Annuity Calculator NerdWallet 2024 is a powerful tool that can help you understand the intricacies of annuities and make informed decisions about your retirement planning. Annuities are financial instruments that provide a stream of income payments, often for life, and can be a valuable addition to your retirement portfolio.

Curious about what an annuity is? Find out in this article: Annuity Kya Hai 2024. It provides a clear and concise explanation of annuities and their benefits.

This calculator, developed by the reputable financial website NerdWallet, simplifies the complex world of annuities by providing a user-friendly interface and comprehensive calculations. Whether you’re considering purchasing an annuity or simply want to explore its potential benefits, this calculator can provide valuable insights into how annuities can work for you.

Understanding the formula behind annuities is crucial. Learn about the “Formula Annuity Certain 2024” in this article: Formula Annuity Certain 2024. It breaks down the calculations and helps you understand how annuities work.

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments for a specified period of time. They are often used for retirement planning, but can also be used for other purposes such as income replacement, long-term care, or even as a way to leave a legacy.

Annuities can be purchased from insurance companies and come in a variety of forms, each with its own features and benefits.

History of Annuities

Annuities have a long history, dating back to ancient Rome. In those days, annuities were used as a way to provide a steady income for individuals who had lost their ability to work. Over time, annuities evolved and became more sophisticated, with the development of different types of annuities to meet the needs of a wider range of individuals.

Want to learn about the secrets to maximizing your annuity income in 2024? Check out this article: 8 Annuity Income Secret 2024. It covers strategies to make the most of your annuity and ensure you’re getting the best possible return.

Types of Annuities, Annuity Calculator Nerdwallet 2024

There are many different types of annuities available, but some of the most common include:

- Fixed Annuities:These annuities provide a guaranteed rate of return, meaning that the payments you receive will not fluctuate based on market performance. This type of annuity is ideal for those who want to protect their principal and ensure a steady stream of income.

Are annuities exempt from taxes? This article, Is Annuity Exempt From Tax 2024 , provides information on the tax implications of annuities and helps you understand how they are treated by the IRS.

- Variable Annuities:These annuities allow you to invest your money in a variety of sub-accounts, such as mutual funds or ETFs. The value of your annuity will fluctuate based on the performance of your investments. Variable annuities can offer the potential for higher returns, but they also carry more risk.

Wondering where annuities fit in your financial picture? This article, Annuity Is Which Account 2024 , explains the type of account an annuity is and how it relates to other financial instruments.

- Immediate Annuities:These annuities begin making payments immediately after you purchase them. This type of annuity is ideal for those who need a steady income right away, such as retirees.

- Deferred Annuities:These annuities begin making payments at a later date, such as at retirement. This type of annuity is ideal for those who want to save for retirement and grow their investment over time.

NerdWallet Annuity Calculator

The NerdWallet Annuity Calculator is a free online tool that can help you estimate the payments you would receive from an annuity. The calculator is easy to use and requires only a few inputs, such as your age, the amount of money you want to invest, and the type of annuity you are considering.

Are annuities guaranteed? Find out in this article: Is Annuity Guaranteed 2024. It discusses the guarantees offered by different annuity types and helps you understand the level of security they provide.

Features and Functionalities

The NerdWallet Annuity Calculator is designed to be user-friendly and provides a range of features, including:

- Multiple Annuity Types:The calculator allows you to compare different annuity types, including fixed, variable, immediate, and deferred annuities.

- Customizable Inputs:You can adjust the calculator’s inputs to reflect your individual circumstances, such as your age, investment amount, and desired payment frequency.

- Detailed Results:The calculator provides detailed results, including estimated monthly payments, total payments received, and the present value of the annuity.

How the Calculator Works

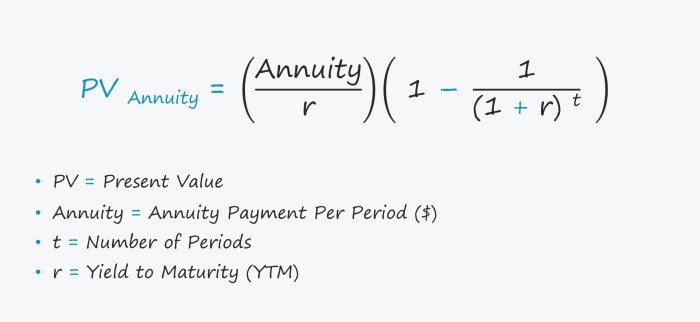

The NerdWallet Annuity Calculator works by using a set of formulas to calculate the estimated payments you would receive from an annuity. The calculator takes into account factors such as your age, the amount of money you want to invest, the type of annuity you are considering, and the current interest rates.

Edward Jones offers a useful calculator for annuities. Learn more about the “Annuity Calculator Edward Jones 2024” in this article: Annuity Calculator Edward Jones 2024. It can help you determine the best annuity options for your needs.

Comparison to Other Calculators

There are many other annuity calculators available online, but the NerdWallet Annuity Calculator stands out for its ease of use, comprehensive features, and accuracy. The calculator is also free to use, making it an excellent resource for anyone considering purchasing an annuity.

Using the Calculator for Financial Planning

The NerdWallet Annuity Calculator can be a valuable tool for financial planning, particularly when it comes to retirement planning. It can help you understand the potential income you could receive from an annuity and how it might fit into your overall financial plan.

Do annuities provide income for life? This article, Is Annuity For Life 2024 , explains the different types of annuities and whether they provide lifetime income.

Estimating Annuity Payments

To estimate annuity payments, simply enter your desired investment amount, age, and the type of annuity you are considering. The calculator will then provide you with an estimate of the monthly payments you could receive.

Learn how to calculate an annuity using Excel with this article: Calculating An Annuity In Excel 2024. It provides step-by-step instructions and formulas to help you make informed decisions.

Scenarios and Annuity Options

The calculator can be used to explore different annuity options and see how they might impact your retirement income. For example, you can compare the estimated payments from a fixed annuity to those from a variable annuity. You can also experiment with different investment amounts and payment frequencies to see how they affect your overall retirement income.

Looking for information about “Annuity 4 Percent 2024”? This article: Annuity 4 Percent 2024 , dives into the specifics of annuities with a 4% return and provides valuable insights.

Step-by-Step Guide for Retirement Planning

Here is a step-by-step guide on how to use the NerdWallet Annuity Calculator for retirement planning:

- Gather your financial information.This includes your age, current savings, and desired retirement income.

- Choose an annuity type.Consider your risk tolerance and investment goals when choosing an annuity type.

- Enter your information into the calculator.Use the calculator to estimate the monthly payments you could receive from an annuity.

- Compare different scenarios.Experiment with different investment amounts, annuity types, and payment frequencies to see how they affect your estimated retirement income.

- Consult with a financial advisor.It is always a good idea to consult with a financial advisor to discuss your retirement planning needs and how an annuity might fit into your overall financial plan.

Factors to Consider When Choosing an Annuity

Choosing the right annuity is an important decision that should not be taken lightly. There are several factors to consider before purchasing an annuity, including your age, risk tolerance, and financial goals.

If you’re considering an annuity with your spouse, you might want to learn about the “Annuity Joint Life Option 2024”. Read this article: Annuity Joint Life Option 2024 , to understand how it works and its implications for your retirement planning.

Key Factors to Consider

- Age:Younger individuals may be more likely to choose a variable annuity, as they have more time to recover from any market downturns. Older individuals may be more likely to choose a fixed annuity, as they want to protect their principal and ensure a steady stream of income.

- Risk Tolerance:Your risk tolerance will also play a role in choosing an annuity. If you are risk-averse, you may be more likely to choose a fixed annuity. If you are comfortable with risk, you may be more likely to choose a variable annuity.

Is annuity income considered earned income? This article, Is Annuity Earned Income 2024 , delves into the tax implications of annuity income and helps you understand how it is treated for tax purposes.

- Financial Goals:Your financial goals will also influence your annuity choice. If you are saving for retirement, you may want to choose an annuity that provides a steady stream of income. If you are looking for a way to leave a legacy, you may want to choose an annuity that provides a death benefit.

If you’re considering an annuity, you might wonder if it’s a better choice than a 401k. This article, Is Annuity Better Than 401k 2024 , can help you understand the differences and make the right decision for your retirement planning.

Pros and Cons of Different Annuity Types

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuity | Guaranteed rate of return, principal protection | Lower potential returns compared to variable annuities, limited investment options |

| Variable Annuity | Potential for higher returns, investment flexibility | More risk, principal not guaranteed, fees can be high |

| Immediate Annuity | Provides immediate income, good for those who need income right away | Lower potential returns compared to deferred annuities, less time for investment growth |

| Deferred Annuity | More time for investment growth, potential for higher returns | Payments don’t start until later, may not be suitable for those who need immediate income |

Determining the Best Annuity for Individual Needs

The best annuity for you will depend on your individual circumstances and financial goals. It is important to carefully consider your needs and compare different annuity options before making a decision. Consulting with a financial advisor can also be helpful in determining the best annuity for your situation.

Advantages and Disadvantages of Annuities

Annuities can be a valuable tool for financial planning, but they are not without their drawbacks. It is important to understand both the potential benefits and risks of annuities before investing.

Need a tool to calculate your annuity? Check out the “Annuity Calculator Gov Uk 2024” featured in this article: Annuity Calculator Gov Uk 2024. It provides a helpful resource for estimating your potential annuity payments.

Benefits of Investing in Annuities

- Guaranteed Income:Fixed annuities provide a guaranteed rate of return, which can be a valuable source of income in retirement.

- Principal Protection:Fixed annuities protect your principal from market fluctuations, making them a good option for risk-averse investors.

- Tax Advantages:Some annuities offer tax-deferred growth, which can help you reduce your overall tax liability.

- Long-Term Care Protection:Some annuities offer long-term care benefits, which can help cover the costs of nursing home care or assisted living.

- Death Benefit:Some annuities provide a death benefit, which can help provide financial security for your beneficiaries.

Risks and Drawbacks of Annuities

- Limited Liquidity:Annuities can be illiquid, meaning that you may not be able to access your money easily if you need it.

- Fees:Annuities can come with high fees, which can eat into your returns.

- Market Risk:Variable annuities are subject to market risk, meaning that the value of your annuity can fluctuate based on the performance of your investments.

- Complexity:Annuities can be complex financial products, and it is important to understand the terms and conditions of your annuity before purchasing it.

Real-World Examples

Annuities can be used effectively for a variety of financial goals. For example, an individual nearing retirement could purchase a fixed annuity to provide a steady stream of income. A younger individual could purchase a variable annuity to grow their investment over time.

Annuities are often used for a specific purpose. Find out what that is by reading this article: Annuity Is Primarily Used To Provide 2024. It provides insight into the main reason people choose annuities.

However, annuities can also be used ineffectively. For example, an individual may purchase an annuity with high fees or choose an annuity that is not appropriate for their risk tolerance. It is important to carefully consider your needs and compare different annuity options before making a decision.

Ending Remarks: Annuity Calculator Nerdwallet 2024

As you navigate the world of retirement planning, the NerdWallet Annuity Calculator can be an invaluable resource. It provides a clear and concise way to explore the potential of annuities, allowing you to make informed decisions based on your individual needs and financial goals.

Remember to consider all aspects of your financial situation, including your risk tolerance and time horizon, before making any investment decisions.

Clarifying Questions

Is the NerdWallet Annuity Calculator free to use?

Yes, the NerdWallet Annuity Calculator is completely free to use.

What types of annuities can the calculator analyze?

The calculator can analyze various annuity types, including fixed, variable, immediate, and deferred annuities.

Can I use the calculator to compare different annuity providers?

While the calculator doesn’t directly compare providers, it can help you understand the potential outcomes of different annuity options, allowing you to make informed comparisons.