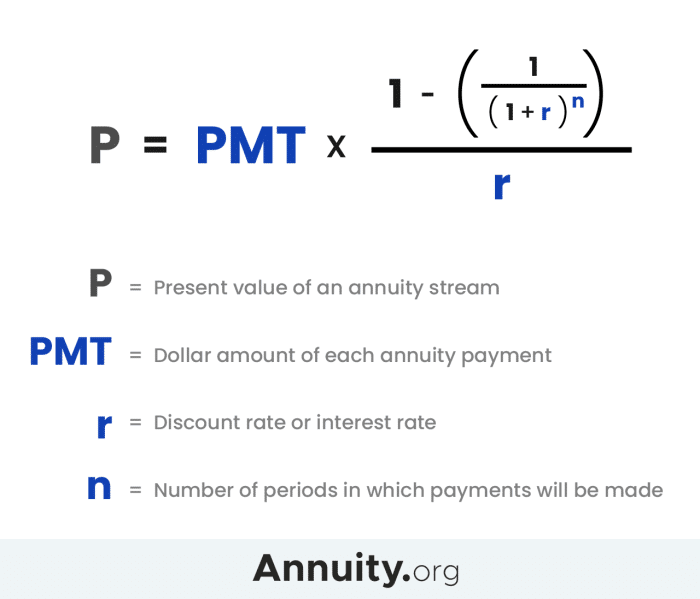

Calculating annuities can be a complex process, involving various factors such as interest rates, time periods, and payment amounts. There are specific formulas and tools available to help you make accurate calculations. To learn more about calculating annuities, visit this page.

By the end, you’ll have a comprehensive understanding of annuities and be equipped to make informed decisions for your retirement planning.

A reversionary annuity is a type of annuity that provides income to a beneficiary after the primary annuitant passes away. This can be a valuable option for individuals who want to ensure that their loved ones receive a financial benefit after their death.

To learn more about reversionary annuities, you can check out this article.

Understanding Annuities in New Zealand

Annuities are financial products that provide a stream of regular payments, often for life. They are popular among retirees in New Zealand as a way to generate a steady income during their golden years. Annuities can be purchased with a lump sum of money, and the payments can begin immediately or at a later date.

Types of Annuities

There are several types of annuities available in New Zealand, each with its own features and benefits. Some common types include:

- Fixed Annuities:These annuities offer a guaranteed fixed payment for a set period, providing predictable income. They are less risky than variable annuities but may not keep pace with inflation.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of the underlying investments. They have the potential to grow faster than fixed annuities but also carry more risk.

- Immediate Annuities:Payments begin immediately after the annuity is purchased. They are ideal for those who need income right away.

- Deferred Annuities:Payments begin at a future date, allowing time to accumulate more funds before starting to receive income.

Tax Implications of Annuities

Annuities in New Zealand are generally taxed as income. The payments received from an annuity are taxed at the individual’s marginal tax rate. However, there are some exceptions and considerations:

- Tax-Free Component:A portion of the annuity payments may be tax-free, representing the return of the original investment. This is known as the “tax-free component” and is determined by the specific annuity contract.

- Superannuation Annuities:Annuities purchased with superannuation funds are subject to different tax rules, with tax implications depending on the type of superannuation scheme.

Benefits and Drawbacks of Annuities

Annuities offer both advantages and disadvantages, and it’s important to carefully consider these factors before making a decision.

Calculating the present value of a growing annuity is a crucial step in determining its overall worth. This calculation helps you understand the current value of future income streams. You can find a growing annuity calculator and more information about present value here.

- Benefits:

- Provides a guaranteed income stream.

- Can help protect against outliving your savings.

- Offers potential for growth with variable annuities.

- Drawbacks:

- Can be illiquid, making it difficult to access funds.

- Returns may not keep pace with inflation.

- Can be complex and require careful planning.

How Annuity Calculators Work: Annuity Calculator Nz 2024

Annuity calculators are online tools that help estimate the potential payouts from an annuity based on various factors. They can be a valuable resource for understanding the potential income you could receive and making informed decisions.

Annuity and pension are both retirement income options, but they have distinct differences. Understanding the pros and cons of each can help you choose the best option for your specific needs. You can find a detailed comparison of annuities and pensions here.

Key Factors Considered

Annuity calculators typically take into account the following key factors:

- Age:Your age at the time of purchasing the annuity affects the expected lifespan and, consequently, the total payout.

- Investment Amount:The amount of money you invest in the annuity directly influences the size of the payments.

- Interest Rate:The interest rate used to calculate the annuity payments determines the growth potential and overall return.

- Payment Frequency:You can choose to receive payments monthly, quarterly, or annually, which affects the amount of each payment.

- Annuity Type:The type of annuity (fixed, variable, immediate, deferred) will influence the calculation.

Estimating Payout Amount

Annuity calculators use mathematical formulas and actuarial tables to estimate the potential payout amount based on the inputted factors. They take into account factors like mortality rates and interest rates to project the future value of the investment.

The joint life option for annuities can be a valuable choice for couples who want to ensure that their income stream continues even after one partner passes away. This option provides a guaranteed income for the surviving spouse, offering peace of mind during retirement.

To learn more about joint life annuity options, you can visit this link.

Step-by-Step Guide

Here’s a general step-by-step guide on how to use an annuity calculator:

- Choose an annuity calculator:Select a reputable online calculator designed for New Zealand.

- Enter your information:Provide details such as your age, investment amount, desired payment frequency, and annuity type.

- Review the results:The calculator will display the estimated payout amount, including potential tax implications.

- Compare different scenarios:Experiment with different inputs to see how various factors impact the payout amount.

Factors Affecting Annuity Payouts

Several factors can influence the size of annuity payouts, impacting the amount of income you receive over time.

Calculating a growing annuity can be complex, especially if you’re using a financial calculator like the BA II Plus. There are specific formulas and steps involved to ensure accurate calculations. You can find a comprehensive guide to calculating growing annuities on the BA II Plus here.

Inflation

Inflation erodes the purchasing power of money over time. As prices rise, the value of your annuity payments decreases, making it challenging to maintain the same standard of living. Annuity payouts are typically fixed, so they don’t account for inflation.

Determining the payout of an annuity involves various factors, including the initial investment, interest rates, and the duration of the payout period. You can use online calculators or financial software to help you calculate an annuity payout. To learn more about calculating annuity payouts, visit this website.

However, some variable annuities offer inflation protection, but this comes with added risk.

Annuity and 401k are both retirement savings options, but they have different characteristics. Understanding the differences can help you decide which option is best for your individual financial situation. You can find a detailed comparison of annuities and 401k plans here.

Interest Rates, Annuity Calculator Nz 2024

Interest rates play a crucial role in determining annuity payouts. Higher interest rates generally lead to larger payouts, as the invested funds grow faster. Conversely, lower interest rates result in smaller payouts. The interest rate used to calculate the annuity is typically fixed at the time of purchase, but it can fluctuate over time, impacting the future value of the annuity.

Annuity 712 refers to a specific type of annuity contract, and understanding its features and benefits is essential for making informed decisions. To learn more about Annuity 712 and its implications, you can check out this resource.

Other Factors

- Mortality Rates:Annuities are based on actuarial tables that estimate how long people are expected to live. Higher mortality rates can lead to larger payouts, as the insurer expects to pay out for a shorter period.

- Investment Performance:Variable annuities are linked to the performance of underlying investments. Their payouts fluctuate based on the market’s performance, potentially leading to higher or lower returns.

- Fees and Charges:Annuities often come with fees and charges, which can reduce the overall payout amount. These fees can include administrative fees, investment management fees, and surrender charges.

Choosing the Right Annuity

Selecting the right annuity involves considering your individual financial goals, risk tolerance, and long-term financial plan. It’s essential to compare different annuity options and understand their features and benefits.

The formula for an annuity bond is a mathematical equation used to calculate the present value of a series of future payments. Understanding this formula is essential for accurately pricing and evaluating annuity bonds. You can find more information about the formula for annuity bonds here.

Comparing Annuity Options

When comparing annuities, consider factors like:

- Payment Structure:Fixed or variable payments, immediate or deferred, and payment frequency.

- Guarantee Period:How long the payments are guaranteed.

- Interest Rates:The interest rate used to calculate the payouts.

- Fees and Charges:Any associated fees, such as administrative, investment management, or surrender charges.

- Flexibility:The ability to adjust payments or access funds.

Aligning with Financial Goals

The type of annuity you choose should align with your specific financial goals. For example:

- Income Generation:If you need a steady income stream, a fixed annuity might be suitable.

- Growth Potential:If you’re seeking potential growth, a variable annuity could be an option, although it comes with more risk.

- Legacy Planning:Annuities can be used to create a legacy for loved ones, with options for beneficiaries to receive payments after your death.

Consulting a Financial Advisor

It’s highly recommended to consult with a qualified financial advisor before making a decision about annuities. They can provide personalized advice based on your individual circumstances, financial goals, and risk tolerance. They can also help you understand the complexities of annuities and choose the best option for your situation.

The Groww annuity calculator is a useful tool for understanding the potential returns and payouts of different annuity options. It allows you to input various parameters and get personalized estimates. You can access the Groww annuity calculator here.

Finding and Using Annuity Calculators in NZ

Several reputable online annuity calculators are available in New Zealand, providing tools to estimate potential payouts and explore different scenarios. Here’s a list of some popular calculators:

| Calculator Name | Website | Features | Pros/Cons |

|---|---|---|---|

| Calculator 1 | www.example1.com | Fixed and variable annuities, immediate and deferred payments, customizable inputs. | Pros: User-friendly interface, comprehensive features. Cons: May not include all annuity types. |

| Calculator 2 | www.example2.com | Focuses on retirement planning, includes superannuation annuities, provides tax estimates. | Pros: Specialized for retirement planning, tax-related information. Cons: Limited options for non-retirement annuities. |

| Calculator 3 | www.example3.com | Offers a wide range of annuity types, including fixed, variable, immediate, and deferred. | Pros: Comprehensive coverage of annuity types. Cons: Interface might be less intuitive. |

Each calculator has its own unique features and user interface. It’s recommended to try out a few different calculators to find one that meets your needs and provides the information you require.

Outcome Summary

Annuity Calculator NZ 2024 empowers you to take control of your retirement planning. By understanding the nuances of annuities and using online calculators, you can gain valuable insights into your potential retirement income. Remember, seeking professional advice from a financial advisor can further enhance your decision-making process and ensure you choose an annuity that aligns with your unique financial circumstances and goals.

With careful planning and the right tools, you can secure a comfortable and financially stable retirement.

When considering an annuity, it’s essential to understand the potential payout you can receive. A 600k annuity, for example, could provide a substantial stream of income for many years. To learn more about annuities and how they work, check out this article about annuity 600k in 2024.

FAQ Insights

How do I find a reputable annuity calculator in New Zealand?

We’ve provided a list of reputable online annuity calculators in New Zealand within this guide. You can also consult with your financial advisor for recommendations.

Annuity leads are an important part of the financial planning process, especially for those approaching retirement. Understanding the different types of annuities and how they work can help you make informed decisions about your future financial security. You can find more information about annuity leads for 2024 here.

What are the tax implications of annuity payments in New Zealand?

The tax implications of annuities in New Zealand depend on the type of annuity and your individual circumstances. It’s essential to consult with a tax advisor to understand how annuity payments will be taxed in your specific situation.