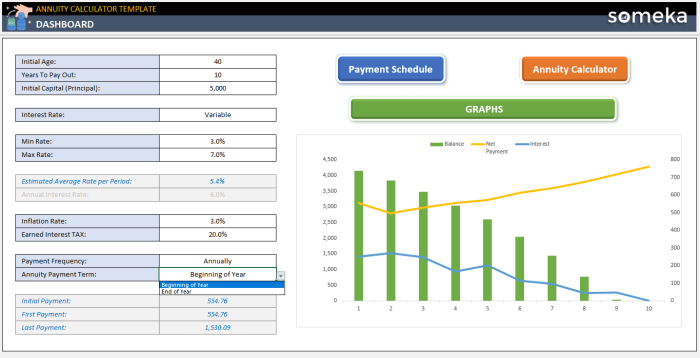

Annuity Calculator Excel Template 2024 provides a powerful tool for individuals and financial professionals to analyze and plan for their financial future. This comprehensive template allows users to calculate the present and future values of annuities, considering factors like interest rates, payment amounts, and time periods.

For individuals turning 65 in 2024, understanding the options available for retirement income is essential. An annuity at 65 can provide a guaranteed income stream, potentially supplementing Social Security benefits and other retirement savings.

With its user-friendly interface and detailed calculations, the template empowers users to make informed decisions regarding their retirement planning, investment strategies, and other financial goals.

For those considering an annuity, understanding the annuity exclusion ratio is crucial. This ratio helps determine the portion of each annuity payment that is considered taxable income. Calculating this ratio accurately can help you minimize your tax liability.

Whether you’re looking to estimate the growth of your savings over time or determine the required monthly payments for a desired retirement income, this template offers a versatile solution. By understanding the key concepts of annuities and leveraging the template’s capabilities, you can gain valuable insights into your financial situation and make informed decisions to achieve your financial objectives.

The relationship between annuities and pensions can be confusing. An annuity is not a pension in the traditional sense. Pensions are typically provided by employers, while annuities are individual contracts purchased by individuals.

Annuity Calculator Excel Template: A Comprehensive Guide for 2024: Annuity Calculator Excel Template 2024

In the realm of personal finance, annuities play a crucial role in securing a steady stream of income for the future. Annuity calculators, particularly Excel templates, offer a valuable tool for individuals and financial advisors to analyze and plan for annuity investments.

When considering an annuity for retirement, the joint life option can be a valuable feature. This option allows two individuals to share the annuity payments, ensuring income for both even if one spouse passes away.

This comprehensive guide provides an in-depth understanding of annuity calculators, their benefits, and how to effectively utilize an Excel template for various annuity scenarios.

Financial calculators like the BA II Plus can be helpful for annuity calculations. Calculating an annuity using the BA II Plus can help you determine the future value of your annuity, the present value, or the amount of each payment.

Introduction to Annuity Calculators

An annuity calculator is a financial tool designed to determine the present or future value of an annuity, based on specific parameters. Essentially, it simplifies the complex calculations involved in annuity planning. By inputting key variables, such as the initial investment amount, interest rate, payment frequency, and duration, the calculator provides insights into the growth potential of the annuity over time.

Annuity contracts can be complex, and understanding the terminology is crucial. If you’re looking for information on an annuity with nine letters , you might be referring to a specific type of annuity or a particular feature. It’s always best to consult with a financial advisor to get personalized advice.

- Purpose and Function:The primary function of an annuity calculator is to streamline the process of evaluating annuity investments. It helps users understand the projected income stream, growth potential, and overall financial implications of various annuity options.

- Benefits of Using an Annuity Calculator:

- Accurate Calculations:Eliminates the risk of manual errors and ensures precise results.

- Time Efficiency:Saves significant time and effort compared to manual calculations.

- Scenario Analysis:Allows users to explore different scenarios and adjust variables to find the most suitable annuity option.

- Informed Decision-Making:Provides valuable data to make informed financial decisions regarding annuities.

- Types of Annuities:

- Fixed Annuities:Offer a guaranteed interest rate and fixed payments, providing predictable income.

- Variable Annuities:Link payments to the performance of underlying investments, offering potential for higher returns but also higher risk.

- Indexed Annuities:Offer returns tied to a specific index, such as the S&P 500, providing potential for growth with some downside protection.

Excel Template Overview

An Excel annuity calculator template provides a user-friendly interface for performing annuity calculations. It typically includes pre-defined formulas and input fields for various annuity parameters. Users can simply enter their specific details and the template automatically generates the desired results.

While annuities can offer valuable benefits, it’s essential to be aware of potential annuity issues. These issues might include high fees, limited flexibility, or potential market risks. It’s crucial to thoroughly research and understand the terms of any annuity contract before making a commitment.

- Features and Functionality:

- Input Fields:Allows users to enter key variables such as the initial investment amount, interest rate, payment frequency, and duration.

- Formulas:Pre-built formulas automatically calculate the present or future value of the annuity based on the input values.

- Charts and Graphs:May include options to visualize the annuity’s growth over time, providing a visual representation of the results.

- Customization Options:May allow users to adjust the template’s appearance and calculations to meet specific needs.

- Step-by-Step Guide:

- Download and Open the Template:Obtain a suitable Excel annuity calculator template from a reliable source.

- Input Variables:Enter the relevant annuity details, such as the initial investment amount, interest rate, payment frequency, and duration.

- Review Calculations:The template will automatically calculate the present or future value of the annuity based on the input data.

- Analyze Results:Review the generated results and use them to make informed decisions about your annuity investment.

- Input Variables:

- Present Value:The initial amount invested in the annuity.

- Future Value:The projected value of the annuity at a specific point in the future.

- Interest Rate:The annual rate of return on the annuity.

- Payment Amount:The periodic payment received from the annuity.

- Number of Periods:The total number of payment periods (e.g., years, months) for the annuity.

Key Calculation Elements

Annuity calculations rely on several key elements that determine the present or future value of the annuity. These elements are typically incorporated into the formulas used in Excel annuity calculator templates.

When it comes to retirement planning, deciding between an annuity or a lump sum can be a big decision. It’s important to consider your individual needs and financial situation before making a choice. An annuity provides a steady stream of income, while a lump sum offers flexibility but requires careful management.

- Present Value:Represents the current worth of a future stream of payments. The template uses the present value formula to calculate the initial investment amount required to generate a specific future income stream.

- Future Value:Represents the projected value of the annuity at a specific point in the future. The template uses the future value formula to calculate the total value of the annuity at the end of its term.

- Interest Rate:Represents the annual rate of return on the annuity. The template uses the interest rate to factor in the compounding effect of interest over time.

- Payment Amount:Represents the periodic payment received from the annuity. The template uses the payment amount to calculate the total income stream generated by the annuity.

- Number of Periods:Represents the total number of payment periods (e.g., years, months) for the annuity. The template uses the number of periods to determine the total duration of the annuity.

Customization and Scenarios, Annuity Calculator Excel Template 2024

Excel annuity calculator templates often provide customization options to tailor calculations to specific needs. Users can modify variables such as interest rates, payment frequencies, and durations to explore different scenarios and analyze their financial implications.

Annuity payments are often calculated using a specific formula. The annuity loan formula takes into account factors such as the loan amount, interest rate, and loan term to determine the regular payments required to repay the loan.

- Customization Tips:

- Adjust Interest Rates:Modify the interest rate to reflect different investment options or market conditions.

- Change Payment Frequencies:Adjust the payment frequency to match the desired income stream (e.g., monthly, quarterly, annually).

- Modify Duration:Adjust the duration of the annuity to reflect the investment horizon.

- Annuity Scenarios:

- Retirement Planning:Calculate the required initial investment to generate a desired retirement income stream.

- Education Savings:Determine the amount needed to fund a child’s education expenses.

- Estate Planning:Estimate the future value of an annuity to ensure financial security for beneficiaries.

- Scenario Table:

Scenario Payment Frequency Interest Rate Time Period Retirement Income Monthly 5% 20 Years Education Savings Quarterly 7% 18 Years Estate Planning Annually 4% 30 Years

Benefits and Limitations

Excel annuity calculator templates offer several benefits, but it’s essential to understand their limitations as well.

To understand the value of an annuity, it’s helpful to calculate its present value. A PV annuity example can demonstrate how to determine the current worth of future annuity payments. This information can help you make informed decisions about your retirement planning.

- Benefits:

- User-Friendly Interface:Easy to use and understand, even for those with limited financial expertise.

- Flexibility and Customization:Allows users to adjust variables and explore different scenarios.

- Cost-Effective:Free or available at a low cost, providing a valuable tool without significant financial investment.

- Offline Access:Can be used without internet access, providing convenience and flexibility.

- Limitations:

- Simplified Calculations:May not account for all complex financial factors, such as taxes or fees.

- Static Data:Calculations are based on static data, and changes in market conditions or interest rates may affect the accuracy of the results.

- Limited Financial Advice:Should not be used as a substitute for professional financial advice.

Closing Summary

The Annuity Calculator Excel Template 2024 is a valuable resource for anyone seeking to understand the complexities of annuities and make informed financial decisions. With its comprehensive features and intuitive design, the template provides a powerful tool for planning your financial future, whether you’re saving for retirement, managing investments, or simply seeking to gain a better understanding of your financial options.

By leveraging the template’s capabilities, you can take control of your financial well-being and make confident decisions to secure a brighter financial future.

The annuity 72t rule allows individuals to withdraw funds from a retirement account before age 59 1/2 without penalty. This rule can be helpful for those who need to access funds for unexpected expenses or other financial needs.

Answers to Common Questions

Where can I download the Annuity Calculator Excel Template 2024?

You can find the template on various websites that offer free financial tools and templates. Search online using s like “Annuity Calculator Excel Template” or “Free Annuity Calculator Template.”

What are the different types of annuities supported by the template?

An annuity can be a valuable tool for retirement planning, but it’s crucial to understand how it works. An annuity stream refers to the regular payments you receive from an annuity contract. These payments can be fixed or variable, depending on the type of annuity you choose.

The template typically supports common annuity types, such as ordinary annuities, annuities due, and fixed annuities. It may also include options for variable annuities and immediate annuities.

Can I customize the template to meet my specific needs?

To better understand how annuities work, it’s helpful to explore annuity examples. These examples can illustrate different annuity types, their features, and how they can impact your retirement income. By reviewing these examples, you can gain a clearer picture of how annuities might fit into your financial plan.

Yes, most annuity calculator templates allow for customization. You can adjust the input variables, such as interest rates, payment amounts, and time periods, to suit your specific financial situation.

Is there a limit to the number of calculations I can perform using the template?

No, you can perform unlimited calculations with the template. You can adjust the input variables and run different scenarios to explore various financial possibilities.

What are some alternative solutions to using an Excel template?

There are online annuity calculators and financial planning software available that offer more advanced features and functionality. However, Excel templates provide a simple and accessible option for basic annuity calculations.

An annuity is a financial product that provides a stream of payments over a period of time. An annuity is defined as a contract between an individual and an insurance company that guarantees regular payments for a specific duration.

Annuities can be structured in various ways, with different features and payout options. An annuity is a series of payments that are guaranteed for a specific period, offering financial security and predictable income during retirement.