Annuity Calculator HMRC 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Retirement planning is a crucial aspect of financial security, and understanding annuities plays a vital role in ensuring a comfortable and sustainable income stream in your later years.

Some annuities offer a guaranteed period of payments, such as a 6-year guaranteed period. This means that you’ll receive payments for at least 6 years, even if you pass away before the end of that period. To learn more about 6-year guaranteed annuities in 2024, visit Annuity 6 Guaranteed 2024.

Annuities, essentially a form of insurance, allow you to convert a lump sum of money into a regular stream of payments, providing a steady source of income during retirement.

If you’re interested in learning more about annuities in Hindi, you can find information on Annuity Ka Hindi Meaning 2024.

This comprehensive guide delves into the world of annuities, explaining their intricacies, benefits, and drawbacks. We will explore the role of HMRC in regulating annuities, discuss the tax implications, and equip you with the knowledge to utilize an annuity calculator effectively.

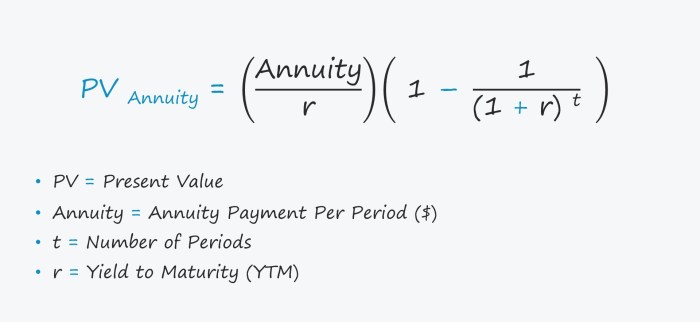

If you’re considering a growing annuity, you’ll need to understand how present value works. A growing annuity calculator can help you determine the present value of your future annuity payments. To learn more about using a growing annuity calculator in 2024, visit Growing Annuity Calculator Present Value 2024.

By understanding the factors that influence annuity calculations and exploring the available tools and resources, you can make informed decisions about your retirement income.

Annuities are a financial product that is popular worldwide. If you’re interested in learning more about annuities in Tamil, you can find information on Annuity Meaning In Tamil 2024.

Understanding Annuities

An annuity is a financial product that provides a guaranteed stream of income payments for a set period of time, either for a specific number of years or for the rest of your life. Annuities are often used by individuals in retirement to supplement their income and ensure a steady flow of funds.

Annuities can be used to provide income for various needs, including healthcare expenses. To learn more about annuities and healthcare in 2024, you can visit Annuity Health 2024.

They can also be used for other purposes, such as providing income for a beneficiary after your death.

If you’re looking for a good laugh, you might enjoy reading some annuity jokes. While annuities are a serious financial product, there are some humorous aspects to them. You can find some annuity jokes at Annuity Jokes 2024.

Types of Annuities

There are various types of annuities available in the UK, each with its own features and benefits. Here are some of the most common types:

- Fixed Annuities:These provide a fixed amount of income each year, regardless of market fluctuations. This makes them suitable for those seeking predictable income streams.

- Variable Annuities:The income payments from these annuities fluctuate based on the performance of an underlying investment portfolio. This offers the potential for higher returns, but also carries a greater risk.

- Indexed Annuities:These annuities link their payments to the performance of a specific index, such as the FTSE 100. This provides a degree of protection against inflation while still offering the potential for growth.

- Immediate Annuities:Payments start immediately after the purchase of the annuity. This is suitable for those seeking immediate income.

- Deferred Annuities:Payments begin at a future date, allowing for a period of investment growth before income is drawn. This is often used as a retirement savings strategy.

Benefits of Annuities

- Guaranteed Income:Annuities provide a guaranteed stream of income, which can be particularly valuable during retirement.

- Protection Against Longevity Risk:Annuities can help mitigate the risk of outliving your savings. They provide income for as long as you live, even if you live longer than expected.

- Tax-Efficient Income:In the UK, annuity payments are typically taxed as income, but there are often tax-efficient options available.

Drawbacks of Annuities

- Limited Flexibility:Once an annuity is purchased, it is generally difficult to access the underlying capital or change the payment structure.

- Potential for Lower Returns:Compared to other investment options, annuities may offer lower returns, particularly if interest rates are low.

- High Initial Costs:Annuities often come with high initial fees, which can reduce the overall returns.

Real-World Examples of Annuities

Annuities are widely used for various purposes. Here are some real-world examples:

- Retirement Income:A retired individual may purchase an annuity to provide a steady stream of income for their living expenses.

- Inheritance Planning:A person can purchase an annuity to provide a guaranteed income for their beneficiary after their death.

- Long-Term Care:Annuities can be used to fund long-term care expenses, providing financial security in case of health issues.

HMRC’s Role in Annuities

HMRC plays a significant role in regulating annuities and their tax implications in the UK. They ensure that annuities are sold fairly and transparently, and they collect tax on annuity payments.

Annuities can be a complex financial product. If you have any questions about annuities, you can find answers to frequently asked questions at Annuity Questions And Answers 2024.

Tax Implications of Annuities

Annuity payments are generally taxed as income in the UK. The tax treatment of annuity payments depends on the type of annuity and the individual’s circumstances.

One of the most common questions people have about annuities is whether or not they are subject to Required Minimum Distributions (RMDs). The answer is yes, in most cases. But, there are some exceptions. To learn more about how RMDs apply to annuities in 2024, check out Is Annuity Subject To Rmd 2024.

- Taxable Income:Annuity payments are typically included in your taxable income and taxed at your marginal rate.

- Tax Relief:In some cases, you may be eligible for tax relief on your annuity payments, such as if you purchased the annuity with a lump sum that was already taxed.

- Inheritance Tax:If you die before receiving all of your annuity payments, the remaining payments may be subject to inheritance tax.

HMRC Guidelines and Legislation

HMRC provides detailed guidance and legislation regarding annuities. Key resources include:

- Annuity Guidance:HMRC publishes guidance on various aspects of annuities, including tax treatment, regulations, and consumer protection.

- Legislation:The relevant legislation for annuities is primarily contained in the Income Tax (Trading and Other Income) Act 2005.

Tax Treatment of Annuity Payments

The tax treatment of annuity payments can be complex and depends on various factors, such as the type of annuity, the date of purchase, and your individual circumstances. It’s essential to seek professional financial advice to understand the tax implications of your specific annuity.

Using an Annuity Calculator

An annuity calculator is a valuable tool for estimating your potential annuity payments and understanding the financial implications of purchasing an annuity. These calculators take into account various factors, such as your age, life expectancy, and the annuity purchase price.

Annuity is a financial product that provides a stream of payments over a period of time. It’s a popular choice for retirement planning, as it can provide a steady income stream in your later years. If you’re considering an annuity, you might be wondering what it is and how it works.

You can find out more about annuities in 2024 by reading Annuity Is What 2024.

How to Use an Annuity Calculator

Using an annuity calculator is straightforward. You typically need to provide the following information:

- Annuity Purchase Price:The amount you are willing to invest in the annuity.

- Age:Your current age.

- Life Expectancy:Your estimated life expectancy. This can be based on actuarial tables or other reliable sources.

- Interest Rate:The interest rate at which your annuity payments will grow.

- Annuity Type:The type of annuity you are considering, such as fixed, variable, or indexed.

Annuity Calculator Table

| Input Variable | Description |

|---|---|

| Annuity Purchase Price | The amount you are investing in the annuity. |

| Age | Your current age. |

| Life Expectancy | Your estimated life expectancy. |

| Interest Rate | The interest rate at which your annuity payments will grow. |

| Annuity Type | The type of annuity you are considering. |

Factors Affecting Annuity Calculations

The annuity payments you receive can be affected by various factors. Understanding these factors can help you make informed decisions about your annuity purchase.

There are different types of annuities available, and each one has its own unique features. You can find a list of 8 popular types of annuities at 8 Annuities 2024.

- Interest Rates:Higher interest rates generally lead to larger annuity payments.

- Life Expectancy:If you live longer than expected, you will receive more annuity payments.

- Annuity Type:Different annuity types offer different potential returns and risks.

- Fees:Annuity providers often charge fees, which can reduce your overall returns.

Factors Affecting Annuity Calculations

Several factors can influence the amount of annuity payments you receive. Understanding these factors is crucial for making informed decisions about your annuity purchase.

Annuities can be a complex financial product, and it’s important to understand all the details before making a decision. To learn more about annuity 4 in 2024, visit Annuity 4 2024.

Impact of Inflation

Inflation can significantly impact annuity payments. If inflation rises, the purchasing power of your annuity payments may decline over time. This is a key consideration when choosing an annuity, particularly for long-term income needs.

You might be wondering how much of an annuity you can get with $80,000. The amount of annuity you can receive will depend on factors such as your age, gender, and the type of annuity you choose. To learn more about how much annuity you can get with $80,000 in 2024, visit How Much Annuity For 80000 2024.

Role of Investment Returns, Annuity Calculator Hmrc 2024

The returns on the underlying investments in an annuity can affect the amount of your payments. Variable annuities, for example, are linked to the performance of investment portfolios. Higher investment returns generally lead to larger annuity payments, but they also carry greater risk.

Federal employees have access to a special type of annuity called a Federal Employee Retirement System (FERS) annuity. To learn more about calculating your FERS annuity in 2024, you can visit Calculating A Federal Annuity – Fers 2024.

Comparing Annuity Options

Different annuity options offer varying potential returns and risks. When comparing annuities, it’s essential to consider:

- Guaranteed Payments:Fixed annuities offer guaranteed payments, while variable annuities have payments that fluctuate based on investment performance.

- Potential for Growth:Variable annuities have the potential for higher returns, but also carry greater risk.

- Fees:Different annuities come with different fees, which can affect your overall returns.

- Tax Implications:The tax treatment of annuity payments can vary depending on the type of annuity and your individual circumstances.

Annuity Calculator Tools and Resources

There are numerous online annuity calculators available that can help you estimate your potential annuity payments. These calculators can be a valuable tool for comparing different annuity options and understanding the financial implications of your purchase.

Reputable Online Annuity Calculators

Here are some reputable online annuity calculators:

- [Insert name of reputable online annuity calculator 1]:[Insert link to calculator 1]

- [Insert name of reputable online annuity calculator 2]:[Insert link to calculator 2]

- [Insert name of reputable online annuity calculator 3]:[Insert link to calculator 3]

HMRC Resources on Annuities

HMRC provides a wealth of information on annuities, including guidance on tax treatment, regulations, and consumer protection. You can find these resources on the HMRC website:

- [Insert link to relevant HMRC resource 1]:[Insert brief description of resource 1]

- [Insert link to relevant HMRC resource 2]:[Insert brief description of resource 2]

- [Insert link to relevant HMRC resource 3]:[Insert brief description of resource 3]

Finding Reliable Annuity Information

When researching annuities, it’s essential to rely on reliable and accurate information. Here are some tips:

- Check the Source:Ensure the information comes from a reputable source, such as HMRC, a financial regulator, or a well-established financial advisor.

- Compare Different Sources:Look at information from multiple sources to get a balanced perspective.

- Seek Professional Advice:Consult with a qualified financial advisor who can provide personalized advice and help you understand the complexities of annuities.

Last Recap: Annuity Calculator Hmrc 2024

Armed with this knowledge, you can confidently navigate the complexities of annuities and make informed decisions about your retirement income. Remember, seeking professional financial advice is always recommended to tailor your retirement plan to your specific circumstances. With careful planning and a clear understanding of annuities, you can secure a comfortable and fulfilling retirement.

FAQ Corner

What is the minimum amount I can invest in an annuity?

There is no minimum amount required to invest in an annuity, but the amount you invest will determine the size of your regular payments.

Annuities are taxed differently than other types of investments. Understanding how annuities are taxed is important for planning your retirement income. To learn more about how annuities are taxed in 2024, visit How Annuity Is Taxed 2024.

Can I withdraw my annuity payments early?

Typically, you cannot withdraw annuity payments early. However, some annuities offer flexibility with partial withdrawals or surrender options, subject to specific terms and conditions.

How do I find a reputable annuity provider?

An annuity is a financial product that provides a stream of payments over a period of time. It can be a valuable tool for retirement planning, as it can provide a guaranteed income stream for your later years. To better understand how annuities work, you can learn more about An Annuity Is 2024.

You can consult with a financial advisor or research reputable providers online. Look for providers with a strong track record, transparent pricing, and positive customer reviews.

What are the tax implications of annuity payments?

Annuity payments are generally taxed as income, and the specific tax treatment depends on the type of annuity and your individual circumstances. It’s crucial to consult with a tax advisor to understand the tax implications.